As Australians are confined to the walls of their homes and the situation around coronavirus pandemic (COVID-19) still remains unresolved, technology has turned out be a saviour for businesses that have been able to reach the consumers online. Thanks to e-commerce companies, online retailers and financial technology (fintech) businesses facilitating this provision, consumers are getting access to essential products and services amid quarantine.

In the present scenario of social distancing being observed across the planet, many online businesses are thriving including food and grocery delivery, while there is an opportunity for several companies, especially in the services sector, to take their business online such as healthcare consultation, conducting educational classes online, and provision of fitness and wellness solutions. All these businesses that are able to withstand the worldwide hurricane of COVID-19 can be considered sustainable and underpinning the importance of going digital in these times and also in general.

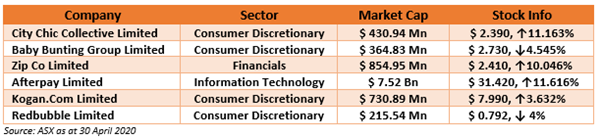

Establishing online presence not only helps in driving higher sales but also helps in reaching a larger consumer base. The following ASX-listed online companies have delivered an exemplary performance and continuing to work hard to stand strong in the market mayhem caused by COVID-19.

City Chic Collective Limited (ASX: CCX)

As a global omni-channel retailer, CCX is a provider of apparel, footwear and accessories, catered towards plus-size women. Primarily appealing to fashion forward women, it is a collection of customer-led brands including City Chic, Avenue, and Hips & Curves.

Speaking of its omni-channel business model, in addition to the operation of ~ 107 physical stores in Australia and New Zealand, City Chic also has approximately two-third of its total sales via multiple websites in Australasia and the US; marketplace and wholesale partnership with major US retailers; and a wholesale business with European and UK partners such as ASOS and Zalando. As a result, City Chic continues to serve its loyal customer base even against a turbulent business landscape and has the advantage of a more variable cost structure than most traditional retailers.

While CCX has implemented a number of measures to minimise the impact of store closures amid COVID-19, the Group remains in a strong cash position with significant headroom in its $ 35 million debt facility, expiring Feb 2023.

Baby Bunting Group Limited (ASX: BBN)

Baby Bunting Group is a nursery retailer and one-stop-baby shop, which offers prams, car seats, cots, high-chairs, change tables, portable cots, toys, monitors, baby wear, home safety, nursery furniture, feeding, and related products.

The Group, as a response to COVID-19, has introduced health and safety measures into its stores and operations, including social distancing, customer number management in stores and encouraging cashless transactions. The teams are working remotely and serving the consumers as there are over 6,000 babies born in Australia each week and Baby Bunting plays an essential role in supporting parents, new-born and young children.

As a result, Baby Bunting has been able to deliver, even during 30 December 2019 to 22 March 2020, total sales growth of 12.4% and comparable store sales growth of 6.2% amidst a challenging operating landscape. Growth in online sales for the same period has been 28.6% while the YTD total sales growth is 10.0%.

The Group is also making essential adjustments to cut costs and capital expenditure to preserve available funds. The Company’s performance to date has been in line with FY20 earnings guidance and it has a strong cash position with ~$ 27 million of unused funds available.

Also, READ: Online fashion retailer City Chic and Baby Bunting braving the corona storm

Zip Co Limited (ASX: Z1P)

Zip Co Limited operates as a leading player in the digital retail finance and payments space and provides point-of-sale credit and digital payment services to the retail, education, health and travel industries.

For the quarter ended 31 March 2020 (Q3 FY20), the Company delivered a revenue of $ 45 million, up 96% year-on-year while receivables rose to $ 1,168.2 million, up 107% year-on-year. Despite a globally challenging operating environment causing large-scale disruptions by COVID-19, the Zip ANZ business in particular continues to perform strongly, with more customers onboarding, transaction volume getting higher, and a strong pipeline of new partners in place.

On the back of its product differentiation, strong proprietary credit platform, healthy repayment profiles and penetration into defensive, everyday spend categories, the Company is well-funded with total available facilities of $ 1,144.5 million ($ 101.5 million currently undrawn), and thus uniquely positioned to trade through the current environment.

Afterpay Limited (ASX: APT)

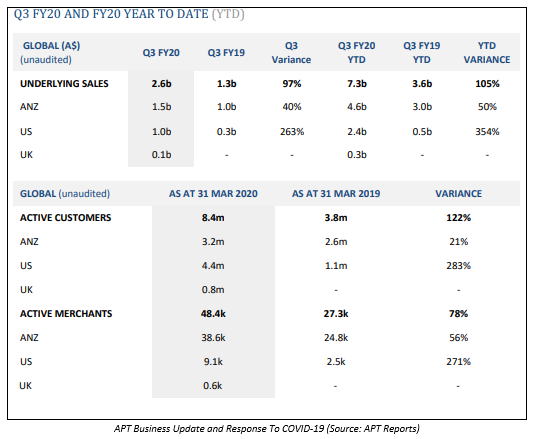

IT company, Afterpay Touch Group offers innovative payment solutions, including buy now, pay later, to make the process of purchasing a memorable and convenient experience for a global customer base in Australia, New Zealand and the United States. The Group has provided an impressive business update for March Quarter 2020 when the first phase of a COVID-19 Response Plan was implemented to manage the business through this evolving cycle.

During the last three months, all Afterpay’s businesses continued to deliver strong performance with overall underlying sales totalling $ 7.3 billion YTD, rising by an outstanding 105% compared to the prior corresponding period (pcp), which is in line with H1 FY20 guidance.

Despite all the global turbulence, March turned out to be the Company’s third largest underlying sales month on record, behind the seasonally higher months of November and December. Also, most of the company employees have been working remotely and the transition was seamless.

Kogan.com Limited (ASX: KGN)

Kogan.com is a holding company for retail and services businesses, renowned for price leadership through digital efficiency. These include Kogan Retail, Kogan Marketplace, Kogan Mobile, Kogan Internet, Kogan Insurance, Kogan Travel, Kogan Money, Kogan Cars and Kogan Energy, all focused on making in-demand products and services more affordable and accessible.

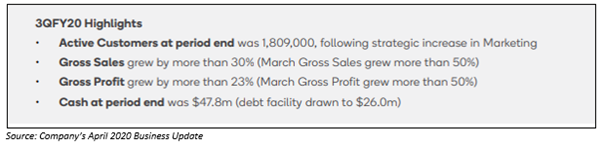

For the March Quarter 2020, Kogan.com has generated strong Gross Sales (up 30%) and Gross Profit growth (more than 23%) while successfully navigating through the significant disruptions of the COVID-19 pandemic and other operational matters to ensure the continuity of high standards of service to consumers.

Kogan.com Founder & CEO, Ruslan Kogan highlighted some long cultivated business elements that can be credited for this performance, such as a portfolio of businesses with world-leading supply chains, a rapid fulfilment and logistics capability facilitating fast delivery of items and cloud-based systems which enable full productivity while working from home. Besides, the Group’s active customers grew by over 13% year-on-year to 1,809,000 as at 31 March 2020.

Redbubble Limited (ASX: RBL)

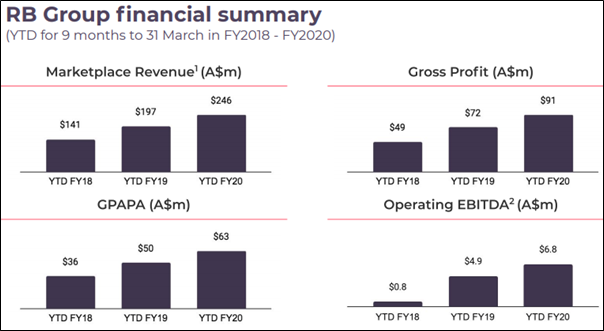

Redbubble Group operates leading global online marketplaces hosted at Redbubble.com and TeePublic.com, powered by more than a million independent artists. It is a unique business model wherein independent artists are able to profit from their creativity and reach global fan base.

To its advantage, RB Group has continued to benefit from increased online activity with stronger sales growth during the March Quarter 2020 and to date. As per the figures released on 28 April 2020, the Group’s marketplace revenue increased by 25% to $ 246 million while the gross profit reached $ 91 million, up 28% and gross profit margin expanded by 0.9 percentage points to 37.2%. The performance can be attributed to a combination of a stronger than expected start to the Q3 FY20 and subsequent fluctuations driven by immediate consumer reactions to COVID-19.

Source: Company’s 3Q FY2020 Business Update

All these companies’ business models have demonstrated resilience during the global pandemic and benefited from consumers moving to online platforms worldwide. Besides, all these companies have a reasonable price point and unique product offerings, which are proving to be attractive to customers who are at home.