On 2 December 2019, the S&P/ASX 200 Health Care Sector (XHJ) traded higher at 42,106.3 points, with a rise of 0.83% compared to the last close. The S&P/ASX 200 Index traded at 6,862.3 points, up by 0.24% from its previous close.

YTD Return of XHJ (Source: ASX)

Let us discuss eight ASX listed health care stocks-

Volpara Health Technologies Limited (ASX:VHT)

Wellington-based health care company Volpara Health Technologies Limited (ASX:VHT) is a MedTech SaaS company which provides digital health solutions. The company was founded in 2009 and listed on ASX in 2016. Volparaâs technology and services have been used by research projects and/or customers in 38 countries, and the company has various patents, regulatory approvals and trademarks, which include CE marking and Food & drug administration approvals.

DENSE trial results published-

The company announced that the results from the eight-year DENSE breast screening trial has been published in the New England Journal of Medicine (NEJM). DENSE trial showed a halving of interval breast cancers in women having extremely dense breasts evaluated by Volpara®Density⢠software.

With a market capitalisation of $392.51 million, the companyâs stock quoted $1.775 on 2 December 2019.

Medical Developments International Limited (ASX:MVP)

An ASX-listed health care player Medical Developments International Limited (ASX:MVP) is engaged in providing emergency medical solutions to improve patient outcomes. The company is a leader in offering emergency respiratory and pain relief products. MVP is involved in the manufacturing of Penthrox®, which is a fast-acting trauma & emergency pain relief product used in Australian Hospitals, Emergency Departments and in other medical applications.

Penthrox IND approved in China-

MVP unveiled about the Chinese National Medical Product Administration approval regarding the opening of MVPâs Investigative New Drug application. This application is a building block and an essential step for the approval of Penthrox sale for Trauma Pain and Procedural Pain in China.

With a market capitalisation of $450.07 million, the companyâs stock quoted $7.090 on 2 December 2019.

Telix Pharmaceuticals Limited (ASX:TLX)

Melbourne-headquartered health care player Telix Pharmaceuticals Limited (ASX:TLX) is a clinical-stage biopharmaceutical company which is engaged in developing therapeutic and diagnostic products by applying Molecularly Targeted Radiation (MTR). The company is developing clinical-stage oncology products for the unmet need in prostate cancer, renal cancer and glioblastoma.

On 21 November 2019, the company updated the market with a CEO presentation, highlighting its clinical pipeline-

Source: CEO presentation

illumet⢠(TLX591 CDx)- illumet⢠is a diagnostic imaging agent of Telix for prostate cancer. It has completed FDA pre-NDA meeting and the EU Competent Authority consultation, while the US/EU marketing authorisation submission is in progress. The estimated launch of this product into US commercial is in mid-2020.

TLX250 CDx- It is the first diagnostic imaging agent for kidney cancer. Currently, it is in the Phase III ZIRCON trial stage.

TLX101- It has demonstrated encouraging early results in brain cancer. Currently it is in Phase I/II IPAX-1 trial of the study. Phase II component is expected to start in mid-2020.

On 2 December 2019 the companyâs stock quoted $1.62 with a market capitalisation of $429.31 million.

Next Science Limited (ASX: NXS)

An established research and development company, Next Science Limited (ASX: NXS) was founded in 2012 and is engaged in the commercialisation of XbioTM technology platform which is a proprietary technology of the company for the treatment of biofilm-based infections. The company has an extensive pipeline for medical devices, over the counter (OTC) drugs and other emerging pharma opportunities.

Next Science updated the market with its investor presentation on ASX, highlighting the developments for H1 FY2019 (ended 30 June 2019).

- The company reported an increased sale in the H1 FY2019, with an increase of 222% as compared to the first half of the previous year which is driven by robust growth in Bactisure and BlastX.

- The company reported first sales of Acne product in Australia, in June 2019, by a distribution partner Advanced Skin Technology (AST), and in September 2019, AST launched the acne product in clinics.

- The developments for animal health and food preparation are in trial.

- The company is also focused on the developments in medical device applications, agriculture applications, medical device coatings, skincare and in other pharma applications.

With a market capitalisation of $388.9 million, the companyâs stock quoted $2.320 on 2 December 2019 which is up by 6.9% from its last close.

Virtus Health Limited (ASX:VRT)

An ASX-listed health care company Virtus Health Ltd (ASX:VRT) is the largest in-vitro fertilization provider in Australia and is engaged in providing various fertility care, day hospital services and specialist pathology services. Virtus Health operates around 125 of the worldâs leading fertility specialists.

AGM presentation-

The company updated its AGM presentation on 20 November 2019 on ASX highlighting the revenue and the key initiatives for the fiscal year 2020-

- The company would focus on the premium ARS business and on the improvement in patient care and experience. The company would adopt the new Embryoscopes, AI technology.

- The company would continue to improve access for patients in the growing (Low price / TFC) segment.

- VRT would focus on the diagnostics revenue and continue non-invasive PGT validation.

The companyâs stock quoted $4.100 on 2 December 2019, down by 0.24% with a market cap of $330.4 million.

Healius Limited (ASX:HLS)

A market-leading ASX listed health care network Healius Limited (ASX:HLS) working with a network of multi-disciplinary medical centres, diagnostic imaging centres and pathology laboratories. The company provides a world-class facility to the radiologists, general practitioners and other health care professionals to deliver quality care to the patients. Healius has a total 2,318 pathologies, 95 medical centres & day hospitals and 145 imaging.

On 29 November 2019, the company updated about the tax case for Financial Years 2003-2007. The Federal Court of Australia announced the decision in favor of the company for a case which is related to the tax treatment of healthcare practitioners lump sum payments.

Healius updated its AGM presentation on ASX discussing the companyâs forecast for FY2020-

- The company is expecting the underlying NPAT to be in between $94 million and $102 million.

- Healius is likely to deliver an increase of 9.4% which is in line with the seasonally adjusted run rate of the second half of FY2019.

With a market capitalisation of $1.91 billion the companyâs stock quoted $3.090 on 2 December 2019.

Avita Medical Limited (ASX:AVH)

An ASX listed company Avita Medical Limited (ASX:AVH) provides regenerative medicine technology for completing the unmet medical needs for the treatment of wounds, burns and aesthetics. The companyâs medical device works by preparing a suspension from the patientâs skin cells which is an autologous suspension and generates natural healthy epidermis. Its proprietary technology has evidence for use in scar revision, chronic and traumatic wounds and vitiligo other than treating burns.

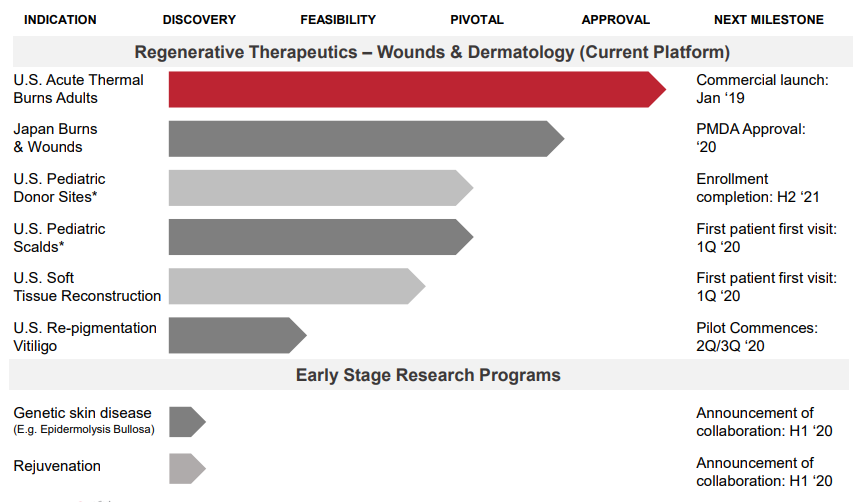

On 26 November 2019 Avita updated its AGM presentation on ASX unveiling its product pipeline, which has a strong growth potential-

Source: AGM presentation

With a market capitalisation of $1.32 billion the companyâs stock quoted $0.635 on 2 December 2019.

Mayne Pharma Group Limited (ASX:MYX)

An ASX-listed specialty pharmaceutical company Mayne Pharma Group Limited (ASX:MYX) is into applying its drug delivery expertise for the commercialization of generic as well as branded drugs. The company offers a robust portfolio of generic and branded pharmaceuticals for the multiple therapeutic applications including cardiology, oncology, womenâs health and dermatology. The oral drug delivery technology of the company has been established for various therapeutic products.

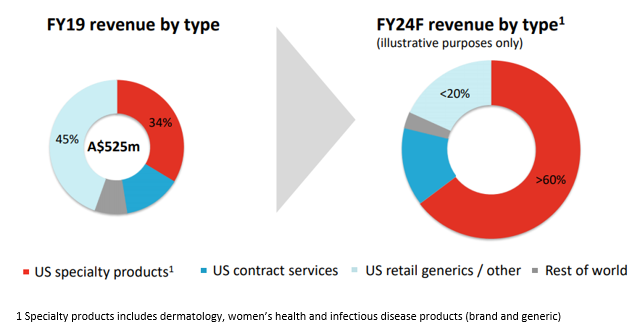

AGM presentation-

The company updated its AGM presentation on ASX discussing the FY2019 overview and about E4/DRSP oral contraceptive (new and next generation combined hormonal oral contraceptive).

The company has a 20-year license (exclusive) and supply agreement for E4/DRSP in the United States, and its launch is expected in the first half of the calendar year 2021 subject to FDA approval.

Source: AGM presentation

On 2 December 2019 the companyâs stock quoted $0.44 with a market capitalisation of $779.56 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.