Investors look for companies with a strong business model, positive net income and positive operating cash flows. Healthy dividend yields can add an icing on the cake. One of the major characteristics of fundamentally good companies is the ability to deliver positive net profit during recession. The business must be able to scale its existing operations in order to increase volumes from its existing operations. Based on the business model and product portfolio, the visibility of future earnings growth can be estimated.

We are discussing five stocks with good business models and positive earnings growth. Letâs have a look at their current operating performance and dividend yields.

Oil Search Limited

Oil Search Limited (ASX : OSH) recently announced its collaboration with PNG Government for Papua LNG Gas Project and we believe, the company will be benefiting from the above move.

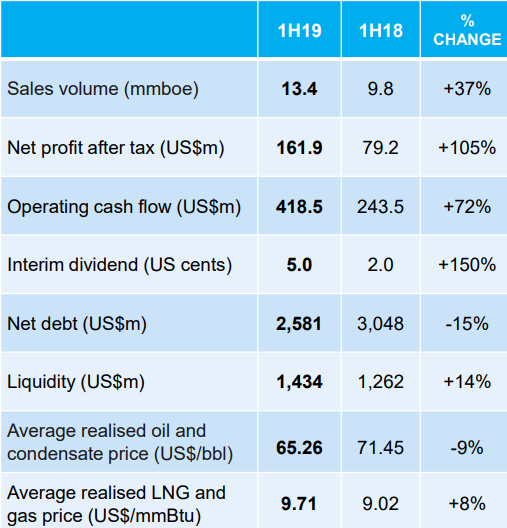

H1FY19 Performance Highlights: The company reported positive net profit at US$161.9 million, higher by 105% on y-o-y basis; sales volume came at 13.4 mmboe, increasing 37% on H1FY18. OSH reported positive operating cash flow at US$418.5 million, up 72% on the prior corresponding period while net debt continues to be lower at $2581 million as compared to $3048 million in H1FY18. During the half-year, average realization of oil prices and LNG and gas prices were at US$ 65.26/bb and US$9.71/ mmBtu.

Operating Highlights during 1H19 (Source: Company Reports)

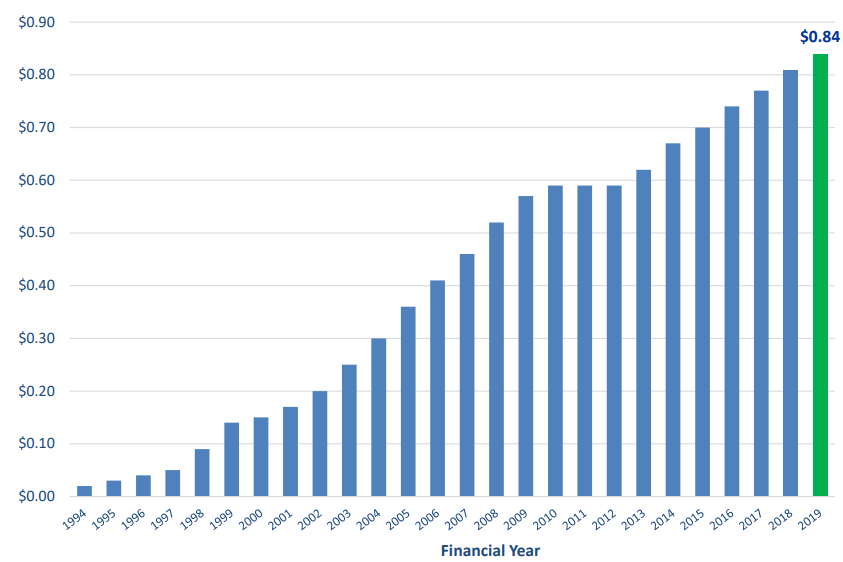

Dividend distribution: The company has declared dividend of USD 0.05000000 for each ordinary share held. The dividend yield of the stock stood at a yield of ~2.63%.

Stock update: On 11 September 2019, the stock of OSH closed at $7.360, down 0.541% from its previous close. The stock has a market capitalization of $11.28 billion and is available at a P/E multiple of 18.57x. The stock has generated ~1.71% and ~0.71% returns in last one-month and three-months, respectively.

Woodside Petroleum Limited

Woodside Petroleum Ltd?(ASX : WPL) is expected to deliver earnings growth from its Greater Enfield Project, where the company has 60% stake. The company has JV with Mitsui E&P Australia Pty Limited, where it has a 40% share. The company expects that the above project will add 100 MMboe from FY20 onwards and would be an important contributor to the total income of the company.

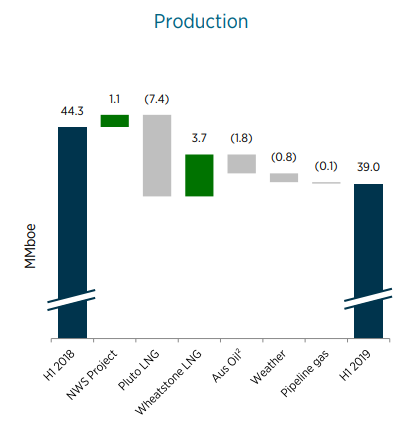

H1FY19 Operating highlights: WPL posted operating revenue at $2,260 million in H1FY19 as compared to $ 2,388 million on H1FY18. During the half-year, the company delivered positive operating cash flow of $1,485 million while the NPAT stood at $419 million as compared to $566 million during H1FY18. The company sold total volume of 38.7 MMboe of liquids during the first half of FY19 compared to 44 MMboe on the previous corresponding period.

Production highlights (Source: Company Fillings)

Dividend distribution: The board of directors announced a fully frank dividend of USD 0.36000000 payable on 20 September 2019. The annualized dividend yield of the stock stood at ~5.58%.

Stock update: On 11 September 2019, the stock of WPL closed at $32.190, down 0.433% from its previous close. The 52-Week trading range of the stock stood at $29.330 to $39.380 and currently the stock is inching toward the lower band of it 52-week trading range. WPL is available at a P/E ratio of 16.750X and the stock has a market capitalization of $30.27 billion. The stock of WPL has generated negative return of 8.02% and 6.83% in last three-months and six-months respectively.

Sonic Healthcare Limited

Sonic Healthcare Limited (ASX : SHL) is expected to get operational benefit from acquisition of Aurora Diagnostics completed during January 2019. The company made strategic disinvestment of its non-core GLP Systems during June 2019. The above disinvestment will yield A$48 million in net profit for the company. To cut excess debt, the company made the above strategic moves. These are expected to provide higher operational efficiencies along with positive cash flows for SHL. The company is well placed to sustain its strong growth for coming years. Due to geographical diversification, the company can mitigate its operational risks.

FY19 Financial highlights: Sonic Healthcare limited reported revenue at A$6.2 billion, a growth 11.6% y-o-y followed by net profit at A$550 million, up 15.6% y-o-y. The company reported positive cash from operations at $847 million, up 10% on FY18. The company reported organic revenue growth of 4% in constant currency terms. The company reported underlying EBITDA at $1,061 million, higher by 10% y-o-y, during the period.

Dividend distribution: The company announced 30% franked final dividend of AUD 0.51000000 for each ordinary share held payable on 25 September 2019. The annualized dividend yield of the company stood at 2.99%.

Dividend history in A$ (Source: Company Reports)

Stock update: On 11 September 2019, the stock of SHL closed at $27.920, down 0.782% from its previous close. The 52-Week trading range of the stock came at $21.260 to $29.930 and currently the stock is inching toward the higher end of it 52-week trading range. The stock has a market capitalization of $13.35 billion. The stock of SHL has generated positive return of 3.91% and 16.38% in last three-months and six-months respectively. SHL is available at a P/E ratio of 22.970X.

Westpac Banking Corporation

Westpac Banking Corporation (ASX : WBC) is one of the leading banks in Australia and New Zealand region. The bank has business visibility aided by good customer presence and positive net profit and return ratios.

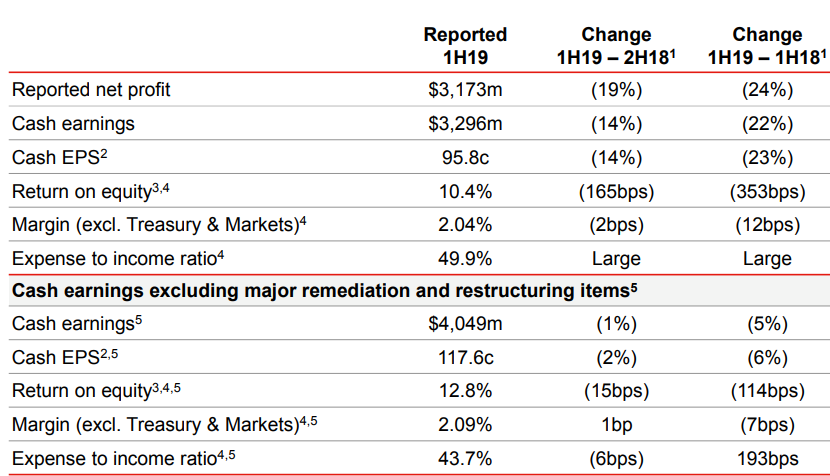

H1FY19 Financial Highlights as on 31 March 2019: The company reported 24% lower net profit at $3,173 million with cash earnings of $ 3,296 million, decreasing 22% y-o-y. The company delivered ROE at 10.4%. Consumer banking grew 7% y-o-y at $1,514 million of cash earnings, Business Bank de-grew 6% y-o-y at $1,013 million of cash earnings. Westpac Institutional Bank and New Zealand segments reported cash earnings growth of 1% and 4% y-o-y, respectively.

H1FY19 Financial Highlights (Source: Company Fillings)

Dividend distribution: The company announced a fully franked dividend of AUD 1.0780 per ordinary share payable on 30 September 2019. The annualized dividend yield of the company stood at 6.46%.

Stock update: On 11 September 2019, the stock of WBC closed at $29.610, up 1.683% from its previous close. The 52-Week trading range of the stock came at $23.300 to $29.610, and currently, the stock is trading at its 52-week high. The stock has a market capitalization of $101.63 billion. The stock of WBC has generated positive return of 7.77% and 5.16% in six-months and twelve-months, respectively. WBC is available at a price to earnings ratio of 14.13X.

Resmed Inc

Resmed Inc (ASX: RMD) is engaged in developing healthcare software and operates across 120 countries and delivers double-digit growth across major Geographies. The company has a strong product pipeline and market standing.

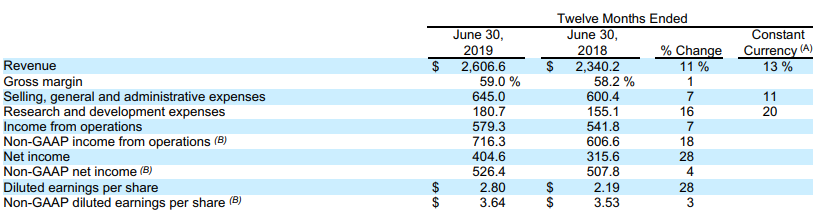

FY19 Operating Highlights: The company reported revenue at US$2.6 billion, increased by 11% on the prior corresponding period, while Net income came at US$ 404.6 million, up 28.2% from FY18. The company reported a gross margin at 58.2% during FY19. Cash from operating activities came at US$ 459.051 million.

FY19 Financial Highlights (Source: Company Reports)

Dividend distribution: The company announced an unfranked dividend of USD 0.0390000 per ordinary share payable on 19 September 2019. The annualized dividend yield of the company stood at 0.77%.

Stock update: On 11 September 2019, the stock of RMD closed at $19.320, down 0.668% from its previous close. The 52-Week trading range of the stock came at $12.650 to $20.750, and currently, the stock is trading towards the upper band of its 52-week trading range. The stock has a market capitalization of $27.88 billion. The stock of RMD has generated a stellar return of 13.68% and 35.63% in three-months and six-months, respectively. RMDC is available at a price to earnings ratio of 48.25X.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.