The Australian share market closed lower today amid jitters on global growth and fears that the US is getting ready for another trade war, this one with Mexico. The US President Donald Trump has warned Mexico of imposing tariffs on Mexican exports to the U.S. unless the country takes unspecified steps to stop a surge of people crossing the border.

Following Mr Trumpâs statement, the US stocks dropped to mark their worst month of the year on Friday. The S&P 500 fell 1.3 per cent to 2752.06, the Dow Jones Industrial Average declined 1.4 per cent, to 24,815.04 and the Nasdaq Composite lost 1.5 per cent, to 7453.15.

Mr Trumpâs threat raised fears that a trade war on various fronts could lead to a recession. Earlier, the US President issued a warning to raise the tariff on Chinese goods to 25 per cent from 10 per cent. Escalating the trade tensions, China also retaliated by announcing tariffs on US goods worth $60 bn.

The S&P/ASX 200 also suffered in the wake of global tensions, closing in red at 6320.5 points, down by 1.2 per cent or 76.4 points. The broader All Ordinaries also fell 1.3 per cent to 6410.8 points. The steep losses occurred a day ahead of a crucial Reserve Bank of Australia (RBA) interest rate meeting.

The RBA is anticipated to cut the interest rates by 25 basis points in a meeting to be held tomorrow. The reduction by the RBA is expected to take the official cash rate down to 1.25 per cent, which was earlier kept steady by the RBA at 1.5 per cent in a meeting in May. Last month, RBA Governor, Mr Philip Lowe gave a strong indication of rates cut in June. The increase in the unemployment rate in April 2019 and disappointing inflation figures in March quarter pushed the RBA to consider rate cut in June.

The top CEOs and Chairmen of Australian firms have warned against the rate cut, stating that the RBA should keep some reserves to guard against an unexpected recession. The CEOs advise keeping some reserves for use as a last resort because monetary policy has failed to boost growth throughout the developed world.

The Australian dollar traded at US69.45¢ on Monday ahead of the RBA meeting. The gold prices also rose as investors rush towards safe-haven assets in the midst of a shaky global scenario.

All the sectors closed in red on the ASX today except S&P/ASX200 A-REIT, that gained 0.70 per cent or 11.1 points, closing at AUD 1,575.8.

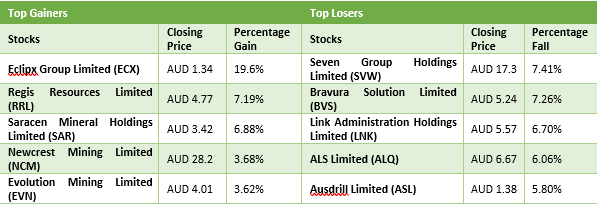

ECX, RRL, SAR, NCM and EVN were the best-performing stocks, while SVW, BVS, LNK, ALQ and ASL closed in red on the ASX today.

The table below shows the share price of the best and the worst performing stocks on the ASX on 3rd June 2019 and the respective percentage change relative to their previous close:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)