Stocks of companies with a market capitalisation between $300 million and $2 billion are referred to as small-cap stocks. Although small-cap companies do not receive as much attention as the large-cap ones, yet these companies can offer market enthusiasts more opportunity for growth. With plenty of promising investments in this area, small-cap stocks generate remarkable benefits of investing.

Small-cap stocks have much more growth prospects along with the ability to multiply in terms of market value over a short time span, given their smaller size.

Just like two sides of a coin, small-cap stocks also carry both advantages that build investors’ sentiments and a few disadvantages. Let us see the advantages and shortcomings of small-cap stocks.

Advantages-

- Opportunity to beat Institutional Investors

- Offers more room for growth to investors

- Adds diversification to the investing portfolio

- Easier to find undervalued stocks as they receive less focus from shareholders

Disadvantages-

- Greater Risk

- Volatility

- Liquidity concerns

- Smaller dividends

In this article, we are discussing four small-cap stocks from the Australian health care sector.

Cynata Therapeutics Limited (ASX: CYP)

Cynata Therapeutics Limited (ASX: CYP) is a stem cell and regenerative medicine company (clinical-stage), focusing on therapy development based on Cymerus™. The Cymerus™ technology, which is the Company’s proprietary therapeutic stem cell platform technology, addresses many of the intricacies and challenges of manufacturing these therapeutic stem cells at a commercial scale.

Cynata Receives $1.892 Million Research & Development Tax Incentive Rebate

- In an announcement dated 07 January 2020, Cynata updated the market about the receipt of $1,891,795 in Research & Development Tax Incentive Refund for the financial year 2018/2019.

- The Tax Incentive Rebate boosted the Company’s cash position, which stood at $9.2 million at the end of the September 2019 quarter.

- Besides the expected Phase 2 trial for CYP-001 in graft-versus-host disease planned to be carried out by Fujifilm, this Tax Incentive Refund would allow Cynata to invest further resources towards its robust & significant Phase 2 clinical trial programs for the critical limb ischemia and osteoarthritis products.

The R&D Tax Incentive Program

Jointly headed by the Department of Industry, Innovation and Science and the Australian Taxation Office, the R&D Tax Incentive offers tax benefits to eligible companies to aid in offsetting the expenditure incurred over research & development activities, consequently reducing the company’s income tax liabilities, in turn, encouraging them to continue to carry out R&D activities benefiting Australia.

Stock Information

On the stock front, CYP’s stock was trading at $1.220, up by 3.39% on 09 January 2020 (01:10 PM AEDT). The company’s market capitalisation stood at $123.56 million with approximately 103.02 million outstanding shares. The 52 weeks high and low of the stock was noted at $1.870 and $0.99, respectively, with an average volume of 129,049.

Opthea Limited (ASX: OPT)

A biologics drug developer, Opthea Limited (ASX: OPT) is focused on the therapies related to ophthalmic diseases, with intellectual property protection covering few Vascular Endothelial Growth Factors, such as (VEGF)-C, VEGF-D and VEGFR-3. Opthea’s subsidiary Vegenics Pty Ltd. holds the intellectual property rights. VEGF regulates the blood as well as lymphatic vessel growth.

The company is focusing on developing, OPT-302 (formerly VGX-300, soluble VEGFR-3), its key product that can cure wet AMD (wet age-related macular degeneration) and DME (diabetic macular edema), which are known to be related to eye diseases.

Completion of Registration in OPT-302 Phase 2a Clinical Trial for Diabetic Macular Edema

On 07 January 2020, Opthea informed that enrolment of patients into the Phase 2a trial has been completed. In this trial, the safety as well as efficiency of OPT-302 dosed to patients, combined with Eylea® (aflibercept) used for treating DME, is being evaluated. The company anticipates reporting the topline data in 2H 2020.

It is estimated that Diabetic Macular Edema, which is a complication of diabetes, would impact more than two million people worldwide. It is the primary cause of loss of vision amid the working-age population.

As per the CEO and Managing Director of Opthea, Dr Megan Baldwin, enrolment completion in this Phase2a DME study indicates a significant landmark in a 2nd disease indication for Opthea.

Stock Information

On the stock front, OPT’s stock was trading at $2.890, up by 1.404% on 09 January 2020 (01:12 PM AEDT). The company’s market capitalisation stood at $767.1 million with approximately 269.16 million outstanding shares. The 52 weeks high and low of the stock was noted at $4.150 and $0.570, respectively, with an average volume of 516,468. OPT generated an outstanding return of 270.13% on a six-months basis.

Althea Group Holdings Limited (ASX:AGH)

Listed on ASX, medicinal cannabis manufacturer, Althea Group Holdings Limited (ASX:AGH) holds the licence for producing, supplying and exporting medicinal cannabis. Althea Group provides several products, access and management facilities to cater to eligible patients and to aid health care professionals in addressing treatment pathways associated with medicinal cannabis.

Althea Reported 48 per cent Month-On-Month Growth in Australia, Exceeding Year-End Target of 4,000 Patients

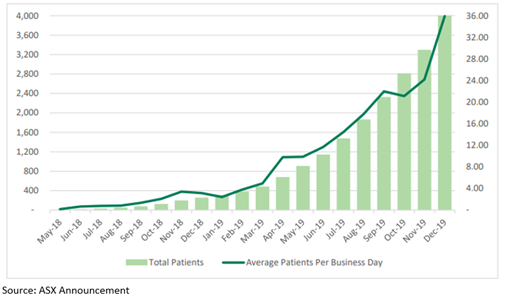

In an announcement dated 07 January 2020, Althea confirmed that in Australia, 4,018 patients were given the prescription of Althea medicinal cannabis as at 31 December 2019, which has exceeded the company’s year-end target of 4,000.

It was further reported that the month-on-month growth rate surged 48% from November 2019. The growth rate continued to accelerate with an average of 36 new patients included each business day in December 2019.

Additionally, a total of 432 Australian Healthcare Professionals had recommended Althea’s products.

According to Althea CEO Josh Fegan, the Company foresees a strong year ahead and anticipates a further significant patient and prescriber growth in 2020.

Stock Information

On the stock front, AGH’s stock was trading at $0.430, up by 3.614% on 09 January 2020 (01:18 PM AEDT). The company’s market capitalisation stood at $96.82 million with approximately 233.31 million outstanding shares. The 52 weeks high and low of the stock was noted at $1.445 and $0.270, respectively, with an average volume of nearly 1.61 million. AGH generated a return of 7.79% on a YTD basis.

MGC Pharmaceuticals Ltd (ASX: MXC)

MGC Pharmaceuticals Ltd (ASX:MXC) develops and commercialises medicines derived from cannabinoid.

MGC Passes 2,000 Prescription Milestone with First Shipment Arrived in Brazil

On 09 January 2020, the Company announced to have crossed 2,000 prescribed units’ threshold of its standardised, affordable cannabinoid medicines. The milestone was achieved from patients in Australia, UK and the recent new patient base in Brazil and Ireland.

Additionally, the Company informed regarding the first delivery of products to Brazil.

MGC Rolls Out New Affordable Cannabinoid Products Line– “Mercury Pharma” in Australia and New Zealand

On 07 January 2020, MGC Pharma informed the market that it has launched a new patented reasonably priced prescription medicine line specifically for the Australian and New Zealand markets, to be branded as Mercury Pharma.

“Mercury Pharma 100” or ‘MP100’, which is a 100 mg/mL cannabinoid solution is the first product that would be prescribed by health care professionals in Australia and New Zealand.

MP100 would be initially distributed by Cannvalate Pty Ltd and Health House International Pty Ltd in due course.

It was further informed that more than 2,000 units would be delivered in January and February 2020 with MP100 purchase orders already received. This trade would provide an immediate and positive impact on MGC’s Q1 2020 revenues, totalling in excess of c.AUD$270,000.

Stock Information

On the stock front, MXC’s stock was trading at $0.035, up by 6.061% on 09 January 2020 (01:24 PM AEDT). The company’s market capitalisation stood at $45.25 million with ~1.37 billion outstanding shares. The 52 weeks high and low of the stock was noted at $0.067 and $0.030, respectively, with an average volume of approximately 2.16 million. MXC generated a return of 6.45% on a YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.