Nearmap Limited recently announced the financial results for FY19, reporting record growth in ACV portfolio driven by strong performance across all the key metrics. However, FY19 results for NEXTDC are still awaited and the company is expecting a strong growth in revenues on the back of acquisitions and strong demand in the market.

By the end of the trading session, on 22 August 2019, the respective stock of both the companies had witnessed a decline in the performance on ASX. Accordingly, Nearmap was at A$2.79, going down by 1.761% and NEXTDC was at A$6.45, with a fall of 0.463% from the previous closing price.

Recent updates from both the companies are described as follows:

Nearmap Limited

Nearmap Limited (ASX: NEA) is engaged in online aerial photomapping via its wholly owned subsidiaries namely- Nearmap US, Inc, Nearmap Remote Sensing US, Inc. and Nearmap Australia Pty Ltd.

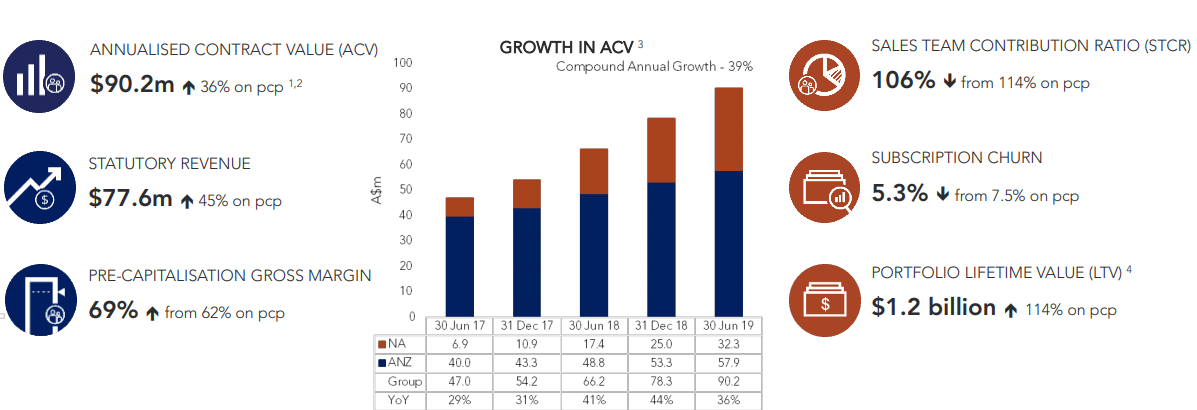

FY19 Financial Highlights: On 21 August 2019, NEA declared the annual report for the period ending 30 June 2019. During the year, group annualised contract value was reported at $90.2 million, representing growth of 36% or $24.0 million on the previous year. Statutory revenue for the period was reported at $77.6 million, up 45% on prior corresponding period revenue amounting to $53.6 million. By the end of the period, total global subscriptions stood at 9,800, up 11% on the previous year and group average revenue per subscription stood at $9,208, up 23% on FY18 value of $7,473. The company reported a strong group sales team contribution ratio of 106%.

Group EBITDA for the period was reported at $15.5 million, as compared to $4.9 million in the previous financial year. As at 30 June 2019, the company had a cash balance of $75.9 million, as compared to $17.5 million as at 30 June 2018. The period was marked by strong net operating cash inflows amounting to $24.9 million, as compared to FY18 net operating cash inflows of $13.7 million. Group Portfolio Lifetime Value was reported at $1.2 billion, against FY18 value of $0.5 billion, representing progress in terms of reducing churn, portfolio growth and pre-capitalisation gross margin expansion.

FY19 Key Metrics (Source: Company Presentation)

FY19 Key Metrics (Source: Company Presentation)

Capital Deployed for Growth: The company deployed $9.0 million of the capital raised for accelerating its growth initiatives. These initiatives involved investment into the North American sales and marketing, research and development expenditure and expansion of the capture program to Canada.

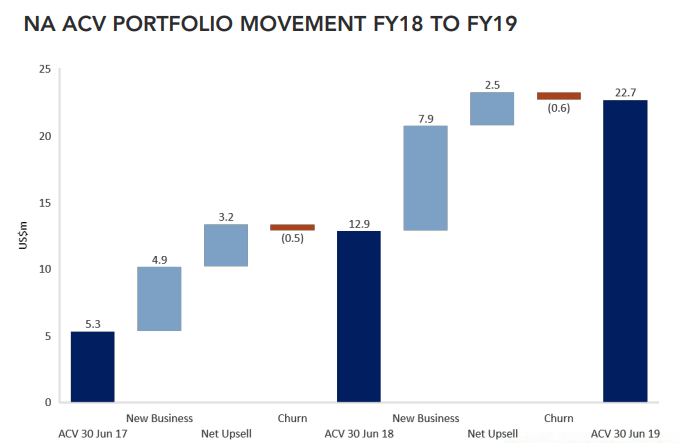

Highlights from North America: The region reported record annual ACV growth. ACV portfolio for North America stood at US$22.7 million as at 30 June 2019. As at 30 June 2018, the portfolio was valued at US$12.9 million. This represents an increase of 76% in FY19 portfolio as compared to FY18. North American annualised contract value now forms 36% of the group portfolio, as compared to 26% as at 30 June 2018. Subscriptions in the region were reported at 1,425, representing a growth of 51% on FY18. Average revenue per subscription stood at US$15,918, up 17% on FY18 value of US$13,603. Performance was also characterised by increasing operating leverage with a pre-capitalisation gross margin of 20%, as compared to FY18 margin of -55%.

ACV Portfolio â North America (Source: Companyâs Presentation)

ACV Portfolio â North America (Source: Companyâs Presentation)

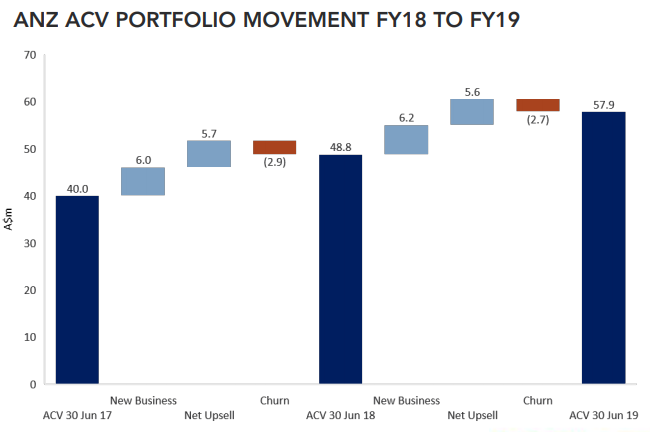

Highlights from ANZ: ACV portfolio for Australia & New Zealand stood at $57.9 million as at 30 June 2019, up 19% in comparison to $48.8 million as at 30 June 2018. The region reported subscriptions of 8,375 in FY19, as compared to 7,917 subscriptions as at 30 June 2018. Annualised contract value churn improved to 5.6% at the end of FY19, as compared to 7.3% in FY18.

ACV Portfolio â ANZ (Source: Company Presentation)

Outlook: The companyâs Performance in FY19 was characterised by record growth in portfolio backed by the changes in product offering with Nearmap 3D and its beta release of Artificial Intelligence content. The developments in FY19 have laid strong foundation for another remarkable year in FY20. Through execution of the growing momentum in North America and consolidation of market leadership in Australia, the company seems well positioned to witness strong growth in FY20.

Stock Performance: The stock of the company generated returns of 80.32% over a period of 1 year. has a market capitalisation of $1.41 billion. NEAâs market capitalisation stood at A$1.27 billion, with around 448.28 million shares outstanding.

NEXTDC Limited

NextDC Limited (ASX: NXT) is engaged with the growth and operation work of independent data centres in the Australian region.

Appointment on the Board: The company, on 28 June 2019, updated that Stephen M. Smith was appointed as a non-executive director on the board of NXT. Mr Smith holds extensive experience in managing market leading technology businesses. Prior to joining NEXTDC, he served as the President and CEO at Equinix Inc.

Senior Debt Facility: On 27 May 2019, NXT notified that it has achieved financial close on the refinance of its existing senior debt facilities of A$300 million.

1HFY19 Highlights: During the first half report of NXT, for the period ended 31 December 2018, NXT generated revenue amounting to $90.8 million, up 17% on prior corresponding period revenue of $77.5 million. Underlying EBITDA for the period was reported at $42.2 million, up 26% on prior corresponding period EBITDA of $33.6 million. Statutory net loss after tax for the period amounted to $3.1 million, as compared to a net profit of $8.4 million in the prior corresponding period. Cash and undrawn senior debt facilities as at 31 December 2018 amounted to $644 million.

1HFY19 Financial Summary (Source: Companyâs Presentation)

Business Performance: At the end of the period, the company had 1,090 customers, up by 215 or 25% as compared to 875 customers as at 31 December 2017. Interconnections went up from 7,456 as at 31 December 2017 to 9,982 as at 31 December 2018, representing an increase of 34%. Contracted utilisation for the period was reported at 50.4MW, up 28% in comparison to 39.2MW as at 31 December 2017.

Steps Towards Development: During the period, the company opened S2 facility for early customer access in the first half. In order to provide early accessibility to the Indigo subsea cable, the company opened P2 microsite and connectivity hub. The period saw B2 expansion with a second data hall being opened and the site also obtained a certificate.

Property Acquisitions: During the year, the company completed the acquisition of the Asia Pacific Data Centre Group and the underlying data centre properties S1, M1 and P1. The underlying valuation of the acquisition was $261 million. The company also incurred a total cost of $24 million for the acquisition of the underlying B1 data centre property. The acquisitions in conjunction, strengthened the balance sheet through addition of further tangible assets and also resulted in annualised rent savings of approximately $15 million.

FY19 Guidance: The company is expecting strong growth in revenue on the back of property acquisitions completed in the first half, continued growth in recurring revenues and strong demand for connectivity solutions. Revenue for the year is anticipated to be between $180 million - $184 million. Underlying EBITDA for FY19 is expected to be in the range of $83 million - $87 million, representing substantial operating leverage. Capital expenditure for FY19 is expected to be in the range of $430 million - $470 million comprising of capacity expansion works for P1, B2 and M2 to cater to a customerâs demand.

Stock Performance: The stock of the company has generated negative returns of 4.14% and 0.15% over a period of 1 month and 3 months, respectively. NXT has a market capitalisation standing at A$2.23 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.