Summary

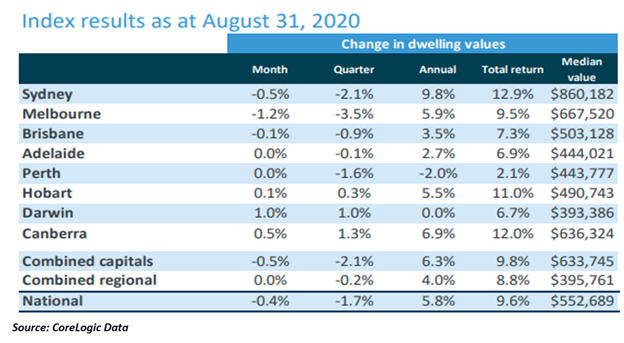

- The CoreLogic House pricing index fell by 0.4% in August driven by a decline of 1.2% in Melbourne house prices.

- The decline in overseas migration, border closures and social distancing have been seen to impact the overall demand side for the Australian property market.

- Although housing values in Melbourne fell, other major capital cities fared better.

- Latest ABS figures depicted a 12% increase in new dwelling approvals for the month of July.

- The loan deferral scheme coming to an end may put pressure on mortgage owners to sell their properties, thereby increasing the distressed listings.

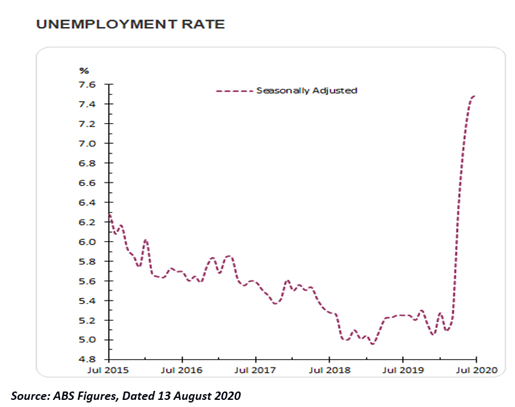

- Although low-interest rates offer lucrative loan prospects for potential homebuyers, the ongoing unemployment scenario could negatively impact their buying sentiments.

Australian property space is currently witnessing an obscured outlook, eclipsed by the COVID-19 induced uncertainty. The headwinds challenging high-priced property space in Australia have entailed a downfall in the housing prices for four months consecutively. Notably, housing values in August decreased by 0.4%.

According to the latest data released by CoreLogic, the decline was majorly led by Melbourne which witnessed strict lockdown, with Victoria being hard-hit by the second wave of infection.

Although the housing values in Melbourne fell by 1.2%, other major capital cities fared better. Significantly, while the housing values are trading below their pre-Covid levels, the rate of decline in prices has softened over the past two months.

Latest ABS figures, reflecting a positive trend for the Australian property market, depicted an increase in the new dwelling approvals in July by 12% to 13840 compared to June 2020.

A Glimpse at the Ongoing Scenario in the Property Market

The generally high price of the Australian property, especially in the key cities, has been warranted by the rising income scenario and increasing number of foreign buyers in the past. The growth in the demand for rented space by international students also appreciated the housing value.

However, the current scenario of distressed labour market amidst the economic downturn along with a drop in overseas migration is typically affecting the demand side, especially in the capital markets.

The demand from overseas migration which is generally enjoyed by capital cities has been chipped away with the international border restrictions.

Australian real estate sector continues to witness subdued demand, which however is substantially offset by the low level of new listings. The downward trajectory is particularly evident in the capital cities as social distancing priorities and remote working continues to impact the house purchase decisions.

Significantly, capital cities command substantially higher rates and the budding alternatives with work-from-home trends is reducing ‘proximity to workplace’ focus.

Notably, the weighted average Auction rate for the week ending 30 August 2020 was around 59%. Melbourne noted the auction rate of 40.63%, while Sydney recorded 64.15%.

Interesting Read: Real Estate vs Stocks - Which Is the Better Investment Option?

Equity Market Trends

Australian real estate player, Goodman Group (ASX:GMG) reported the increase in its operating profit by 12.5% on FY19 for the year ended 30 June 2020. Meanwhile, the operating performance remained ahead of the guidance for the year. GMG shares traded at $18.6 on 3 September, offering a return of ~21% over the past three months.

While the performance of Scentre Group (ASX:SCG) remained stagnant viz-a-viz overall property market trends. The results for the half-year ended 30 June 2020 for Scentre Group indicated a loss of $3.6 billion in the statutory results. SCG shares settled the day’s trading session at $2.270, up 1.3% on 3 September.

Key Factors to Behold for the Property Market

Prevailing economic uncertainty is one of the critical barriers to the growth momentum of the property market. As per the latest figures released by ABS, Australian GDP dwindled by 7% in the June Quarter, following a 0.3% contraction in the March Quarter. The slump in economic activity is expected to weigh on the property market.

ALSO READ: Australian Gross Domestic Product Slides 7%, Recession Bells Ringing?

Worrisome Unemployment Scenario

According to ABS statistics, the unemployment rate in Australia jumped to 7.5% in July 2020, showing distressed economic scenario. At the same time, employment has increased from 114,700 to 12,460,800 people, driven by an increase in the number of people employed in both full and part-time jobs.

Low Immigration

The overseas investments in property is one of the significant factors that are expected to guide the momentum of the real estate sector. The closure of international borders as a defensive strategy against the pandemic is substantially impacting the number of potential buyers in the market. Meanwhile, the rancour political relations of Australia with China are significantly reducing the value of foreign investments in the country’s real estate.

Interest Rates

The low-interest-rate environment can be a potential opportunity for many home buyers to make their purchases. Reserve Bank of Australia (RBA) has held the cash rate at 0.25% considering the bleak economic scenario.

However, the low rate scenario is also allowing the banks to provide home loans at a cheaper rate. Significantly, the competition has spiked among the banking players, offering mortgage at a lower rate.

Fiscal Package and Loan Deferral Scheme

The wage subsidy from JobKeeper and JobSeeker schemes has allowed many individuals and businesses to stay afloat during critical times. However, the reduction in the phase 2 of wage subsidy could affect the people, the spillover effect of which can be significantly felt on the loan payments. Furthermore, the loan deferral scheme coming to an end in September may put considerably higher pressure on the mortgage owners.

The banks facing the default risk could put pressure on the customers to sell their properties. Notably National Australia Bank Limited (ASX:NAB) has urged its high-risk loan holders to sell their properties in the near time.

Commenting on the same, NAB Chief Executive Ross McEwan stated that there would be circumstances when people could be “better-off selling out early”. It could lead to a sudden increase in the number of distressed listings. The growth in the supply side for the property market is expected to show a significant impact on the movement of housing values.