The ongoing reporting season has seen mixed bag of developments/earnings releases across different sector players. In this article, we discuss full-year results of three companies engaged in the exploration, development and production of gold and copper. With two of these companies operating internationally, it would be interesting to see their performance amidst ongoing US-China trade concern and commodity pricing scenario.

Perseus Mining Limited (ASX: PRU)

On 28 August 2019, the company released full-year results for the period ended 30 June 2019. Accordingly, the company had produced record production from its two mines at an improved AISC compared to preceded years. This had been the outcome of its corporate plan to emerge as a multi-mine, multi-jurisdiction gold producer.

In FY2019, the companyâs production included 271,824 ounces of gold at an AISC of US$960/oz, including production costs, royalties and sustaining capital. In Cote dâIvoire, Sissingué Gold Mine produced 79,853 ounces of gold at an AISC of US$746/oz. In Ghana, Edikan Gold Mine produced 191,971 ounces of gold at an AISC of US$1,049/oz.

Meanwhile, the company is developing its third mine Yaouré Gold Mine in Cote dâIvoire, and engineering and supply contracts were also executed during the year. It has also completed the FEED study for the project, and the total cost for the development of mine was estimated at US$265 million.

In June 2019, the company secured a US$150 million revolving credit facility from a consortium of three banks, including Macquarie Bank, Nedbank Limited & Société Générale. It intends to fund the development from the revolving credit facility, existing cash and bullion along with cash flows from its two gold mines.

At the end of FY2019, the companyâs total bank debt was US$31.5 million, following the repayment of project debt facility provided by Macquarie Bank for Sissingué, and revolving working capital debt facility for Edikan. In FY2019, the company successfully raised US$39.2 million after fees from the exercise of A$0.44 warrants that matured in April 2019.

Reportedly, the revenue was $508.7 million in FY2019 compared to revenue of $378 million in FY2018. Gross profit declined to $11 million in FY2019 against $18.3 million in FY2018. Net profit after tax was $7.6 million in FY2019 compared to a net loss after tax of $24.9 million in FY2019.

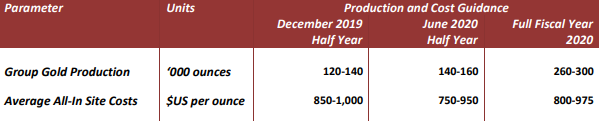

Besides, these above financials were predominantly impacted by a depreciation & amortisation expense of $153.3 million, up 28% over FY2018. The assets impairment charge for the period was $0.1 million down from $24.3 million in the previous year. Meanwhile, the company recorded a foreign exchange gain of $15.5 million compared to gain of $5.7 million in the previous year. The financing costs of the company was $6 million during the period, which was $3.1 million in the previous year. Below figure provides the guidance for FY2020:

FY2020 Guidance (Source: Perseusâ Announcement)

On 29 August 2019, PRU settled the dayâs trading at A$0.755, down by 3.21% from the previous close.

Silver Lake Resources Limited (ASX: SLR)

Recently, the company had released full-year results for the period ended 30 June 2019. In FY2019, the company merged with Doray Minerals Limited and formed a multi-asset, mid-tier gold company. Its operations are in the Eastern Goldfields & Murchison districts of Western Australia. Now, the company operates five mines and two processing facilities across Deflector and Mount Monger operations.

Reportedly, the revenue for the period was $301.5 million compared to revenue of $255.6 million in FY2018. In FY2019, the company sold 171,322 ounces of gold at an average realised price of A$1,754/oz compared to sales of 151,250 ounces of gold at an average realised price of A$1,684/oz in FY2018. The increase in revenue is attributed to better-realised prices of gold, and contribution from the acquisition.

Meanwhile, the company achieved net profit after tax of $6.5 million for the period, compared to $16.2 million in FY2018. The lower profit was due to expenditure incurred with the merger for $10.2 million, a 12% decrease in feed grade, and an increase in iron ore stockpiles.

Further, the cost of sales increased to $272.1 million for the period compared to $225.9 million in FY2018 attributing to cost of sales with the Deflector Operations from the acquisition date. The All-in Sustaining Cost for the period was A$1,367/oz compared to A$1,289/oz, which was in line with the forecast provided at the half-year results release.

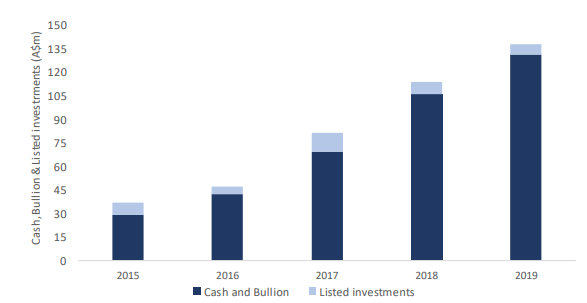

Cash & Bullion Growth (Source: SLRâs FY19 Financial Results Summary)

In FY2019, the operating cash flow for the period was $71.8 million, which attributed to cash & bullion balance of $130.7 at the year-end. The company acquired cash of $13.3 million as a part of Doray acquisition, and exploration, capital expenditure stood at $57.7 million.

On 29 August 2019, SLR settled the dayâs trading at A$1.125, down by 0.442% from the previous close.

Sandfire Resources NL (ASX: SFR)

Recently, the company released full-year results for the period ended 30 June 2019. Accordingly, the revenue growth for the period was 4%, taking the revenue to $592.2 million in FY2019 compared to $570 million FY2018. Besides, net profit contracted by 13% over FY2018, which stood at $106.5 million from $123 million in FY2018.

Reportedly, the company announced a fully franked dividend of 16 cents per share payable on 29 November 2019 to the shareholders. The performance of the company was attributed to significantly low C1 costs at the DeGrussa Operation, excellent gold and copper output and lower Australian Dollar, which helped to offset fall in copper prices.

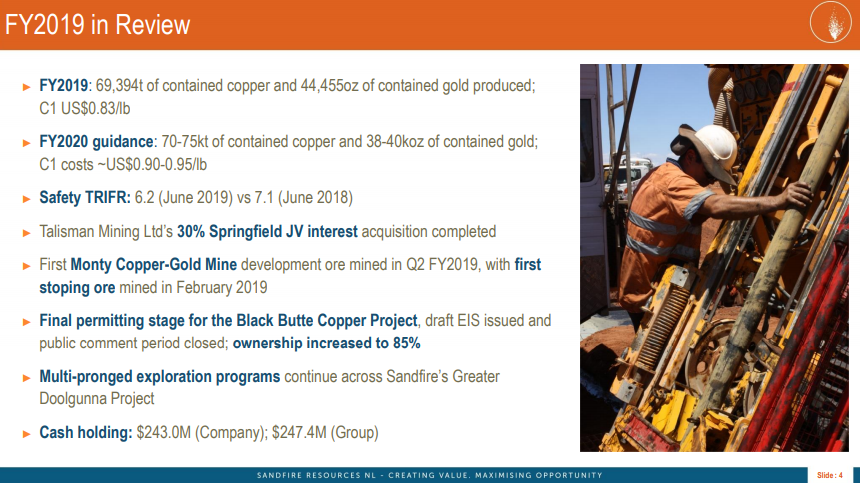

Meanwhile, the company produced 69,394 tonnes of contained copper and 44,455 ounces of contained gold at a record low C1 cost of US$0.83/lb from US$0.93/lb in FY2019, and this marked the best operational performance considering the volumes and costs.

FY2019 Highlights (Source: SFRâs 2019 Annual Results Presentation)

FY2019 Highlights (Source: SFRâs 2019 Annual Results Presentation)

Besides, the revenue of $592.2 million was contributed from the sale of 65,074 tonnes of payable copper and 39,265 ounces of payable gold. Cash flow from operating activities was $210.4 million for the period compared to $245 million in FY2018, while excluding the impact of payments for exploration and evaluation, the cash flow operating activities was $267.4 million.

More importantly, the company remains debt-free, and the interest-bearing liabilities on the balance sheet were related to obligations under finance leases and hire purchase contracts, which were just under $550k at the year-end, including current and non-current liabilities.

The year-end cash position of the company was $247.4 million from $243.3 million in FY2018.

Development & Outlook: Reportedly, in FY2019, the company invested in the advancement of the new high-grade Monty Cooper-Gold Mine, which is now feeding ore into the DeGrussa Concentrator. These developments are consistent with the companyâs global growth strategy, which emphasises on diversified exploration pipeline, expanded reserve base.

Meanwhile, Sandfire Resources America Inc., progressed the permitting of the high-grade Black Butte Copper Project in USA, while continuing a Feasibility Study to develop a new copper mine.

In June 2019, the company announced the proposed acquisition of MOD Resources Limited (ASX: MOD), which would add to the capabilities of producing copper with a belt-scale 11,700km2 landholding in the Kalahari Copper Belt. Sandfire is expecting to complete the transaction in October this year.

More importantly, the company is positioned with strong liquidity and debt-free balance sheet to tap the opportunities in the global base metal sector. The FY2020 production forecast is 70-75 kilo tonnes of CU, and 38-42 kilo ounces of gold at a C1 cash cost of US$0.90-0.95/lb.

On 29 August 2019, SFR settled the dayâs trading at A$6.020, down by 2.59% from the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.