The following article will help the buyers take a decision to buy a house in Australia now or later. The article also incorporates details of some real estate stocks trading on the Australian Stock Exchange.

Australia Property Market Trends

The large fluctuations in the Australian economy have raised uncertainty over the performance of the economy in the upcoming months. The Australian property sector has seen a persistent fall in housing prices in the past few months. A recently released data has indicated a decline in the residential property prices across all the eight capital cities of Australia in the March Quarter 2019. The data was released by the Australian Bureau of Statistics, showing the sharpest fall of 3.9 percent in Sydney and 3.8 percent in Melbourne during the period.

However, the recent figures on Australian property prices published by a property consultant have shown a mild recovery in Sydney and Melbourneâs property prices in May. The figures indicated that the rate of decline in house prices has slowed down in May, in the wake of rising auction clearance rates and easing of lending rules. Thus, the Australian property market seems to be on the path towards recovery.

Australia Property Market Outlook

Some market experts think that the Australian housing market might bottom out next year, stabilising in the second half of this year. Economists have given this optimistic outlook in the wake of recent transitions in the Australian economy favouring the property market, including ease of lending regulations by the Australian Prudential Regulation Authority (APRA). The authority has proposed a plan in May to remove 7 per cent floor in mortgage serviceability assessments, benefitting the new home loan buyers. Along with this, the RBA's earlier-than-expected rate cut easing and the victory of the Coalition government in the federal elections might provide a turnaround the two-year long property slump.

Investment In Real Estate Stocks

The investment in real estate stocks could be an alternative for the buyers interested in investing in the property market. Let us have a look at some of the real estate stocks trading on the Australian Stock Exchange:

McGrath Limited

Headquartered in New South Wales, Australia, McGrath Limited (ASX: MEA) is engaged in the business of the real estate. The company offers different services like agency sales, mortgage broking, property management and career training. The McGrath agents are spread across the East Coast of Australia in 96 offices.

Operational Performance

In April this year, the company entered into an agreement to acquire the business and assets of a real estate business - Sydney Sothebyâs International Realty - CBD and Pyrmont - owned by a leading real estate agent in the Lower North Shore of Sydney. The company informed that the acquisition would be settled in cash at a total consideration of around $2 million.

Financial Performance

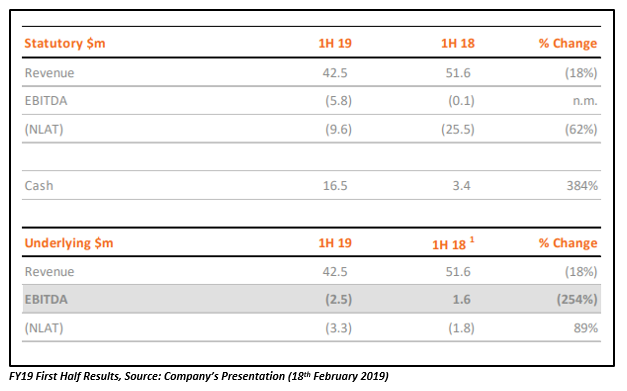

The company released its FY19 First Half Results in February 2019. The revenue of the company was down 18 percent to $42.5 million in 1H FY19 relative to 1H FY18. The company reported an underlying EBITDA loss of $2.5 million during the period, affected by the continuing subdued property market conditions. The national market share by sales value improved a little to 3.1 percent from 2.9 percent in June 2018. The company declared an underlying NPAT loss of $3.3 million in 1H19.

Future Outlook

In its recently released trading update, the company informed that it expects full-year EBITDA loss of $6 - $6.5 million for the year ending 30th June 2019 owing to the challenging market conditions. The company expects more favourable housing sector conditions in the next financial year contributing to the companyâs improved performance.

Stock Performance

The companyâs stock ended up lower on the Australian Securities Exchange at AUD 0.245 (as on 21st June 2019), down by 2 percent in comparison to the last closed price. Around 50,287 number of companyâs shares were in trade today. The stock has delivered a negative return on a YTD basis of 13.79 percent. The company has a market capitalisation of A$41.98 million with approximately 167.93 million shares outstanding.

APN Industria REIT

An Australian Real Estate Investment Trust, APN Industria REIT (ASX:ADI) holds a portfolio of 28 properties located across the major Australian cities. The company holds interests in the properties that offer functional and affordable workspaces for businesses.

Operational Performance

The company announced the acquisition of four industrial warehouses located in Knoxfield and Kilsyth for $38.25 million on 13th May 2019. The company reported that a combination of debt and equity would be used to fund the Acquisitions and associated transactional costs.

In the half-year ending 31st December 2018, the companyâs portfolio occupancy improved to 96 per cent owing to 6,600 square metres of leasing. The company informed that around 3,700 square metres of renewals were agreed, and 2,900 square metres of vacancy was leased during the period. Around $26.3 million of acquisitions were settled at an average of 7.1 percent yield.

Financial Performance

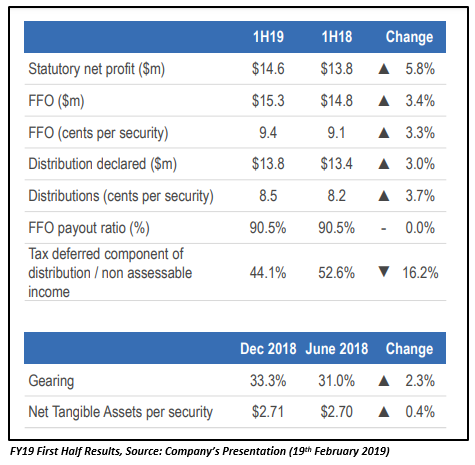

Driven by the contracted fixed uplifts across the property portfolio and two new acquisitions, the companyâs net profit for the half-year ending 31st December 2018 rose by $0.8 million to $14.6 million relative to the prior corresponding period (pcp). The Funds From Operations (FFO) improved 3.4 per cent to $15.3 million or 3.3 per cent on a per security basis to 9.4 cents. Also, the companyâs Net Tangible Assets (NTA) reported valuation gains of $3.1 million during the period.

Future Outlook

In a recent announcement on the ASX, the company mentioned the following expectations for the future:

- The FY19 Funds From Operations (FFO) of 19.15 â 19.25 cents per security, reflecting 3.5 â 4.0 percent growth.

- DPS guidance for FY19 re-affirmed to 17.0 cents per security.

- The initial FY20 FFO per security growth guidance of 2.5 â 3.0 percent.

- Industria's pro-forma gearing forecasted to be approximately 33 percent as on 31st December 2018 including the impact of the Acquisitions and Placement.

Stock Performance

As on 21st June 2019, the companyâs stock closed higher on the ASX at AUD 2.950, up by 1.724 percent relative to the last closed price. The stock opened at AUD 2.93 and touched a dayâs high value of AUD 2.980 during the intraday session. The market capitalisation of the company stood at AUD 525.34 million, with around 181.15 million outstanding shares at the time of writing the report. The stock has delivered a return of 54.96 percent since it commenced trading on the ASX.

Cedar Woods Properties Limited

One of Australiaâs leading property companies, Cedar Woods Properties Limited (ASX:CWP) was established in 1987 in Perth. The company is engaged in the development of residential communities and commercial developments. The company has successfully completed many projects in Victoria, South Australia, Western Australia and Queensland in the past.

Operational Performance

In May 2019, the company announced that it has signed a conditional contract for the acquisition of the Subiaco TAFE site for $15.05 million. The contract confirmed Cedar Woods as the preferred proponent to purchase the site. The acquisition was consistent with the Companyâs national diversification strategy.

The company released its operational update on 7th May 2019 in which it notified that it is on track to deliver a strong increase in earnings in FY19. The company informed that it had constructed several projects during the third quarter of FY19, and several further stages are anticipated to be completed by the end of the financial year.

Cedar Woods acquired a 20.2-hectare site in Brabham in Perthâs north-east growth corridor for $28.25 million with payment on deferred terms in March 2019. The company reported that the settlement is expected to take place in July 2019.

Financial Performance

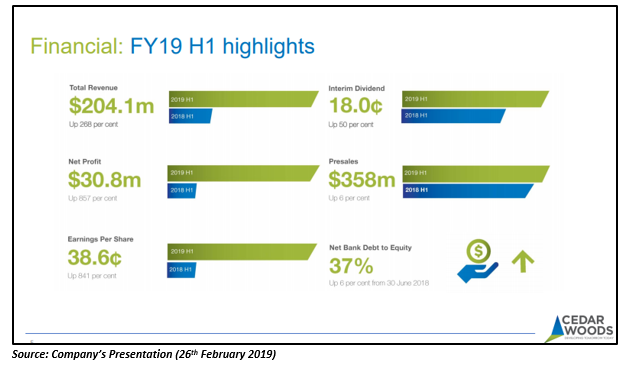

The company announced its financial results for the first half of the 2019 financial year on 26th February 2019. Cedar Woods posted a net profit after tax (NPAT) of $30.8 million, up significantly on the $3.2 million profit for pcp. The companyâs pre-sales at the end of the period stood at $358 million, 6 per cent higher than the pcp. The revenue of the firm was up 268 per cent on the pcp to $204 million during the period.

Future Outlook

The company expects a strong increase in its earnings in FY19. The company informed that the property market conditions have weakened nationally and are providing the potential for weaker FY20 earnings. The company anticipates that several new projects will support sales volumes and contribute to earnings from FY20.

Stock Performance

The stock closed the trading session lower on ASX at AUD 5.700 (on 21st June 2019), with a dip of 4.523 percent compared to the previous closed price. The 52-week high and low value of the stock was recorded at AUD 6.30 and AUD 4.52, respectively. The stock has delivered a return of 19.59 percent on a YTD basis. The company has a market capitalisation of A$478.3 million with approximately 80.12 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.