The process of investing undergoes a prior deep research based on fundamental analysis, technical evaluation and macro-scenario analysis. But the concept does not end with the investor risking his money on a lucrative stock. The most interesting part comes post investing, or after the risk has been taken- the consequences. The fundamental rationale behind investing in equity market is to earn profits and source out a stable form of income, and this happens through capital appreciation as well as dividends.

Talking about dividends, we often come across corporate updates wherein the company has offered franked dividends for quarterly/semi-annually/annually basis. Today, Material sector player, Amcor PLC (ASX:AMC) has announced an unfranked quarterly dividend of AU 0.17725 cents per share. Iron ore giant, BHP recently announced fully franked final dividend of US 78 cents/share. Several other companies have updated the market with their dividend payout plans in the ongoing reporting season.

Todayâs article would provide you with a holistic understanding of one of the dividend constituents- Franking Credits. Let us dive right in:

Understanding Franking Credits

Often synonymously used as imputation credit, franking credit could be best described as the type of tax credit which is paid to the shareholders by the company they would have invested in, along with the dividend payments.

Franking credits could exist as a consequence of an entitlement to a franked distribution, when the company is a beneficiary of a trust. The concept is fairly famous in Australia, with several companies offering franking credits to eliminate or at least reduce any sort of double taxation, depending on the investorâs tax bracket. Shareholders avail a reduction in their income taxes or are granted a tax refund, as the company distributing the dividend, already pays the tax on them and the franking credit allows the company to allocate a tax credit to their shareholders. In the Australian context, a franking credit can be described as an entitlement, offered to the shareholders by a company they would have invested in, to a reduction in personal income tax which is payable to the Australian Taxation Office.

Australia, New Zealand and Malta have imputation systems, whereas countries like the UK, Chile, Korea and Canada have a partial imputation system.

Breaking Down The Concept

Often, you would have come across the term âfrankedâ when it comes to dividend distribution. Dividends are paid out of the generated profits subject to the Australian Company Tax system, which means that the shareholders are granted a rebate for the tax which is paid by the company on the profits that are distributed in the form of dividends.

Let us take an example: Mr X is the owner of shares in a company, that pays him a fully franked dividend of $800. The dividend statement states that a franking credit of $200 exists, representing the tax amount on the dividend which the company would have paid. When Mr X declares his personal income, he would state an amount of $1000, (which was the actual dividend). If the tax rate was 15%, he would have paid $150 tax on the dividend, but as the company has already paid the franking credit amount as tax, Mr X would receive a refund of $50. In case Mr X was on a higher tax slab, he would not be entitled to avail a refund, rather he would be paying extra tax. On the contrary, a lower bracket slab would lead to the possibility of full refund.

History of Franking Credits

The concept of franking credits was brought into consideration in the late 1980s by the Hawke Government, making it a relatively new area in the business line. The franking credit imputation system has existed in Australia and its taxation system for approximately 30 years. In the beginning, the franking credit system was granted exclusively for the offsets on the tax amount paid. This was modified in 2001, which allowed the cash refund of the excess credits to shareholders who had their tax liabilities lower than the refunded credits.

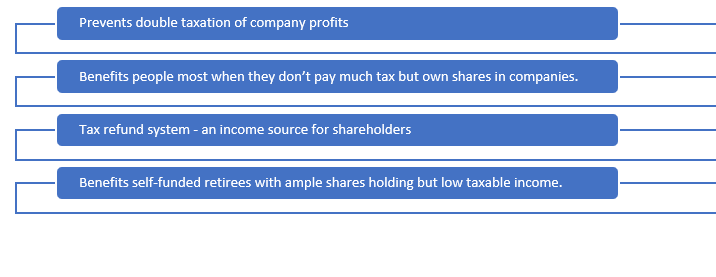

Benefits of Franking Credits

The concept, even though is new, has proven its advantages for both companies and shareholders. Some of these are mentioned below:

Calculation of Franking Credits

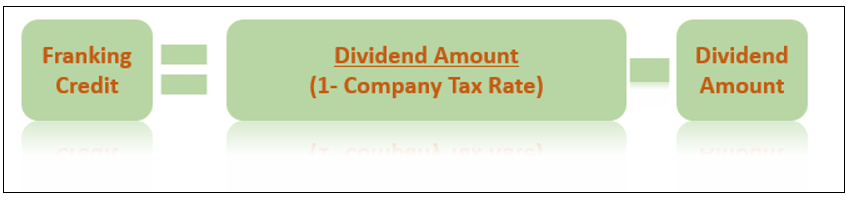

In Australia, in order to be eligible to receive franking credits, one needs to hold their shares for over 45 days at risk, which is the 45 day Holding Rule. The franking credit to be paid to a shareholder can be derived using the following formula:

Functionality of Franking Credits

The franking credit is attached to a dividend which the company pays to shareholders out of its after-tax profits. Its worth is the same as the amount of tax which is paid on the individualâs share from the profit generated by the company, before it was distributed as a dividend. Intended to shun down or remove the double taxation concept, because the tax on dividends is already been paid by the company, when personal income tax is computed for the individual, the value of their accrued franking credits can be subtracted from the tax payable.

A company can differ from the another in the way that it deals with franking credits, depending upon the amount of tax they have paid. It should be noted here that the company cannot offer a franking credit exceeding an amount that is paid in company tax, and they cannot offer the franking credit for tax that has been paid in a foreign country. In the context of Australia, this means that the benefit of franking credit is exclusively available to Aussie residents and cannot be claimed by the foreign proprietors of the Aussie companies.

Franking Credits On The ASX

As per a report from the Australian Securities Exchange, in the S&P/ASX 200 index, which marks the 200 biggest players of the Australian equity market, 184 companies had paid dividends in the 52 weeks to 19 April 2018. Of these companies, half granted fully franked dividends and around a fourth paid semi-franked dividends and unfranked dividends. The highest franking balances on the market included (in no particular order) Commonwealth Bank of Australia (ASX: CBA), BHP Billiton Limited (ASX:BHP), Westpac Banking Corporation (ASX:WBC), Woolworths Group Limited (ASX:WOW) and TPG telecom Limited (ASX:TPM).

Key Takeaways:

- Imputation credit or franking credit is the type of tax credit which is paid to the shareholders by the company along with the dividend payments to avoid double taxation.

- The concept of franking credits was brought into consideration in the late 1980s by the Hawke Government

- In Australia, in order to be eligible to receive franking credits, one needs to hold their shares at risk for over 45 days at risk, which is the â45 day Holding Ruleâ.

- A company cannot offer a franking credit exceeding an amount that is paid in company tax, and they cannot offer the franking credit for tax that has been paid in a foreign country.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.