In this article, we would discuss three stocks from the ASX-listed universe. Two of these companies have reported full-year results for the period ended 30 June 2019. Meanwhile, the third company has recently reported completion of a placement.

Landmark White Limited (ASX: LMW)

On 19 July 2019, the company reported on the updates related to the Entitlement Offer and Shortfall Offer. Accordingly, the company closed the Entitlement Offer on 16 August 2019, and the residual shares from the Entitlement Offer were offered in a separate public Shortfall Offer. Landmark noted that both of these offers were closed and fully subscribed, raising $5.44 million.

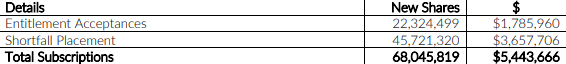

Reportedly, under the offer, the company had offered 4 fully paid ordinary shares of LMW for every 5 fully paid ordinary shares held by the shareholders. Below table provides the break-up of both the offers.

Offer Break-Up (Source: Companyâs Announcement)

Meanwhile, the directors of the company were pleased with the investor response attracted by the offer and the employees of the company. Applications were received in excess of the shortfall placement capacity, which was scaled back or not accepted.

Strategy

As per the release, the offer was intended to support the optimisation of the companyâs business, and the delivery of operational and earnings-based improvements. Besides, the optimisation is focused on enhancing streamlined operations, better customer experience, improved earning margins while ensuring the synergies within the business units are realised.

More importantly, the successful capital raising activity allows the company to deliver on its plans and objectives. The issue date of the new shares would be 23 August 2019, and the company expects its shares to be reinstated to the exchange on 26 August 2019, subject to ASX discretion.

Megaport Limited (ASX: MP1)

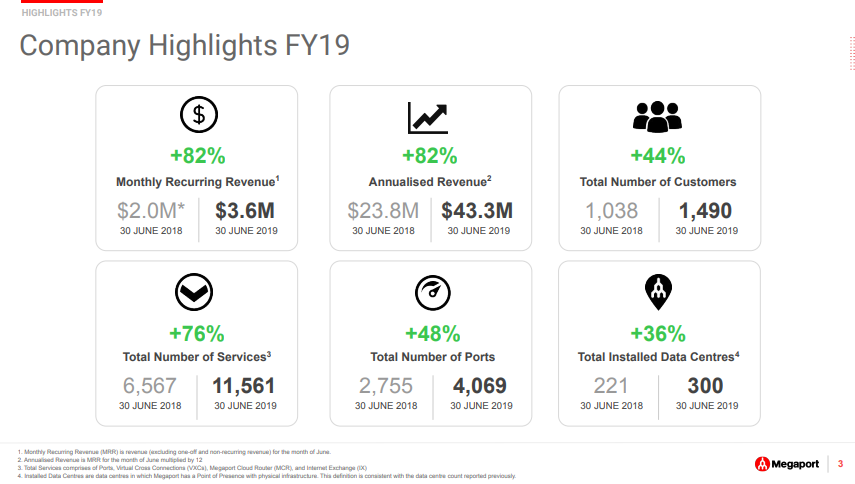

On 21 August 2019, the company announced results for the year ended 30 June 2019. Accordingly, the revenues of the company were by 78% to $35.1 million in FY2019. By the end of June 2019, the total installed data centres were 300, an increase of 79 or 36% year-on-year.

Reportedly, the customer count of the company increased by 44% year-on-year to a total of 1,490, and the total port sales increased by 48% to 4,069 year-on-year. Meanwhile, in June 2019, the average revenue per port increased to $887 compared with $720 in June 2018, this depicted the increase in the adoption of services of the company.

Besides this, MP1 recorded a net loss for the full year of $33.6 million in FY2019, more than the $24.46 million recorded in FY2018. The company completed capital raising activities of $60 million during the fiscal year, and the cash position was $74.9 million as at 30 June 2019. Further, the net current assets were $70.9 million in FY2019 compared to $49.7 million in FY2018, and the total equity was $110.6 million in FY2019 compared with $80.2 million in FY2018.

Highlights (Source: MP1âs FY19 Full Year Results and Global Update)

Review of Operations

Reportedly, Megaport Cloud Router (MCR) was launched in January 2018, and it allows the customer to quickly provision and control virtual routers through the Megaport web-based portal. In FY2019, the company had released new features to the MCR and expanded its service availability to additional locations to improve the adoption of cloud connectivity services in the future.

Meanwhile, the company is a partner of Alibaba Cloud Technology, AWS Technology, AWS Networking Competency, Google Cloud Interconnect, IBM Direct Link Cloud Exchange provider and more. Its global footprint across the Asia Pacific, Europe & North America offers a customer neutral platform through its 528 enabled data centres.

By June 2019, the company was servicing 1490 customers in 98 cities through 528 enabled data centres, which generated Monthly Recurring Revenue of $3.6 million. In North America, there were 304 data centres, in Europe, there were 143 data centres, and in the Asia Pacific, there were 81 data centres.

As per the release, the revenue growth of 78% was backed by solid growth in North America business, which grew 154% year-on-year, the Asia Pacific recorded growth of 59%, and Europe grew by 36% during the financial year 209. Besides, the gross profit after direct network costs was $11.9 million in FY2019, up by 166% year-on-year.

The company enhanced its leadership position in cloud networking by enabling twenty-three new cloud onramps globally. The company has entered into new partnerships with DataBank, DataMSP, Cavern Technologies, NTT Malaysia, 365 Data Centers, Evoque, Digiplex, Ficolo and more.

As outlook, in FY2020, the company would be focusing on an aggressive global expansion strategy and maintaining the innovations to its product sets, which driver better value to customers and partners.

On 23 August 2019, MP1 was trading at A$8.65, up by 4.59% from its previous close. Over the last one year, the stock is up by 107.79%. It has recorded a return of 121.12% over the year-to-date period. The market capitalisation stands at ~A$1.11 billion, with ~134.75 million shares outstanding.

Emeco Holdings Limited (ASX: EHL)

On 21 August 2019, the company released results for the full-year ended 30 June 2019. Accordingly, the operating revenues were up by 22% to $464.5 million in FY2019 compared to $381 million in FY2018. Besides, the operating EBITDA was up by 40% to $214 million in FY2019 compared to $153 million in FY2018, and the operating EBITDA margin was up by 590 bps to 46.1% in FY2019 against 40.2% in FY2018.

Reportedly, the operating NPAT was $20.1 million in FY2018, which increased by 214% to $63.1 million in FY2019. The group supplies safe, reliable and maintained equipment rental solutions to its customers. Meanwhile, the growth in operating EBITDA was attributed to recent acquisitions, increased utilisation of the fleet by customers, rental rate increase, and cost management initiatives implemented during the FY2019.

Besides, the acquisition of Matilda Equipment in July 2018 had resulted in improved operating utilisation of the rental fleet, rental rates on new and renewed contracts. The maintenance services revenue from both rental maintenance services and workshop increased due to the full-year contribution of the Workshop division along with three new workshops, which opened during the year.

As per the release, the company reviews its rental fleet mix on a continuing basis to meet its long term rental demand while improving returns on investments. Besides, the assets with ending useful life are transferred to non-current assets held for sales, which are actively marketed for selling purposes through the companyâs network of brokers.

Meanwhile, the net sustaining capital expenditure increased to $88.5 million in FY2019 compared with $57.6 million in FY2018 consistent with a larger fleet.

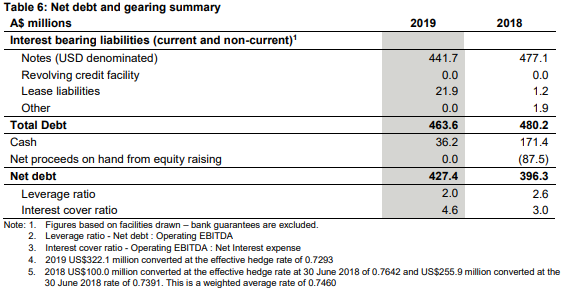

Debt Reduction

Reportedly, the total outstanding debt was reduced by $16.6 million by the repurchase of US$33.8 million of the outstanding notes, which were offset by an increase in finance lease liabilities of $21.9 million. The adjusted net debt increased to $427.4 million at 30 June 2019 from $396.3 million at 30 June 2018, and this was due to growth assets being funded through cash and debt.

Besides, the secured notes mature in March 2020, with a semi-annual coupon of 9.25%, and the terms of debt do not have maintenance covenants. At 30 June 2019, US$322.1 million of the notes were outstanding compared to US$355.9 million in FY18.

Debt Summary

Meanwhile, the A$40 million revolving credit facility, involving A$35.0 million cash advance facility and an A$5.0 million bank guarantee facility maturing in March 2020, was refinanced in September 2018. The facility was replaced with an A$65.0 million facility maturing in September 2021.

More importantly, the leverage ratio has improved from 2.6x at 30 June 2018 to 2x at 30 June 2019, and the company anticipates decreasing it further in FY20.

Outlook for FY20

Reportedly, the company expects to witness additional growth in revenues & earnings in FY20, with better earnings in the second half of FY20. The company intends to pursue greater commodity diversification.

Meanwhile, the company expect to prolonged demand in metallurgical coal, and it is focused on diversifying Eastern Region exposure to gold and copper. Besides, the conditions have been improving in the western region, and the equipment was committed to gold and iron ore projects. The company would also allocate growth assets and assets to thermal projects to the Western Region to meet fleet requirements.

On 23 August 2019, EHL was trading at A$1.940, down by 4.90% from the previous close. Over the last one year, the stock is down by 44.86%. Besides, the stock has recorded a return of 1.49% over the year-to-date period. The market capitalisation stands at ~A$659.35 million, with ~323.21 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.