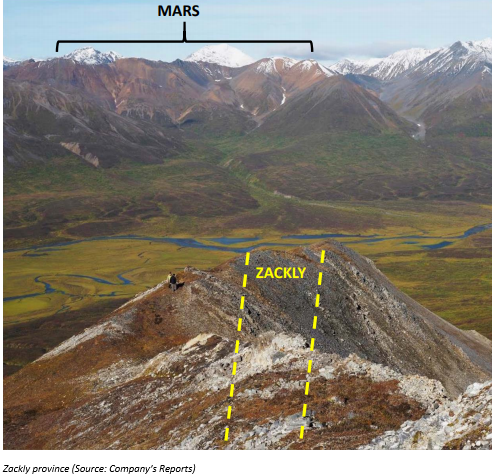

PolarX Limited (ASX: PXX) is an ASX-listed metals and mining company and has a high potential Alaskan project, spreading across 241 km2 of State Mining claims. Within the 35 km mineralised belt, several large unexplored advanced targets and existing high?grade resources are contained, which are now under PolarXâs control.

An early soil sample on this 35 km belt is mineralised with Copper, Gold and Silver on almost the entire 35 km beltâs surface in various geological forms.

On 4th June 2019, the company announced that it has raised approximately $4.3 million before costs via a share placement to Lundin Mining Corporation, a Canadian base metals mining company. Lundin Mining will get its hands on 53.44 million ordinary shares at a purchase price of $0.08 per share. For this share placement, shareholder approval is not required. 23.62 million shares will be issued under Listing Rule 7.1 and the remaining 29.82 million shares will be issued under Listing Rule 7.1A.

Under the agreement, Lundin Mining has an exclusive option to spend a total of US$24 million on the exploration activities for a period of three years and making consistent payments in cash over the period of time to PolarX, summing up to US$20 million. Pursuant to these conditions, Lundin Mining can elect to earn into the Stellar project.

The option will expire on either 31st December 2019 or 30 days after Lundin Mining has been provided with all information and data from the work program, whichever is later.

After the share placement, the company has intentions to raise additional capital up to $4.25 million via a 1 for 7 non?renounceable entitlement offer to the eligible shareholders. The offer price is same as the placement issue price at $0.08 per share.

The proceeds from the funds will be directed towards exploration on the underexplored Zackly Claims and the Caribou Dome project, apart from the working capital.

On 3rd June 2019, in another announcement, the company reported a trading halt of its listed securities on the ASX. ASX accepted the request, and the securities went on halt yesterday, the reason being a pending announcement related to a strategic investment in the company.

Accordingly, the halt was likely to be lifted on 5th June 2019 or when the company announces the information to the market. As the information was released to the market, the trading halt has been lifted, and the normal trading of the companyâs securities has commenced as of 4th June 2019 (AEST: 11:41 AM).

Separately, on 25th March 2019, the company confirmed a large Porphyry target, using its 3D modelling.

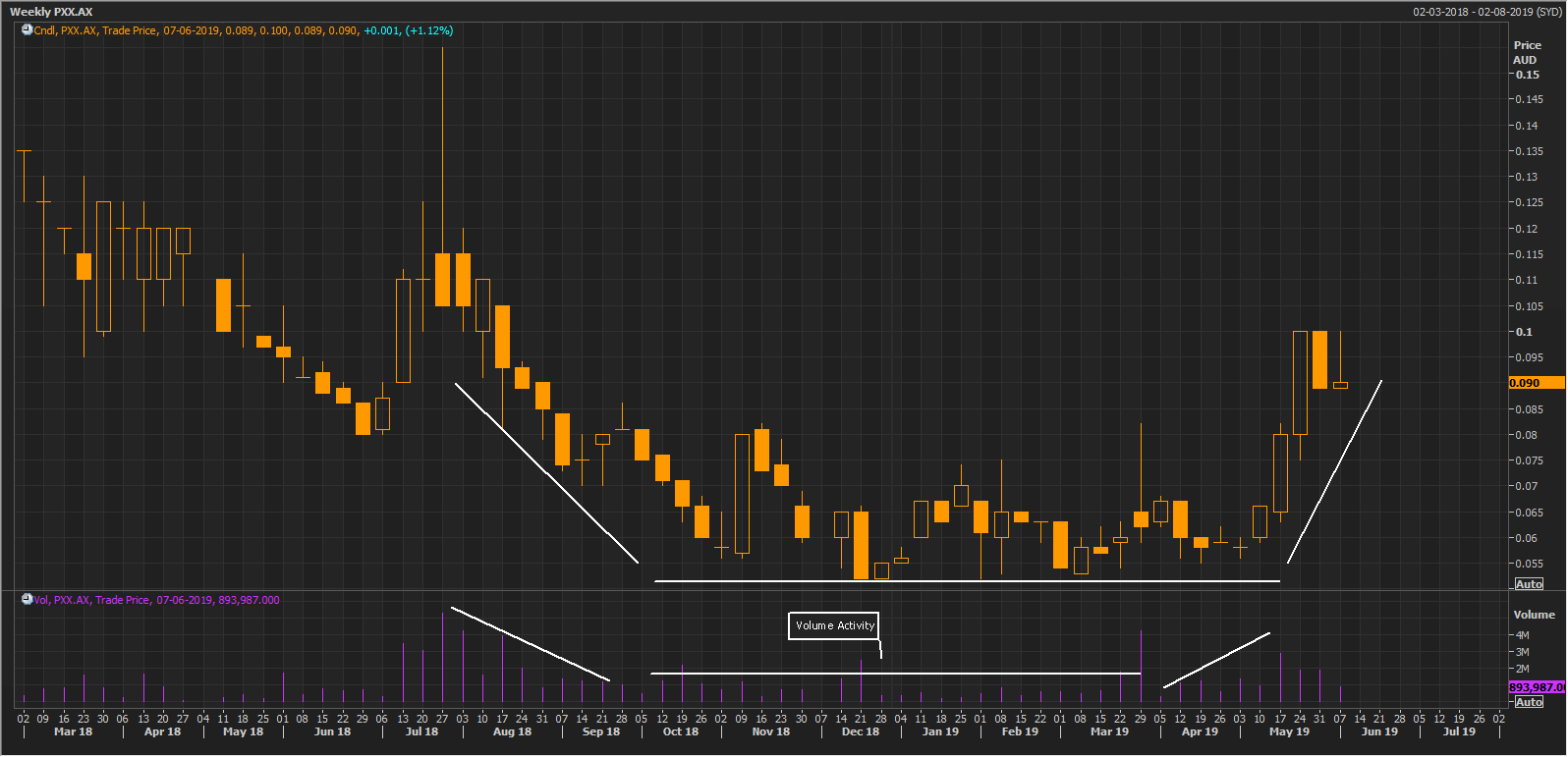

Technical Outlook

On the weekly chart, the stock has made a good base formation at the bottom. The base is a zone wherein the stock takes support or rests after a downfall and is generally a sign of a bullish reversal. A base formation is a very good signal for the potential reversal however, generally the stock price consolidates for a while before it makes a decisive move.

It starts to move in a sideways trend which halts the previous downtrend and generally strong hands accumulate shares in this calm environment.

Volume can never be overlooked when base formation is happening. Letâs look at the volume action with the price to get a better view.

When the stock started to fall, the volume also tapered down. This was the first indication that the selling it running out of steam. When the stock was forming the base throughout May 2019, the volume was quite stagnant, and the stock kept on moving forward with a strong support of A$0.052.

Weekly chart of PolarX (Source: Thomson Reuters)

When the stock was about to break above its base, the volume also started to pick up. This volume action was another sign of an uptrend as the price was increasing with the rising volume.

As of 5th June 2019, the stock is comfortably trading above its base.

Stock Performance

The company holds a market capitalisation of $28.73 million, and the stock has touched a 52-week high and low of $0.155 and $0.052, respectively. The stock closed at $0.095 (as on 5th June 2019), up by 5.556%. The last one-year return of the stock is negative 5.26%, and the YTD return stands at 63.64%.

Fenix Resources Limited

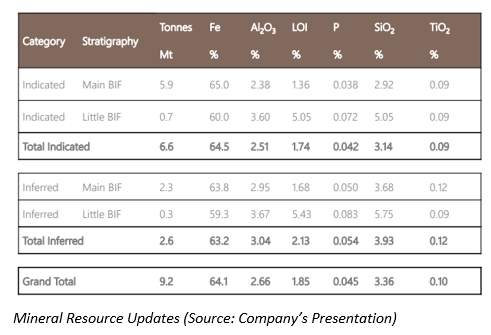

Fenix Resources Limited (ASX: FEX) is an ASX-listed metals and mining explorer, with 100% owned Iron Ridge iron ore flagship project, located 490 km from Geraldton port. It is a premium DSO deposit hosting JORC 2012 compliant resources.

Today, the company released to the market its investor presentation. The company reported a high grade of overall resource at 64.1% Fe, the scale of 9.2Mt exceeds the companyâs expectations. Furthermore the company witnessed excellent preliminary metallurgical results.

On 4th June 2019, the company updated investors that it is on the verge of commencing a combined infill and geotechnical diamond drill program at its flagship Iron Ridge project in the Mid-West region of Western Australia.

The drilling will incorporate seven holes for 880m of infill diamond drilling so that a portion of existing inferred mineral resource can be converted to Indicated category. The company expects to release the results progressively from July 2019 onwards, and Project feasibility study (PFS) is now due to be completed in October 2019. It is expected to commence further drilling of 650m for the purpose of hydrological studies.

Key Personnelâs statement

Robert Brierley, Managing Director of the company, stated that it is an important step for the feasibility study on the development of the project. The company is also looking forward to intersecting more iron ore mineralisation as it progresses towards direct shipping production in the fastest possible time.

Technical Outlook

On the daily chart, the stock is in an uptrend. This uptrend can be gauged by a simple moving average. On 30th November 2018, the stock opened gap up and rose above the 50 days moving average. But this gap was not backed by higher volume, therefore in the later days the stock started to correct. But before filling in the gap, it stopped just above the moving average and started to get stabilised around the moving average line.

Daily chart of Fenix Resources (Source: Thomson Reuters)

Post that, the stock saw one more gap up opening (on 23rd January 2019) and this time the volume was the star of the show. The volume on 23rd January picked up to a massive 157.8 million, increasing the credibility of the gap. Since then the stock price kept on rallying to higher levels, with moving average simultaneously trending up.

The second gap had probably initiated the strong force for this continued trend. Currently the stock is trading at A$0.120 and the trend is deemed to be positive until the price breaks below the moving average.

Stock Performance

The company holds a market capitalisation of $24.98 million, and the stock has touched a 52-week high and low of $0.117 and $0.020, respectively. The stock closed the trade at A$0.120 (as on 5 June 2019), up by 20%. The stock has generated an annual return of 177.78% and exhibited a YTD return of massive 354.55%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)