Xplore Wealth Limited (ASX: XPL), formerly known as Managed Accounts Holdings Limited, was established in 2004, and based in Sydney and Melbourne, Australia. The company operates as a leading independent platform provider and investment administrator with a specialization in managed accounts in Australia. In around thirteen years, following its inception, the Groupâs funds under administration grew to approximately $ 2.5 billion, making it Australiaâs largest specialist Managed Discretionary Account (MDA) Solutions provider.

It offers a broad range of platform, administration, and technology solutions including off the shelf and bespoke offerings to over 150 financial services groups including IFAs, stockbrokers, wealth managers, and financial advisory firms with access to local and global markets. Xplore Wealthâs investment solutions include wrap and superannuation, managed discretionary account, and broking solutions.

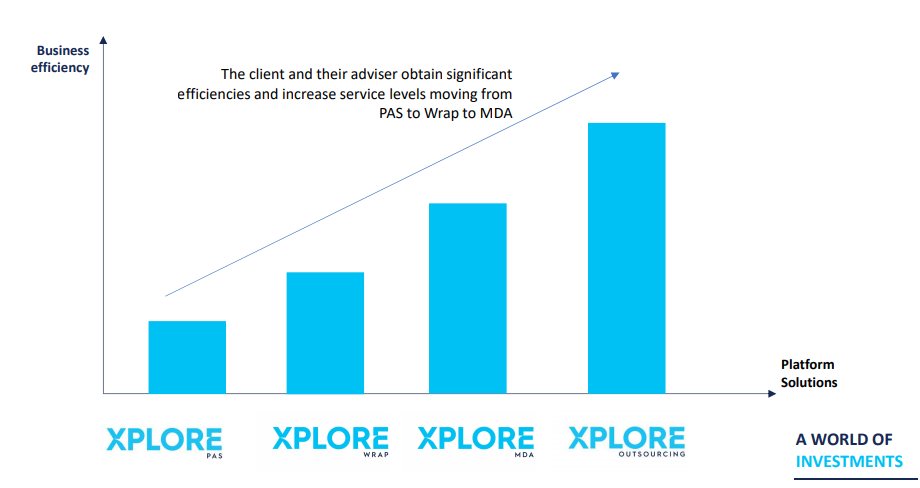

Platform Solutions with a single backend; Source: Companyâs Presentation

The key competitive strengths of Xplore Wealth include the following â

- Broad asset offering, local and international assets, multi-currency multi-market.

- Non-custody and custody solutions.

- Flexible platforms to enable investment managers to optimize investment outcomes.

- Competitive pricing driven by scale and efficiencies.

- Broker sponsorship supporting broker of choice and flexible execution options.

- Experienced team with deep industry expertise.

The companyâs business model is organized such that, the client and their adviser obtain significant efficiencies and increased service levels moving from PAS to Wrap to MDA (as depicted below).

Efficiency Dividend; Source: Companyâs Presentation

Today, on 17 July 2019, the Group has announced the sale of its 50% equity holding in the highly successful, Queensland-based financial planning practice McGregor Wealth Management. Through a binding agreement, Xplore Wealth would transfer its shareholding back to an entity controlled by Mr Rob McGregor for a consideration of $ 500,000 plus the repayment by this entity of $ 225,000 in loan funds.

The equity sale follows a request put in by Mr McGregor to buy back the Xplore Wealth shareholding in his firm.

March 2019 Quarter â Activities and Business Update

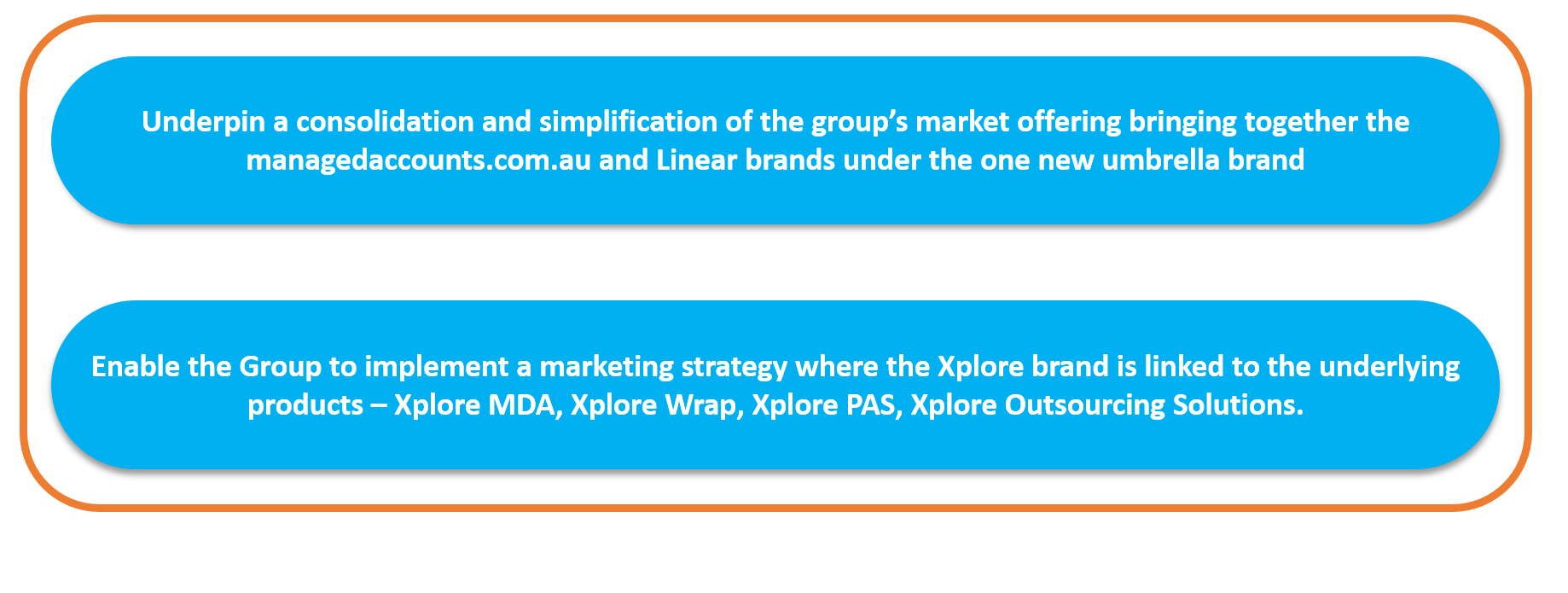

Rebranding-During the three months ended 31 March 2019, the Group executed and rolled out itâs new branding for the business â Xplore Wealth, which was positively received by the clients, staff and the general market. Approved by the shareholders on 12 April 2019, the strong brand name was chosen to reflect the companyâs universal growth plans and underline its leading services to the wealth management professionals.

The Purpose of Branding

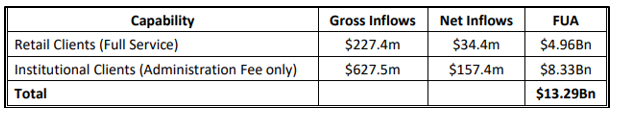

Quarterly Inflows and Funds Under Administration (FUA) Growth- As of 31 March 2019, Xplore Wealthâs funds under administration were valued at approximately $ 13.3 billion, including over $ 2.6 billion in direct international securities as at 28 February 2019.

Quarterly Inflows and Funds Under Administration (FUA) Growth- As of 31 March 2019, Xplore Wealthâs funds under administration were valued at approximately $ 13.3 billion, including over $ 2.6 billion in direct international securities as at 28 February 2019.

The Retail Client (Full Service) Gross inflows for the period amounted to around $ 227.4 million, strongly rising up from $ 188.7 million in the December 2018 quarter while the Net Inflows were valued at ~$ 34.4 million, down from $ 50.3 million in the December 2018 quarter. In addition, the Institutional Client (Administration Fee-Only) Gross inflows for the period stood at $ 627.5 million and the corresponding Net Inflows at $ 157.4 million.

The Gross flows were up for both the Retail and Institutional side of business while the Net flows in the Retail business were down due to the impacts of the Hayne Royal Commission into Financial Services that affected one of the larger clients in the MDA business leading to significant outflows over the quarter which were unavoidable for the Group.

Source: March 2019 Quarterly Business Update

Source: March 2019 Quarterly Business Update

New Client - Xplore Wealth announced that it had been appointed by First Point Wealth Management Pty Ltd to provide a new Managed Discretionary Account service.

First Point Wealth Management is led by four vastly qualified finance professionals including Brad Matthews, Sam Robson, Toby Lewis & Paul Saliba, who manage a wide range of multi-asset portfolios comprising direct Australian shares, managed funds as well as exchange traded funds (ETFs).

Launch of new Xplore Investment and Superannuation Wrap

Recently on 1 July 2019, Xplore Wealth unveiled a new wrap platform solution, Xplore Wrap, to the market for discretionary investments, superannuation and pension monies, making it the first under the recently rebranded Xplore Wealth. Launched on 28 June 2019, Xplore Wrap promises a âworld of investmentsâ providing true multi-currency and multi-market investment access to investors, enhanced functionality, and investment market access to advisers from operating across a broad range of business model, client type and super/ non-super client needs.

The new launch is aimed at transforming client and adviser relationships. Xplore Wrap offers a range of managed funds, ASX listed equities, international securities on 28 exchanges and a range of cash investment products. It is managed via a single ecosystem with streamlined reporting and can support both adviser and investor-led investment decisions.

Leadership Changes: Recently on 27 June 2019, Xplore Wealth announced the resignation of Non-Executive Director Ms. Pamela McAlister, effective 1 July 2019. Simultaneously, the Group announced that Mr. Alex Hutchison would take up the role as a Non-Executive Director on the Xplore Wealth board. He is currently CEO of a prominent industry super fund and has extensive expertise in superannuation, platforms and financial planning. Mr Hutchison is actually joining back the Group after resigning from the board in 2018 due to personal circumstances.

Earlier on 5 June 2019, the Group had announced the departure of Mr. Tony Nejasmic as the Head of Distribution and Marketing to take up an opportunity within the financial services industry. Since then, advanced discussions have been underway to welcome fresh talent into the role and continue the exciting growth plans for Xplore.

Also, during the March 2019 quarter, Mr. Bruce Hawkins was appointed to the position of the Group CFO. He holds an extensive experience of over 25 years and is a well-regarded finance executive and member of pioneering executive teams within the investment platform sector across the Australian superannuation and wealth management industry.

Stock Performance: Xplore Wealth has a market capitalisation of around AUD 32.65 million, with approximately 296.79 million shares outstanding. Today, on 17 July 2019, the XPL stock closed at AUD 0.115), with ~ 182,043 shares traded. In addition, XPL has generated a positive one-month return yield of 4.76%.

Recently the Groupâs Director Donald Sharp increased his shareholding in Xplore Wealth to 11.69% (from 10.68%) upon acquisition of 717,090 ordinary shares (Direct and Indirect interest) at $ 0.10 each on-market trade.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.