An individual earns, saves and invests to fulfil the basic needs and aspirations of his/her family. Money and wealth attainment do not end the continuous monetary cycle of oneâs living, unless it is spent and managed well. Assorting and getting money is easy, but managing the same can be a task, requiring much thought and studying various money management and investment options. While most people spend their time and energy in procuring their incomes, it is equally essential to manage and invest the same.

People have variant ways of defining their budgets and managing money, for the primary reason that the earning bucket varies from person to person, followed by their needs and wants. The importance of money management is realised in times of volatility of the environment one lives in, be it an economic change, a personal change or any event that would involve financials.

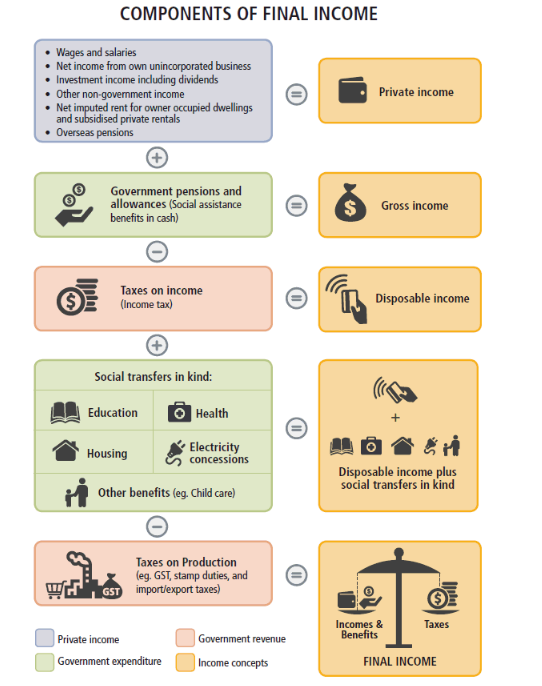

Components of Final Income (Source: ABS)

How does one Manage the Family Money?

To combat times of volatility, to be financially safe and have personal security, the concept of family money management becomes vital. It should be noted here that just like any other form of management, managing the family money would also require the 5 essential functions of management:

Initially, one would plan his/her most feasible form of managing money- be it via investing into shares, creating bank deposits for long-term returns, investing in ETFs, purchasing long-term assets etc. These modes of money management would be then organised to make the plan successful by looking into available resources and deciphering the practical approach one can apply. Under the staffing stage, one would reach out investment advisors/intermediaries/ banks, to seek assistance and financial guidance to get this planning model functional. This would eventually be led and controlled by the person in charge.

One has to undertake several decisions such as investing money for enhanced returns; cost of childcare, support and education; insurance cost; food, electricity and transport bill; medical bills; vacation planning; retirement planning as well as critical decision of making will. One needs to make a budget; look at incoming funds and its sources as well as required expenditures.

What is the importance of Managing the Family Money?

Besides the fact that managed money is perhaps the most important asset of security one can ever possess, which would come handy especially in times of distress, following are few pointers that explain the dire need of managing oneâs family money:

- Managing money would chalk down oneâs income versus their expenses, and aid in pulling the expense reign, if needed, to save more money.

- Family Money Planning aids in planning tax payments and making family budgets.

- It helps in investing in prudent securities like insurance and other policies, for the short and long terms.

- With measurable financial goals, one can increase their knowledge of the financial space, which would in turn be helpful in the future.

- Retirement planning is a major part of managing family money and this secures the future of the individual doing it, as well as other members.

- Managing the family money is an all-together new business now, with financial advisors, legal agents and businesses running Apps to aid one towards it. Hence, it gives rise to employment opportunities as well.

What are the different Options of Managing Family Money?

In the present times where change is the only constant, there are new options available every other day, to manage oneâs family money. These can be chosen as per the income, expense and saving pattern of the individual who is looking towards managing family money. Few of these options, from a horde of the ones available, are listed below:

- Investing in shares and ETFs- If one is capable to take the risks associated with investing in the equity market, investing in shares or ETFâs (Exchange traded funds) is a great option. This could lead to good returns in the long run and offer a plethora of opportunities for the investor to look into. With the number of interested investors on a rise, there are market experts and agencies that can guide the person to tap the best available options, after scrutinising the resources and the investorâs willingness to spend. Given lower interest rate regime, more people are inclined towards equity markets. The S&P/ASX 200 has increased by 20% per cent on YTD basis.

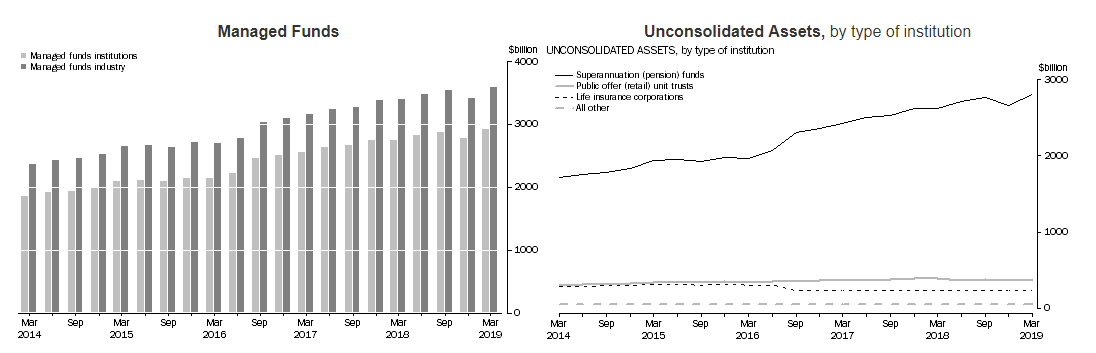

As per the ABS report, on 31 March 2019, the managed funds industry had ~$3,590 billion FUM (Funds Under Management).

Managed Funds and Unconsolidated Assets in Australia (Source: ABS)

Managed Funds and Unconsolidated Assets in Australia (Source: ABS)

ALSO READ: Smart Ways Of Investing And Storing Gold Amidst Gold Rush

- Using online Apps: Taking the reference from the Australian point of view, with technological advancement, one can make use of applications like Centrepay, MoneySmart, National Debt Helpline and TrackMySPEND which are genuine offerings of the government and aid one to manage their money effectively and efficiently. Let us look at them:

Centrepay is a free and voluntary service that pay bills and expenses as regular deductions from the Centrelink payments. These expenses include child care bills, electricity payment, rental payments, etc.

TrackMySPEND offered by ASIC lets the user to track their personal expenses on the go and is a free easy-to-use app.

The National Debt Helpline is a free counselling platform, wherein one can seek advise and get assistance and tips to resolve their issues related to debts. It is an NPO service provided by the Australian government.

- Making retirement plans: Aging is an inevitable process and the phase of life where one cannot rely on their working capacity to generate enough income to take care of their livelihood. Therefore, planning oneâs retirement is an activity that should be given heed to while one can assimilate enough resources for a better old age. The government of Australia has a Financial Information Service (FIS), which is a free service and can be utilised to educate one on financial matters. The Work Bonus facility enables one to earn more income from working if they are an eligible pensioner without reducing their pension.

What do the Aussie statistics say?

As per the 2016 National Census, which is conducted every 5 years by the Australian Bureau of Statistics, the population of the country stood at 24.4 million. The young population of the country underwent a slowdown, and the greying of the country continues with the median age reported to be 38. There were over six million families in Australia, with 45 per cent being only couples with children, 38 per cent being just couples and 16 per cent single parents.

Looking into the money aspect of the survey, the national weekly median income was $662 for citizens over the age of 15 years, which was up from $557 in 2011. The Australian Capital Territory recorded the highest median personal income of $998 per week, while Tasmania was recorded the lowest at $573.

Coming to owning of residential properties, 31 per cent of Australian homes were reported to be owned outright and 34 per cent were owned with a mortgage. The rest 31 per cent were rented accommodations.

It would be interesting to witness how the Aussie population manages their Family money in the days to come, and the other options that the government serves to the citizens to have a robust managing portfolio.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.