Dividend is distributed to the investors when a company earns profit from the business. Dividends received by the investors act as return on investment for them. Investors look for dividend yield when they plan to invest for long-term perspectives.

Investors choose their stocks wisely when they create their portfolio. When a long-term investment is done, the capital gets invested in that particular asset class for that entire tenure. So, the investor does not have the option to utilise the money for other purposes unless the stock is sold. Thus, the dividend acts as a source of profit or incentive to them.

A stock providing regular dividends helps to provide regular income to the investors particularly during the tepid economic scenarios when most of the stock prices are down and selling of stocks would lead to huge losses to the investorâs pocket. During a bull market, investors use to book profits on regular intervals, which helps them to churn their portfolio. Profit booking depends upon the investorâs expectations over the stock.

In case of mining stocks, dividend plays an important role, as in several scenarios, the business is not sure whether it would be able to deliver profit in the coming year due to factors like the nature of the business, fluctuations in commodity prices, etc. Thus, when the Board of Directors of mining companies declares dividends, it helps to boost investorsâ sentiments as a whole.

Letâs have a look at the following two mining companies that have a decent dividend yield.

BHP Group Limited

BHP Group Limited (ASX: BHP) is engaged in the exploration, development and production of oil & gas. The company is also associated with mining of several metals and minerals like copper, silver, zinc, molybdenum, uranium, iron ore, coal and gold.

FY19 Revenue at US$44,288 Million:

BHP Group Limited declared its full year consolidated financial results for FY19 ended 30 June 2019, unveiling revenue of US$44,288 million as compared to US$43,129 million during the previous financial year. BHP reported net profit at US$9,185 million in FY19 as compared to US$4,823 million on FY18.

During the year, the company reported financial expense at US$1,510 million as compared to US$1,567 million in the same period a year ago, followed by a higher financial income of US$446 million versus US$322 million in FY18.

On the balance sheet front, the company reported US$23,373 million in total current assets including cash and cash equivalents of US$15,613 million, trade and other receivables of US$3,462 million and inventories of US$3,840 million as on 30 June 2019. Property, plant and equipment (PPE) were reported at US$68,041 million while intangible assets and investments accounted for using the equity method were recorded at US$675 million and US$2,569 million, respectively. The company reported total assets at US$100,861 million and net assets at US$51,824 million at the end of FY19.

Net operating cash flows from continuing operations during the year stood at US$17,397 million, net investing cash outflows in continuing operations reached US$7,377 million and net financing cash outflows in continuing operations stood at US$20,515 million.

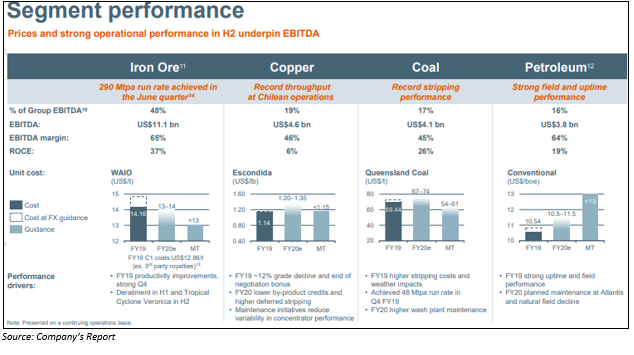

Segment Wise Performance:

BHP Group reported $5,930 million in revenue from the petroleum segment which represents 13.39% of the total revenue followed by copper revenue at US$10,838 million contributing 24.47% of the total revenue. Underlying EBIT from petroleum came in at US$2,220 million and from copper stood at US$2,587 million.

Revenue from iron ore reached US$17,255 million (38.96% of the revenue) and coal at US$9,121 million (13.39% of the total revenue) during FY19, while underlying EBIT from iron ore and coal came in at US$9,397 million and US$3,400 million, respectively.

On the geographical point of view, majority of the companyâs business comes from Asia primarily China which constitutes approximately 54.81% of the total companyâs income while the company exports 9.47% to Japan, 5.6% to India, 5.76% to South Korea and 6.64% derives from rest of Asia. The company derives 5.51% of the total revenue from North America and 4.23% of the total revenue from Europe. BHP posted US$2,568 million sales from domestic market during FY19 which represents 5.8% of the total revenue.

Stock Update:

The stock of BHP was trading at $35.290 on 9 October 2019 (AEST 02:20 PM), down 0.899% from its previous closing price, with outstanding shares of 104.9 billion. The stock has generated a negative return of 12.20% and 10.73% during the last three months and six months, respectively. The stock has a market capitalisation of $104.9 billion while an annualised dividend yield of 5.39%. The stock is available at a price to earnings multiples of 15.58x.

Imdex Limited

Imdex Limited (ASX: IMD), which is involved in mining and exploration activities, is also a provider of sub-surface technologies to the global minerals industry and other targeted non-mining markets. On 08 October 2019, IMD announced a fully franked dividend of AUD 0.02 (Record Date: 18 October 2019 and Payment Date: 1 November 2019).

Revenue Up 12% in FY19:

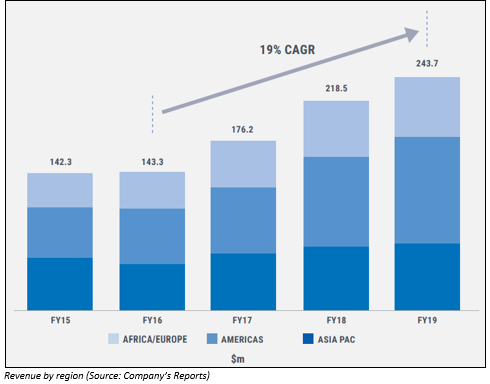

IMD announced its full year financial results for FY19 (ended 30 June 2019) in August 2019, posting revenue of $243.7 million, as compared to $218.5 million during FY18, representing a year-on-year increase of 12%. The company reported its NPAT at $27.6 million as compared to $21.1 million as on FY18.

During FY19, the company reported gross margin at 52.3% as compared to 42.4% on pcp, primarily driven by streamlining business operations and internal digital transformation followed by improvement in cost base. The company reported operating cash flow at $35.2 million during FY19, up 19.3% from $15.9 million in the same period a year ago.

The company reported net assets at $220.0 million as on 30 June 2019, representing an increase of 18% year-on-year. IMD had cash of $29.5 million, inventory of $37.1 million, fixed assets of $39.4 million and total assets of $259.2 million at the end of the year FY19. Payables and borrowings stood at $25.3 million and $6.3 million, respectively during the reported year.

Outlook:

The Management has guided that the company will continue investment across leading technologies to aid future growth. The primary and intermediate resource companies are increasing their expenditure to replace reserves. The Management expects to exercise option to acquire Flexidrill during mid-December 2019.

Stock Update:

The stock of IMD was trading at $1.450 on 9 October 2019 (AEST 02:56 PM), down 0.344% from its previous closing price, with outstanding shares of 388.06 million. The stock has generated a stellar return of 21.25% and 47.72% during the last three months and six months, respectively. The stock has a market capitalisation of $564.62 million while annualised dividend yield of the stock stands at 1.51%. The stock is available at a price to earnings multiples of 19.74x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.