Interest rate cuts are perhaps one of the hottest topics of the Australian economy for 2019. With some historic amendments made in the Royal Commission era, the rate cuts have significantly impacted consumers, businesses and investors alike. The rate cuts not only have an impact on the present economic landscape but affect the future prospects too.

In todayâs article, we would discuss the rate cut landscape in the country and also decipher probable ways in which the rate cuts could impact Australiaâs earnings outlook. But foremost, let us understand the concept of rate cut:

Rate Cut- the concept

Interest rates express the costs associated with money. It is the percentage (%) of principal that is levied by the lender when an amount of money is given for use. In a nutshell, interest rates express the amount which is paid in a particular tenure. Interestingly, interest rates are highly competitive, but they aren't the same.

Breaking down the concept, a bank lends money (principal) and charges interest, which is applied to the total unpaid portion of your loan/ credit. This is paid in the agreed time frame, and in the absence of this procedure, the outstanding debt increases.

Now that we understand interest rates, let us acquaint ourselves with the concept of an interest rate cut:

In an ideal scenario, an interest rate cut indicates that the economy is either sinking or is looking like that it could sink. Regulatory bodies manage the interest rate environment through monetary policy. When there is a speculative fear of recession hovering over an economyâs health, the concerned regulatory body lowers the prevailing interest rates which would motivate people to take loans and spend from their pockets.

At this point, it is important to understand that industry experts believe that an interest rate cut raises consumer confidence and their expectations as they are able to make feasible assessments of their own finances.

Why do regulators cut interest rates?

The simple answer to the question in discussion is- to stimulate economic growth when the economy shows the sign of a slump. This is because if the rate of interest is lower, borrowing and investing is highly encouraged, which propels growth. Moreover, rate cuts have been regarded as an effective tool to decelerate the impact of inflation and return growth to more balanced levels.

Consequently, rate cuts aid users to save money by lowering the interest payments. It can be stated that a rate cut incentivises borrowing and disincentivises savings, but most importantly, this regulatory action gets money out of bank accounts, right into the economy.

Interest rate cut in Australia

Australiaâs central bank, Reserve Bank of Australia (RBA) has been raising a lot of brows as Australians have faced three rate cuts so far in 2019, with speculations of another in the close radar. In September 2019, the bank cut the official cash rate by 0.25% to a new record low of 0.75%, which marks the third reduction in the cash rate in five months.

The prior two rate cuts were exercised in June and July, historically successive in nature. With the protracted USâChina trade dispute affecting global trade and businesses scaling back their investment, along with an ongoing recession debacle, the regulatory move was made in order to increase employment and lift the persistent low inflation in the country.

With the primary reason stated to boost the Australian economy, the bank believes that the low level of interest rates, consecutive tax cuts, the prevailing spending on property and a silver lining in the two-year doomed housing market, along with a optimistic outlook in the resources sector would support the overall growth in Australia.

Impact of rate cuts in the overall earnings outlook

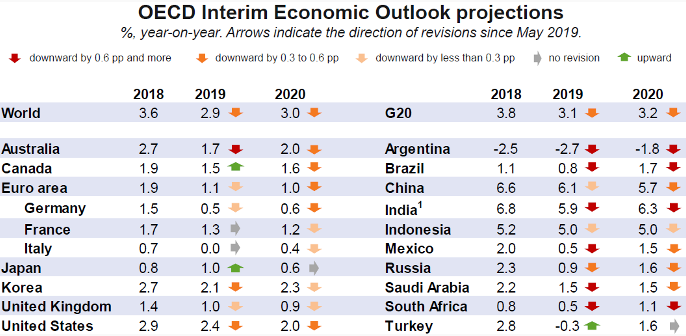

According to a recently released report by the Organisation for Economic Cooperation and Development (OECD), Australia's economic growth forecast was slumped to 1.7% for 2019. The main catalyst of the lowering of the countryâs growth is likely to be the trade wars, which have undermined confidence, growth and job creation across the world, making the global economy extremely sensitive and vulnerably uncertain.

(Source: OECD)

Interestingly, this projection and the rate cut which took the benchmark borrowing rate in Australia to a record low of 0.75 per cent were announced almost around the same time frame.

Amid the ongoing global and country-specific (to Australia) concerns, the rate cuts are a tool to support the economy, as the lower interest rates are likely to put a pressure on the net interest margins of the Australian banks.

It should be noted that the OECD anticipates the global economy to grow by 2.9 per cent this year and by 3 per cent in the next year. This would mark the weakest annual growth rates ever since the Great Financial Crisis of 2008.

What to look out for amid the rate cut landscape?

Experts believe that Australians have been quite doubtful about the Australian economy in the recent times, with confidence plunging ever since the RBA began the rate cut debacle in June. However, one should be aware of the fact that a single economic policy does not affect the overall economy. Therefore, besides rate cuts, one should be wary of the below:

- The property market in Australia is showing signs of recovery.

- Banks are under heavy selling pressure post the rate cuts.

- The tariff war between the two of the worldâs biggest economies continues to cast its spell in Australia, along with other economies.

- If the Australian labour market improves, wage growth and labour income growth may be reported.

- Uncertainty about expected household income growth is a vital element to watch out for.

The Share Market Performance

Let us understand the stance of the investing sentiment in Australia, while micro and macro level factors affect the economy. After the trading hours on 11 October 2019, the S&P/ASX 200 built positive investor sentiment and closed in the green zone, at 6547.1, up by 0.01% or 0.4 basis points.

With RBA edging down the cash rates and the prospect of an Australian quantitative easing knocks the economyâs door while recession anticipations continue, it would be interesting to witness Australiaâs path in the coming times. One should be aware that the Australian economy was one of the few to have surpassed the Great Financial Crisis without much hassle, thanks to the then prevailing mining boom.

But the debate stays on if the conventional monetary policies and regulatory actions are the right path for the country to take.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.