Google, the search engine, is a subsidiary of US-based Alphabet Inc., which is a provider of online advertising services across the globe. Google, with its products and platforms like Chrome, YouTube, Gmail, Google Play, Google Cloud, Search and Maps, eases the day-to-day lives of billions of people worldwide.

Since Google was founded in the year 1998, it is the reigning champion of search. In several ways, it controls how businesses access their customers through the online platform. Its strategy is to ensure that a Google search is available, wherever a user is. For mobile OS market share, it has Android; for internet browser market share, it has Chrome; and for video platform market share, it has YouTube.

Even in travel space, the company is on track to make its Google Travel business own the industry in the coming years. Let us have a look at how the expansion of this conglomerate is hampering the online travel businesses.

Fear Looming on Travel Industry

Google made changes to its travel search results in May 2019, easing the lives of users to navigate between Google Trips, Google Flights and Google Hotels. The changes are part of its plan to boost Google Travel business and grab a bigger slice of the industry, which is worth more than $ 2 trillion.

It combined the mobile Google Trips app, Google Flights, Google hotels and other tools under a singular landing page called Trips, aimed at turning it into a travel planning service. The changes were made in May 2019, to enable users to research and buy plane tickets, hotel accommodations and other travel related services. The new changes give access to new trip-planning features to customers, such as viewing their upcoming flights and hotel stays. Moreover, they can edit their itineraries and make additions related to new reservations.

The company made its first purchase in the travel industry in 2010 by acquiring ITA Software in a deal worth USD 700 million. Though the business wasnât strong at that time, the huge financial capacity of the company enabled it to make its flight search product the best portal in the globe.

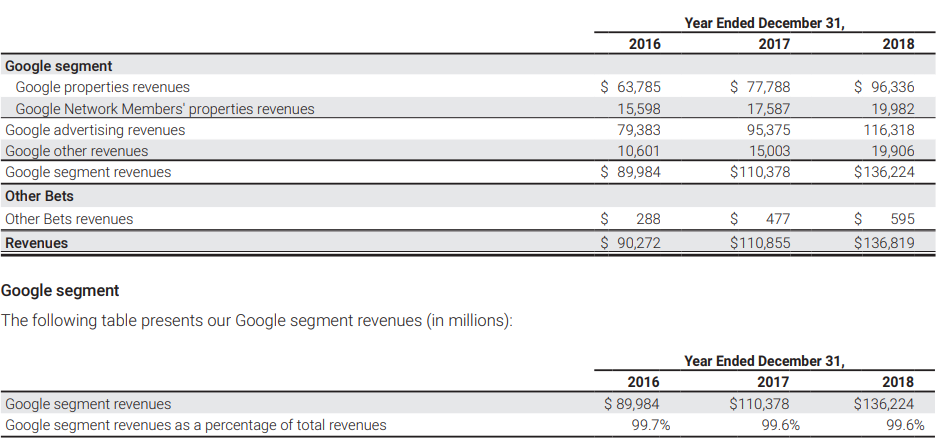

Below figure highlights the strong financial position of the company:

Note: Figures are in Million (Source: Alphabet Financial Results)

Note: Figures are in Million (Source: Alphabet Financial Results)

Competition in the global travel industry is growing. The fear among several businesses operating in the travel industry concerns that Google will soon own the online travel arena, as the search engine is using its popularity to destroy competing content providers. According to market experts, currently, Google accounts for 95% of the travel search market.

With the expansion of Googleâs offerings for the travel industry, several travel companies have been hit hard. For instance, TravelFish.org, which is the digital version of the Lonely Planet guide in South East Asia of Stuart McDonald, is the recent prey of Google in the travel industry.

According to the TravelFish.org, people travelling to the region look for suggestions related to the places for stay, local food and best places to visit on their website; however, they are being directed by Google to websites that are paying the search engine to stay at the top of the list and sites.

In the recent times, traffic to TravelFish.org reduced by almost 50%, as travellers finding snippets from the website are not much directed to the website by Google as in the past.

Expedia Group and Booking Holdings, which have duopoly in the industry, pay billions of dollars every year to Google, ensuing that their products stay on top of the searches. Expedia Group owns Travelocity, Orbitz, Expedia, Hotels.com, Trivago and Hotwire; while Booking Holdings owns Priceline, Kayak and Booking.com.

The way Google is improving Google Travel, it is likely to cover the whole journey of a traveller. It should not be a surprise to the online travel industry, if the business segment gets the complete hold of the industry.

Moreover, market participants believe that airline industry might get impacted by Google Travel business in the coming years, as they perhaps would be required to make Google a major part of their distribution.

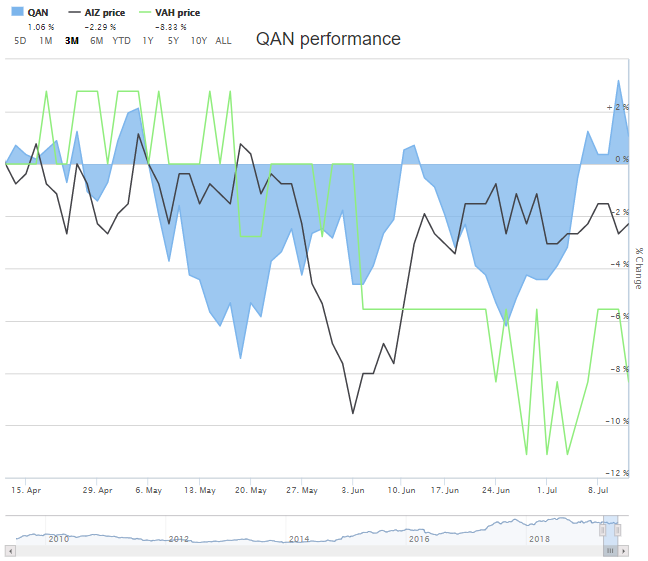

Below is the graph depicting the last three-month performance of air transportation service providers Qantas Airways Limited (ASX: QAN) Virgin Australia Holdings Limited (ASX:VAH) and Air New Zealand Limited (ASX: AIZ) on ASX. All three stocks have shown negative/low returns.

QAN, AIZ & VAH 3-Month Performance (Source: ASX)

It is nothing new, when a big player like Google with a deep pocket, keen e-commerce strategy and a huge user base of billions of people, when enters a sector wants to mark its dominance. In the wake of Googleâs market dominance, several companies are seeking regulatory interference to address the issue and help them save their businesses.

Impact on ASX Travel Related Stocks:

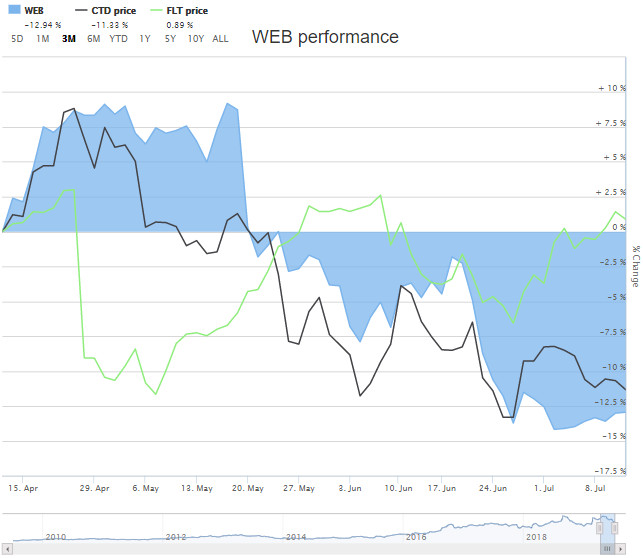

Strong positioning of Google is putting pressure on several travel-related stocks in Australia. Below graph depicts how the stocks of companies like Webjet Limited (ASX: WEB), Corporate Travel Management Limited (ASX:CTD) and Flight Centre Travel Group Limited (ASX: FLT), performed during the last three months.

WEB, CTD and FLT 3-Month Performance (Source: ASX)

WEB, CTD, FLT traded at lower levels in the past three months.

Google Facing the Regulation Heat in Australia

Recently in July 2019, the Australian Competition and Consumer Commission (ACCC) submitted a report to Treasurer Josh Frydenberg regarding the impact of market dominance of Google and Facebook on traditional media companies in the country.

The report has found lack of transparency in the way Google operates its business in Australia. According to the report, Google receives $ 47 for every $ 100 spent on digital advertising in the country. The final report is expected to demand the formation of a regulatory authority, which will have the responsibility to monitor the advertising business for Google and other such companies.

Following the submission of the report, Treasurer Josh Frydenberg issued a warning to two US-based conglomerates and signalled towards introducing some restrictions on how they operate.

The ACCC was directed in December 2018 to prepare a report related to the impact of social media platforms, search engines and other online aggregation sites on competition in the domestic media & advertising industry.

In Australia, Google accounts for about 90% of internet searches from computers and 98% from mobile devices. With growing digitisation in the country, use of search engines is expected to grow; however, the government needs to look at issues related to genuine competition, privacy, and data collection method and its use.

The report is expected to be made public in late-2019.

How Strong is Google?

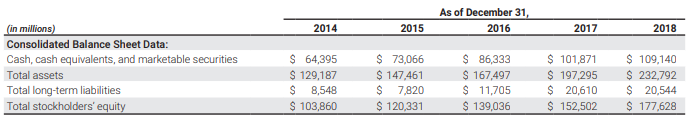

Google has a huge cash surplus. It is capable of making payments towards fines for breaching anti-trust laws. With around USD 109 billion in cash in Alphabetâs balance sheet at the end of 2018, Google paid a USD 5 billion fine related to the breach of anti-trust laws to the European Commission in 2018.

Alphabet Balance Sheet (Source: Alphabet Financial Results)

Alphabet Balance Sheet (Source: Alphabet Financial Results)

Several market experts suggest that regulatory bodies need to act proactively, otherwise it would be too late to get a hold of Googleâs dominance, as the power that this company holds is extraordinary.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.