Health Care â A Lucrative Sector for Investors

Amid global trade worries and lower returns on investment, investors are flocking to the equity market. One sector that is gaining the interest of market players is the health care sector. The sector includes companies providing medical services, medical insurance and medical equipment, as well as players engaged in drug development and research & development activities. The sector, which is represented by ample lucrative stocks with strong growth prospects, is considered as a complex sector and is among the fast-growing industries in the economy.

The health care industry is showing a positive trend and not even a single sign of slowing down in 2019. Some of the factors contributing to growing investorsâ interest in health care stocks include

- Demographic trends of the aging population,

- Advancement in medical technology

- Development of precision medicines

- Competition among health care providers and drug developers

- Growing popularity of medicinal cannabis

Some investors eye popular blue-chip players with successful commercialisation in the market. While others intend to tap the potential growth prospects of pharma players engaged in clinical trials and research & development. Investment in health care stocks provide great diversification support to market enthusiasts, while associated risks must be kept in mind. In the health care sector, investors can inject their funds in health care service providers, biotechnology players, and medical device companies.

Let us look at two small cap stocks in the health care sector that are listed on the ASX and are under focus, backed by strong results in FY2019 and good returns on a year-to-date basis.

Pro Medicus Limited

Pro Medicus Limited (ASX:PME) is a health imaging IT provider, specialising in enterprise imaging and radiology information system (RIS) software. The company has more than thirty years of experience in aiding its clients to provide first-rate patient care by streamlining and improving medical practices. Its product line includes solutions for RIS/practice management, health care imaging and e-health. PME also offers software applications for clinical reporting, medical accounting, appointments/scheduling and marketing/management.

Sale of Foundersâ Shares

On 6 September 2019, the company gave a market update related to the sale of shares by founders. In February 2018, PME had unveiled regarding the Board decision of encouraging the companyâs founders to mull the sale of a maximum of three million shares each. Through the share sale, the Board intended to boost the liquidity in the companyâs shares.

PME in March 2018 was updated regarding the sale of one million shares by each of its founders. Additionally, each of the companyâs founders have sold further one million shares (during the current trading window). According to the recent company announcement, the founders do not plan to sell any further shares in the company prior to the trading period.

Mr Sam Hupert and Mr Anthony Barry Hall, the companyâs founder, have sold 1 million ordinary shares each in the capital of PME. The number of securities held by Mr Hupert and Mr Hall after the change is 28,107,660 ordinary shares, representing nearly 27.03 per cent of the companyâs issued share capital and 28,067,500 ordinary shares, representing nearly 26.99 per cent of the companyâs issued share capital, respectively.

In another market update on 2 September 2019, the company announced the vesting of 364,376 performance rights to key management personnel under its Long-Term Incentive plan.

PME Performance during FY2019

- Revenue increased by 47.9 per cent to $50.1 million compared to the previous corresponding year (PCP)

- Revenue grew in all three key regions, up 42.2 per cent in North America, 102.3 per cent in Europe and 30.2 per cent in Australia

- Transactional revenue grew by 43.5 per cent year on year

- Profit after tax went up by 91.9 per cent year-on-year to $19.1 million

- Underlying net profit after tax surged by 83.1 per cent to $22.7 million

- Cash reserves increased by 28.0 per cent to $32.3 million

- PME declared a fully franked final dividend of $0.045 per share, with total dividend up 75 per cent on pcp

- Europe benefitted from the capital sale in the first half of FY2019, while in Australia, the company started to witness benefits flowing from I-MED and Healius rollouts

- PME entered the S&P / ASX 200 Index during the year

Key Contracts Won During FY2019

- November 2018 â The company signed a seven-year contract with Partners Healthcare for the Massachusetts General Hospital and Brigham and Womenâs Hospitals for $27 million.

- December 2018 â PME unveiled a more than $3.0 million extension to the contract with a large government hospital network in Germany.

- April 2019 â The company signed a seven-year contract with Duke Health, which is the most respected health provider in North America, for $14 million.

Stock Performance

The stock of PME was trading at $29.210 on 23 September 2019 (AEST 02:47 PM), up 0.655 per cent from its previous closing price. The company has a market cap of $3.02 billion and approx. 103.98 million outstanding shares. The 52-week high and low value of the stock is at $38.390 and $08.716, respectively. The stock has generated a positive return of 65.54 per cent in the last six months and 155.20 per cent on a year-to-date basis.

Clinuvel Pharmaceuticals Ltd

Based in Melbourne, Clinuvel Pharmaceuticals Ltd (ASX: CUV) is a global biopharmaceutical company, which is engaged in drug development to treat severe skin disorders. The company worked for two decades, testing the SCENESSE® technology, targeted towards providing entire skin surface protection without exposure to light and UV.

New Director Appointment

On 23 September 2019, CUV updated the market about the appointment of a new board member. Susan (Sue) Smith, who joined the company as a Non-Executive Director, is expected to aid the company in progressing its operational strategy, mainly in the context of the ongoing commercialisation program in Europe.

CUV to Present SCENESSE®

On 10 September 2019, the company unveiled that the safety and effectiveness data from the treatment of erythropoietic protoporphyria patients with SCENESSE® would be presented at the International Congress and Porphyrias in Milan, Italy, this week. Data was collated as part of a post-authorisation safety study within the EU.

In another market update, the company, on 3 September 2019, announced a change in the interest of director (Karen Agersborg) after the acquisition of 1,400 CL VLY ADRs. The number of securities held by the director post-change is 2,900 ordinary shares and 2,600 CLVLY ADRs.

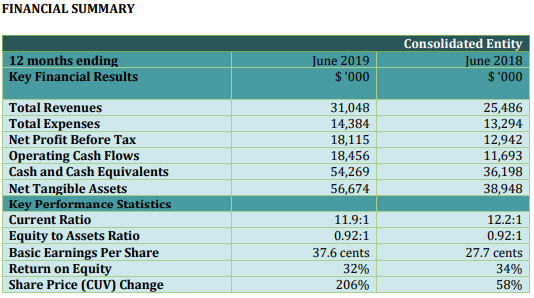

CUV Performance during FY2019

On 28 August 2019, the company announced financial results for FY2019. Major highlights are as follows:

- Total revenue increased to $31.05 million in FY2019 from $25.49 million in FY2018

- Net profit before tax surged to $18.12 million from $12.94 million in the same period a year ago

- Earnings per share increased by 35.7 per cent year-on-year

- Enterprise value of the company increased during the reported financial year

- The company was included in the S&P / ASX 200 Index in June 2019

- Cash and cash equivalents stood at $54.27 million

Source: Companyâs Report

The company also declared a fully franked dividend of $0.025 for the twelve monthsâ period ended 30 June 2019 (ex-date - 4 September 2019 and payment date - 19 September 2019).

Outlook

Business of CUV in Europe generates a solid base of earnings to fund its progress towards activities like development of products in the pipeline for a range of skin related indications and further growth in the European distribution.

Stock Performance

The stock of CUV was trading at $24.690 on 23 September 2019 (AEST 03:12 PM), down 3.328 per cent from its previous closing price. The company has a market cap of $1.25 billion and approx. 48.96 million outstanding shares. The 52-week high and low value of the stock is at $39.850 and $14.100, respectively. The stock has generated a positive return of 41.89 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.