Base metals prices are on an upsurge in the international markets despite the escalated trade tension between the United States and China- the largest base metal consumers across the globe. The increase in prices is mainly derived by Chinaâs added stimulus over to infrastructure spending and the future predicted deficiencies in the supply chain.

While the base metals are on a bull run, the ASX-listed metal miners presented themselves at the Diggers and Dealers Mining Conference held from 5 August to 7 August 2019 in Kalgoorlie, Western Australia to attract the global investors.

Let us now take a look over some of the many presentations presented by the ASX-listed resources players.

Independence Group NL (ASX: IGO)

IGO is a publicly trading company listed on the Australian Stock Exchange who is engaged in multi-commodity prospects. The company holds a non-operating gold interest in the Tropicana Gold Mine and is directly involved in the exploration of base metals such as nickel, zinc, and copper. The Long Operations of the company gives it a footprint in nickel and copper, while the Jaguar Operations of the company gives it exposure to zinc and other by-products.

Decent Execution:

IGO NPAT grew by 43 per cent to stand at A$76 million in the financial year 2019. Net cash from operating activities increased by 34 per cent yearly to stand at A$372 million in FY2019, which in turn, oversaw an EPS growth of 44 per cent year over year.

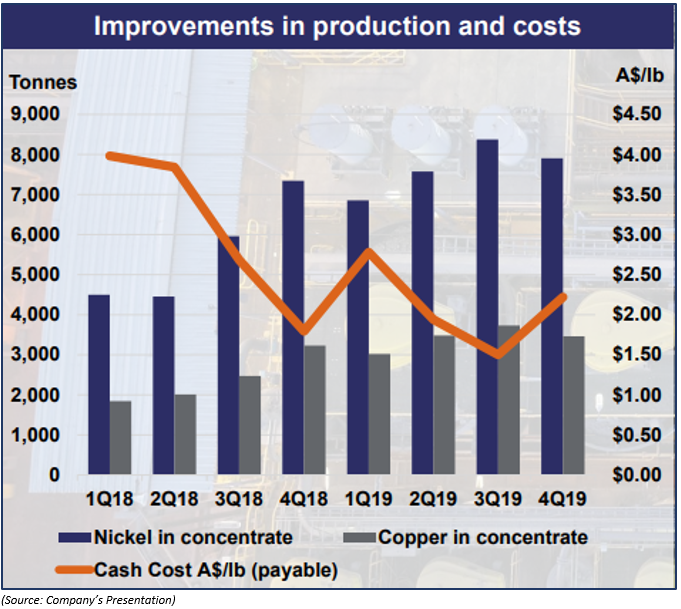

Nova Performance:

During the financial year 2019, the nova operations of the company delivered healthy production, and the nickel production from the operations during FY2019 stood at 30,708 tonnes. However, the production declined slightly during the last quarter of FY2019.

The June 2019 quarterly production of nickel stood at approx. 8,000 tonnes, against the prior-year corresponding quarter production of approx. 8,500 tonnes.

On the cost front, the payable cash cost during the December 2019 quarter stood at A$2.07 per pound, which was higher than the previous yearâs corresponding quarter cash cost of approx. A$1.50per pound.

However, despite a slight decline in production and slight increase in cost during the last quarter of the FY2019, IGO witnessed a rise of 51 per cent in the EBITDA margin at 51%.

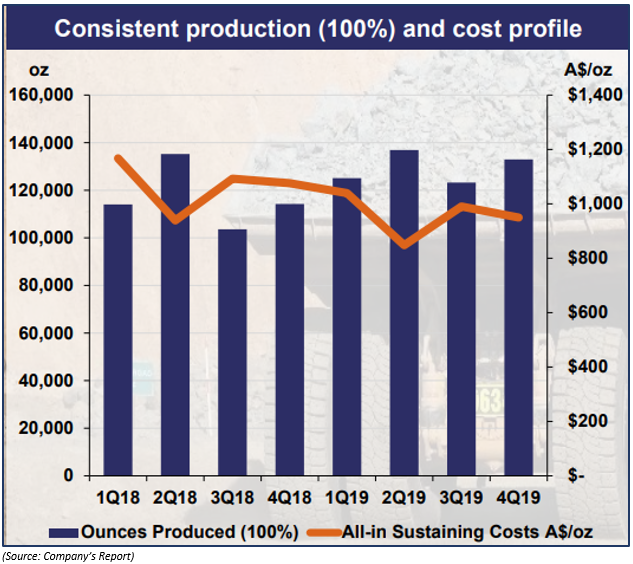

Tropicana on a Growth:

Tropicana Gold Mine delivered a total gold production of 518,172 ounces in FY2019 on a 100 per cent basis, and the company holds 30 per cent interest in it. The all-in sustaining cost (or AISC) remained low and stood at A$951 per ounce.

Output of gold in the June 2019 quarter remained higher than the previous corresponding quarter with lower AISC. The Tropicana operations delivered an EBITDA margin of 62 per cent.

What Progress Did the Company Make?

IGO commissioned second ball mill at the Tropicana Gold operations and commenced Boston Shaker underground development the prospect site.

On nickel, the company progressed with a nickel sulphate downstream processing studies and continued to strengthen the exploration team and portfolio.

Apart from that, IGO has improved on metal recoveries, and as per the release, the nickel recovery underpinned a 2.2 per cent year-on-year improvement; while copper recovery underpinned a 4.5 per cent year-on-year improvement with a step-change in June 2019 quarter.

As per the company, the recovery rates further hold an upside potential in FY2020 amid multiple ongoing work programs.

Clean Energy and IGO:

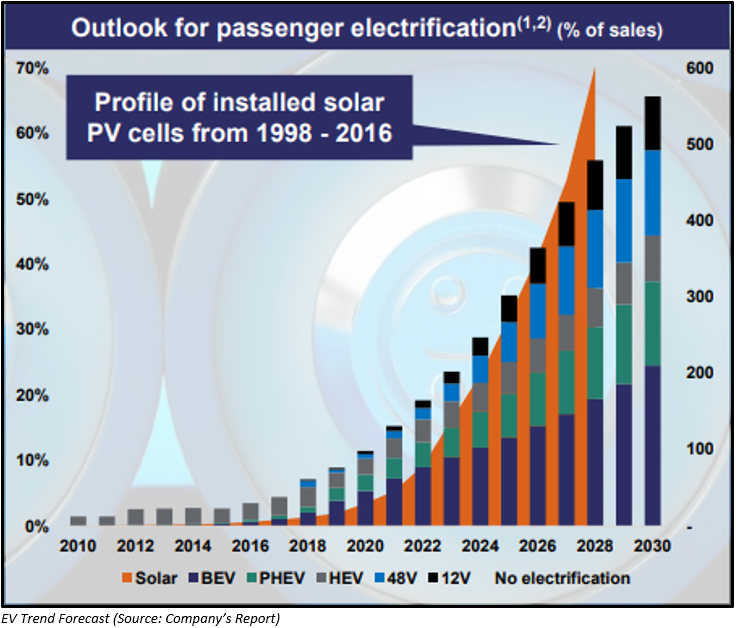

IGO is currently focused base metals such as nickel, copper, etc., required for clean energy, as the renewables and EV boom could reduce carbon emission, which in turn, could drive the demand for nickel and copper in the long-run.

A Look at EV from IGOâs Lens:

As per the company, EV sales and forecasts are growing, which in turn, could pull up the battery demand, and the current battery constitution favours nickel and copper. However, the development in battery technologies, which could prefer other battery chemistries is a potential threat to the companyâs outlook.

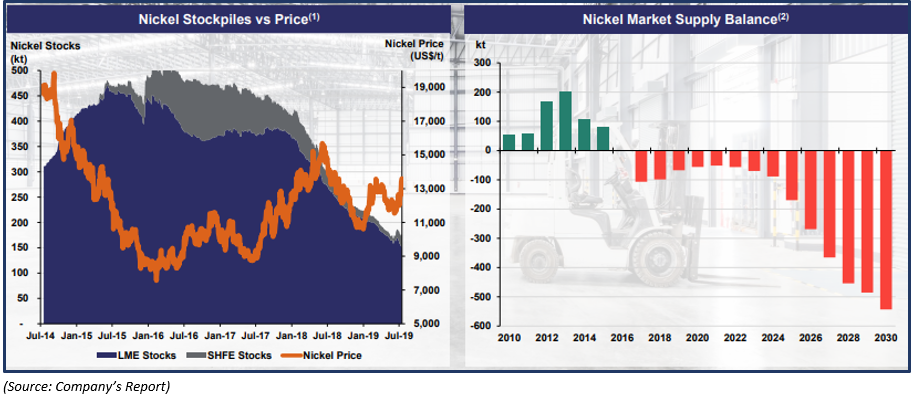

For now, the company is banking on the EV revolution and forecasts shortage in the nickel supplies over the coming years. The Australian Department of Industry, Innovation and Science has also anticipated a shortfall in the nickel supply chain, which in turn, somewhat converges with the companyâs outlook. If such a scenario emerges, it could pull up nickel and copper prices in the market, which could provide IGO with an advantage in the long-run.

However, the subdued global business conditions amidst the U.S-China trade spat remains a potential risk.

Banking on Gold:

Gold prices are riding high at the back of global uncertainties and the company is banking on the high exploration potential at its 30 per cent owned Tropicana Gold Mine. As per the company, the Tropicana prospect contains an underground exploration potential.

The shares of the company ended in green on Friday at A$5.750, up by 5.311 per cent as compared to its previous close on ASX.

Cobalt Blue Holdings Limited (ASX: COB)

COB is a publicly trading company listed on the Australian Securities Exchange. The company engaged in the development of its cobalt prospect- the Thackaringa Cobalt Project, which is located in New South Wales. COB hosts two exploration and two mining leases, namely EL 6622 and EL 8143, andML 86 and ML 87, respectively.

The Strategy:

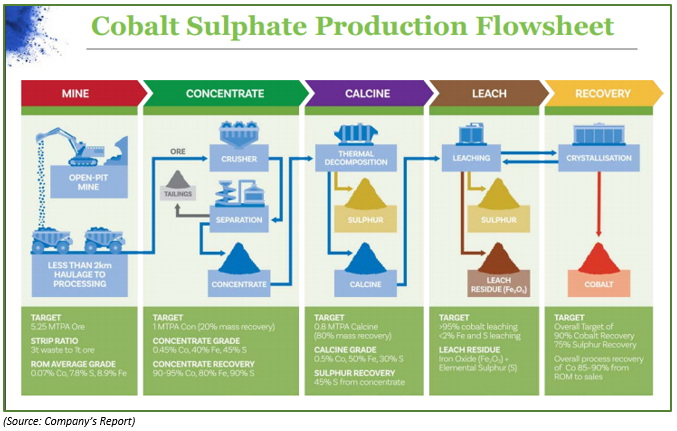

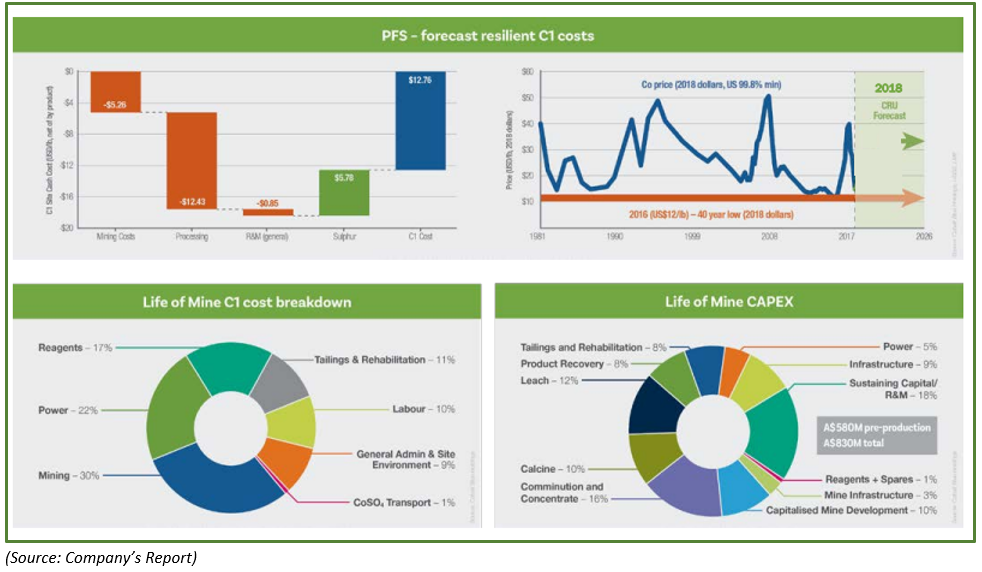

The business strategy of the company is to mine cobalt, nickel, and copper, and further take it tom refinery to produce cobalt sulphate (the product), which would finally find an uptake in the Li-ion battery markets.

The exploration licences and the mining leases of the company contain the Pyrite Hill, Railway and the Big Hill prospects.

Mineral Profile:

The prospects of the company contain a total Mineral Resource of 111 million tonnes with an average grade of 715 parts per million cobalt, 889 parts per million cobalt equivalent, 8.9 per cent iron, 7.8 per cent sulphur, and 15 per cent pyrite. The total Mineral Resources of 111 million tonnes estimated to account for 79,500 tonnes of contained cobalt.

Out of the total resources, the prospects contain 18 million tonnes of Measured, 55 million tonnes of Indicated, and 38 million tonnes of Inferred Mineral Resources.

The Prospect Mineral Profiles:

The Pyrite hill prospect of the company hosts 33 million tonnes of total Mineral Resources, which are further categorised (JORC 2012), and the prospect contains Measured Resources of 18 million tonnes, Indicated and Inferred Resources of 7 million tonnes.

The total Mineral Resources of 33 million tonnes at the Pyrite Hill prospect contains an average grade of 867 parts per million cobalt, 1070 parts per million cobalt equivalent, 10.4 per cent iron, 9.3 per cent sulphur, and 17 per cent pyrite. The total Mineral Resources of the prospect is estimated to account for 28,400 tonnes of contained cobalt.

Railway Prospect:

The Railway prospect of the company hosts 61 million tonnes of total Mineral Resources, which are further categorised (JORC 2012), and the prospect contains no Measured Resources and 37 million and 24 million tonnes of Indicated and Inferred Resources.

The total Mineral Resources of 61 million tonnes at the Railway prospect contains an average grade of 667 parts per million cobalt, 834 parts per million cobalt equivalent, 8.7 per cent iron, 7.5 per cent sulphur, and 14 per cent pyrite. The total Mineral Resources of the prospect is estimated to account for 40,500 tonnes of contained cobalt.

Big Hill Prospect:

The Big Hill prospect of the company hosts 18 million tonnes of total Mineral Resources, which are further categorised (JORC 2012), and the prospect contains no Measured Resources and 11 million and 7 million tonnes of Indicated and Inferred Resources.

The total Mineral Resources of 18 million tonnes at the Railway prospect contains an average grade of 599 parts per million cobalt, 732A parts per million cobalt equivalent, 6.5 per cent iron, 6.0 per cent sulphur, and 11 per cent pyrite. The total Mineral Resources of the prospect is estimated to account for 11,000 tonnes of contained cobalt.

The flowsheet of the product (Cobalt Sulphate) of COB is as:

Banking on Cobalt:

The company is banking on the deficiency of cobalt in the long-run and on the cobalt-based battery chemistry. However, the reduction of cobalt content in the batteries of Tesla Tesla and the follow up of other EV manufacturers such as Volkswagen, and BMW amid ethical issues related to cobalt is a potential risk to the companyâs outlook.

Apart from that, the adoption and development of cobalt and lithium free batteries also represent a potential threat in the long-run.

The shares of the company ended in green on Friday at A$0.120, up by 4.348 per cent as compared to its previous close on ASX.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.