Gold prices soared in the international market as dollar plunged; the prices of Gold Spot rose from the level of US$1266.35 (low in May 2019) to the present month high of US$1348.34 (as on 13th June 2019 AEST 12:38 PM).

The Gold Rush:

After a three consecutive monthly fall from February 2019 to April 2019 from the level of US$1346.79 (high in February) to the level of US$1266.43 (low in April), the gold prices took a sharp U-turn.

The factor which exerted pressure on gold prices from the mid of the second quarter (2019) was U.S-China trade talks, which spurred the optimism among market participants over the global economic growth. Along with the U.S-China trade talks many other factors such as improving economic figures, Dollar movement, Fixed Income market, all added worries to the gold buyers.

However, the market participants were shocked when the United States moved ahead and raised the tariffs on China from 10 per cent to 25 per cent. China soon encountered the action of the United States; retaliating and raising the tarrifs as well.

The fully escalated trade war loomed the market against the risky assets and supported the prices of precious metals in the international market, as a result of which, gold prices took a U-turn in May and is still rising.

Smart Ways to Invest in Gold:

Gold prices are shining in the market and investors are pulling in more money to hedge the trade war risk, and with such a high investment moving in gold, how money gets invested makes a vital consideration.

Investment in gold could be made in a variety of ways, and every approach has its pros and cons. Following are highly active forms of gold investing:

- Physical Investment

- Derivative Markets

- Gold ETFs

- Gold Saving Funds

- Gold Related Stocks

Physical Investment:

The physical investment in gold is a traditional way of investing in gold in the form of jewellery, coins, bars, etc. The physical investing provides the owner with a consumption right with the investors holding the underlying asset in the material form. However, the main disadvantage of jewellery is that the making cost usually absorbs the price appreciation, which the investor would have otherwise obtained from different ways of investing. The problem with gold coins and bars revolves around the resale value.

Derivative Market:

The Derivative market or exchange offer future contracts (Gold Futures) with gold as an underlying asset. The future contacts derive its price from the movement in the underlying asset (spot market), and these futures usually trade actively in the international as well as domestic market. Many Exchanges such as COMEX in the United States, MCX in India, and many such exchanges across the globe offers such future contacts.

These contracts generally contain an expiry date after which the physical settlement is made mandatory by many exchanges across the globe; however, an investor could easily trade these contracts to take price advantage or may exit before expiry to avoid physical settlement.

The other advantage offered by these contracts is leverage. The investors do not have to pay the whole amount to buy the contract; one has to pay a notional amount only to enter the contract. However, the leverage increases the margins of profit and loss drastically.

One specific disadvantage of these contracts is that, at times, the price actions generated by buying and selling of these contracts could differ from the price actions of the underlying asset.

Gold ETFs:

Gold Exchange Traded Funds are funds with no lock-in period (open-ended) offered by various financial institutions such as Mutual Funds. Gold ETFs track the movement in gold prices. It is a pool of investment from general public/investors to hold the physical gold.

Each unit of physical gold in the fund generally represents 1 gram or 0.5 gram, and once the investors buy the ETF, they get a contract indicating their ownership in gold equivalent relative to the amount the investor has invested. The Gold ETFs are generally traded on a stock exchange, and hence could be bought with ease and high liquidity.

Gold Saving Fund:

Gold saving funds are also known as gold saving funds of funds which are generally passively managed. These funds incorporate an underlying ETF and keep the physical prices as the return benchmark. The creator of such funds provides the investors with units in a paper form, and these funds generally make a basket of different ETFs to match the benchmark return or to outperform the benchmark index.

However, such funds could charge a high annual expense as compared to the Gold ETFs. But these funds also offer Systematic Investment Plans (SIPs), which provide investors with an easy way of regular investing in small tranches.

Gold Related Stocks:

Investing in the shares of the gold producer and explorer is also a convenient way of investing and taking exposure to gold prices. However, doing so brings additional risk to the investors as it exposes investors to the operational risk of the miner along with the market risk.

The share prices of gold miners majorly track the movement of gold; however the fundamental aspects and events related to the miners also add and subtract value to the share prices, which generally lead to high deviation in returns from the stocks as compared to the underlying commodities; further increasing the risk and return magnitude of the investment.

How smart investing could mitigate the storage risk?

Storing gold safely is also a significant problem associated with the physical investment. The national governments store gold with the central banks, which acts as a custodian for the government, the custody of the central banks is highly secure and is well protected; however, not every individual investor could afford such high security.

The smart investing such as, investing in ETFs could save the burden related to gold storage, as the ETFs also offers the option of physical deliveries.

Apart from ETFs, traditional methods of private vaults, locker storage, etc. also provides secure ways to store gold; however, such methods could add additional expense.

Gold and Gold Miners:

The movement in gold prices set the trend of gold miners over the long-run and profoundly impacts the return profile of these stocks; however, variance in the stock price movement occurs time to time amid fundamentals and event impacts.

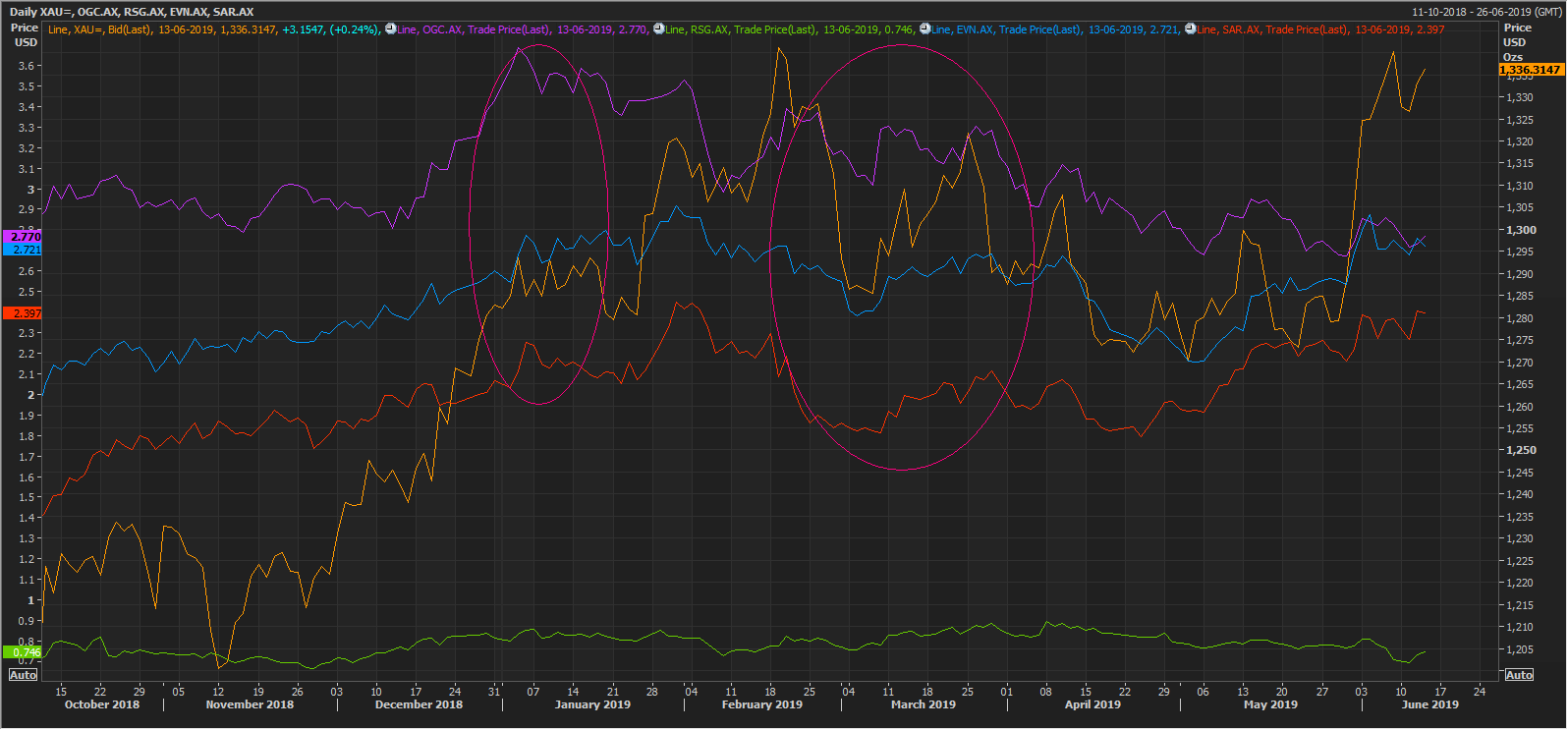

Price Performance Chart - OGC, RSG, EVN, SAR (Source: Thomson Reuters)

It can be seen on the chart above that the share prices of gold miners tracks the gold movement and follow its trend as the revenue of companies are derived from the selling price and quantity of gold. If gold prices rise, it increases the sales proceeds of the company in terms of high realised price, which in turn further supports the company, and vice-versa.

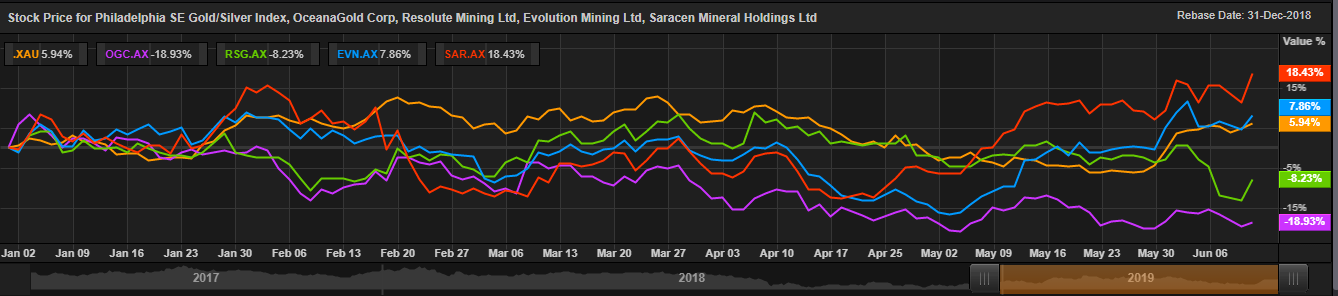

Price Performance Chart 2019 - OGC, RSG, EVN, SAR (Source: Thomson Reuters)

We can see in this chart that the gold returns were outperformed by Saracen Mineral Holdings (ASX:SAR) and Evolution Mining (ASX:EVN) and the returns from Resolute Mining (ASX:RSG) and OceanaGold Corporation (ASX:OGC) underperformed the gold returns.

Gold stocks to look at:

Evolution Mining Limited (ASX: EVN)

EVN in one of the popular names on the Australian Securities Exchange and the company contains extensive gold resources and reserves.

Return Metrics:

EVN delivered a return of 11.59 per cent in just one year and demonstrated massive growth of 417.88 per cent in 5 years. The shares delivered a return of 5.77 per cent on a YTD basis and a return of 13.91 per cent in the past six months.

Saracen Mineral Holdings (ASX: SAR)

SAR is another Australian Securities Exchange-listed popular gold miner with massive return metrics.

Return Metrics:

SAR delivered a return of 57.73 per cent in past one year and demonstrated massive growth in five years by providing a return of 813.16 per cent. The shares delivered a return of 19.24 per cent on a YTD basis and a return of 25.72 per cent in the past six months.

Companies with fewer returns worth looking

Resolute Mining Limited (ASX: RSG)

The company is among the top pioneers to bring automation in the haulage process; the short-term return of the company is negative; however, the company has shown promising growth in the medium and long-term.

RSG delivered a return of -17.19 per cent in past one year and demonstrated substantial growth in five years by providing a return of 76.67 per cent. The shares delivered a return of -7.42 per cent on a YTD basis and a return of 0.95 per cent in the past six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.