Metals & mining sector of Australia plays a substantial part in the development of its economy. This sector comprises more than 600 companies listed on the Australian Stock Exchange. The sector gets affected by challenging market conditions like the US-China trade war.

On 6th September 2019, the S&P/ASX 300 Metals and Mining Industry closed trading at 4,345.3, up 4.4 points or 0.1% from its previous close, against S&P/ASX 200, which closed at 6,647.3, reporting an increase of 34.1 points or 0.51%.

Let us have a glance at some market updates from four metals & mining sector players.

Fortescue Metals Group Limited

Fortescue Metals Group Limited (ASX: FMG) is engaged into exploration, development, production as well as sale of iron ore.

Completion of Offering of Unsecured Notes

The company, through a release dated 6th September 2019, updated the market regarding the successful completion of the offering of Senior Unsecured Notes amounting to US$600 million at an interest rate of 4.5%, which are scheduled to mature on 15th September 2027. FMG would direct the funds generated from Senior Unsecured Notes towards making the partial repayment of US$600 million of the outstanding US$1.4 billion 2022 Syndicated Term Loan Facility.

Additionally, the company is in discussions with the 2022 Syndicated Term Loan Facility lenders in order to get an extension for Term Loan maturities of US$600 million, to 2025 on the same terms and conditions.

South Australian Ministerial Approval

As per a company release dated 30th August 2019, the Farm-in and Joint Venture Agreement between Tasman Resources Ltd (ASX:TAS) and a subsidiary of Fortescue Metals Group Limited, FMG Resources Pty Ltd, has secured the South Australian ministerial approval over the formerâs 100% owned Exploration Licence 5499. The licence hosts the Vulcan prospect, holding iron oxide, copper gold and uranium.

Under the terms of the agreement, FMG Resources Pty Ltd might earn a beneficial interest of 51% in exchange of a sole funding worth A$4 million-plus GST on exploration expenditure within a three-year period. FMG Resources Pty Ltd is required to spend at least A$1 million before it can withdraw.

Financial Performance

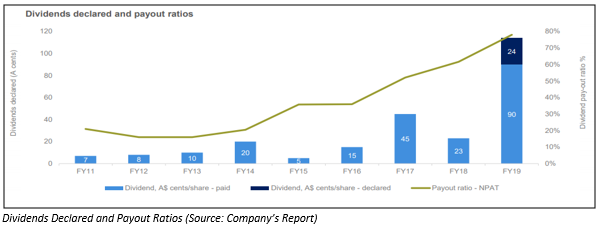

In FY19, the company reported record net profit after tax amounting to US$3.2 billion and revenue of around US$10.0 billion. Underlying EBITDA reported by the company stood at US$6.0 billion. Meanwhile, the company has also declared a final dividend amounting to A$0.24 per share, fully franked, bringing the total FY19 dividend to A$1.14, which represents 78% of pay-out of full-year NPAT, 396% higher than the FY18 dividend of A$0.23 per share.

The stock of Fortescue Metals Group closed the dayâs trading at A$8.380 per share on 6 September 2019, up 1.33% from its previous close, with a market cap of A$25.46 billion.

Syrah Resources Limited

Focussed on becoming a quality graphite productsâ supplier, Syrah Resources Limited (ASX: SYR) is primarily involved in increasing production at the Balama Graphite Operation in Mozambique.

Trading Halt

As per a company release dated 6th September 2019, SYR securities would be placed in a trading halt on the Australian Securities Exchange, owing to the companyâs request, pending a SYR announcement regarding natural graphite market conditions and operational response. The securities of the company would remain under the halt until the earlier of the commencement of normal trading on 10th September 2019 or when the announcement is released to the market.

Quarterly Rebalance of S&P/ASX Indices

On the same day, the S&P Dow Jones Indices made an announcement that Syrah Resources Limited would be removed from S&P/ASX All Australian 200, effective at the market open on 23rd September 2019.

Change of Key Personnel

According to a market update on 5th September 2019, SYRâs Company Secretary, Jennifer Currie would be on maternity leave for a minimum period of 6 months, which became effective from 5th September 2019. The company also updated the market that Melanie Leydin would handle the responsibilities of Company Secretary for the period of Jenniferâs maternity leave.

In another update, Syrah Resources unveiled that Credit Suisse Holdings (Australia) Limited has become an initial substantial holder in the company with an initial voting power of 5.11%, which became effective on 21st August 2019.

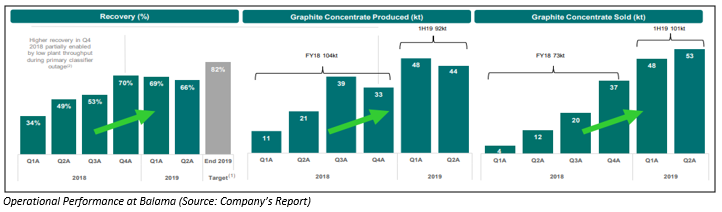

As per the Diggers and Dealers presentation by the company, improvement in operational performance at the Balama Graphite Operation is being supported by enhanced equipment management and growing process control. The company is continuing the delivery of production improvement plan as expected, with the target of 82% flake graphite recovery by the end of 2019. Its operational focus is on increased recovery and higher-value products.

The stock of Syrah Resources Limited last traded on 5th September 2019, closing the day at a price of A$0.705 per share. It has provided negative returns of 12.96% and 35.99% in the last one month and three months, respectively.

Jupiter Mines Limited

Jupiter Mines Limited (ASX: JMS) is engaged in the sale of manganese ore as well as operation of Tshipi Manganese Mine.

Dividend Announcement

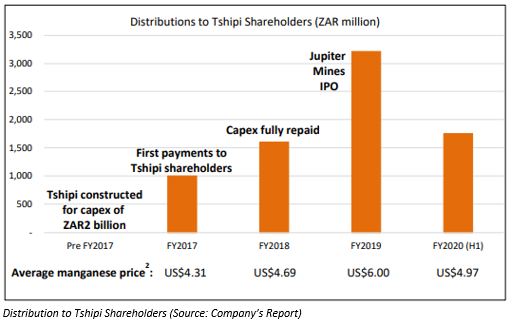

As per the Annual Report 2019 of Jupiter Mines Limited, the company has an interest of 49.9% in Tshipi é Ntle Manganese Mining (Pty) Limited. The company through a release dated 6th September 2019 announced that the Board of Directors of Tshipi é Ntle Manganese Mining (Pty) Limited has declared a dividend amounting to ZAR600 million to its shareholders, bringing the total 1H FY20 dividend to ZAR1.75 billion.

As per the investor presentation dated 30th July 2019, since FY17, the company has returned an amount of A$300 million to its shareholders, which is equating to 38% of current market capitalisation as in the period between 30 July 2019 and 1 August 2019.

Following Resolutions were on the agenda during the Annual General Meeting 2019:

- Resolution 1-Remuneration report

- Resolution 2-Spill resolution

- Resolution 3-Re-election of Brian Gilbertson

- Resolution 4-Election of Yeongjin Heo

- Resolution 5-Election of Melissa North

Outlook

For FY20, the company is targeting robust cash generation by delivering 3 million tonnes per annum business plan as well as continuing to be one of the lowest cost manganese producers worldwide. JMS would have an exclusive focus to put the cash into the shareholders pocket through a high payout and double-digit yielding dividend.

The stock of Jupiter Mines Limited closed the dayâs trading at a price of A$0.380 per share on 6th September 2019, up 1.333%. It has provided returns of 10.29% and 15.38% in the last three months and six months, respectively.

Metals X Limited

Metals X Limited (ASX: MLX) is involved into the operation of tin and copper mines as well as development and exploration of base metal projects in Australia.

Drilling Results from Bell 50

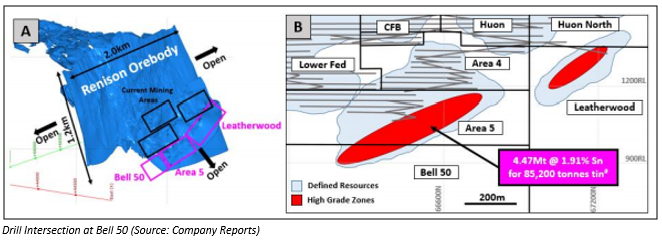

In a release dated 6th September 2019, MLX announced results of drilling activities at Renison Tin Operations. The company reported that Renison Tin Operations is 50%-owned via Bluestone Mines Tasmania Joint Venture. A record drill intersection of 30.10 metres at 4.58% Sn from 233.0 metres within the hole identified as U6966 has been returned, as part of the recent additional drilling at Bell 50. With the intersection, the company achieved the best-ever drill results for the project under the current ownership.

Quarterly Rebalance of S&P/ASX Indices

On 6th September 2019, the S&P Dow Jones Indices announced that MLX would be removed from the S&P/ASX 300 Index, effective at the market open on 23rd September 2019.

Financial Performance

For the full year 2019 ended on 30th June 2019, the company reported EBITDA for the Renison Tin Operations amounting to A$21.5 million as compared to A$36.5 million in FY18. EBITDA for corporate activities stood at (A$7.1 million), which was lower in the current period owing to the costs associated with a re-organisation of the companyâs executive management team.

The stock of Metals X Limited closed the dayâs trading at a price of A$0.185 per share on 6th September 2019, down 2.632% from the previous close. It has provided negative returns of 7.32% and 20.83% in the period of one month and three months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.