Iron ore prices tumbled in the international market post a build-up in iron ore inventory across the 35 significant Chinese ports and decline in daily average deliveries from the ports to mills in China.

The iron ore inventory across the 35 substantial ports in China inched up by 2.84 million metric tonnes to stand at 109.14 million metric tonnes (as on 26 July 2019), up by 2.67 per cent against the previously reported level.

After a build-up across the Chinese ports, the daily average deliveries from those ports marked a decline, and as per the data, the daily average deliveries from the Chinese ports slipped by 23,000 metric tonnes on 26 July 2019, as compared to the previous week to stand at 2.48 million metric tonnes.

The higher volatility in the iron ore prices narrowed the mills' purchase, which in turn, exerted pressure on iron ore prices.

The prices of most actively trading September series iron ore (DCIOU9) on the Dalian Commodity Exchange in China, jolted from the level of RMB 915.00 (Day's high on 31 July 2019) to the level of RMB 857.00 (Day's low on 2 August 2019), a decline of over 6 per cent.

Likewise, the prices felt the heat in the international market, and the prices of August series iron ore on the Chicago Mercantile Exchange in the United States (TIOQ19) fell from the level of US$117.14 (Day's high on 30 July 2019) to the level of US$106.51 (Day's low on 2 August 2019), a decline of over 9 per cent.

What Else is Dragging the Iron Ore Down, and for How Long Would the Impact Last?

The recently adopted measures by the China Iron Ore and Steel Association (or CISA) further exerted the pressure on iron ore prices, and before the decline, the high iron ore prices prompted the steel mills to utilise steel scrap as feedstock, which extended the pressure on iron ore prices.

However, the use of steel scrap as a feedstock could only serve as a short-term method as the regulations only allow to use 25 per cent of steel scarp in raw materials. The resilient steel scrap prices and the falling steel prices in China have damped the profit margins of the steel mills, and the mills are now trying to ramp up the production to offset the thin margins, which in turn, could fan the iron ore prices in the days ahead.

Whatâs Ahead?

Tangshan (Hebei provinces) in China witnessed a ban on sinter machines and shaft furnaces from 26 July 2019 midnight to 29 July 2019 midnight, which in turn, slowed down the production capacities of the mills operating in the Tangshan (Hebei provinces). The ban on the entry of heavy trucks in the regions during the period reduced the ports deliveries.

However, with the ban lifted, the steel mills on Tangshan (Hebei provinces) are expected by the market participants to extend the purchase to increase the production. Independent steel rolling mills in the Tangshan province in China are likely to extend the output as the authorities in the city allowed for 15 days continuous production, which in turn, could support the iron ore prices ahead.

Loosening Production Curbs:

Tangshan in the Hebei provinces is mulling looser restrictions on steelmakers following the plan for smog control, and the potential ease could boost the steel production, which in turn, could support the iron ore demand, which previously weakened over the production restrictions.

The iron ore inventory in China is still 30.74 million metric tonnes less from last year, and if the demand arises, the lower inventory could again propel the iron ore prices in China, as well as in the international market.

While the iron ore prices contain the potential for a possible turn around, the drop in the prices has added the burden on the ASX-listed iron ore player- Fortescue Metals Group (ASX: FMG) shares.

Fortescue Metals Group Limited (ASX: FMG)

The share prices of the company have dropped from the level of A$9.550 (Dayâs high on 4 July 2019) to the present low of A$7.190 (Dayâs low on 5 August 2019), which in turn, marks a slide below the eleventh week low of A$7.420 (low for the week ended 2 August 2019).

The prices cracked nearly 25 per cent from its recent top-level of A$9.550 as investors seem to discount the fall in iron ore prices, and the shares of the company are witnessing selling pressure despite a strong quarterly performance.

FMG June 2019 Quarter:

FMG witnessed a strong June 2019 quarter with an ore shipment of 46.6 million tonnes, up by 22 per cent as compared to the previous quarter shipment of 38.3 million tonnes. The company also reduced the cash production cost (or C1) to US$12.78 per wet metric tonne in June 2019 quarter, as compared to the previous quarter cash production cost of US$13.51 per wet metric tonne.

The iron ore prices flexed the average realised price during the June 2019 quarter, and FMG achieved an average price of US$92 per dry metric tonne against the previous quarter realised price of US$71 per dry metric tonne, which in turn, noticed a growth of over 29.50 per cent.

However, the FY2019 shipment of 167.7 million tonnes remained a per cent below from FY2018 figure amid the impact of the Tropical Cyclone Veronica on the companyâs operations.

Progress During the June 2019 quarter:

The company completed the towage infrastructure through the opening of Judith Street Harbour in Port Hedland during the June 2019 quarter. FMG also secured the approval for US$287m investment in the Queens Valley mining area development at the Solomon Hub.

The company further notified that the Rail & Iron Bridge Magnetite projects and Eliwana Mine are progressing on schedule and budget.

FMG established a wholly-owned subsidiary in Chinese sales entity during the June 2019 quarter to improve the direct supply of products to Chinese customers in Renminbi directly from regional ports.

Iron Ore Marketing:

FMGâs West Pilbara Fines (or WPF) shipment stood at 4.7 million tonnes during the June 2019 quarter, which in turn, underpinned a growth of 10 per cent, and the company mentioned that the high-demand of the West Pilbara Fines reflects the success of the WPF as a competitive substitute for other high-quality mainstream mid-iron content products.

However, the shipment for other products of the company marked a decline in FY2019.

The shipment summary of the FY2019 is as:

The fall in shipment across the high-graded blends could be a possible reason for the market discounting the share prices of the company along with the drop in iron ore prices.

Iron Ore Projects Update:

The Eliwana Mine and Rail Project of the company is anticipated to achieve first iron ore train on schedule and within budget at the end of the year 2020.

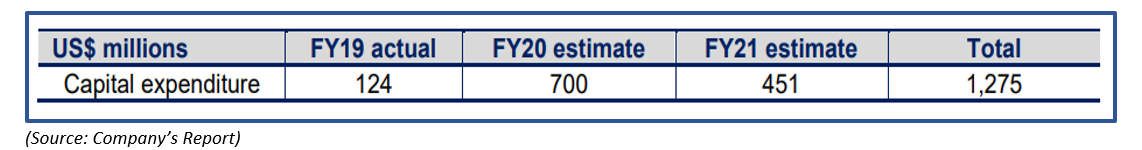

The company incurred a capital expenditure of US$124 million in FY2019, and the estimated capital expenditure is set to reach US$451 million by FY21.

The year-wise estimation of the expected capital expenditure is as:

FMG awarded A$330 million (till 25 July 2019) contracts to over 250 Australian businesses though the Eliwana Mine and Rail Project.

FMGâs- US$2.6 billion Iron Bridge Magnetite Project is estimated to produce 22 million tonnes of 67 per cent graded iron ore concentrate, and the company started the detailed engineering of the project during the June 2019 quarter.

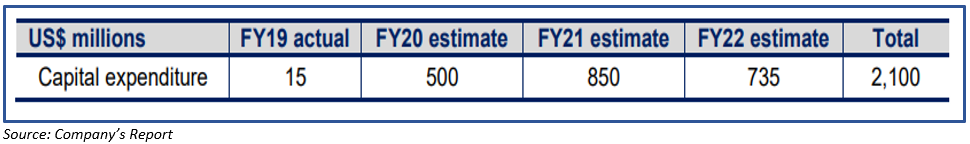

FMG capital expenditure during the June 2019 quarter over the Iron Bridge Magnetite Project stood at US$15 million, and FMG estimates the total spending to reach US$2,100 million by FY22. The year-wise split of the estimated capital expenditure is as:

FY2020 Guidance:

The company kept the shipment guidance in the range of 170-175 million tonnes including the shipment of 17-20 million tonnes of West Pilbara Fines and kept the cash production cost (C1) in the range of US$13.25-13.75 per wet metric tonne.

FMG allocated the total capital expenditure of US$2.4 billion for FY2020.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.