Investing mammoth Warren Buffett has a certain set of values that make him an inspirational investor. His simple rule number one is- to never lose money, followed by an even simpler rule number two - do not forget the rule number one. Addressing the stock market as a âmanic depressiveâ, he rightly emphasises on the fact that equity markets are prone to swing wildly on the slightest sentiment from macro and micro economic factors.

Investing, Investors and Investment

Investing, in simple terms, refers to placing oneâs money into financial schemes, property, shares, or a commercial venture which is likely to help the investor in achieving a profit. A key term in this description is investor, who is a person or entity, committing his capital to achieve the profits/ financial returns. The investment could be either an asset or any item or a monetary asset purchase, that has been acquired with the aim of generating income or appreciation. It is the purchase of goods that are not utilised in the present time but are an asset to create wealth in the future/ long-run. These efforts are put together for a simple reason- to attain a greater payoff in the future than what was formerly put in.

Advantages of Investing

The concept of investing comes with an ocean of pros. These are the points that attract interested parties to participate in the investing world:

- Investing aids in times of inflation, as purchasing power of the investor does not drastically decline.

- Investing is one of the best ways to build wealth and grow money.

- Investing boost advantages of compound interest, as eventually due to investing, oneâs interest starts earning another interest.

- Investing is thought as a safe and best retirement security.

- Investors are better positioned to save on taxes.

- It helps people meet their financial goals, especially when a person has invested as a young adult.

- Investors reap benefits generated from the stocks they put their money in and have a say in the companyâs decisions at times.

Disadvantages of Investing

Every aspect of the business has two sides, just like other situations of life. Investing too, comes with a bunch of cons, few of which are as listed below:

- The concept of investing can be complicated to understand, especially at the beginnerâs level.

- Market risks, macro and micro economic factors can cause a stir in the stock exchanges, adversely impacting the companyâs performance and in turn, the investors return.

- The annual returns are unpredictable at times.

- Investing is a time-consuming affair, and requires detailed research, analysis and expert advice, before jumping into it. This research includes basics like share market terminologies and market insights.

- Financial planners and advisors are an added expense, if opted for.

The Investing Process

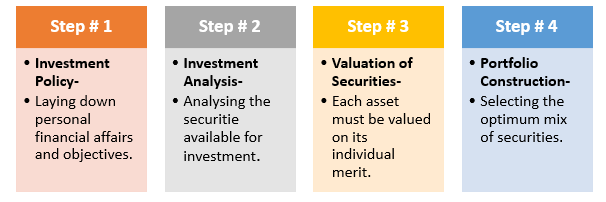

The process of investing can be broken down into four main steps, which holds equal importance at their respective stages. Prior to this, the basic initiator should be the personâs will to get into the investing world and the research that one does- holistically, before applying his gained knowledge into the process. Given we are in a dynamic business world, knowledge is power.

Let us look at the four steps of investing:

10 Investing Tips- A Beginnerâs Guide

As understood, up until now, the prime objective of investing is to set aside money to fully reap the reward of oneâs labour in the future. When one is just entering the world of investing, the following tips would be a handy guide:

- On an initial tough budget, one should invest a fair portion of the salary into the retirement plan which is available at the workplace.

- Spot major changes in market trends as they emerge.

- Find the best stock and know what a big market winner looks like beforeit takes off.

- In times of a volatile market, one should ideally tap the stocks whose relative strength line is at or near a new 52-week high, which is a bullish sign of market leadership.

- One should always avoid having the herd mentality and undertake proper research.

- One should invest in a business that he/she understands.

- Diversification of portfolio across asset classes and instruments would boost optimum returns on investments with minimum risk.

- One should always be ready to take risks and bear realistic expectations from the investment.

- One should constantly monitor the portfolio and amend the desired changes in it, as and when called for.

- One should be vigilant about the commissions and fees that is charged by the brokers.

A Sneak Peek on Investing in Australia

The Australian Trade and Investment Commission states that it has been welcoming towards foreign investment. Primarily, there are growth opportunities in five fields which play to Australiaâs strengths, namely Agriculture business along with food, key infrastructure, infrastructure related to tourism, resources and energy sector and enhanced manufacturing, services and tech along with the Australian medical and materials sciences and technologies along with digital technologies.

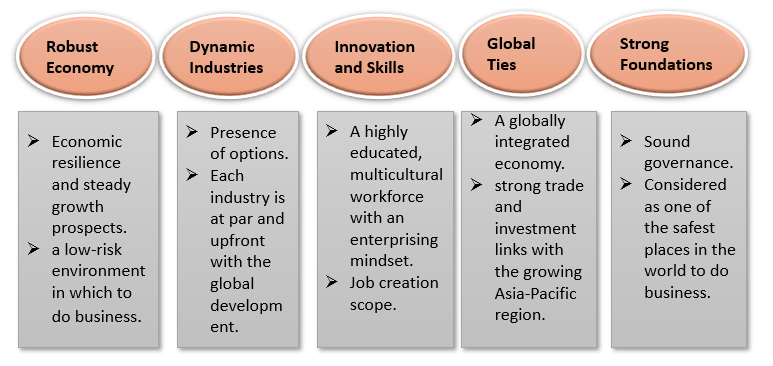

There are five prime reasons that should be taken into consideration when one cherry picks Australia as the investing destination:

The Australian Stock Market Performance

During the trading session on the Australian Securities Exchange on 6 September 2019, the S&P/ASX 200 was trading higher at 6653.3 basis points, up by 40.1 basis points or 0.6 per cent (at AEST 1:00 PM).

Some of the stocks on 6 September 2019, at AEST 1:10 PM, on ASX were trading in green and red zone are as mentioned below:

Some of the drivers of this uptrend, or the gainers currently, include- Emeco Holdings Limited (ASX: EHL), which was trading, up by 2.956 per cent and was quoted A$2.09, CYBG PLC (ASX:CYB), which edged up by 1.008 per cent and quoted A$2.005, followed by Pinnacle Investment Management Group Limited (ASX: PNI), which was up by 0.667 per cent, and quoted A$4,53.

The stocks trading in red includes Nanosonics Limited (ASX: NAN), which has plunged by 1.841 per cent and quoted A$6.93, followed by AGL Energy Limited (ASX: AGL) trading at A$18.89, slipping down by 0.683 percent.

We are committed towards providing insights about shares and businesses to investors, and encourage you to tune in for more updates, tips and information pertaining to the Australian and global businesses.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.