Uber (NYSE:UBER) and Lyft (NASDAQ:LYFT), the two major ride hailing companies, had remained in the limelight since quite a few months for some or the other reasons. Earlier during June 2019, the companies were in the news because their drivers were misusing apps to increase the price and charge more from the travellers, a process known as surge pricing.

The rivals were also in discussion recently after lawmakers passed the Assembly Bill 5, or AB5 Bill in September, owing to which gig economy workers would be reclassified as the employees instead of contractors of those companies for which they are providing services. The bill is likely to reshape how Uber, Lyft and other alike companies carry out their operations. The bill is expected to come into effect on 1 January 2020.

According to Uber and Lyft, the law does not apply to them; however, if they are forced to reclassify their contractual drivers as their employees, then their cost would go up by ~20%.

On 15 October 2019, 17,088,949 LYFT shares were in short interest and on 31 October 2019, the number stood at 15,770,405. Based on this data, one can say that investors gained a little confidence in LYFTâs shares as the value of short interest declined with 15 daysâ time.

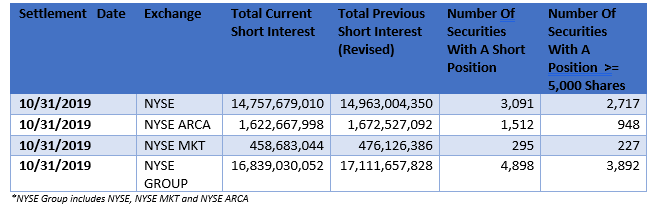

In the table below extracted from NYSE, a certain level of confidence in the investors of Uber can also be observed. On 31 October 2019, there was a fall in the total current short interest as compared to the previous short interest in NYSE, thus giving investorsâ confidence in its shares as well.

Letâs take a look at the factors that might have resulted in the investorsâ confidence.

Lyft:

- Despite the fact that Lyft faced a number of challenges post its listing on NASDAQ, the company reported significant growth of 63% year-on-year (y-o-y) in its revenue for the third quarter ended 30 September 2019, driven by strong growth in both active riders and revenue per active rider.

- However, the companyâs net loss went up from US$249.2 million in the third quarter of 2018 to US$463.5 million in the third quarter of 2019. Out of the total net loss incurred by the company in Q3 2019, US$246.1 million was due to stock-based compensation along with the related payroll tax expenses.

- Contribution for Q3 2019 increased by 82% y-o-y to US$479.2 million.

Outlook:

- Lyft expects to register revenue in between US$975 million and US$985 million during Q4 and between $3.57 billion and $3.58 billion for 2019.

- Q4 revenue growth is expected to be in the range of 46% to 47% y-o-y and annual revenue growth is expected to be ~66%.

Recent Buzz around Lyft:

- According to media reports, Gett, a ride-hailing company that serves corporate clients, is shutting its ride sharing app, Juno in New York City and forming a strategic alliance with the company to allow its corporate riders to use the Gett app to avail the ride facilities offered by the Lyft drivers in the United States.

- Recently, Royal Bank of Canada 's RBC Capital Markets had a discussion with the management of the company, unveiling that Lyft is likely to have a clearer path towards profitability.

Share Information:

The shares of LYFT on 22 November 2019 closed at US$46.46, down by 0.64% from its previous close.

Uber:

- Uber, in its Q3 2019 (ended 30 September 2019), reported a 30% growth in revenue to US$3.8 billion on a constant currency basis.

- Rides Adjusted EBITDA went up by 52% as compared to the previous corresponding period.

- Following several leadership and organisational changes, during the third quarter, the company reorganised operations and financial reporting into 5 segments.

- Revenue growth, along with the take rates in the Eats business performed well during the quarter.

- Adjusted Net Revenue growth enhanced to 33% y-o-y.

- Net loss attributable to the company was US$1.2 billion, which comprises of US$401 million in stock-based compensation expenditure, representing an improvement quarter-over-quarter in part due to revenue growth of US$647 million.

- There was also an increase in monthly active platform consumers by 26%, trips by 31%, and gross bookings by 29% on pcp.

- Revenue generated during the quarter was 39% from the US and Canada and 2% from Latin America, while EMEA and APAC contributed 24% and 31%, respectively.

Outlook:

- Uber expects its adjusted net revenue growth to accelerate again in the fourth quarter.

- Uber also improved its full year adjusted EBITDA guidance by US$250 million to a US$2.8-US$2.9 billion loss.

Developments Post Q3 2019:

- Uber during October 2019 announced an agreement, to acquire a majority stake in Cornershop, which is a leading online grocery provider in countries like Chile, Mexico, Peru and Toronto.

- Investment is anticipated to complete in H1 2020; however, it is subject to regulatory approval.

Share Information:

UBERâS shares on 22 November 2019 closed at US$29.56, up 0.34% from its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.