Portfolio management is a technique under which investors make their investment decisions based on investment objectives. In order to mitigate risks, investors prefer to diversify their portfolio. This article includes recent updates on four diversified stocks.

Civmec Limited (ASX:CVL)

On 31 July 2019, Civmec Limited (ASX: CVL), an engineering and construction company stated that it was able to achieve an important milestone in the construction of a maintenance hall and purpose-built assembly in Henderson, Western Australia.

The construction started last year in the month of October 2018. Once the completion of the facility, it would be one of the most efficient and innovative facilities in the world. It would be able to provide a new resource to the Australian maritime landscape. The facility has a usable floor area of 53,000m2. Moreover, the facility is 18 storeys high and would be the largest undercover modularisation as well as maintenance facility in Australia. It has potential to store large vessels such as complete air warfare destroyers, frigates and offshore patrol vessels that are required for construction and maintenance. The facility also has large integrated units for the oil & gas as well as metals & minerals sectors.

With the recent addition of 27-metre-high bay structure above the expansive main roof, the building now has a height of 70 metres.

Stock Information

By the end of dayâs trading session on 2 August 2019, the price of the shares of CVL was A$ 0.400. CVL has a market cap of A$200.4 million and approximately 501 million outstanding shares.

Peppermint Innovation Limited (ASX:PIL)

Peppermint Innovation Limited (ASX:PIL), a company which focuses on the commercialisation of proprietary Mobile Banking, Payments and Remittance technology released its quarterly report for the period ended 30 June 2019.

The company delivered a strong June 2019 quarter with 14% growth in the cash receipt as compared to the March 2019 quarter. The result primarily outline the outcome of meeting operational objectives by the company which includes the registration of extra Bizmoto agents, mobile app downloads as well as utilisation rates for those agents, growth in the âeâ-wallet loading and activations, deployment of BizmoGo delivery riders in three areas of Manila. Around 100 merchants subscribed for BizmoGo delivery program, as per the companyâs report.

In May 2019, the company launched a mobile App for Co-operative Health Management Federation (CHMF) which provides medical-based information to its 41,000 members. The company is looking forward to phase 2 development of this mobile App, which would have functions such as wallet, QR code payments as well as member-to-member payment option.

In February 2019, the company announced that it was working together with BancNet after the Central Bank of Philippines directed all commercial banks to have safe, efficient, affordable and reliable electronic payments system throughout the country. In this, the company was appointed as the service provider of Mobile Banking Solutions to BancNet Outsourcing Banks.

Financial Highlights:

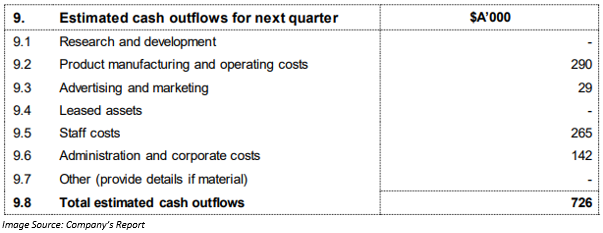

Peppermint Innovation Limited used A$0.335 million in its operating activities. There was a cash inflow of A$0.330 million from the financing activities of the company. The net cash available with the company by the quarter ended 30 June 2019 was A$0.082 million. Expected cash outflow in September 2019 quarter would be A$0.726 million.

Stock Information

By the end of dayâs trading session on 2 August 2019, the price of the shares of PIL was A$0.011, down by 8.333% as compared to the previous closing price. PIL has a market cap of A$11.85 million and ~987.58 million outstanding shares.

Xplore Wealth Limited (XPL)

Xplore Wealth Limited (ASX: XPL) is one of the leading independent platform providers and investment administrators in Australia, primarily focused on managed accounts. On 31 July 2019, the company released its June 2019 quarterly business update.

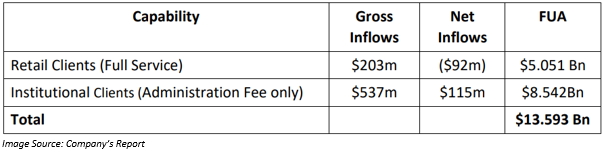

The Groupâs Funds under Administration (FUA) as on 30 June 2019 stood at $13.593 billion. Last year in the month of November, the company had acquired Aracon Superannuation Pty Limited which is a registrable superannuation entity (RSE) for superannuation funds. During the mid of December 2018, the company made another acquisition of DIY Master Pty Limited (DIY). In June 2019, the transition of the administration services for the Aracon client base to DIY got finalised.

With the acquisition, there was the growth in new client, which resulted in increased FUA. FUA for DIY was $953 million which included $320 million FUA from Aracon and $172 million from Xplore Wealth clients as at 30 June 2019.

The company launched Xplore Wrap, the first new product under the Xplore Wealth brand at the end of June 2019. Xplore Wrap provides with improved functionality as well as investment market access to advisers who are operating across a wide range of business model and client type.

Presently, the company is in the stage finalising the new approved product list which would be circulated across all product and services. It would deliver consistency for advisers while providing wider adviser access for fund managers, stated XPL.

In an announcement dated 12 March 2019, the company stated that it has been rebranding Xplore Wealth to reflect the Xploreâs planned growth purpose as well as highlight its offering amongst the top autonomous investment platform solutions for wealth management professionals.

On 31 July 2019, the company also updated the market about its Employee Share Option Plan wherein some options have been vested, and some have lapsed.

Outlook:

In the third quarter, the company will be appointing CEO. It would also be appointing an executive as the Head of Distribution and Marketing. It would work on improving Xplore Wrap with new overlay service as well as Portfolio Administration Service.

In the fourth quarter, there would be a custodian across the Group and single front-end reporting across all products.

Stock Information

By the end of dayâs trading session on 2 August 2019, the price of the shares of XPL was A$0.091, up by 5.814% as compared to the previous closing price. XPL has a market cap of A$25.52 million and ~296.79 million outstanding shares.

Yojee Limited (ASX:YOJ)

on 31 July 2019, Yojee Limited (ASX: YOJ), a logistics technology company, released its quarterly activity report for the three months ended 30 June 2019.

After the release of the 2.0 infrastructure, the company reported an increase in the new customer as well as the delivery number. There was also a growth in the pipeline of global key accounts. The cash receipt during the quarter stood at A$192,000 (highest for any quarter till date).

During the period, the company inked 10 new software customer contracts, and the cash outflow declined 40% since 1Q FY2019. The company also announced the foundational SaaS agreement with ten leading logistics companies worldwide. It also entered a three years agreement with Geodis to administer various projects across APAC region under standard commercial terms and condition.

The company also announced the appointment of Ms Lynn Mickleburgh and Mr David Morton to its Advisory Board.

Stock Information

By the end of dayâs trading session on 2 August 2019, the price of the shares of YOJ was A$0.092, down by 6.122% as compared to the previous closing price. YOJ has a market cap of A$83.05 million and ~847.44 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.