Death Care Industry:

The death care industry is the provider of important service to people as well as families who are handling with or preparing for, death and sorrow. It comprises of morgue services, cremation of dead body, organising and conducting a funeral, burial as well as memorialisation.

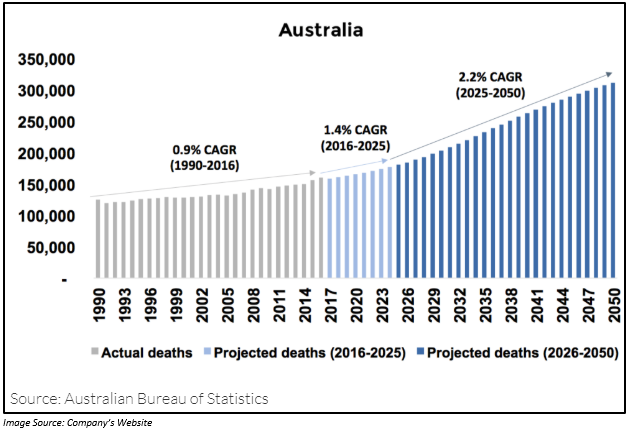

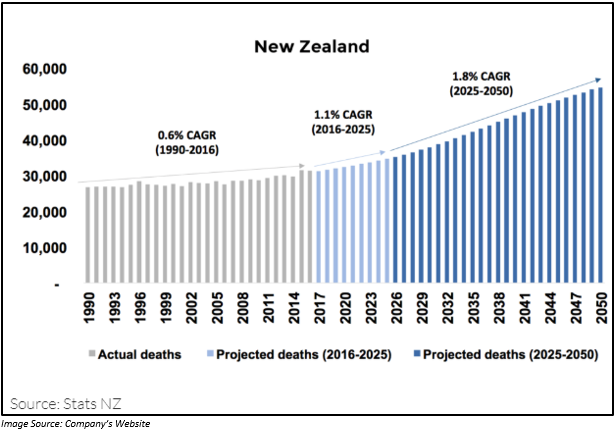

In Australia and New Zealand, there is an increase in the number of deaths with an increase in the population followed by maturing of the âbaby boomersâ. Below is the chart which highlights the actual number of deaths in Australia and New Zealand along with the forecast of the expected deaths by 2050.

In the below article, we will look into the recent developments of one of the death service providers, Propel Funeral Partners Limited.

Propel Funeral Partners Limited (ASX: PFP)

Propel Funeral Partners Limited (ASX:PFP) is a provider of death care services. It ranks amongst the biggest private providers of death care services in New Zealand as well as in Australia. The company has funeral homes, cemeteries, crematoria and related assets which are located in places like Queensland, Victoria, New South Wales, Tasmania, Western Australia, South Australia as well as in New Zealand.

Recent Development:

PFPâs Revenue up 19% in Q1 FY2020:

On 9 October 2019, Propel Funeral Partners Limited released is Q1 FY2020 trading update for the quarter ended 30 September 2019.

During Q1 FY2020, the company performed a record number of funerals. There was an increase in the funeral volume in Q1 FY2020 as compared to the previous corresponding period. As a result, the revenue also increased by 19% to $28.9 million and operating EBITDA by 38.3% to $8.9 million as compared to Q1 FY2019.

The Average Revenue Per Funeral increase was in between 2% to 4% over that in FY19.

PFPâs Revenue Improved By 17.6% In FY2019:

The company during the financial year ended 30 June 2019 reported a strong result in spite of below-trend death volumes in most of the markets in which the company operates.

- The revenue of the company during the period increased by 17.6% year over year to $95.1 million.

- Operating EBITDA went up by 10.6% year over year to $23.8 million.

- The operating net profit after tax went up by 8.1% year over year to $13.3 million. However, overall, the net profit after tax declined slightly from $12.5 million in FY2018 to $12.3 million in FY2019.

- Dividend for FY2019 was 11.5 cents per share, representing a growth of 79.7% on the previous corresponding period.

A Glance at the Funeral Volume in FY2019:

Acquisitions During FY2019:

The company remained consistent with the investment strategy during FY2019. Below is the list of acquisitions made by the company during the period.

- The company during FY2019 finalised the purchase of businesses, assets along with a freehold property of Newhaven Funerals NQ, functioning from 2 locations in North Queensland.

- The assets, as well as the business of Martin Williams Funeral Directors, was also acquired during the period. It operates in locations of South Auckland, New Zealand. The company signed a conditional sale agreement for the acquisition of total issued share capital of Dils Funeral Services Limited.

- The complete issued share capital of Noxomo Pty Limited was also acquired during FY2019 which trades as Manning Great Lakes Memorial Gardens. Manning Great Lakes Memorial Gardens possesses as well as runs a crematorium and lawn graveyard located on the mid north coast of NSW.

- The company also completed the acquisition of business, assets and a freehold property related to Waikanae Funeral Home and the Kaitawa Crematorium situated in Waikanae, New Zealand.

- PFP also acquired Morleys Funerals Pty Ltdâs total issued share capital, its related businesses along with the freehold assets during FY2019. It operates from 6 places Townsville, Queensland

- The company also purchased 7 freehold properties which include four properties that were earlier tenanted by PFP, 2 potential greenfield development opportunities along with a potential brownfield extension opportunity.

On 19 August 2019, the company signed a conditional sale agreement to obtain the complete issued share capital of Codfern Pty. Ltd along with three substantial freehold properties along with a parcel of vacant land on the Sunshine Coast in Queensland.

The company is looking for further opportunities for potential acquisitions in line with its investment strategy. The company recently expanded its senior debt facilities to $100 million with Westpac Banking Corporation (ASX:WBC). On 26 August 2019, the companyâs net cash held was $8 million.

FY2020 Outlook:

The company is well positioned to derive benefits from the acquisition during FY2019 along with its probable future acquisitions.

July 2019 was a positive start of the company In FY2020 with the record in the number of funerals performed by the company and also achieved an average revenue per funeral growth in the range of 2 to 4%.

Stock Information

The shares PFP have generated a decent YTD return of 23.35%. By the end of the trading session on 10 October 2019, the closing price of the shares of PFP was $3.050, down by 1.294% from its previous closing price. PFP holds a market capitalisation of $304.39 million with ~ 98.51 million outstanding shares and a PE multiple of 24.60X.

Conclusion:

Based on the past performance of the company along with the acquisitions made, it appears that the company would continue to excel in the upcoming period. Also, as per the data and forecast of the death in the Australia and New Zealand, the growth in the death rate will help the company to improve further in the future. This in turn would impact the share price of the company and also benefit its shareholders.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.