Small-cap stocks refer to the stocks of companies with a market capitalisation of less than US$2 billion, and these companies have huge growth potential, as every company starts small to become a large enterprise. However, small-cap stocks are a relatively riskier form of investments than mid-caps & large-caps, due to their high volatility.

Mid-cap stocks fall in the bracket of stocks with market capitalisation within the range of US$2 billion to US$10 billion. These stocks offer relatively better growth potential than the large-cap stocks (over $10 billion). It represents companies with relatively higher risk when compared to large-cap peers. Over a long-term period, mid-cap stocks offer better potential for growth in a bid to become a large-cap company and attain a higher market capitalisation.

Super Retail Group Limited (ASX: SUL)

On 4 October 2019, SUL closed the trading session at a PE multiple of 13.51x. Super Retail Group Limited has a presence in the automotive parts, expedition equipment & gear, sporting goods, and outdoor equipment & apparel.

As per its Annual Report for the period ended 29 June 2019, the group operates 690 stores, five support offices, seven distribution centres, and is operational in three countries â Australia, New Zealand & China.

In FY 2019, the group achieved revenue growth of 5.4% over the year to reach $2.71 billion, and net profit after tax of $139.3 million, up by 8.6% from $128.3 million in FY 2018.

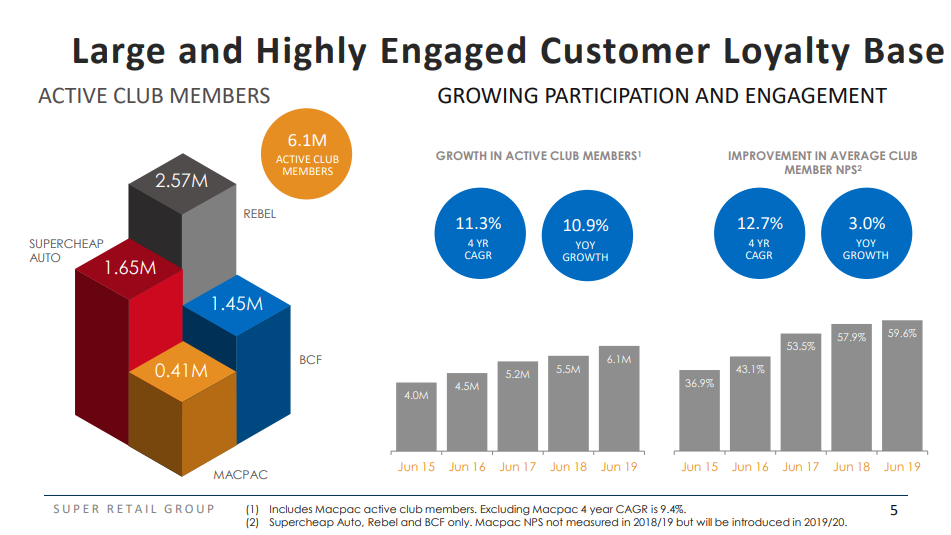

The groupâs total active club members increased by 10.9% in year-on-year terms with an average club member net promoter score (NPS) of 59.6%, up by 3% over the year. It achieved a growth of 2.3% over the year in total customer transactions at $46.7 million.

Customer Base (Source: SULâs 2019 Full Year Investor Presentation)

Further, its online sales have been picking up pace, and it grew by 25% over the previous year; the group has been investing its digital capability to improve the omni-retail experience for the customers. Its click & collect online service reaped 43% of the total online sale, and rest was delivered at homes of the customers.

Among its brands, Supercheap Auto is the largest speciality automotive parts and accessories retailer in Australia & New Zealand. It had an average active club member NPS of 61%, online sales growth of 25% over the year, and sale growth of 3.4% over the year.

Rebel is a sporting goods retailer arm of the group, operating with an average active club member NPS of 57.1%. Its online sale witnessed a growth of 33%, and overall sales were up by 3.8% over the year.

BCF is the outdoor retailer of the group, having a presence in each of the states in Australia. It was operating with an average active club member NPS of 61%, achieving 3.3% growth in sales over the year.

Besides these, since 1973, Macpac has been designing apparel & equipment for outdoors made for adventurers. The group acquired the brand in FY2018, and Macpac completed its full-year under the group in the FY 2019. It achieved 24% growth in online sales, and the group has been transforming some of its Rays stores to Macpac Adventure Hubs.

On 4 October 2019, SUL ended the dayâs trading at $9.56, up by 0.21% relative to the last close.

Breville Group Limited (ASX: BRG)

In 1932, when entrepreneurs of Australia, Bill OâBrien & Harry Norville combined surnames to form Breville â a radio manufacturer out of Sydney was founded. Later, the founders went on to solve the problems faced in the kitchen with small appliance research & development centre.

Since then, the group has evolved into a global kitchen appliances powerhouse with presence around the globe through distribution channels or centres. In ANZ, the group trades under the brand Breville®, Kambrook® and Aquaport® with machine partnership in place with Nespresso® and Nestlé® Dolce Gusto®.

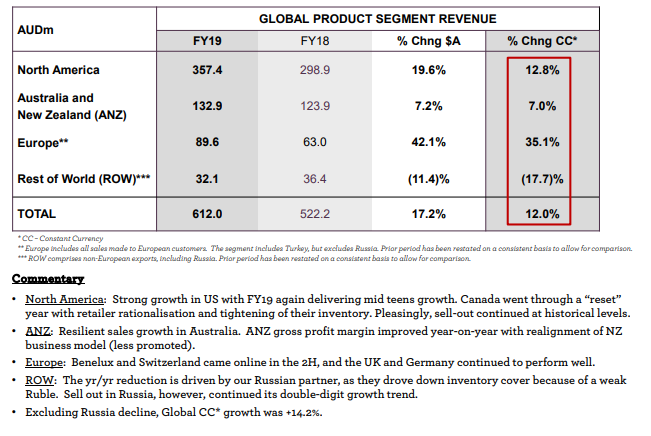

Segment Performance (Source: BRGâs FY 2019 Investor Presentation)

In North America, the group leverages premium channels to market Breville® and Polyscience® products and distributes Nespresso® products under machine partnership. In Europe, the group-owned brand â Sage® is used to distributes Breville® designed products to premium retailers.

Besides, the group has a procurement & quality assurance centre in Hong Kong, supplying its products to the rest of the world except Europe. It supplies products to the Middle East, Asia Pacific and South American markets.

According to its annual report for the period ended 30 June 2019, the groupâs total sales revenue increased by 17.5% to $760 million over the previous year. Besides, it also witnessed a growth of 15.2% in its net profit after tax to $67.4 million.

On 4 October 2019, BRG ended the dayâs trade at $15.8, down by 0.75% relative to the last close.

Bapcor Limited (ASX: BAP)

Bapcor Limited operates a business of automotive aftermarket parts, accessories, automotive equipment and services in over 950 locations in Australia, New Zealand & Thailand. Its core business is automotive aftermarket with end-to-end solutions at a single place.

In FY 2019 ended 30 June 2019, the company delivered a strong performance amid softer trading conditions. The sales revenues were robust across all business segments of the company, resulting in strong growth in revenue, EBITDA, EPS, and net profit after tax from continuing operations increasing to $96.53 million.

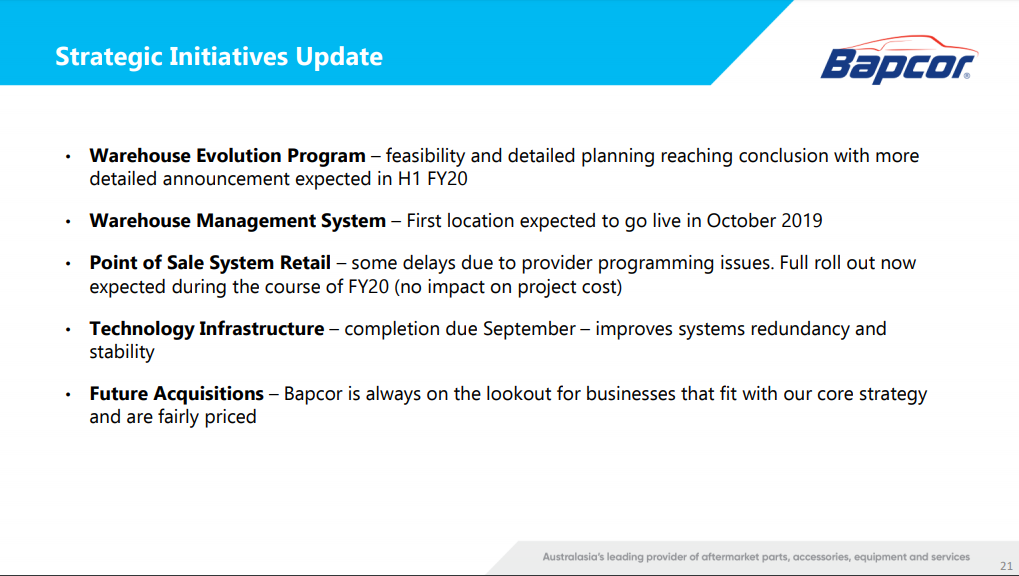

In recent years, the company has acquired businesses across trade specialist wholesale, retail segments, and it focused on improving the synergies from the acquired businesses in the year FY 2019. Further, the company is improving its capability in warehousing, retail point of sale and information technology with investments in technology and infrastructure.

Strategic Initiatives (Source: BAPâs FY2019 Results Presentation)

FY 2019 results were benefitted by the acquisition of Commercial Truck Parts Group (CTPG), specialising in sales of light commercial truck spare parts. Revenue of the company increased by 4.8% to $1,297 million with trading results for twelve months of Tricor Equipment, AADi and CPTG, offset by the divestment in TRS.

Further, the company has delivered a growth of 10.3% to 33.45 cents per share in the year FY 2019, depicting a continued trend of year-on-year growth. In FY 2019, the company announced a total fully-franked dividend of 17 cents per share, depicting an increase of 9.7% over the previous year.

On 4 October 2019, BAP closed the trading session at $7.05, down by 0.14% relative to the last close.

InvoCare Limited (ASX: IVC)

InvoCare is the provider of funeral services in Australia, New Zealand & Singapore. The amendments in the accounting standards AASB 15 & 16 has impacted the company in many ways. In the half-year ended 30 June 2019, the case volumes sustained a year-on-year growth of 1.4% in the core markets, reverting back to historical norms.

In H1 2019, the companyâs renovated sites were back to normal with the more attractive product, the impact of acquisitions, better marketing and customer service. This resulted in an increase in market share growth by 110 bps.

Besides, the company was engaged in implementing sensible cost control measures through the half-year period, and it will increase its emphasis on cost control during the second half period to offset the possible downside risks in a number of deaths throughout the winter season.

Funeral Performance (Source: IVCâs 2019 HY Investor Results Presentation)

In Australia, the company increased its funeral sales to $147.9 million against $145.5 million in the previous corresponding period. The number of funeral services provided were consistent with the previous corresponding period.

In New Zealand, the sales increased by 1.7% to $22.5 million for the period compared to $22.1 million in the previous corresponding period. In NZD terms, the sales were down by NZD 0.2 million over the previous corresponding period.

Further, the company delivered sales of $9.8 million via the acquisitions in Australia & New Zealand.

In Singapore, the sales increased by 41.4% to SGD 9.5 million compared to SGD 6.7 million in the previous year. This was positively impacted by the recovery of the temporary closure of parlours for renovations.

Consolidated Financials

Reportedly, the fair value of the funds under management increased to $38.3 million, implying growth of $28.6 million, compared to $9.7 million in the previous corresponding period. A substantial increase was attributed to strong equity performance in domestic & international markets along with a better performance from the domestic property investments.

Consequently, the net profit after tax for the period witnessed a substantial increase to $41.14 million for the half-year compared to $21 million in the previous corresponding period. Besides, the revenue from continuing operations increased to $244.2 million compared to $227.1 million in the previous corresponding period.

On 4 October 2019, IVC ended the dayâs trade at $13.6, up by 0.74% relative to the last close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.