In the current scenario, technology forms a backbone for any company or sector. There is an involvement in technology to get any piece of work done. Technology not only supports any particular company, but it also has a major influence on any countryâs economy.

On 9 August 2019, the S&P/ASX 200 Information Technology (Sector) closed the day at 1,274.3 up by 1.25%

In this piece of article, we would be looking at four stocks from the information technology sector and discuss their recent developments.

LiveTiles Limited

Company Profile:

LiveTiles Limited (ASX:LVT) is a company that is into the business of developing and selling software for business purposes in Australia and worldwide.

Recent Update:

Quarterly Update:

On 30 July 2019, LiveTiles Limited released its quarterly results as well as the activities of the company during Q4 FY2019 which ended on 30 June 2019.

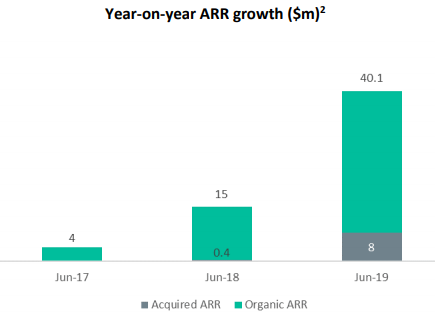

During the quarter, the annual recurring revenue of the company increased by 167% and reached $40.1 million in the past 12 months. The period also witnessed substantial growth in the enterprise customer base. The cash receipt from the customer went up by 52% to $7.9 million in Q4 FY2019 as compared to Q3 FY2019 and by 130% as compared to the corresponding period of prior year. The fourth quarter of FY2019 was the fourth consecutive quarter with improved cash generation through operating activities and consequently lower total cash outflow.

Image Source: Companyâs Report

The company expects strong growth in the customer and revenue in FY20 and beyond as a result of the increasing brand and product awareness and augmented by strong sales pipeline conversion. The objective of the company at this stage is to grow the Annualised Recurring Revenue organically to a minimum of $100 million by June 2021.

Financial Highlights:

The company used A$6.180 million in its operating activities and A$0.481 million in investing activities. The net cash inflow from the financing activities was A$0.356 million. The net available cash and cash equivalent by the end of Q4 FY2019 was A$14.814 million. The estimated cash inflow in Q1 FY2020 would be A$15.930 million.

Strategic Partnership with UiPath:

As per the ASX release on 25 July 2019, LiveTiles Limited entered into a strategic partnership with UiPath, recognized as a global leader in fields of Robotic Process Automation (RPA). Under this partnership, both the parties would look at the potential for development of joint RPA and Artificial Intelligence (AI) solutions with respective technologies

Stock Performance:

In the previous six months, the shares of LVT have provided a return of 32.86%. The opening price of the shares of LVT on 9 August 2019 was A$0.480. By the end of the dayâs trading, the shares closed at a price of A$0.485, which was 4.3% up as compared to its previous closing price. LVT has a market capitalisation of A$ 307.21 million and has approximately 660 million outstanding shares.

Objective Corporation Limited

Company Profile:

Objective Corporation Limited (ASX: OCL) is a software company which specialises in the enterprise content management. It comprises of those technologies that deal with work related to document management, record keeping, workflow and web content management.

The company creates solutions related to information as well as process governance.

Recent Update:

Buy-Back Extension:

On 29 July 2019, Objective Corporation Limited (ASX:OCL) announced buy-back of maximum 9,287,911 Ordinary shares for the purpose of capital management. The company intends to commence the buy-back of shares from 13 August 2019 and this would end on 12 August 2020. Further, the company possesses the right to terminate the buy-back whenever it desires.

Trading Update:

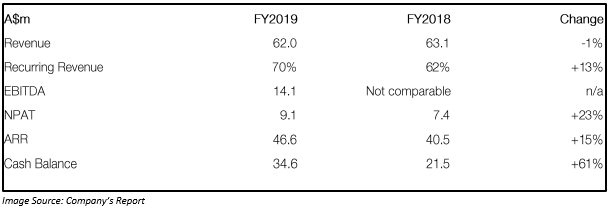

On 15 July 2019, the company announced the trading update for the FY2019 as per the unaudited management account as on 30 June 2019. The revenue of the company declined by 1% to 62 million, recurring revenue increased by 13% to 70%. EBITDA for the period was A$14.1 million, NPAT by 23%, and ARR by 15% as compared to the corresponding prior-year period.

Outlook:

The company believes that the growth in proportion of the subscription revenues could drive the future revenue of the company, enabling the company to plan and manage its resources in a better manner. The cash generated through the business would be invested in the existing product portfolio of the company. Further, the agnostic framework of the companyâs product is expanding the addressable market. Its iQ interface offers various opportunities to grow revenue in its existing customer base.

Stock Performance:

In the previous six months, the shares of OCL have provided a return of 30%. The opening price of the shares of OCL on 9 August 2019 was A$3.360. By the end of the dayâs trading, the shares closed at a price of A$3.340, which was 1.183% down as compared to its previous closing price. OCL has a market capitalisation of A$ 313.93 million with approximately 92.88 million outstanding shares, PE ratio of 45.68x and an annual dividend yield of 1.48%.

GBST Holdings Limited

Company Profile:

GBST Holdings Limited (ASX: GBT) is a fin-tech company. It provides software related to administration and transaction processing for retail wealth management organisations and investment banks.

Recent Update:

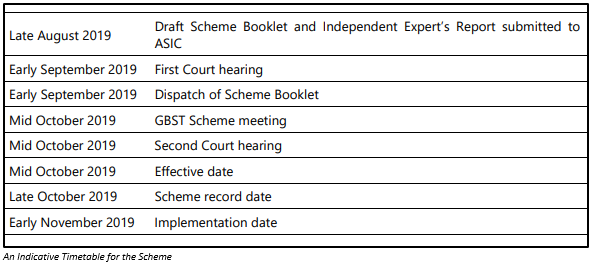

On 29 July 2019, GBST Holdings Limited announced that it had entered into a binding Scheme Implementation Deed under which FNZ Group would be acquiring the 100% of the shares of GBST Holdings by means of a Scheme of Arrangement. Under this Scheme of Arrangement, the shareholders of GBT would be receiving A$3.85 in cash for each share of the company. It will be reduced by the amount in case of any special dividend is declared up to a maximum of A$0.35 for each of GBT shares.

The scheme provides a substantial premium to the undisturbed pre-announcement share price. The directors of the company recommended the shareholders to vote in favour of the Scheme and also proposed to vote shares in their control in favour of the Scheme in absence of a Superior Proposal. Further, the Scheme depends on court approval and conclusion by an Independent Expert that the scheme that would be best in the interest of the shareholders of the company.

Stock Performance:

In the previous six months, the shares of GBT have provided a return of 200%. The opening price of the shares of GBT on 9 August 2019 was A$3.830. By the end of the dayâs trading, the shares closed at a price of A$3.84, which was unchanged as compared to its previous closing price. GBT has a market capitalisation of A$ 260.78 million with approximately 67.91 million outstanding shares, PE ratio of 35.00x and an annual dividend yield of 0.65%.

GetSwift Limited

Company Profile:

GetSwift Limited (ASX:GSW) is an ASX listed company with staff in the US, APAC and EU regions. It provides top rated, a real-time delivery of software solutions for clients residing in more than 69 countries and across 630 cities.

Recent Update:

The company reported a 30% increase in the revenue and other income for Q4 FY2019 as compared to Q3 FY2019. The total revenue and other income for the quarter ending 30 June 2019 were ~ $1.409 million, up by 249% as compared to the corresponding prior-year period. However, the company incurred a net loss of ~ $6.0 million. A significant portion of the amount was assigned for the development of the technology staff as well as on improvements of R&D platform for Q4 FY2019.

The company reported a strong balance sheet with cash of $68.9 million and no outstanding debt.

The Tech, Product and Support Cadence delivered value for the customer.

Financial Highlights:

The company used A$6.257 million in its operating activities. The net cash inflow from the investing activities was A$65.068 million. The net available cash and cash equivalent by the end of Q4 FY2019 was A$68.859 million. The estimated cash inflow in Q1 FY2020 would be A$7.650 million.

Stock Performance:

In the previous six months, the shares of GSW have provided a return of -56.99%. The opening price of the shares of GSW on 9 August 2019 was A$0.215. By the end of the dayâs trading, the shares closed at a price of A$0.220, which was 10% up as compared to its previous closing price. GSW has a market capitalisation of A$ 37.7 million and has approximately 188.52 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.