Jupiter Mines Limited (ASX: JMS) is primarily involved in the operation of the Tshipi Manganese Mine in South Africa and the sale of manganese ore. Tshipi Borwa in South Africa, of which Jupiter owns 49.9%, is one of the largest, longest-life and lowest-cost manganese exporters globally.

In an announcement made on 22 May 2019, the company advised that its Tshipi production is on track to deliver its 3 million tonnes sales target. Further, the company has advised that its FOB production cost this year averaging ZAR31.04 per dmtu (USD2.18).

The companyâs Board has decided to pay out ZAR1.15 billion (~AUD 116 million) to its shareholders at the end of June 2019. The company is expecting to pay a healthy H1 FY2020 distribution to its shareholders, in line with double digit yields and exceeding the companyâs policy.

Following the release of this news, the share price of the company increased by 2.059% during the intraday trade.

Tshipiâs development commenced in 2011, with first production in 2012. Today it is one of the worldâs pre-eminent manganese exporters. Tshipi produced near 3.5 Mn tonnes for FY 2019 with around 3,114,536 BCM mined in the fourth quarter.

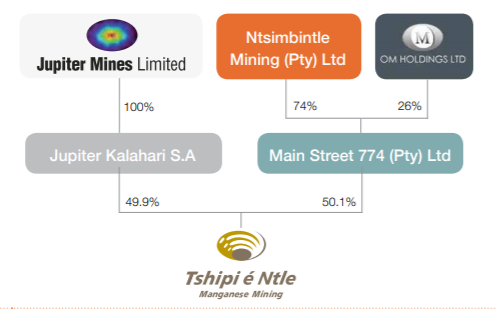

Jupiterâs interest in Tshipi is held through its wholly owned subsidiary Jupiter Kalahari S.A., as shown in the diagram below -

(Source: Company Reports)

The companyâs business model depends on the Tshipi Mine being able to continue production and transport the manganese ore product efficiently to market for a viable sales price.

The company recently reported that it has commissioned an independent valuation of its Central Yilgarn Iron Ore assets and also launched a process to review its strategic options with regards to these projects.

The assets, comprising the Mount Mason DSO Hematite and Mount Ida Magnetite projects, hold great value to the company. Further, the advanced nature of these projects, their proximity to established and available infrastructure (road, rail and port), the size and quality of the mineral resources and ease of mining and ore extraction is providing an attractive opportunity to commence high-grade DSO hematite production and high-grade magnetite concentrate production that could underpin quality long-term supply. At the end of FY19, the company had current assets of around $158 million and current liabilities of around $132.9 million.

Now, letâs have a glance at the companyâs stock performance and the return it has posted over the past few months. The stock is trading at a price of $0.347, up by 2.059% during the dayâs trade with a market capitalisation of ~$666.06 million as on 23 May 2019. The counter opened the day at $0.355 and reached the dayâs high of $0.370 and touched a dayâs low of $0.345 with a daily volume of ~ 12,129,566.

The stock has provided a year till date return of 41.67% & also posted returns of 17.24%, 6.25% & 3.03% over the past six months, three & one-month period respectively. It had a 52-week high price of $0.400 and touched 52 weeks low of $0.230, with an average volume of ~3,501,998.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.