NEXTDC Limited

Brisbane-based IT company, NEXTDC Limited (ASX: NXT) is a data centre operator established in 2010. With a market capitalisation of circa AU$ 2.27 billion with ~ 344.52 million outstanding shares, the NXT stock ended the market trading today (31 May 2019) at AU$ 6.570, down 0.455% with ~ 1.14 million shares traded. Besides, the NXT stock has generated a positive YTD return of 8.55%.

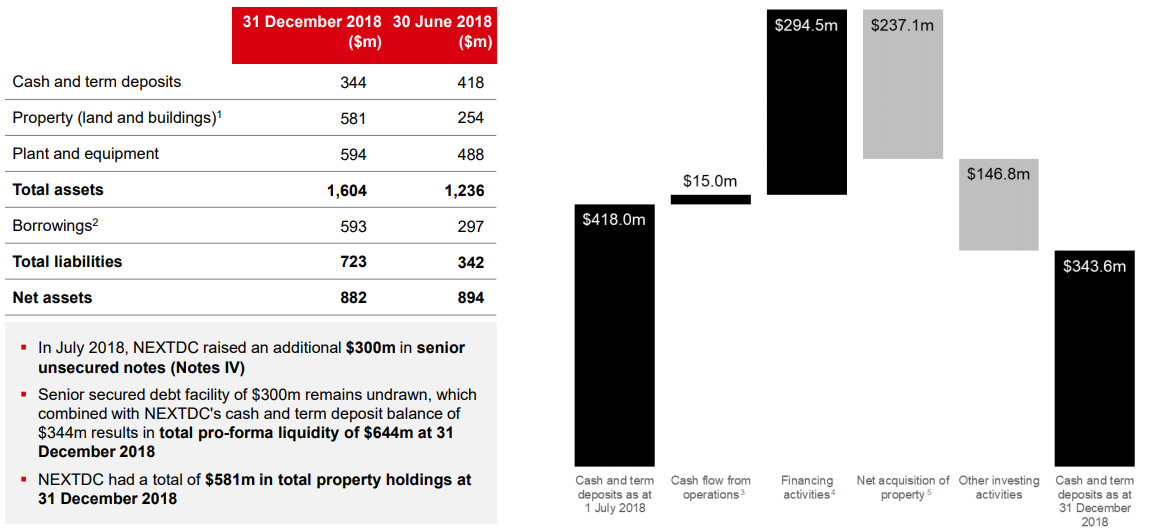

On 27 May 2019, the company announced that it had achieved financial close on the refinance of its existing AU$ 300 million senior debt facilities with the benefits of a superior set of financial covenants and new maturity date of 30 September 2022. Besides, NEXTDC recently announced that it was intending to raise a senior unsecured debt in addition to its existing Floating Rate Notes IV worth AU$ 200 million (due 9 June 2022). The company will determine and disclose the Notes IV-2 volume and pricing terms by June 2019, subject to the ongoing market conditions and investor feedback. As per the half yearly result for the six months to Decemberâ18, the company seems to be well capitalised for growth:

Source: FY19 Half Year Presentation

Source: FY19 Half Year Presentation

Integrated Research Limited

Integrated Research Limited (ASX:IRI), headquartered in North Sydney, Australia, designs, develops, commercialises and implements systems and applications management computer software for business-critical computing, unified communication networks, and payment networks for clients in the Americas, Europe, and the Asia Pacific. With market capitalisation of around AU$ 527.61 million and ~ 171.86 million outstanding shares, the IRI stock price closed the trading at AU$ 3.00, down 2.28%, with ~ 203,732 shares traded on 31 May 2019.

In addition, the IRI stock has also generated a positive and high TD return of 75.43% so far.

Recently, Integrated Research appointed Mr. John Ruthven as its Chief Executive Officer with a commencement date in early July 2019. Most recently, Mr John has served as the Operating Officer, Global Sales at TechnologyOne.

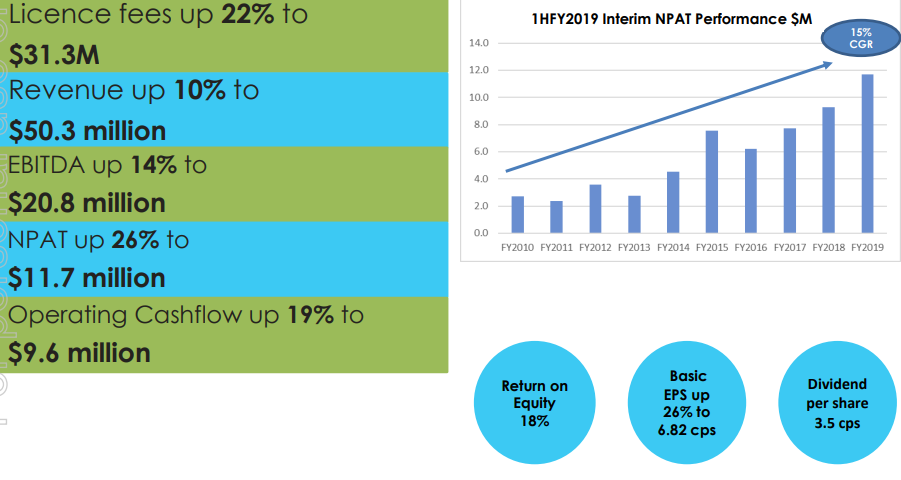

The company reported solid results for the first half of 2019 with investments in place to drive sustainable long-term performance. A snapshot of the key financial metrics is as follows:

Source: Companyâs FY2019 Half-Year Results

Source: Companyâs FY2019 Half-Year Results

The Citadel Group Limited

Software and Technology company, The Citadel Group Limited (ASX:CGL) develops and delivers systems, services, and managed solutions to the government and private sector. It helps organizations maximize value through leadership and risk management, acquisition and sustainment, and other services.

With a market capitalisation of circa AU$ 213.29 million and ~ 49.26 million outstanding shares, the CGL stock price closed the market trading at AU$ 4.320, down 0.231% by AU$ 0.010 with ~ 139,158 shares traded.

Three of the companyâs Directors recently increased their interest in the company.

- Director Peter Leahy AC acquired 6,745 ordinary shares (Direct and indirect interest) at a value consideration of AU$ 4.4100 per share.

- Director Mark McConnell acquired 9000 ordinary shares (Indirect interest) at a consideration of $ 4.446 / share.

- Director Harry Kevin McCann AM acquired 10,000 ordinary shares (Indirect interest) at $ 4.4221 per share.

On 27 May 2019, the company informed the stakeholders that it had executed an agreement to buy the entire share capital of Noventus Pty Ltd, a private multi-disciplinary company engaged in serving the Defence, Government, Transportation and Telecommunication sectors. As per the company, the acquisition is fairly synergistic, especially concerning the Defence and National Security (DNS) division.

The value consideration for the transaction is around AU$ 5.7 million cash, which includes ~ 50 per cent to paid on completion and 50% to be paid within a span of three months.

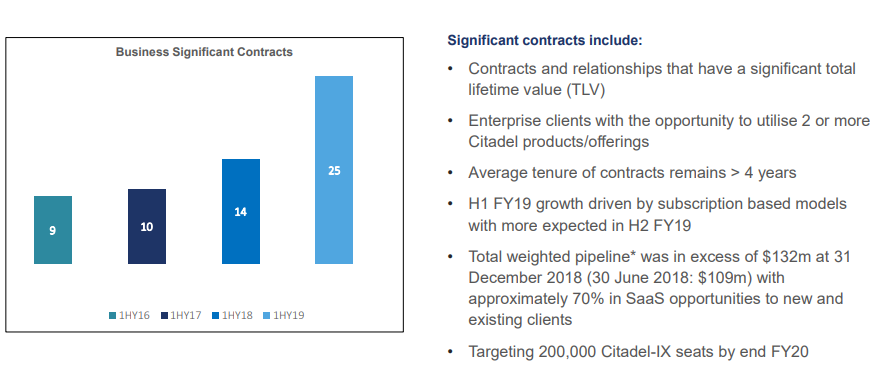

The company has recorded a significant growth in the SaaS-based contracts awarded and new product revenue so far as posted in the recent half-year 2019 results.

Significant SaaS contract growth (Source: Companyâs Macquarie Australia Conference Presentation)

Significant SaaS contract growth (Source: Companyâs Macquarie Australia Conference Presentation)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.