In the buoyant Australian gold market, emerging gold explorer, Middle Island Resources Limited (ASX: MDI) is progressing rapidly with its flagship, Sandstone Gold Project. The companyâs primary ambition is to recommission its 100 per cent owned processing plant at Sandstone, which has been kept on maintenance since September 2010.

The Sandstone processing plant is MDIâs key asset, with the fully compatible CIP processing plant supported by a laboratory, fuel tanks, workshops, mine offices, and a substantial inventory of spares & equipment and a contracted diesel-generated power plant.

Focussing on its Sandstone Gold Project that has considerable additional exploration upside, Middle Island created an all-encompassing strategy that incorporated the following components:

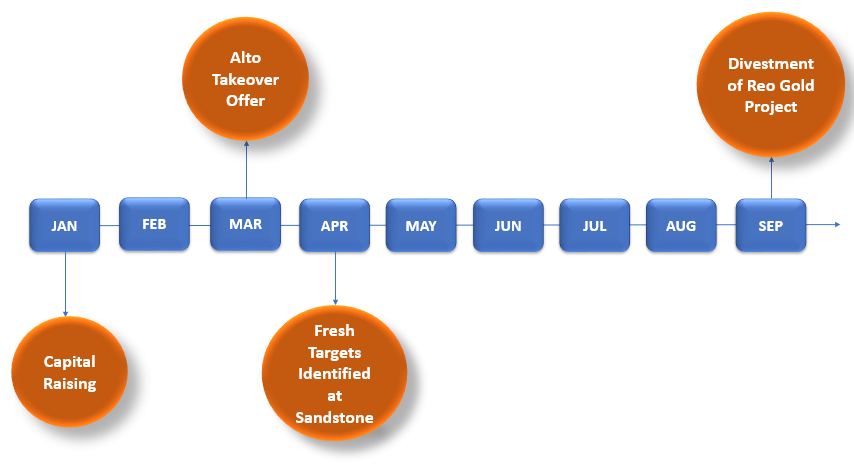

The company has so far made sizable progress in line with its comprehensive strategy, with 2019 being a remarkable year for Middle Island, during which it made significant strides.

Let us take a look at the companyâs journey in 2019:

Capital Raising

In January this year, at a time when numerous small cap resource companiesâ fund raising programs were falling short of target, Middle Island closed its $1.4 million Entitlements Offer and the issue was over-subscribed.

Demand for the Entitlements Offer and Shortfall Shares surpassed the available number of shares, showcasing a resounding vote of confidence by the shareholders. The company informed that around 70 per cent of the register, including all Directors, took up their full entitlement while 50 per cent applied for the shortfall.

Use of funds: The proceeds were primarily used on key activities at the Sandstone Project, specifically,

- Undertaking work on the Two Mile Hill tonalite deeps deposit,

- Drilling other nearby gravity targets,

- Updating the resource estimate and pit optimisation for the Wirraminna deposit,

- Other Greenfields exploration on the original and Sandstone tenements,

- To explore consolidation opportunities.

Alto Takeover Offer

In compliance with its initial component of the comprehensive strategy, the company put forward an all scrip off-market takeover offer for ASX-listed Alto Metals Ltd (ASX:AME) in March this year. Under the Offer, MDI notified about its plan to acquire 100 per cent of the issued voting shares in AME by offering 5 ordinary shares of MDI for every 1 share of AME, valuing Alto Metals at $9.4 million.

However, in June 2019, the company adopted a strategic approach and extended the premium for AME shareholders by offering 6 ordinary shares of MDI for every 1 share of AME. On 23 September 2019, the all scrip off-market takeover offer closing date was extended to 29 November 2019.

AMEâs mineral resources are located within 30 kilometres of Middle Islandâs Sandstone gold processing plant. In case the takeover offer gets successful, the company will integrate Altoâs assets with its Sandstone project and will instantly start an updated feasibility study, embedding AMEâs Mineral Resources, to validate the economics of recommissioning MDIâs processing plant based on the combined Mineral Resources.

Fresh Targets Identified at Sandstone

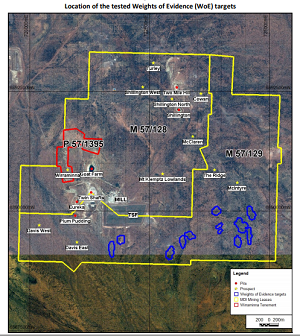

In April this year, the company reported encouraging exploration results from the geochemical aircore drilling conducted on several defined Weights of Evidence (WoE) targets within the Sandstone project. The company informed about the identification of new gold targets at the southern end of the Sandstone gold project, close to five known deposits

- Plum Pudding

- Goat Farm

- Wirraminna

- Eureka and

- Twin Shafts

The gold anomalies were found under a significant blanket (5-15m) of transported sheetwash cover that had hindered the previous exploration.

Source: Companyâs Report (18th April 2019)

Three significant, cohesive gold anomalies with a minimum strike length of ~160m, with peak values of up to 337ppb Au were defined. Each of the anomalies were in accordance with those defining high grade, nearby open pit deposits that have been processed and mined.

All gold anomalies linked with the WoE targets were defined on permitted Mining Leases and within 2.5 kilometres of the Sandstone processing plant. Each of these new WoE targets boosted the potential of a mill recommissioning decision, consistent with the companyâs primary objective.

The company mentioned that the previous success at the projectâs Davis prospect and correlation between the orientation and position of the anomalies provides considerable confidence that the further 18 WoE targets (which are yet to be tested) are likely to generate similar anomalies.

Divestment of Reo Gold Project

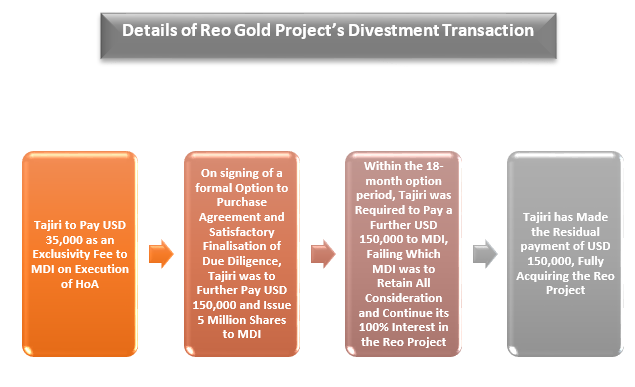

In order to focus entirely on the advancement of its Sandstone Gold Project, Middle Island has divested its 100 per cent stake in the Reo Gold Project to Tajiri Resources Corporation for USD 335,000 and 5 million fully paid Tajiri ordinary shares. The Reo Gold Project situated in Burkina Faso, West Africa, was sold after Tajiri exercised its option to acquire the project.

The divestment was completed in September 2019 after Tajiri made the last payment of Option Extension and Exercise Fee of USD 150,000 to MDI.

The transaction structure enabled MDI to retain exposure to the Reo project via Tajiri shares and a residual 2 per cent net smelter return, which Tajiri can acquire at any point for USD 5 million. This would allow MDIâs shareholders to hold a sizeable indirect share in the upside potential of Western Africa-based Reo Project.

The divestment is likely to offer MDI an exposure to Vancouver-based Tajiriâs highly prospective gold exploration projects in Guyana, South America.

One can deduce that Middle Island has achieved significant milestones in 2019, backed by its spectacular strategy and advanced Sandstone project. The company seems to be well-positioned to become the leading gold explorer of Australia in the near future.

A Brief look at Gold Price action in 2019 â Setting the Ground for MDI

Gold Spot Daily Chart (Source: Thomson Reuters)

Gold Spot Daily Chart (Source: Thomson Reuters)

Gold as an asset class has performed remarkably well in 2019. On the daily chart, we can notice that gold prices have been moving in an uptrend, and the price actions witnessed a positive crossover of 21- and 200-days exponential moving averages in December 2018.

Post the positive crossover the prices rallied consistently till February 2019 and consolidated thereafter in a bullish flag pattern. Gold prices broke out of the flag in May 2019 to reach a record high of USD 1,557.09 on 04 September 2019.

MDI followed the gold trend, and the stock price of the company surged to move in a short-term uptrend since the onset of July 2019.

The prevailing gold scenario adds to the positive case for MDI that aims to achieve a magnificent growth trajectory in the mid- to long- term.

Stock Performance: MDI last traded on 02nd October 2019 at AUD 0.007, The stock has generated a return of 75 per cent on a YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.