Lithium prices are sustaining in the international market post a massive downfall, which is now turning investors eye towards the lithium stocks across the globe. Lithium stocks are under scrutiny by the global market participants over the much-anticipated rush for lithium amid forecasted galloping of the electric vehicle industry.

Lithium on the London Metal Exchange

London Metal Exchange is a prominent exchange for metals with its ring sessions particularly famous among the global metal industry participants. The exchange took the initiative to standardise the lithium prices across the globe and provide the market participants with a reference price as spot prices across different geographies vary substantially.

The Fastmarkets MB lithium carbonate min 99.5 per cent of the lithium carbonate battery grade, spot prices CIF, China, Japan & Korea remained stable at USD 10.00 per Kg; while the same delivery and spot lithium hydroxide monohydrate (56.5 per cent) stood stable at USD 12.00 per Kg (as on 10 October 2019).

Itâs been a month, and the lithium-based chemicals have not shown any further downfall, which is now restoring confidence among the white gold-enthusiasts over the lithium stocks.

To Know More, Do read: How Are Australian Lithium Miners Taking Roots To Leap on the Stabilised Lithium Chemical Prices?

Australia and the White Gold

Australia hosts a wide resource and reserves of lithium and bags the number one spot in the lithium supply industry. Previously, over the ongoing trade war, the lithium chemical prices were under pressure in China, which is among the top Australian spodumene consumer.

The drop in the chemical prices in China caused many headwinds for the Australian lithium stocks; however, the Australian lithium stocks are now gaining momentum.

To know More, Do Read: Lithium Demand Plays Spoilsport; Alita, Galaxy and Pilbara Limits Production

The Australian lithium companies are developing their projects to ensure the dominancy in the lithium industry as they face challenges from Chile.

To Know How? Do Read: Chile And SQM Leap To Regain The Market Share Posses Headwinds For Australian Lithium Miners Ahead

While the Australian lithium industry is reviving from the jolts of the lithium supply glut, the investors and lithium advocates are clinching to the lithium industry and to the lithium outlook.

Want to Know Why? Do Read: Why Are Market Players Clinching to the EV and Lithium Forecast?

ASX-Listed Lithium Miners

Altura Mining Limited (ASX: AJM)

Operational Milestones

Altura flagged a record production of 45,484 wet metric tonnes of lithium concentrate at itsâ wholly-owned Pilgangoora lithium mine for the quarter ended 30 September 2019. The production witnessed the growth of 7.3 per cent against the June 2019 quarter amid increased ore production, higher grade and improved plant throughputs.

The per-unit production cost declined by over 6.88 per cent to stand at USD 365 per wet metric tonnes in the September 2019 quarter as against the per-unit production cost of USD 392 per wet metric tonnes.

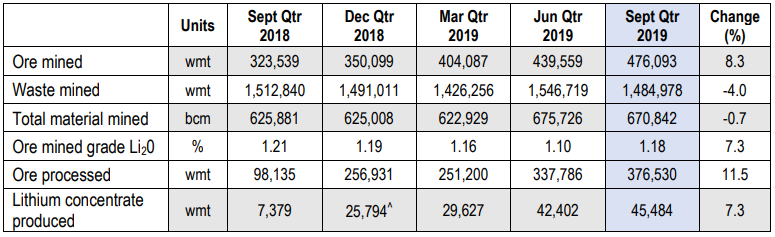

The mining and processing quantities for the September 2019 quarter against same corresponding quarter in 2018 and against the previous quarters stood as below:

The above information would require re-processing and /or blending to be incorporated in the saleable product (Source: Companyâs Report)

- The ore production soared by 8.3 per cent in September 2019 quarter to stand at a record of 476kt amid optimised operations and mine design.

- The company introduced a night shift for one week in three from August and along with the introduction of a second excavator to enable multiple dig faces ensured a steady supply of ore to the mill.

- The milled ore grades stood 7.3 per cent higher in September 2019 quarter against the June 2019 quarter to stand at 1.18 per cent of lithium oxide.

On the processing counter, the plant utilisation increased to 90 per cent in the September 2019 quarter against the utilisation rate of 84 per cent in the previous quarter.

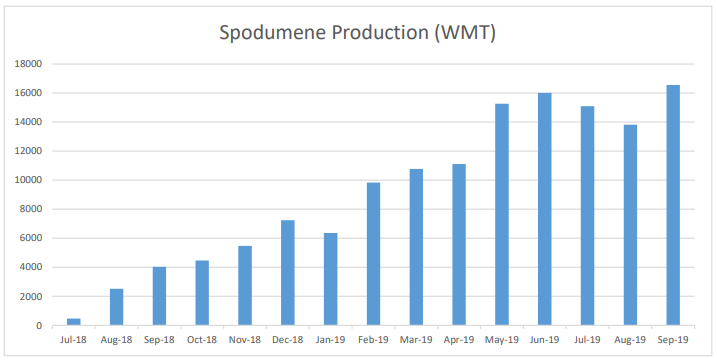

The spodumene concentrate production surged in the September to stand at 17,887 wet metric tonnes after witnessing a decline for three consecutive months.

(Source: Companyâs Report)

The spodumene Concentrate product stocks stood at 30,387 wet metric tonnes including a cargo of 12,500 wet metric tonnes, which left the effective stock at 17,887 wet metric tonnes.

The current run-of-mine and crushed ore stocks stood at 540,513 wet metric tonnes (as on 30 September 2019), out of which 300,140 wet metric tonnes stood above the grade of 1.20 per cent lithium oxide, which in turn, would provide sufficient stock to blend and feed the process plant.

The Qube Bulk hauled 44,407 wet metric tonnes to the storage facility from the mine site during the September 2019 quarter, which underpinned the growth of 12 per cent against the previous quarter.

Shipment and Marketing Status

Altura shipped three cargoes totalling 25,601 dry metric tonnes in the three months to the September 2019 and loaded a further shipment of 11,587 dry metric tonnes during September 2019 (delivered on 2 October 2019).

The prices realised by the company remained stable in the September 2019 quarter over the stabilised lithium prices to stand at USD 599 per dry metric tonne (CIF to mainland China basis SC6), against the previous quarter realised price of USD 600 per dry metric tonne (CIF to mainland China basis SC6).

Pilbara Minerals Limited (ASX: PLS)

Pilbara is securing the Chinese giantsâ interest. The Peopleâs Republic of China approved the proposed participation of the Contemporary Amperex Technology Limited (CATL) in Pilbaraâs $91.5 million capital raising program.

CATL holds large agreements with leading global car manufacturers such as Toyota, BMW, Volkswagen and Honda, which makes the interest of the company in Pilbara very intriguing among investors.

CATL is one of the strategic relationships which the company secured amidst the development of the Pilgangoora Lithium-Tantalum Project. The other strategic relationships which Pilbara holds include POSCO, Ganfeng Lithium, and many other lithium behemoths in China.

Pilbara received the Tranche 1 payment of $20.0 million from CATL post the approval from the Peopleâs Republic in China, and now the company seeks the shareholdersâ approval to secure another payment of $35.0 million.

Pilbara, under its Share Purchase Plan (or SPP), had received applications totalling approximately $27.3 million, while the pan of the company was to raise $20 million.

Under the purchase plan, the issue price was decided to be at $0.30 a piece, which remains higher than the last traded price of $0.285 on the Australian Securities Exchange.

To conclude, the Australian lithium suppliers are now taking a respite over the stabilised lithium prices in the market, and the miners are again ramping up the production or either securing strategic position to leap with the anticipated rush for the white gold.

While Altura reaches record production and operational milestones, Pilbara seized strategic opportunities, and not just these two; many other ASX-listed lithium miners are again rising to position themselves in the lithium supply chain in different manners.

Investors should look and analyse the further development among the Australian lithium miners to gauge the mood of the lithium industry and to reckon if the lithium downfall is coming to an end?

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)