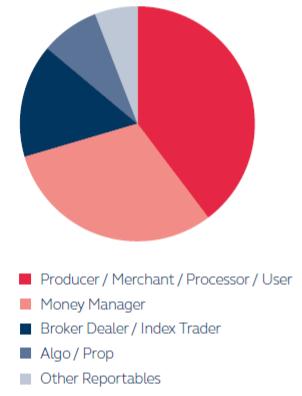

The London Metal Exchange (LME) connects physical metal market to the financial market to create a global pool of liquidity. The LME participants are the metal producer, merchants, metal user, money managers, brokers, and prop traders. These participants engage in buy and sell of LME future and option contracts. The buy and sell activities of these contracts is done to transfer the risk (hedge) by metal producer and in order to gain the benefit of price movement by financial market participants. LME contract is backed and settled by physical stock stored in LME-warehouses globally. As most of the participants in LME use the contact as a mean for hedging and to take the benefit of price movement, less than 1% of contract traded gets settled physically.

LMEâs Participants (Source: LME)

Types of LME contracts:

LME has three types of contract, where the contract trades with a daily expiry up to 3 months, weekly expiry up to 6 months and a monthly expiry up to 123 months depending upon the underlying metal. The LME deals in non-ferrous metals and ferrous steel scrap and rebar only, it has contracts of non-ferrous metals like copper, zinc, nickel, tin, molybdenum, cobalt, lead, gold & silver, etc.

The daily expiry- a 3month delivery contract is so far the most actively traded contract on LME and was the first to start on LME because initially, it used to take three months-time for copper to reach the UK from Chile and tin from Malaysia.

Because the 3-month is the most traded non-carry contract, traders will sometimes look at 3-month LME select (LME trading platform) live volumes to gauge total trading activity on the LME.

Settlement:

When the LME contract is held open till expiry date, then it gets settled through a physical delivery of the underlying metal by approved warehouses, registered under LME warehouse network, there are over 550 LME approved warehouses spread across 34 locations in 14 countries around the world. The bearer document for this is called a "warrant."

The ownership of these warrants is transferred randomly through LME sword, which is a system which allocates random transfer of LME warrants to buyer and sellers, which means that buyers cannot choose a particular brand or location for the metal they receive. If the buyer wants to buy from a particular location or brand, they can trade the contract off-exchange.

The final days before the expiry date are known as "Cash-today," "Cash-tomorrow Tom" or just "Cash."

Expiry, also known as, cash today, settlement date or prompt date, is the date an LME contract can no longer be rolled forward. It is also the date on which the contract must be honoured through the transfer of metal warrants to settle any outstanding long or short position.

Tom: It is an abbreviation of Cash-tomorrow and means the next LME trading day. It is the last date of the contract which could be closed without a warrant transfer, but only up until 12:30 (London time).

Cash: The LME cash price is used to represent the market price for spot metal that will be delivered in two LME trading days and is the last full day a contract can be settled or cleared in any of the official LME currencies.

The trading platform on LME:

The London Metal Exchange has three trading platforms:

- The Ring (Trading hours: 11.40â17.00) (U.K time)

- It is an open-outcry trading floor, where liquidity is concentrated into Five minutes sessions known as the ring. It is a face to face platform, where buyers and seller meets to engage in a trade.

- LME Select (Trading hours: 01.00â19.00) (U.K time)

- It is an electronic trading platform, for the trading of all LME contracts.

- Inter-office telephone (Trading hours: 24 hours)

- The members of LME can execute their orders through telephone and can engage in a transaction.

Understanding LME reported data:

London Metal Exchange reports its data of LME warrants and Inventories on a daily basis from 16.40 of the previous day to 16.40 to the next day, which is the actual date of reporting the data.

How to understand the reported data:

The LME reports its data as the increase/decrease in inventories along with the number or ratio of cancel warrants.

LME inventories are stock stored in the LME approved warehouses, and LME reports the increase or decrease in the present stock the next day.

Example of data that LME reports:

LME Inventory Data (Source: LME)

The LME data presented here was reported on 15th November 2018 by LME, the inventories which earmark the stock increase and decrease, stood negative which marked a fall in the stock of zinc in the warehouse of the London Metal Exchange.

The Cancelled warrant stood at +5,850, cancel warrants earmarks increase or decrease in delivery. A positive number suggests that the warrant holder cancelled the delivery contract which leads to a shortage of supply and a negative number indicates that the warrants were met and drop in supply.

So, a falling inventory along with a rising delivery (cancel warrants) provides a bullish view and vice versa.

In December 2012, LME was acquired by the Hong Kong Exchanges and Clearing, for $2.2 billion. The London Metal Exchange is the worldâs major hub for trading of industrial metals. In 2018, 185 million lots were traded, whose total value translated to $15.7 trillion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.