The Australian government recently directed Australiaâs competition regulator ACCC (Australian Competition and Consumer Commission) to initiate an inquiry into home loan pricing.

The competition watchdog intends to investigate how the cost of financing for banks has impacted bank decisions on interest rates, and why the recent interest rate cuts by RBA are not passed to customers in full.

In the light of above scenario, let us now take a closer look at five banking sector stocks.

National Australia Bank Limited (ASX: NAB)

National Australia Bank Limited (ASX: NAB) is one of the Australia's leading bank serving around 9 million customers at more than 900 locations in Australia, New Zealand and around the world.

Recently NAB responded to the ACCC inquiry into mortgage pricing by stating following fast facts:

- NAB currently has the lowest Standard Variable Rate of the major banks;

- Last year, NAB held its SVR for 4 months saving home loan customers almost $70 million;

- NAB continues to back young Australians with their home ownership dreams by offering a special fixed rate of 2.88% p.a. for two years for first home-owners;

- Every month, NAB lends, on average, $4 billion for customers to buy, renovate or refinance their home;

- NAB home loan customers are, on average, 33.7 months ahead on their repayments, with two-thirds at least one month ahead;

- NAB recently scrapped over 100 fees from its products and services.

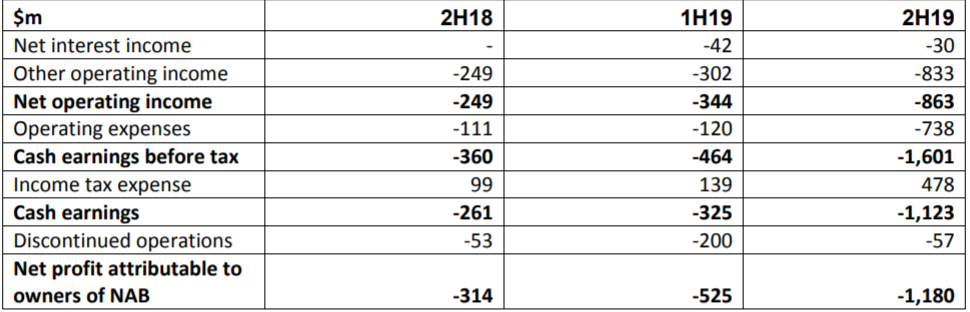

The company recently announced additional charges of $1,180 million after tax for customer-related remediation and software capitalisation change, which is expected to reduce 2H19 cash earnings by an estimated $1,123 million after tax. It will also reduce the bankâs earnings from discontinued operations by around $57 million after tax.

The key items giving rise to increased provisions for customer-related remediation include:

- Adviser service fees charged by NAB Advice Partnerships

- Consumer Credit Insurance sales through certain NAB channels

- Non-compliant advice provided to Wealth customers which is being addressed as part of NABâs ongoing wealth advice review

- Adviser service fees charged by NAB Financial Planning

Impact of customer-related remediation and software capitalisation change is detailed out in following table:

(Source: Companyâs Report)

In Q3 FY19, NABâs cash earnings were up by 1% as compared to the 1H19 quarterly average, with revenues slightly up by 1%, reflecting growth in SME lending and a slightly higher group margin.

Q3FY19 Highlights:

- Net interest margin increased primarily due to lower short-term wholesale funding costs;

- Expenses were flat given ongoing productivity savings from the transformation program, compensating for higher compliance and risk costs;

- As at 30 June 2019, the company had Group Common Equity Tier 1 ratio of 10.4%, Leverage ratio (APRA basis) of 5.4% and Net Stable Funding Ratio (NSFR) of 113%.

In the past six months, NAB stock has increased by 14.34% as on 17 October 2019. At market close on 18 October 2019, NAB stock was trading at a price of $28.760 with a market capitalisation of circa ~$83.2 billion. The stock is trading with a PE multiple of 14.070x with an annual dividend yield of 6.31%.

Westpac Banking Corporation (ASX: WBC)

While commenting on the new ACCC inquiry into the pricing of residential mortgage products Westpac Group Chief Executive, Brian Hartzer highlighted following points:

- In Australia, the competition in the banking sector is intense and Australian and foreign banks are competing fiercely for customers;

- While making a pricing decision, the Bank needs to manage the net interest margin, and as part of this process, bank takes into account the interest of borrowers, depositors as well as shareholders;

- Bank also needs to make a reasonable level of return to support shareholder investment as well as to maintain prudential stability, and debt rating;

- Brian Hartzer highlighted Westpacâs profitability in terms of ROE has more than halved over the last 15 years;

- The AA rating of Westpac allows it to import funding at a more reasonable cost from international investors.

In the past six months, WBCâs stock has increased by 8.47% as on 17 October 2019. At market close on 18 October 2019, WBCâs stock was trading at a price of $28.840 with a market capitalisation of circa ~$101.49 billion. The stock is trading with a PE multiple of 14.110x with an annual dividend yield of 6.46%.

Australia And New Zealand Banking Group Limited (ASX: ANZ)

While commenting on Federal Governmentâs decision to direct ACCC to conduct an inquiry into mortgage pricing, ANZ Chief Executive Officer Shayne Elliott told that despite intense competition, there is cynicism in the broader community about interest rates for home loans.

ANZ expects to publish its interim report by 30 March 2020 and will probably release its final report by 30 September 2020.

In the first half of FY19, the bank rereported a statutory profit after tax of $3.17 billion, down by 5 per cent as compared to previous corresponding period (pcp).

During the first half the bank took several business initiatives which are as follows:

- Introduced single home loan origination system for all channels in Australia to improve the application and assessment process;

- Increased the number of dedicated home loan assessors in Australia to assist with enhanced verification;

- Named number 1 trade financier in Australia for eighth consecutive year;

- Grew home loans and retail deposits in New Zealand by 6% respectively year on year;

- Maintained leading market position in Australia and New Zealand and retained number 1 position for overall relationship quality in Asia for the second consecutive year;

- Named Asian Bank of the Year for 2018 by IFR Asia;

- Maintained digital wallet leadership with more than 88 million transactions in the last 12 months, with total customer spend up 114% in that same period.

In the past six months, ANZ stock has increased by 4.60% as on 17 October 2019. At market close on 18 October 2019, ANZ stock was trading at a price of $27.760 with a market capitalisation of circa ~$79.23 billion. The stock is trading with PE multiple of 12.760x with an annual dividend yield of 5.72%.

Commonwealth Bank of Australia (ASX: CBA)

The strategy of Commonwealth Bank of Australia (ASX: CBA) to become a simpler and better bank, in order to deliver better outcomes for its customers.

In order to become a simpler bank, the bank exited from its wealth management businesses and sold its New Zealand life insurance business, Sovereign, as well as TymeDigital and Colonial First State Global Asset Management businesses.

By simplification, CBA is seeking to reduce risk as well as cost. As at 30 June 2019, the bankâs Common Equity Tier 1 capital ratio was 10.7%, which is higher than APRAâs âunquestionably strongâ benchmark of 10.5%.

In the past six months, CBA stock has increased by 9.31% as on 17 October 2019. At market close on 18 October 2019, CBA stock was trading at a price of $79.640 with a market capitalisation of circa ~$141.81 billion. The stock is trading with a trading with a PE multiple of 16.500x with an annual dividend yield of 5.38%.

Bank of Queensland Limited (ASX: BOQ)

The FY19 (year ended 31 August 2019) results of BOQ were impacted by the challenging operating environment. However, the bank made good progress in foundational investments.

Factors affecting FY19 results include:

- Slow credit demand and lower interest rates

- Regulatory changes impacting insurance income

- Rise in regulatory costs as flagged in 1H19

- Loan impairment expense impacted by new AASB9 collective provision model â underlying asset quality remains sound

BOQâs statutory NPAT declined by 11% to $298 million in FY19 while its net interest margin down 5 basis points to 1.93%. The bankâs basic cash earnings per share was down 16 per cent to 79.6 cents per share and its cost to income ratio was up 300 bps to 50.5%.

While commenting on the results and outlook for BOQ, new Managing Director & CEO George Frazis outlined his key priorities, which are:

- Return to profitable and sustainable growth;

- Embed bankâs purpose-led, customer culture;

- Simplify BOQâs business, improve productivity and address costs;

- Close the digital and data gap, delivering BOQâs mobile and VMA investments; and

- Continue to strengthen the Bank.

In the past six months, BOQ stock has increased by 4.78% as on 17 October 2019. At market close on 18 October 2019, BOQ stock was trading at a price of $9.150 with a market capitalisation of circa ~$3.82 billion. The stock is trading with a PE multiple of 11.790x with an annual dividend yield of 6.9%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)