Regulatory technology or Regtech companies help in the management of regulatory processes in the banking & financial sector through technology. These companies generally use cloud computing technology to support organisations to comply with the rules and regulations in an efficient and cost-effective manner.

These companies collaborate with regulatory bodies and financial institutions, using technologies including cloud computing and big data for information sharing. The regulatory companies support other organisations facing issues like breaches, hacking, money laundering, among others.

Below discussed is ASX-listed Kyckr Limited, which operates in the same space.

About the Company

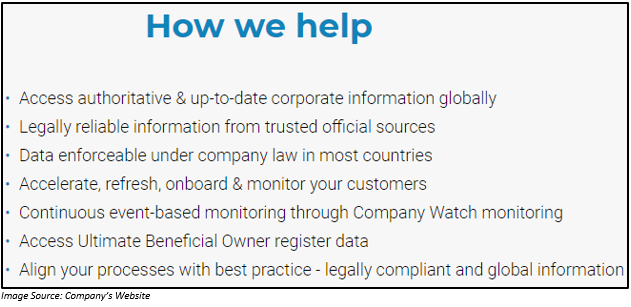

Kyckr Limited (ASX:KYK) is a global regulatory technology company, providing global company intelligence from the legally trustworthy as well as compliant sources across the globe. Its solutions are connected to 200+ regulated primary sources in 120+ countries. The company offers instant company registry information on more than 170 million businesses across the globe. Additionally, KYK provides access to automated technology solutions that boost the efficiency of Corporate KYC (Know Your Customer).

Approach

The company, instead of storing the information, connects its clients to the registry at each search. Through this, KYK tries to ensure that the information it returns has quality as well as accuracy. The automated solutions provided by the company offer access to tools that support in managing compliance processes from any location.

Industries

Kyckr Limited caters to below mentioned industries:

- Banking & Financial Services

- Investment

- Legal & Accounting

- Payment Service Providers

Regulations

- Markets in Financial Instruments Directive II (MIFID II): KYK provides a range of solutions that help the business of its client to meet the MIFID II compliance challenges. MIFID II is a European legislation for regulating companies offering services to clients associated with financial instruments like shares, bonds, etc. With international access to primary sources of data, the company helps in speeding up the process of repapering of corporate clients as well as counterparties.

- Compliance in 4th & 5th Anti-Money Laundering Directive: In the European Union, 4AMLD and 5AMLD, which stand for 4th Anti-Money Laundering Directive and 5th Anti-Money Laundering Directive, strengthens EU rules related to laundering the proceeds of crime as well as the introduction of criminal earnings. Here, KYK helps other companies concerning ownership and control over information.

- Compliance in Foreign Account Tax Compliance Act (FATCA): FATCA requires all US based companies with operations at a global scale to adhere to the US tax obligations.

- General Data Protection Regulation: General Data Protection Regulation is designed for protecting the citizens of the EU from privacy as well as data infringements by changing the handling of data and consent.

Solutions

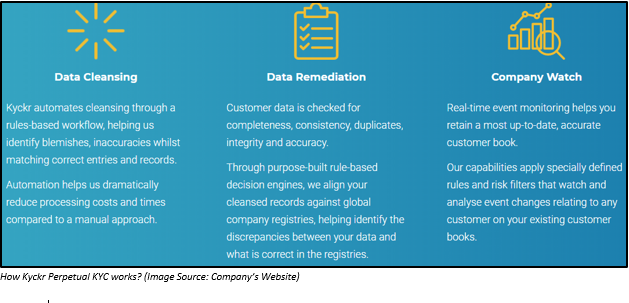

- Kyckr Perpetual KYC: Kyckr Perpetual KYC is a solution that helps in automating userâs access as well as processing of compliance obligations. The company uses its innovation and expertise, enabling it to offer powerful technologies and services, supported by its access to primary source registry information.

The company uses event-based approach and intelligence to observe as well as achieve changes based around the features of its clientâs customer information, thereby helping in minimising risk and cost as well as deriving actionable insights.

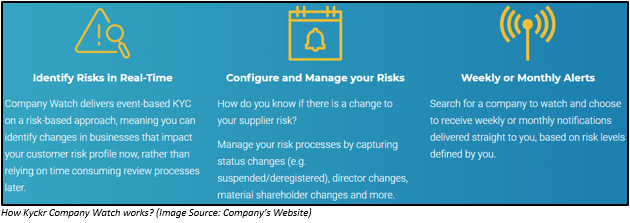

- Kyckr Company Watch: Kyckr Company Watch is a smart online monitoring service provided by the company. The service notifies the users in case of any changes to the information.

- Kyckr for Business: Kyckr for Business provides the user with the most recent and primary source of data about the company. Its enhanced search software helps in streamlining as well as simplifying the compliance process.

- Kyckr API: By integrating Kyckr API to the userâs system, information from more than 200 company registries in 120 countries can be accessed. It also helps in connecting to more than 170 million legal entities.

Recent Updates

Completion of Share Placement:

On 19 September 2019, Kyckr Limited updated the market with the successful completion of a placement worth A$ 5.2 million before costs to new as well as existing institutional and sophisticated investors. The placement included approx. 78.35 million new ordinary shares (fully paid) at a price of 6.6 cents per share.

Tranche 2 of the placement secured a go-ahead from shareholders in the extraordinary general meeting on 13 September 2019. Under the second tranche of the placement, the company issued 46 million ordinary shares (fully paid), resulting in a capital raise of A$ 3.1 million.

The capital raising took place under the leadership of Mr Richard White, who has become a substantial investor in Kyck. Mr White is a prominent technology entrepreneur and has a 19.6% holding in the company.

The proceeds generated through the placement would be used for accelerating the global commercialisation activities of the company as well as for the business development and account management.

FY2019 Highlights:

- FY2019 revenue went up by 25.8% as compared to its previous corresponding year (pcp), reaching A$ 2.22 million.

- Its loss increased by 72.7% in FY2019 to A$ 6.13 million

- Online revenue through Kyckr.com went up by 40% on pcp.

- The company also noted an increase in new registrations across its web-based solution by 50% on pcp.

- The website was re-launched to promote future sales.

- During the period, the company laid emphasis on strategic partnerships and collaborations like ESC.

- Revenue of the company through its enterprise solutions declined by 8% to $0.65 million, which was the outcome of lower contribution from the Bank of Ireland contract. Excluding the revenue through the Bank of Ireland, revenue through the companyâs enterprise solutions increased by 9% and represented growth in revenue diversification across the segment.

- Contract renewal rates got extended into a further year.

- Perpetual KYC pilots were recommended with key banks in FY2020.

Outlook:

In FY2020, the company would continue to focus on driving strategic partnerships with global data providers as well as credit bureaus. Apart from that, it would also look at increasing its online growth from its recent Kyckr.com digital platform. Enterprise business would continue to be in the companyâs priority list amid current as well as prospective enterprise clients.

Stock Information:

The shares of Kyckr Limited have given a solid YTD return of 185.71%. On 20 September 2019, the shares of KYK opened at a price of A$ 0.240, an increase of A$ 0.04 from its last closing price. By the end of the dayâs trading on20 September 2019, the shares closed at a price of A$ 0.240, up by 20% as compared to its last closing price. KYK holds a market cap of A$ 45.86 million and has ~ 229.32 million outstanding shares. Around 16.86 million shares of the company traded on ASX.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.