The technology sector has been in the limelight since the COVID-19 pandemic led to an economic crisis with the temporary shutdown of several businesses and lay-offs and stand-downs of millions of employees. With governments implementing lockdown of regions and encouraging social distancing, the need of the hour was how to manage your work as well as daily chores while staying at home. This is where the demand for technology emerges.

Companies being able to allow its workforce to work from home, students being able to continue their studies despite not going to school via e-learning, family members able to order the necessary items online without the need to go to the market – All this is possible because of technology.

In this article, we would be looking at some ASX-listed technology stocks which drove the technology sector during the pandemic.

Interesting Read: How Digital Technologies are helping in revamping businesses?

Splitit Payments Ltd Registers MSV growth of 165%

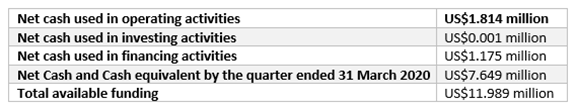

BNPL company, Splitit Payments Ltd (ASX:SPT) reported robust growth in its revenue during Q3 FY2020 ended 31 March 2020. Let us take a look at the quarterly highlights of the company:

- Witnessed growth across all leading KPIs during the quarter and from 1 April till date.

- Merchant Sales Volume (MSV) grew by 165% during April 2020 (1 April till 26 April 2020) as compared to the previous corresponding period.

- MSV increased by 152% during March 2020 following the new significant merchant wins.

- March 2020 quarter witnessed 104% in revenue on pcp to US$657K, and merchants increased by 108% to 862 on pcp. The growth in 12M Active Merchants was 12% compared to the previous quarter.

- Entered into a crucial global agreement with Visa to accelerate instalment payment innovation.

- Formed alliance with Stripe to accelerate rapid scalability in the upcoming quarters.

A look at the Financial Position:

On 30 April 2020, SPT received firm commitments to raise $16 million in equity at $0.41 per share through a fully committed share placement to institutional, sophisticated as well as professional investors. The proceeds from the placement would allow the company to complete its high-growth strategy by investing in go-to-market & technology resources. It would also help in supporting the existing merchant credit facilities as well as for general working capital needs.

Stock Information:

SPT shares have delivered a negative Year to Date return of 21.80%. However, in the previous one-month, the shares have provided a return of 67.74%. SPT stock last traded at $0.505 on 30 April 2020, down 2.885% from its previous close.

Bigtincan Holdings Limited Registers 178% growth in Cash Receipt

Bigtincan Holdings Limited (ASX:BTH), the global software company providing a leading AI-powered sales enablement automation platform, released its Q3 FY2020 results.

Q3 FY2020 Highlights:

- Customer cash receipts grew by 178% to $14.9 million on pcp.

- Cash operating payments which was $6.8 million in Q3 FY2019 increased to $11.1 million in Q3 FY2020.

- Net cash and cash equivalent for the quarter ended 31 March 2020 was $31.5 million.

- Won a new customer during the period, DXC Technology. It continued to focus on increasing its present customers and acquire new customers.

- Introduced its community program that provides a coronavirus awareness toolkit and ‘working remotely’ awareness course to support businesses adopting working from home & showcase the power of its mobile-first solution.

- BTH reaffirmed its FY2020 outlook to deliver organic revenue growth in FY2020 in the range of 30% to 40%.

Stock Information:

BTH shares have delivered a negative Year to Date return of 6.29%. However, in the previous one-month, the shares have provided a return of 67.50%. BTH stock last traded at $0.770 on 30 April 2020, up by 4.054% from its previous close.

MNF Group Limited Reports increased demand for voice and collaboration technology

MNF Group Limited (ASX:MNF) is the fastest growing technology company in the APAC region. The company develops & operates a global communications network as well as a software suite facilitating some of the leading innovators in the world to provide new-generation communications solutions.

On 28 April 2020, the company presented its operations and trading update amid these unusual circumstances.

Operational Update:

MNF continues to refine & improve the initiatives in place to tackle with coronavirus. It is also following the guidelines provided by the government. Further, the company is giving regular updates to its team to make sure they are supported as well as involved during this period & is continually observing feedback from staff.

Trading Update:

The present COVID-19 pandemic has resulted in increased demand for voice and collaboration technology as work and school continues from home. MNF, being the principal provider of software for telecommunications & unified communication technologies, noted strong demand for its core products. Direct business is undergoing more than average usage volumes.

The domestic Wholesale business is gaining from the extra demand for domestic voice minutes while the Global Wholesale segment has a positive effect from a rise in the use of collaboration & UCaaS services.

Outlook:

The company reaffirmed its guidance to deliver EBITDA between $36 million to $39 million.

The company confirmed that it had $38.6 million of cash as at 31 December 2019 and it also had undrawn committed debt facilities of $30 million.

Stock Information:

MNF shares have delivered a negative Year to Date return of 8.96%. However, in the previous one-month, the shares have provided a return of 2.24%. MNF stock last traded at $4.460 on 30 April 2020, up by 1.532% from its previous close.

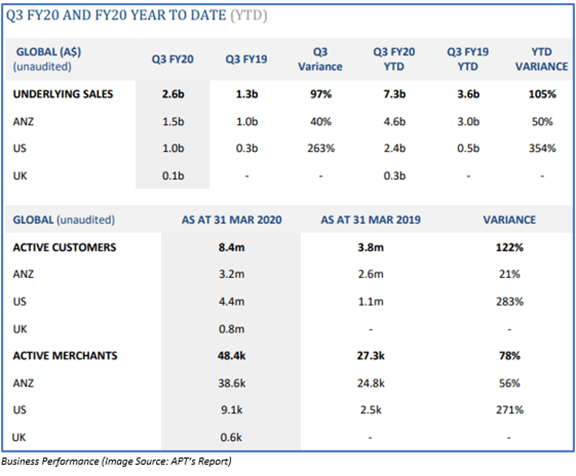

Afterpay Limited Records Underlying Sales of $7.3 billion YTD

On 14 April 2020, BNPL player Afterpay Limited (ASX:APT), in its business update for three months period ended 31 March 2020, reported strong growth across the business with the underlying sales of $7.3 billion YTD. It improved by 105% on pcp.

The income margins for March 2020 and FY2020 YTD was above 1H FY2020. Gross Losses for March 2020 was circa 1%.

Stock Information:

APT shares have delivered a negative Year to Date return of 7.57%. However, in the previous one-month, the shares have provided a return of 53.86%. APT stock last traded at $31.200 on 30 April 2020, up by 10.835% from its previous close.

Interesting Read: BNPL Stocks Bounce Back: Favourable Market Updates, Earnings Potential Highlight Strength

WiseTech Global Limited Announces Growth in Revenue & Cash Generation

WiseTech Global Limited (ASX:WTC), in its recent announcement on the business update, reaffirmed its FY2020 guidance. It expects its FY2020 revenue between $420 million to $450 million and EBITDA in between $114 million to $132 million.

For Q3 ended 31 March 2020, WTC confirmed that its business traded in line with the anticipated range for FY2020 guidance. As a result, the company registered an increase in revenue, cash generation from operation as well as onboarding of further users. It considerably offset the projected reduction from COVID-19 disruptions.

WTC confirmed that its balance sheet is strong with strong liquidity and cash generation. The net cash position of the company as at 31 March 2020 was $230 million. WTC has addition debt facility of $190 million, which remains undrawn.

Other than this, people and platforms are fully operational across each geographical location.

Outlook:

WTC confirmed that its business is healthy. Considering the present economic situation and impact on the global supply chain movement due to COVID-19, the company expects an increase in the demand for the worldwide technology, digital transformation & integrated platforms like CargoWise to accelerate.

Being a cloud-based, SaaS technology company, WTC has flexibility & experience to change its operations despite the global economic downturn. The company would now be investing in its technology and would remain solid to derive advantage from the economic recovery.

Stock Information:

WTC shares have delivered a negative Year to Date return of 26.31%. However, in the previous one-month, the shares have provided a return of 8.83%. WTC stock last traded at $18.590 on 30 April 2020, up by 5.745% from its previous close.

Redbubble Limited Reports 25% Growth in Revenue

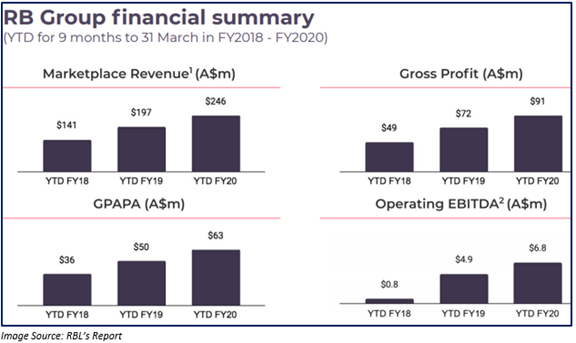

Redbubble Limited (ASX:RBL), the operator of global online marketplaces, reported 3Q Group Marketplace Revenue YoY growth of 20% during the beginning of COVID-19.

YTD Marketplace Revenue grew by 25%YoY. RBL noted a positive impact of COVID-19 on its sale in April 2020. Its supply chain remains strong. Gross profit improved by 28% to $91 million. Operating EBITDA profit was up 39% to $6.8 million.

By closure of 3Q FY2020, the cash balance with the company was $31.9 million.

Stock Information:

RBL shares have delivered a negative Year to Date return of 23.96%. However, in the previous one-month, the shares have provided a return of 38.66%. RBL stock last traded at $0.790 on 30 April 2020, down 4.242% from its previous close.