What is Bitcoin?

Decentralised digital currency, Bitcoin plays on blockchain technology wherein transactions are scrutinised by network of nodes via cryptography and recorded in a public distributor ledger. Bitcoin came into existence in 2008 with the inventor as Satoshi Nakamoto. Its creation was through digital mining as a reward of complex problemâs solution. These could be swapped for other currencies, services & products. Bitcoin has received unfavourable remarks and criticism on issues such as illegal transactions, price volatility, high electricity consumption, thefts from exchanges, etc. However, BTC (Bitcoin) exists and finds its application at various places with being accepted by several merchants. BTC generated wealth for value investors and has given quick money to short-term investors or traders over its high price volatility.

In 2011, the price started at $0.30 per bitcoin, but in the year 2013, BTC rose from US$99.8 in October 2, 2013 to US$1,200 on December 7, 2013, showing a return of 1102.40%. Then, it declined to its 2 years low at US$164.9 on January 14, 2015, and then made its all-time high at US$19,891 on December 17, 2017, which was an increase of 11,962% over the course of 2 years. It again declined to US$3,216 on December 15, 2018, which was a decrease of ~83.83% from its all-time high. It rose again to a decent level of US$13,764 on June 26, 2019. It is currently trading at US$10,346.6, dipping down by 2.09 percent (as on September 9, 2019, 23:28:24 UTC-4). On the back of the statistics, we can have a fair idea that with every dip, there is a buying or accumulation opportunity for whopping returns. An investor should consider buying Bitcoin when it is trading at its low levels and prefer exit at its highest levels.

For an insight on the matter, we would now discuss a few companies, that are engaged with bitcoin, directly or indirectly. Letâs explore the business metrics and financial of these companies.

Change Financial Limited

Change Financial Limited (ASX:CCA) is focused on advancing development of the Mastercard Payments Processor and Enterprise Solution, monetising the Mobile Banking Consumer Business, and divesting from non-core assets, specifically the Ivy Project.

CCA is one of the first to be certified to process transactions using the Mastercard Network Gateway Services platform and the first newly certified Mastercard processor in the last 5 years. The company is eligible for registration as a Mastercard third-party processor using the Mastercard Network Gateway Services, after completing all test transaction cases in the final stage of certification.

After the launch, the enterprise solution will primarily target more than 7,000 Federal Deposit Insurance Corporation, 6,000 credit unions, banks, and innovative financial services providers in the US with innovative mobile banking services. For the same, the addressable market in the US stands at ~US$50 billion in 2019 which is growing at ~20% per annum through to 2025.

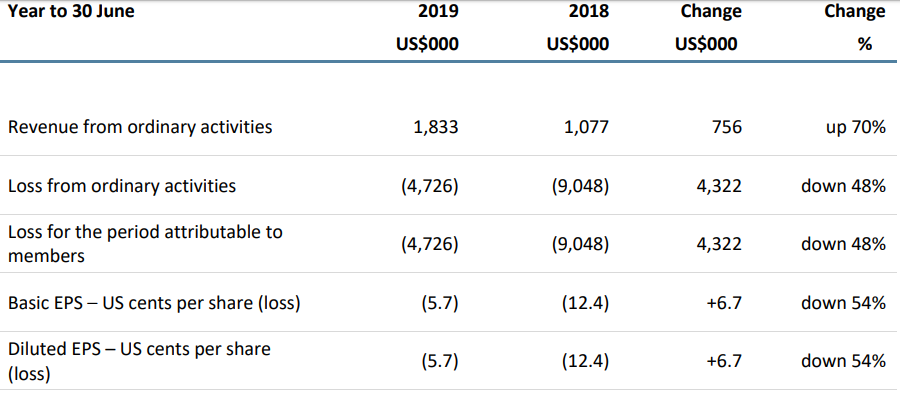

Coming to the financial performance, the companyâs revenue for FY19 stood at US$1,833,301 as compared with US$1,076,868, posting an increase of 70%. The company posted losses in FY19 which reduced from US$9,047,969 to US$4,764,888.

FY19 Results Snapshot (Source: Companyâs Report)

FY19 Results Snapshot (Source: Companyâs Report)

During FY19, apart from new funding secured from Altor Capital in the month of December 2018, CCA undertook an entitlement offer to existing shareholders, raising A$0.597 million. With the placement of shortfall totaling $195,000, the company raised a total of $792,000.

As far as associates and joint ventures are concerned, the company has a 33.3% investment in Ivy Blockchain Pty Ltd and Ivy Koin LLC as of 30 June 2019.

At the current market price of A$0.086, the stock is trading flat (as on 9 September 2019, AEST 1:31 PM) with the market capitalisation of A$8.05 million. The stock has generated 48.28% in last 6 months with 52-week trading range at A$0.028 - A$0.245.

DigitalX Limited

DigitalX Limited (ASX: DCC) is a blockchain company with offices in Perth, Sydney and New York. The company provides market-leading services to the digital asset market through four main service offerings â (a) corporate advisory (b) blockchain consulting and development, (c) funds under management, and (d) media (via Joint Venture with Coincast). The company is continuously making efforts to leverage its core competencies, predominantly, the commercialisation of blockchain technologies and is focusing on blockchain consulting and development and funds management.

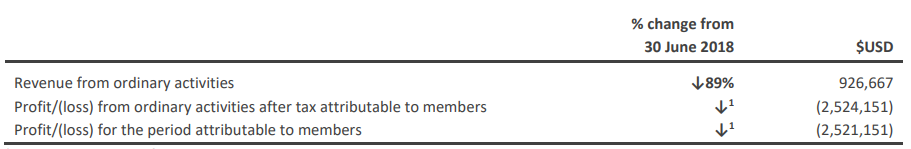

On financial front, the company, for the year ended 30 June 2019, posted a consolidated loss of USD2.524 million against a profit of USD2.595 million in FY2018.

FY19 Results Highlights (Source: Companyâs Report)

FY19 Results Highlights (Source: Companyâs Report)

The company recently updated the market related to the activities for the start of FY20. With the resignation of previous Directors and the re-appointment to the Board of Mr Toby Hicks as the Chairman in the month of July, the company faced significant changes.

The company undertook actions to assess and strengthen the structures to enhance its assets and technical knowledge. Results of the assessment are â (A) the company inked a deed of termination and settlement with First Growth Funds Limited (ASX:FGF) with regards to Futuredge Capital Pty Ltd (previously known as FutureICO Pty Ltd) (Futuredge). The Company currently retains its holding in Futuredge with the other shareholders. (B) DCC agreed with its JV partner to end the Coincast Media JV. Both the parties were of the view that the business model had not developed in the manner of anticipation by them. A process-oriented shut to the JV intends to ensure no harm to existing clients. DCC intends to continue its media presence and after shutdown of the JV, the domain âwww.coin.orgâ will come back to it. (C) a restructuring by DCC was taken place related to two active business units i.e. Blockchain Consulting and Development, and Funds Management.

The company also notified a change in Directorâs Interest wherein Leigh Daniel Travers acquired 538,889 shares for the consideration of $0.027 per Share on 5 September 2019.

On 9 September 2019, DDCâs stock has a current market price of A$0.028, moving up by 3.704 percent (at AEST 1:53 PM). The market capitalisation of the company stands at A$16.1 million. The stock 52-week trading range of A$0.025 - A$0.125.

Yojee Limited

Yojee Limited (ASX:YOJ) focusses on developing a sharing-economy based logistics technology through the creation of the Yojee delivery network and secure blockchain technology platform, initially targeting the Asia-Pacific region. The company recently released its full-year results for FY19 which has been a remarkable year for Yojee, as it updated the market with its version two platform which takes the company to the leading edge of industry.

In Australia, the company has a strong client base across wharf cartage, line haul, freight forwarding and courier. YOJ has strong pipeline and network partnership opportunities, strengthening the outlook for the company. Customers of the company in Australia include SILA Global, Telstra Group South East.

For Asia Pacific region, the company has multiple clients across different verticals of the freight sector, including cross border development and innovation in the âline haulâ space. Multiple global players from the different industry have chosen Yojee for visibility and efficiency.

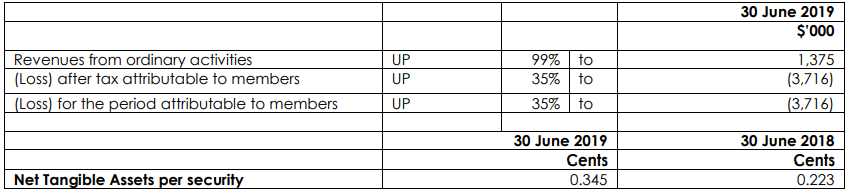

Coming to the financial performance of the company, YOJ posted a yoy growth of 99% in terms of revenue which came in at $1,375,000. Net tangible assets per security at the end of FY19 stood at 0.345 cents as compared with 0.223 cents in FY18.

Financial Performance in FY19 (Source: Thomson Reuters)

Financial Performance in FY19 (Source: Thomson Reuters)

Going forward, the management is looking forward for a strong growth with the addition of new key accounts, resulting in, continued revenue growth.

On 9 September 2019, YOJâs stock was trading flat at A$0.090 (at AEST 2:01 PM), also, the market capitalisation of the company stands at A$76.27 million. The stock has gained 47.54% on YTD. The 52-week trading range for the stock comes in at A$0.053 â A$0.140.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.