We will be discussing few small cap stocks with diversified businesses. These stocks were very much active in the recent past due to several business updates, management updates and financial updates:

NRW Holdings Limited (ASX: NWH)

NRW Holdings Limited is engaged in providing contract services to the resources and infrastructure sectors based in Australia. The business has operations across Western Australia, South Australia, New South Wales, Queensland and Victoria.

On 02 December 2019, the company reported about a change in the interest of one of its directors, Julian Alexander Pemberton, who acquired 2,137,500 fully paid ordinary shares.

Recently, NWH announced that it has received commitments to issue 42.1 million new fully paid ordinary shares under the companyâs placement program at an issue price of $2.85 per share. The business intends to raise $120 million before costs under its placement program.

Stock update: The stock of NWH quoted $3.080, up 0.32% as on 03 December 2019. The stock has a market capitalization of $1.17 billion and currently, the stock is quoting at the upper band of its 52-week trading range of $1.400 and $3.240. The stock has generated positive returns of 30.08% and 22.31% in the last three month and six-months, respectively.

Virgin Money UK PLC (ASX:VUK)

Virgin Money UK PLC provides banking and other financial services. Recently the company announced that one of its Non-Executive Director, Clive Adamson, stepped down from the Board w.e.f. 29 November 2019. Clive joined the Board in July 2016 and served as the Chair of the Boardâs Risk Committee and a member of the Boardâs Audit Committee.

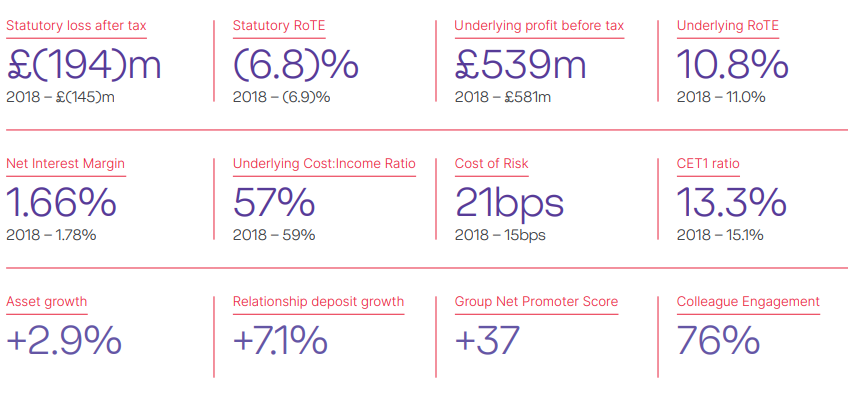

Financial Highlights for FY19 for period ended 30 June 2019: VUK reported its FY19 results wherein, the company reported statutory loss after tax at £194 million and the underlying profit before tax was £539 million. CET1 ratio stood at 13.3%. Net interest margin during the period was 1.66% followed by asset growth of 2.9%.

FY19 Operating Highlights (Source: Company Reports)

Outlook: The Management expectations, amid the political and economic environment is likely to remain uncertain and would be impacted by the impending General Election where vivid potential outcomes are expected, with the out-turn likely to influence the shape of any Brexit arrangements that may follow.

Stock Update: The stock of VUK quoted $3.330, down 5.12% on 03 December 2019. The dividend yield of the stock on an annualized basis stood at 1.58%. The stock is trading at the upper band of its 52-week trading range of $1.860 to $4.080. The stock has generated returns of 37.65% and 9.35% in the last three months and six-months, respectively.

Northern Star Resources (ASX: NST)

Northern Star Resources operates in mining and exploration of gold and other minerals. Recently, the company updated regarding the change in interest of one of its Directors, Mary Hackett wherein she acquired 5,382 ordinary fully paid shares.

September 2019 Quarterly Highlights: The quarterly highlights for the period ended September 2019 are summed below:

- Revenue from Gold during the September quarter stood at 184,005oz at an AISC of A$1,493/oz.

- The company reported Underlying free cash flow of $28 million, despite a capex of $43 million.

- Cash, bullion and investments stood at $372 million as on 30 September, up by $11 million (since 30 June 2019).

- NST informed that the business has forecasted of an investment of US$30 million, utilized for expanding Pogo plant capacity from 1Mtpa to 1.3Mtpa.

Guidance: The business is expecting total production of 800,000-900,000oz at an AISC A$1,200-A$1,300/oz.

Stock Update: NST quoted $9.78, down 0.4% as on 03 December 2019. The stock is trading at a market capitalization of ~$6.37 billion. The stock has reported an annualized dividend yield of 1.37% and currently the stock is available at a price to earnings multiple of 40.250x on trailing twelve months (TTM) basis.

BHP Group Limited (ASX : BHP)

BHP Group Limited operates in minerals exploration, production and processing several minerals like coal, iron ore, copper, manganese ore and hydrocarbon exploration. Recently, the company informed about a change in the Directorâs interest of Andrew Mackenzie wherein he acquired 271,348 ordinary shares.

With a recent market update, BHP Group Ltd informed about a change in the interest of a substantial holder of BlackRock Group from 4.97% voting rights to 5.94% voting rights.

Stock Update: The stock of BHP quoted $37.770, down 1.41% as on 03 December 2019. The stock is trading at a market capitalization of $112.86 billion. It is available at a price to earnings multiples of 16.76x on TTM basis and has generated returns of 4.73% and 4.07% during the last three-months and six-months, respectively.

Woodside Petroleum Ltd (ASX: WPL)

Woodside Petroleum Ltd operates in managing and operating of hydrocarbon exploration and involves in the development, production, transportation of its North West Shelf Gas Project.

On 02 December 2019, WPL confirmed the appointment of Ms Goh Swee Chen as a non-executive director, with the term effective from 1 January 2020.

Recently, the business updated that the estimated gross contingent resource (2C) dry gas volume has increased to 11.1 Tcf, up 52% from 7.3 Tcf across its Scarborough field. WPL further reported that the increased volume estimates follow execution of integrated subsurface studies incorporating full waveform inversion (FWI) 3D seismic reprocessing and updated petrophysical interpretation.

Guidance: As per the business guidance, WPL is looking for a final investment decision regarding the development of the Scarborough gas resource in the H1FY20.

Stock Update: The stock of WPL quoted $33.680, down 1.57% as on 03 December 2019 along with a market capitalization of $32.25 billion. The stock has generated an annualized dividend yield of 5.27%. The stock is available at a P/E multiple of 17.72x. The stock has generated mixed returns of 7.61% and -1.01% in the last three months and six-months, respectively. At current market-price of the stock is at the upper band of its 52-week trading range of $29.330 to $37.70.

Mayne Pharma Group Limited (ASX :MYX)

Mayne Pharma Group Limited develops, manufactures and distributes branded and generic pharmaceutical products across the globe. Recently, the company announced its collaboration with Encube Ethicals Pvt Ltd (Encube) for its rights to generic topical dermatology product. Encube is a leading US based developer and manufacturer of topical formulations.

The above product is likely to enhance the product portfolio of Mayne Pharma which includes branded and generic dermatology products. MYX has filed its approval in the US Food and Drug Administration (FDA) and is expected to get the results in CY20.

Stock Update: The stock of MYX quoted $0.445 on 03 December 2019. The stock is trading at a market capitalization of $746.03 million. At the current market price, the stock is trading at the lower band of its 52-week trading range of $0.430 and $1.005. The stock has generated negative returns of 13.59% and 19.09% in the last one month and six-months, respectively.

Oil Search Limited (ASX : OSH)

Oil Search Limited is engaged in the exploration, development and production of oil and gas resource and has operations in Papua New Guinea.

In the September ended quarterly update (for the period ending 30 September 2019), OSH reported its third quarter results, wherein the company reported total production of 6.81 mmboe, down 1% on q-o-q basis. During the quarter, the company reported total volume sales of 6.47 mmboe deriving a revenue of US$361.1 million, down 5% on q-o-q basis.

Production Highlights (Source: Company Reports)

Stock Update: The stock of OSH quoted $7.100, down 2.74% as on 03 December 2019. The stock is available at a price to earnings ratio of 18.32x. The stock has given an annualized dividend yield of 2.66%. The stock has generated returns of 11.62% and 5.34% in the last three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.