The ASX is intending to unveil a new technology index in early 2020 - S&P/ASX All Technology Index (XTX). Projected to go live on 21 February 2020, the new index will provide a better transparency and precision to investors pursuing ASX technology stocks.

The new S&P/ASX All Technology Index, including all ASX technology stocks, is intended to be a wider and more comprehensive index as compared to the XIJ - existing S&P/ASX 200 Information Technology Index, comprising top 200 IT stocks.

This signifies the strong foothold of ASX technology stocks. Further specification will be revealed about the Index methodology on the launch of the index.

The index launch is driven by ASX strategy to attract more young tech companies to list in Australia and to position itself as a “late-stage VC funding market”.

The Nasdaq composite index comprises all companies listed on the Nasdaq Stock Market and tracks greater than 3,300 stocks in all. It presently traces the execution and performance of the world’s top tech stocks, which includes tech behemoth like Apple, Microsoft, Amazon.com, Facebook and Netflix.

ASX executive general manager, Max Cunningham stated that the new index is likely to boost the profile of tech companies, currently shrouded in the spectres of the $30 billion ‘WAAAX’ stocks.

The word WAAAX is an acronym where "W" stands for WiseTech Global Limited (ASX: WTC), "A" for Appen Limited (ASX: APX), the next “A” stands for Altium Limited (ASX: ALU), and the last "A" for Afterpay Touch Group Limited (ASX: APT), and finally "X" represents Xero Limited (ASX: XRO).

The main aim for the launch is to develop an index with a decent, high-quality, increasing tech sector, which open-heartedly welcomes mid-cap and upwards to the latest tech index.

Technology Sector Outshines; Continues to Boom in 2020

The S&P/ASX 200 Information Technology index has been one of the best-performing indices last year, with more than 30% return on a year-to-date basis.

The technology industry is expected to continue 2020 on an promising note. We note that cloud computing boom, driven by growing use of AI and ML technologies, is the key optimistic factor.

Markedly, an advancing economy and improved job chances are aiding the technology sector, which usually plays well in a developing economic cycle.

Semiconductors have always been the key drivers of the entire technology expansion due to their necessity in everyday life from phone, cars, other electronic devices to planes and weapons. Chipmakers, on the other hand, also aids the global technology with their innovative usage and helps in digitalisation in numerous places like transport, financial systems healthcare, retails agriculture, defence, agriculture, to name few.

Global semiconductor and chip market segments are likely to improve, this year. According to media sources, global chip market will increase ~6% in 2020, after an approximate drop of 13% in 2019.

Continuous enhancement in electronic devices and robust adoption of smart-connectivity solutions and wearables are expected to drive the technology sector in the days ahead.

Moreover, rapid adoption of cloud, Internet of Things, autonomous cars, gaming, drones, cryptocurrencies, and other advanced information technologies are fuelling evolution in the space.

Three Stocks in Radar

Given the above scenario, we have highlighted three stocks to be a part of the to-be launched tech index in early 2020.

Appen Limited (ASX: APX)

Appen Limited is a global IT player, which is involved in offering quality data solution, human annotated datasets that are utilized for machine learning and AI. The company excels in >180 languages and has greater than 1 million skilled contractors.

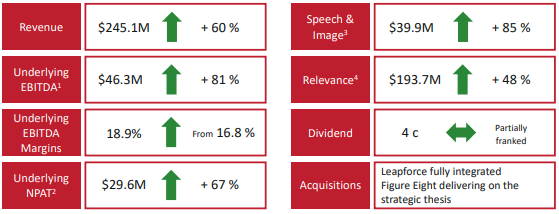

Financial Highlights (Source: Company Reports)

Financial Takeaways for 1HFY19

In its financial performance for the half year ended 30th June 2019, the company reported revenues of $245.1 million, up 60% year over year. Relevance revenue during the period stood at$193.7 million, soaring 48% on a yearly basis. The company’s underlying EBITDA came in at $46.3 million, an increase of 81% year over year. Further, underlying EBITDA margins increased from 16.8% to 18.9%. The company declared a partially franked dividend of 4 cents per share.

Expect What?

The company had revised its FY19 guidance. It now expects its underlying EBITDA to be in the band of $96M to $99M in FY19, as compared to the previous guidance of $85 million – $90 million. The company expects its ARR outlook in the range of $30M - $35M, unchanged from the previous outlook.

Stock Performance

Appen has a market cap of $2.69 billion with ~ 121.11 million outstanding shares. The stock of APX at the end of the trading session on 03 January 2020 closed at $22.52, up 1.53% from its previous close.

NextDC Limited (ASX: NXT)

A technology-based company, NextDC Limited is engaged in building and operating independent data centres in Australia.

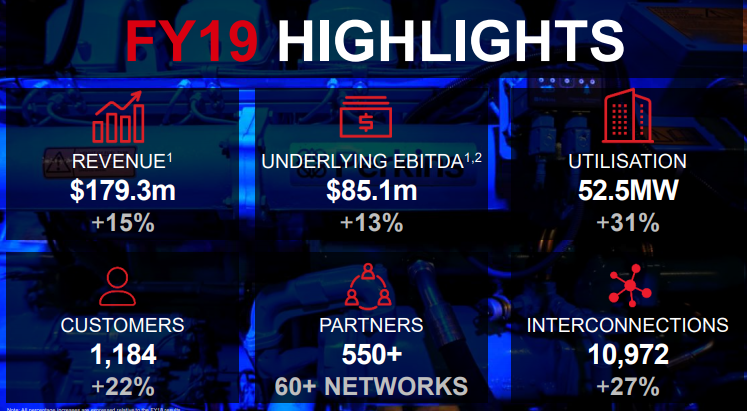

Financial Takeaways for FY19 Period Ended 30 June 2019:

- NextDC Limited delivered FY19 revenues of $179.3 million, soaring 15% on a yearly basis.

- Underlying EBITDA went up by 13% and reached $85.1 million.

- Statutory net loss after tax increased from a profit of $6.6 million reported in FY18 to $9.8 million in FY19.

- Underlying capital expenditure for the period came in at $378 million, up from $285 million reported in FY18.

- The company’s sale from contracted utilisation came in at 52.5MW, an increase of 31% year over year. Interconnections for the period stood at 10,972, soaring 27% year over year.

Financial Highlights (Source: Company Reports)

Cashflow Facts:

The company’s cash flow from operations during the period came in at $39.4 million, as compared to $33.4 million in FY18. The company ended FY19 with cash balance of $399 million, down from $418 million at the end of FY18.

Guidance for FY2020:

For FY20, the company anticipates revenues to be in the band of $200 million to $206 million. Underlying EBITDA is projected to be between $100 million to $105 million. The company expects capital expenses to be in the band of $280 million to $300 million.

Stock Performance

NextDC Limited has a market cap of $2.26 billion with ~ 345.39 million outstanding shares. The stock of the company at the end of the trading session on 03 January 2020 closed at $6.550, up 0.31% from its previous close.

Altium Limited (ASX: ALU)

Altium Limited is one of the early providers of PCB design tools and components coupled with data management software solutions. The company’s leading product is best acknowledged for skills in 3D Printed Circuit Board (PCB) Computer. The company has also helped many enterprises in designing next-generation electronic products and systems.

Power in the PCB Market (Source: Company Reports)

Financial Takeaways for FY19 Period Ended 30 June 2019:

- The company delivered revenue of US$171.8 million, soaring 23% year over year.

- The company’s net profit after tax (NPAT) for FY19 came in at US$52.9 million, up from US$37.5 million reported in FY18.

- Earnings per share increased a whopping 41% and came in at 40.57 cents per share.

- The company ended FY19 with US$80.5 million.

- The total number of subscribers for the period came in at 43,698, up 13% year over year.

- The company paid annual dividend of 34 cents, up 26% from the year-ago period.

Outlook

For FY20, the company anticipates revenues to be approximately US$200 million. EBITDA margin is expected to be in the band of 37% to 38%. The company plans to attain 100,000 subscribers by 2025.

Stock Performance

Altium Limited has a market cap of $4.5 billion with ~ 130.97 million outstanding shares. The stock of the company at the end of the trading session on 03 January 2020 closed at $34.530, up 0.553% from its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice