Companies engaged in metals and mineral extraction, processing in addition to their trading come under the metals and mining sector. Australia is an energy resource-rich country. Domestic as well as international demand for the energy resources in the country is continuing to grow.

In this article, we would look at three ASX-listed stocks from the metals & mining sector and cover their recent updates.

Tasman Resources Ltd

Tasman Resources Ltd is a Perth based Australian exploration company, with major focus on the South Australia region. The company works on exploration projects, holding potential for gold, copper, zinc, lead, and other base and precious metals.

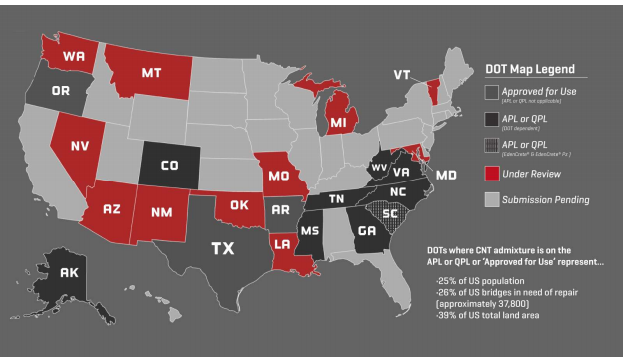

EDENCRETE® and EDENCRETE®Pz Secure SCDOT Approval

On 6 August 2019, Tasman Resources Ltd (ASX: TAS) updated the market with an announcement made by Eden Innovations Ltd (ASX: EDE), in which TAS, via its wholly owned subsidiary Noble Energy Pty Ltd, holds more than 624 million fully paid shares. The shareholding is equivalent to 37.49% of Edenâs total issued capital. Additionally, through Noble Energy, TAS holds over 14.81 million EDEOB options, representing 21.26% of the issued EDEOB options.

As per the announcement by Eden Innovations, it has obtained approval for the use of EdenCrete® and EdenCrete®Pz in concrete. The approval was given by the South Carolina Department of Transportation (SCDOT), which also added these products to its Qualified Product List for âType Sâ concrete admixtures.

EdenCrete® has received approval for use in 12 states in the US. Earlier, the product was in use in 11 US states. The SCDOT approval for EDENCRETE®Pz represents the first approval for the product from a department of transportation in the United States.

Eden completely owns EdenCrete®, which is a carbon-strengthened concrete additive. The additive is used to improve a broad range of concrete performance features such as compressive strength, abrasion resistance, and flexural and tensile strength. The primary target market of EdenCrete® includes road, bridge as well as other infrastructure construction and maintenance.

Source: Companyâs Report

On 11 July 2019, the market was updated regarding EdenCrete® and EdenCrete®Pz, the products of Eden, securing certifications in compliance with the relevant standards of the American Association of State Highway and Transportation Officials (AASHTO) as well as Table 1 of ASTM C494 for a Type S. The certification comes after the completion of a one-year trial by a National Transportation Product Evaluation Program (NTPEP)-appointed independent lab.

The approval has opened the way for Eden to file applications with DOTs in the United States, where the products are not yet approved.

Stock Information

In the previous six months, the shares of Tasman Resources have provided a positive return of 23.40%. The shares of TAS last traded at a price of $ 0.059 on 7 August 2019, up 1.724% from its previous closing price. Tasman Resources has a market cap of $ 30.62 million and approximately 527.86 million outstanding shares.

Lucapa Diamond Company Limited

Focusing on high-value mines in Angola and Lesotho, Lucapa Diamond Company Limited (ASX: LOM) is engaged in diamond production activities. The company aims to become a major producer of diamonds (premium and high-quality) from Lulo alluvial and Mothae kimberlite sources in the world.

Diamond Recovery at Mothae

LOM, along with the Government of the Kingdom of Lesotho, unveiled the recovery of an extraordinary 64 carat diamond from the Mothae Kimberlite mine in Lesotho. The company holds a 70% stake in the mine, while the government owns the remaining 30%.

According to Stephen Wetherall, the Managing Director of LOM, the Type IIa D-colour gem is the best single diamond ever found from the Mothae mine. He also stated that the recovery of the 64-carat diamond unveils a strong beginning for the company in relation to its mining campaign in the southern pit at Mothae, covering the higher margin zones. The company would continue with the mining work in the southern pit throughout the year 2019.

Source: Companyâs Report

Stock Information

In the previous six months, the shares of Lucapa Diamond Company Limited have provided a negative return of 22.50%. The shares of LOM opened flat at $ 0.155 on 7 August 2019 and closed the dayâs trading at $ 0.155. It has a market cap of $ 76.86 million and approximately 495.9 million outstanding shares.

PolarX Limited

PolarX Limited (ASX: PXX) is engaged in the exploration and development of minerals. Its current programs are aimed towards bringing Zackly Deposit, in which the company holds a 100% stake, and Caribou-Dome Deposit, in which the company controls an 80% interest, into early production.

Large Anomalies Identified at Saturn Target

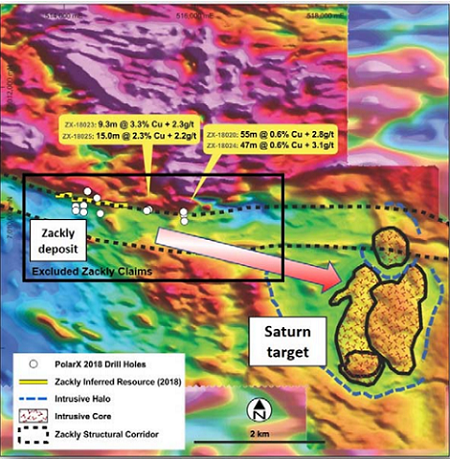

On 6 August 2019, PolarX Limited announced the identification of large anomalies, in line with the targeted copper?gold porphyry mineralisation, based on initial data from an Induced Polarisation (IP) survey, undertaken over the Saturn target, which lies within the companyâs Alaska Range Project.

Source: Companyâs Report

The company has reached an agreement with Lundin Mining Corporation for an initial diamond drilling program, covering 8 to 10 holes at Saturn to a total depth of ~5,000 meters. The first two holes are now in progress. PXX would fund the drilling program through the proceeds generated from the recent share placement to Lundin Mining worth $ 4.3 million. Also, Lundin Mining is the biggest shareholder of the company with a 12.85% stake and holds exclusive rights to start an earn-in option for a 51% interest in PolarXâs Stellar Project by spending US$ 24 million in stages and payment of US$ 20 million to the company in stages.

IP Survey:

As part of the IP survey, which was started in July 2019, data has been collected along the first three EW profiles. Additionally, zones of anomalous chargeability have been recognised in these three segments. In each of the scenario, the highest chargeability occurred on the exterior flanks of the magnetic highs, encompassing a zone of elevated chargeability linked with the magnetic highs, which are in consistent with the classic porphyry copper exploration model.

Also, through the IP survey, the data obtained shows the presence of decreased resistivity above the chargeability highs, which might be an indication of the existence of clay?minerals associated with argillic alteration or weathering. Two drilling rigs are on site. Drill holes, 19SAT001 and 19SAT002, are due to be drilled down to at least 600 metres deep for testing the IP chargeability response as well as magnetic bodies. It is expected that each hole will take around two weeks for drilling.

Saturn Target (Source: Companyâs Report)

Background:

PXX identified the Saturn copper?gold porphyry target, hosted by the Stellar Project, via an assessment of regional aeromagnetic data in early 2018. Moreover, the copper?gold porphyry target was confirmed by a higher?resolution survey in October 2018. Saturn lies ~ 3 kms towards the east of high?grade Zackly skarn deposit. Its magnetic body stretches 2km x 1km in areal extent and is covered by approximately 10 to 15 metres of post?mineral gravels.

Stock Information

In the previous six months, the shares of PolarX Limited have provided a decent return of 58.04%. The opening price of the shares of PXX was $ 0.110 on 7 August 2019, slightly lower than its previous closing price. The stock closed the dayâs trading at $ 0.115. PolarX Limited has a market cap of $ 47.83 million and approximately 415.92 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.