Across the world of investing, the investor is offered multiple choices to invest. An Index Fund is also a type of investment product in the form of a mutual fund, ETF or managed fund. The history of the index funds dates back to 1970s when, Mr Jack Bogle started the First Index Investment Trust on 31 December 1975 in the United States, which later became Vanguard 500 Index Fund.

Index Fund seeks to replicate return from the stocks constituted in a financial market index; an Index is an indicator of the performance of the underlying securities. It provides investors with a broad exposure to the variety of stocks within the specific indices. In addition, it may also offer the opportunity for low operating expenses and low portfolio turnover, and these funds follow the benchmark index irrespective of the market conditions.

Index funds operate in a systematic manner, and the benchmark index is replicated in a way that it may follow the weightings of each stock in the index and allocate the same weightings to the stocks in the fund. Several fund houses offer the funds at competitive fees and expense, on the back of the scale of the operations. Investors must consider these characteristics of the funds prior to investing.

In this article, we will discuss four such index funds. These funds have a record in distributing the income while also providing decent returns from the market along with exposure to the global market.

SPDR S&P/ASX 200 Fund (ASX: STW)

SPDR is an abbreviation for Standard & Poor's Depositary Receipts; the first ETF launched by State Street in 1993. Similarly, SPDR S&P/ASX 200 Fund (ASX: STW) is a product of the State Street Global Advisors (SSGA). The fund seeks to closely match the return from the companies constituting S&P/ASX 200 Index, before fees & expenses. The base currency of the fund is AUD, and it was incepted in August 2001. SSGA Australia Limited is the investment manager of the fund, and it distributes income quarterly.

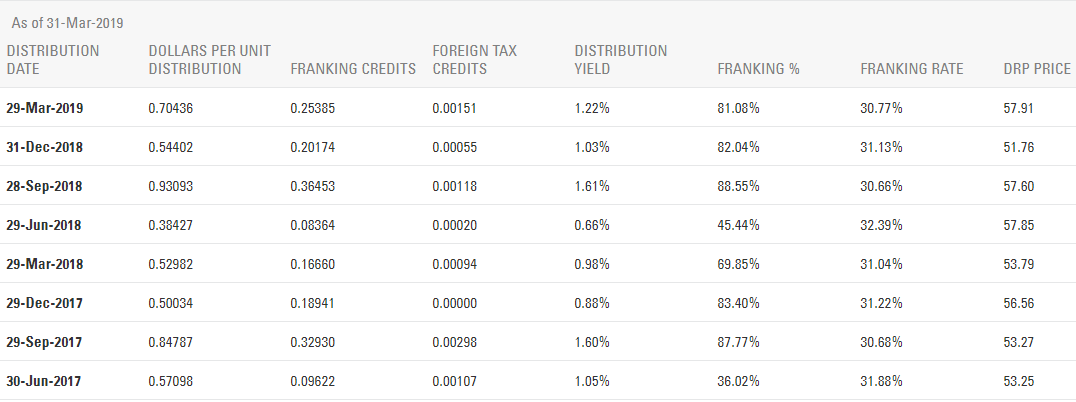

Past Distributions (Source: SPDR Website)

Past Distributions (Source: SPDR Website)

Recently, STW announced the distribution for the period ending 28 June 2019, which was AUD 76.8196 cents per unit on 27 June 2019. Also, the distribution was 54.2053% franked at a franking rate of 0%, and the foreign income percentage was 1.0072% at a foreign tax credit of 15.8283%. Further, the record date for the distribution was 28 June 2019, and the units trade ex-distribution from the start of trading on 27 June 2019. Additionally, the distribution will be paid on 11 July 2019.

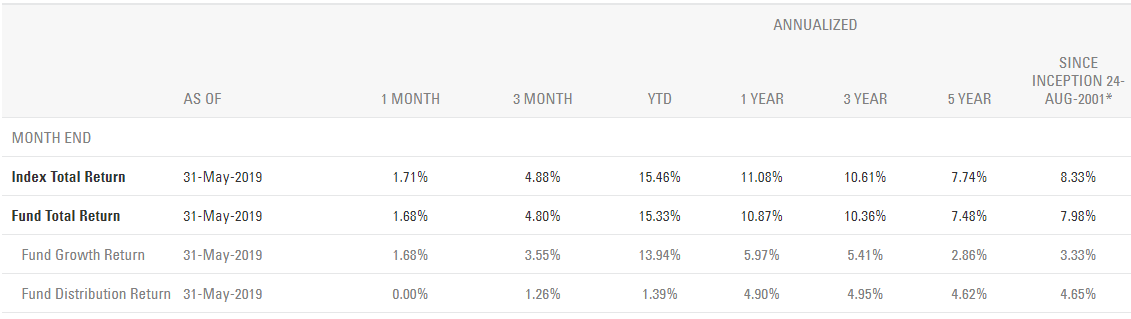

Fund Performance (Source: SPDR Website)

Fund Performance (Source: SPDR Website)

As on 03 July 2019, STW is trading at A$62.020, up by 0.65% from the previous close (as at 2:58 PM AEST), and the annual dividend yield is currently at 4.78%.

SPDR MSCI Australia Select High Dividend Yield Fund (ASX:SYI)

SPDR MSCI Australia Select High Dividend Yield Fund (ASX:SYI) tracks the returns of MSCI Australia Select High Dividend Yield Index before fees & expenses. The fund usually distributes better income, which is depicted by the annual dividend yield currently at 7%.

Reportedly, the fund announced the distribution of 67.8784 cents per unit on 27 June 2019 for the period ending 28 June 2019. Also, the distribution is 61.2248% franked at a franking rate of 29.959%, and the record date for the dividend was 28 June 2019. Further, the units trade ex-distribution from the start of trading on 27 June 2019. Additionally, the distribution will be paid on 11 July 2019.

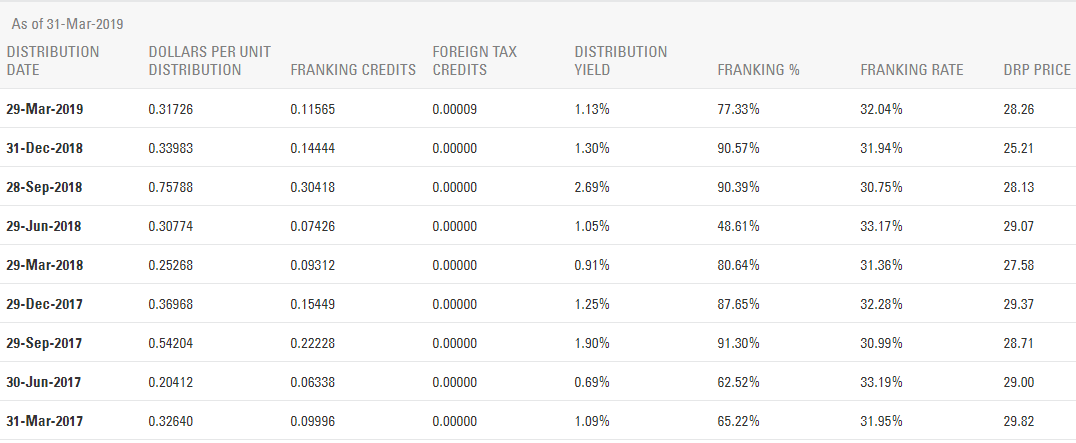

Past Distributions (Source: SPDR Website)

Past Distributions (Source: SPDR Website)

Holdings: As of 01 July 2019, the allocation of the fund in big four Australian banks was over 40%. Also, the financial & property trust was allocated with 60.66% of the capital while the materials sector constituted for 15.21% of the fund.

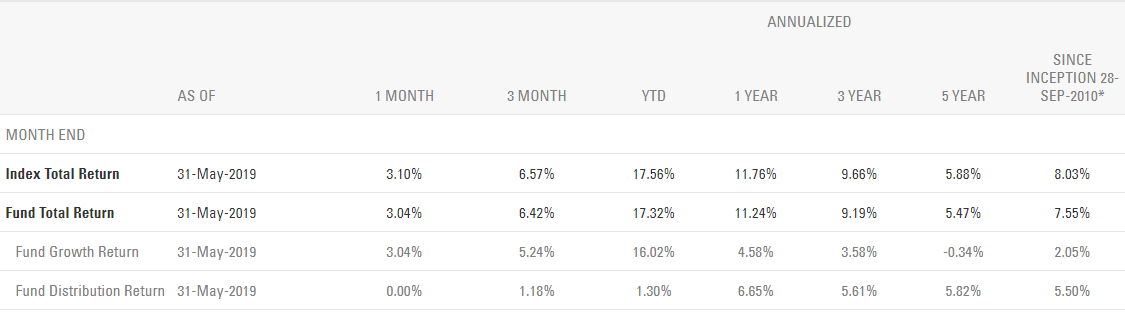

Performance (Source: SPDR Website)

Performance (Source: SPDR Website)

On 03 July 2019, SYI is trading at A$62.040, up by 0.68% (as at 3:14 PM AEST). The fund distributes income quarterly.

UBS IQ MSCI Australia Ethical ETF (ASX:UBA)

Reportedly, the fund reported an estimated distribution of AUD 63.0225 cents per unit on 24 June 2019, for the period ending 30 June 2019. The final distribution announced on 03 July 2019 amounts to AUD 63.0224 cents per unit. Further, the ex-distribution date for the distribution was 27 June 2019, and the record date was 28 June 2019. Lastly, the payment is scheduled for 12 July 2019. The franking level is 68.20%; each unit will receive ~ AUD 18.4214 cents of franking credits.

The fund follows a semi-annual dividend schedule with periods ending 30 June and 31 December. Some of the past distribution from the fund are mentioned below.

Past Distributions (Source: UBS Website)

Past Distributions (Source: UBS Website)

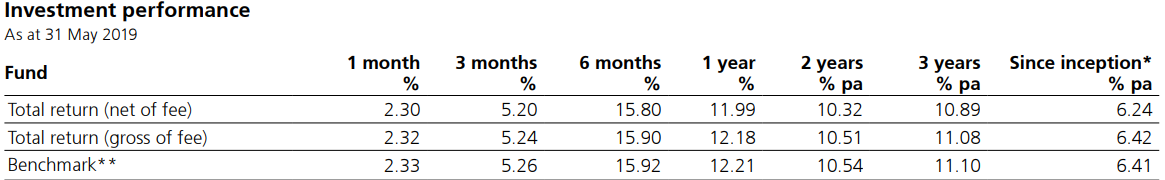

The below figure depicts the performance of the fund as of 31 May 2019, and in the past one year, the total return of the fund is 11.99% (net of fee).

Total Return (Source: UBS Website)

Total Return (Source: UBS Website)

On 03 July 2019, UBA is trading at A$22.250 (as at 3:26 PM AEST), flat from the previous close; and the annual dividend yield currently stands at 3.95%.

iShares S&P 500 ETF (ASX:IVV)

BlackRock Investment Management (Australia) Limited is the Responsible Entity for the iShares S&P 500 ETF. It seeks to track the return of the S&P 500 (before fees and expense), a benchmark index to track the large capitalisation U.S. equities. Since the second half of 2018, the fund had been converted to Australian domiciled iShares ETF; this provides the investor to refrain from completing U.S. tax forms â W-8BEN.

The fund provides exposure to the top 500 large-cap U.S. equities with low cost, while it also provides an opportunity to diversify the investment portfolio internationally and seek long-term growth. iShares S&P 500 ETF distributes income on a quarterly basis, and the latest estimated dividend was announced on 28 June 2019.

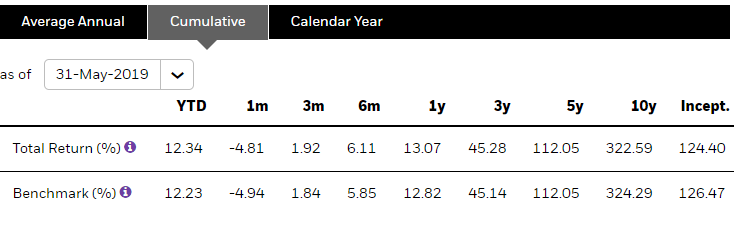

iShares S&P 500 ETF recently announced estimated distribution of AUD 227.223769 cents per unit, with the ex-distribution date of 01 July 2019 and the record date of 02 July 2019. Further, the confirmed distribution would be announced on 4 July 2019. Lastly, the payment is scheduled for 11 July 2019. Below figures depict the past dividends paid by the fund and the performance of the fund in the past one year, which was +13.07%.

Past Dividends (Source: BlackRock Website)

Past Dividends (Source: BlackRock Website)

Cumulative Performance (Source: BlackRock Website)

Cumulative Performance (Source: BlackRock Website)

On 03 July 2019, IVV is trading at A$426.25, down by 0.06% from the previous close (as at 3:44 PM AEST) and the annual dividend yield is currently at 1.51%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.