Cryptocurrency is basically a form of digital currency platform whereas Blockchain stores and records the data of a transaction in cryptocurrency. To understand the current scenario of the businesses that are engaged with these two segments, we have picked up five companies and tried to dig with recent news and financials. As per the latest financial results available on the exchange, all five companies operating in the either of the above two sectors have reported losses. Change Financial Limited reported a loss of $4.28 million in 1HFY19 majorly due to management of the ChimpChange program. Animoca Brands reported a loss of $ 3.11 million 2018 while remaining in the development phase of operations.

DigitalX witnessed a loss in 1HFY19 amounting to $3.93 million due to lower revenues from token advisory. Fatfish Blockchain reported a net loss of $21.94 million in 2018, due to fair value gains from improvement in share price of the Groupâs listed investee company, iCandy Interactive Limited. Despite incurring a loss in 2018, iCandy improved on its performance due to the recent launch of new game titles and development of first blockchain game.

Change Financial Limited

Change Financial Limited (ASX: CCA) is engaged in providing mobile banking services through the ChimpChange mobile application. The company has recently received proceeds from the divestment of the companyâs interest in the Ivy Project. As per the final terms of the transaction, the company will transfer back 117,000,000 Ivy tokens, carried at cost at a value of $1.

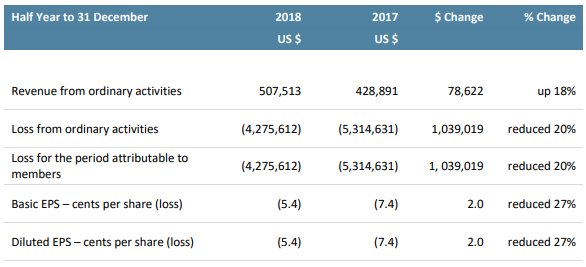

1HFY19 Highlights: During the period, the company generated revenue amounting to US$507,513, up 18% in comparison to prior corresponding period revenue of US$428,891. Loss from ordinary activities during the period stood at US$4.28 million, as compared to 1HFY18 loss of US$5.31 million. During the year, the company secured new funding of A$4 million, from Altor Capital. The company also appointed Harley Dalton and Ben Harrison as Directors, during the first half.

1HFY19 Results (Source: Company Presentation)

Strategic Update: During 1HFY19, the company finalised a strategic review of the businesses and concluded that it will focus on the processor business, to monetise its investment in the Ivy Project. While the enterprise processor business has risk and cost associated with the completion, it offers a significant opportunity due to the size of the addressable market and limited competition. As per data provided by Edgar Dunn & Company, the market size in 2019 will be approximately $50 billion, with a compound annual growth rate of over 60% per annum through to 2025.

After the end of the six months, the company restructured its mobile banking business leading to significant cost savings. The company has also entered into an agreement with Central Bank of Kansas City that will enable the company to eliminate losses incurred in managing the ChimpChange program.

The company has a market cap of $ 6.52 million and the CCA stock last traded at $ 0.066 on 1 August 2019.

Animoca Brands Corporation Limited

Animoca Brands Corporation Limited (ASX: AB1) is engaged in the development, marketing and publishing of a broad portfolio of mobile games and apps for smartphones and tablets.

June 2019 Quarter Update - The company recently provided an update for the quarter ended 30 June 2019. During the quarter, the companyâs cashflow remained positive at $ 2.9 million. The quarter was marked by record cash receipts of $9.1 million. Cash receipts for the first half were reported at $13.2 million. Unaudited revenue for the quarter were recorded at approximately $8.7 million. Unaudited revenue for the half year amounted to $13.0 million.

Receipts from customer witnessed an increase of 117% qoq. Operating cash flows for the period comprised of one-time cash payments of $1.2 million and $4.1 million in administrative and corporate costs. The company had cash amounting to $10.2 million and digital assets amounting to $3.2 million at the end of the quarter.

Key Milestones of the Quarter: During the quarter, the company infused investment into Lucid Sight. In addition, the company also partnered Lucid Sight to promote and distribute its games in Asia. The quarter also saw the acquisition of Stryking Entertainment, an operator of fantasy sports game Football-Stars. The company also completed a capital raise of A$4.6 million, at a premium of 4.2%. The period also saw acquisition of 75% stake in Skytree Digital Limited (a mobile games developer, based in Hong-Kong). The company also acquired 100% stake in Leade.rs,Inc and Gamma Innovations Inc.

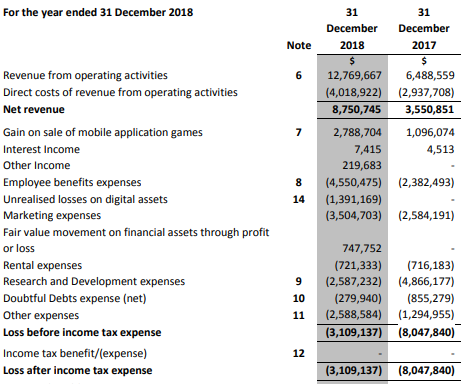

During the year ended 31 December 2018, the company generated net revenue amounting to $8.75 million, as compared to $3.55 million in the prior corresponding year.

Income Statement (Source: Company Reports)

On 2 August 2019, the stock of the company settled the trading at $ 0.200, up 5.26% by $ 0.010.

DigitalX Limited

DigitalX Limited (ASX:DCC) provides advisory services including ICO/STO advisory, Blockchain consulting, FUM and media.

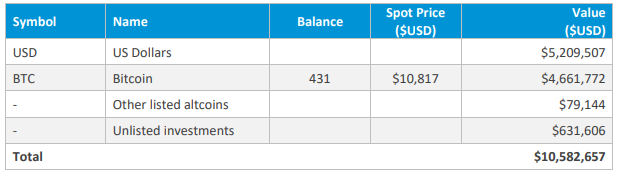

Highlights of June Quarter: The company has a strong cash and digital asset position during the quarter, owing to a capital raise of A$3.75 million. At the end of the quarter, the company had total of around US$10.5 million in cash, listed digital assets and liquid unlisted investments. The company reported a loss of US$4.18 million for the year ended 31 December 2018.

Listed Digital Asset Holdings and DigitalX Investment Fund Units (Source: Company Reports)

Business Updates: The company continued its business of providing advisory services during the quarter but did not receive any new advisory engagements for the period. The company has been an advisor to Bullion Asset Management Pte Ltd on the launch of its gold backed stablecoin, xbullion. Under the asset management division, the company is planning to launch a range of new products.

Board Changes: Subsequent to the quarter, Mr Stephen Roberts and Mr Sam Lee resigned from the position of directors of the company. In addition, the company re-appointed Mr Toby Hicks as the non-executive Chairman of the Board.

Outlook: The company seems to have a stable foundation for executing its growth strategy, provided its strong balance sheet position and an experienced legal and corporate governance.

The stock of the company settled the dayâs trading on 2 August 2019 at $0.039.

Fatfish Blockchain Limited

Fatfish Blockchain Limited (ASX: FFG) is engaged in investment in tech and internet companies.

June Quarter Update: The company recently provided an update on the quarterly activities for the three months to 30 June 2019. The companyâs 81%-owned Sweden-based subsidiary, Fatfish Global Ventures AB, is planning an IPO with Mangold Fondkommission AB acting as the broker. Minerium Technology Ltd, the companyâs 51% owned entity, has decided to postpone its IPO plan and has held its expansion to Mongolia owing to uncertain market sentiment in cryptocurrency. The companyâs share listing on the OTC Market in the U.S, was transferred to the Pink Open Market segment from OTCQB segment. The company also sold off its complete holding in Malaysia-listed Peterlab Holdings Berhad, to support its strategy to dispose non-core assets. iCandy Interactive Limited, FFGâs investee company completed a private placement exercise of raising A$1.5 million, thus expanding its working capital and to support its M&A strategy.

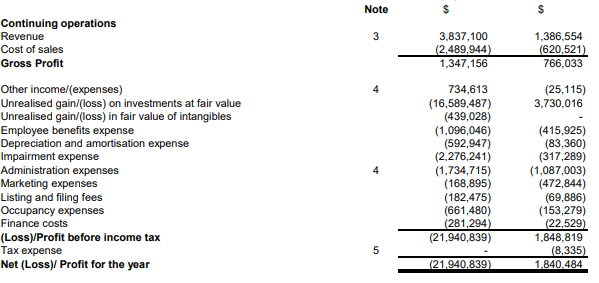

During the year ended 31 December 2018, the company reported revenue amounting to $3.84 million as compared to 2017 revenue of $1,39 million. Net loss for the year was reported at $21.94 million, as compared to a profit of $1.84 million in 2017.

2018 Income Statement (Source: Company Reports)

The stock of the company is currently trading at a market price of $0.012, reporting no change on the previously traded price on 01 August 2019.

ICandy Interactive Limited

ICandy Interactive Limited (ASX: ICI) is a developer of mobile games and digital entertainment.

Quarterly Update: During the quarter ended 30 June 2019, the company completed a capital raise amounting to $1.5 million through private placement of 25,000,000 ordinary shares. The company plans to utilise the funds for expanding its working capital and to facilitate its merger and acquisition strategy.

Update on Cryptant Crab: The companyâs blockchain-based game, CryptantCrab, released its highly anticipated competitive battle feature in the quarter. The feature involves players competing against each other and receiving digital rewards in return. Offering these kinds of incentives will the company to grow its CryptantCrab community. To provide mobile accessibility to the game, the company has also entered into a partnership with Lumi Wallet and Infinito Wallet.

Partnership with 9Games: During the quarter, the company entered into a Game Cooperation Agreement with 9Games and Animoca Brands Limited for the purpose of publishing, marketing and localisation of its iCandyâs mobile game Groove Planet, in Mainland China. The agreement will help both iCandy and Animoca to reap benefits out of the strong Chinese market presence of 9Gamesâ.

Appointment of Director: The company appointed Piew Lum as an independent director on the Board in the month of May 2019. His key role would involve advising and assisting the company on international business partnership, publishing and platform development operations.

The stock of the company closed the dayâs trading at a market price of $0.035 on 02 August 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.