Whatâs happening in the US & Canada?

Cannabis companies in the countries where they are legalised came under pressure, following the US Governmentâs take on the e-cigarettes. E-cigarettes have been existing in the market in a less harmful way for smokers, compared to a cigarette, as embraced by the US FDA. In the meantime, the high-flying growth in minors using e-cigarettes has forced the FDA to re-consider the course.

Many companies sell E-cigarettes/vapes, which includes cannabis companies as well, and they offer a variety of flavours. Official bodies in the country have been investigating over 450 cases of lung diseases, allegedly caused by vaping.

The US Cities that have banned the e-cigarettes include Michigan, San Francisco, and Boulder, Colorado. The cannabis-focused media houses have been reporting the decline in vape sales, and the sales have declined significantly since the first death caused by vape was reported.

UK market is progressing

In the UK, the officials have been actively working upon obtaining the legalisation of marijuana in due course. Experts on drug legalisation from the USA were in talks with the UK officials to acquire insights on the path of the legalisation process.

Also, these experts had advised hiring former cannabis dealers to enter the potential legal cannabis market. This step would be taken to protect the interest of common man, as handing over the industry to a few corporations is not viable as per them.

South America; the cannabis bowl

Brazil had introduced a plan, through which the native patients could import medicinal cannabis since the year 2014. From 2014, the authorisation granted to import the medicinal products have now surpassed 10k in the second quarter of this year, as per the data of Agência Nacional de Vigilância Sanitária (ANVISA).

At the same time, the country is working on getting domestic cultivation of medicinal cannabis legalised. However, it appears unlikely, as the policymakers have not got into any common grounds, and widespread differences persist among them.

ANVISA had conducted a feedback poll about its plans to legalise the drug in the country, and two thirds of the poll saw ANVISAâs proposal as positively impacting the change.

European Markets

In Europe, the countries have distinct requirements to consider a product as medicinal cannabis & hemp, based on the THC potency level of the strains ranging from 0.2% THC in most EU countries to maximum of 1% in one of the nations.

Netherlands remains the largest supplier to many countries in the EU. While Denmark has swift norms, which enables the cultivation of high THC-potency strains. Malta, a small EU country, has been very favourable to the industry, and one of the ASX-listed players is invested in the country as well.

Czech Republic had been one of the first movers when it comes to legalisation. The country had seen tremendous growth in the year 2018 and through to Q2 period this year. In the meantime, the country has been working on getting public health insurance in place, which would cover the substantial cost, and a similar move in Germany has seen rapid growth in the industry.

Insights from the Australian Cannabis Players:

Cann Global Limited (ASX: CGB)

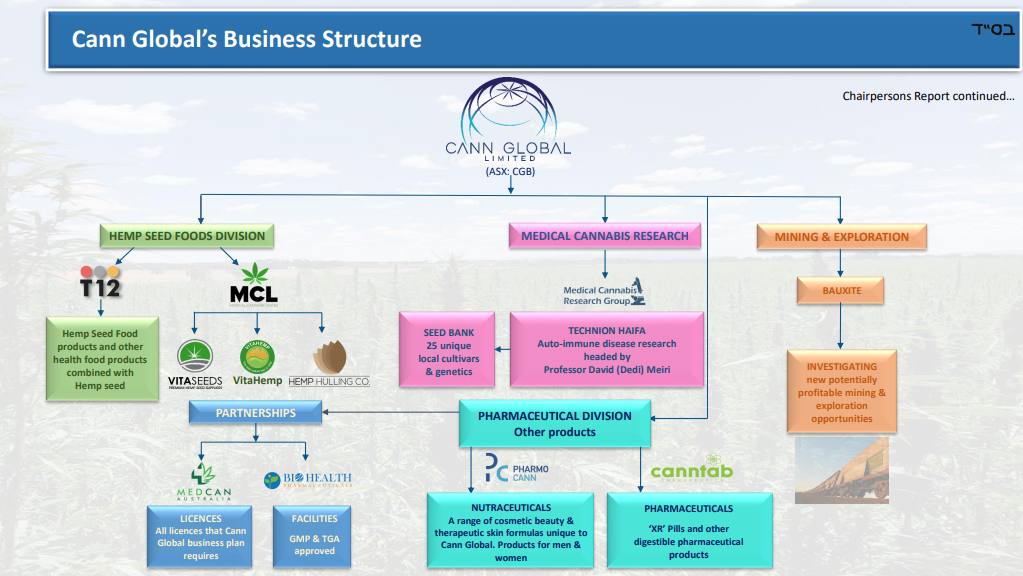

Formerly known as Queensland Bauxite Limited, the company was reinstated to ASX in late August this year. Besides, the companyâs project pipeline appears to be really promising with a range of cannabis businesses under the holding company.

Business Structure (Source: CGBâs June Quarterly Report)

Recently, on 9 September 2019, the company updated on previously notification dated 5 September 2019 that it had signed an exclusive supply deal to export premium quality products from one of its business segments T12 to Vietnam. The deal has been signed with EPCO Foods Co. Ltd in Ho Chi Minh City, Vietnam.

It was noted that the discussion started in the year 2017 with EPCO, with regards to the supply of products to Vietnam. In April this year, a team from EPCO visited T12âs facility. and products were taken back to officials of the government to test the products.

Besides, the company noted that the government had given the nod to the supply of a complete range of T12âs Hemp Seed Food products. In addition, the company is also engaged in discussion with its Vietnamese partners to consider the supply of other products, including Hemp Seed oils, seed, flour, hemp milk, and protein.

On 13 September 2019, CGB last traded at A$0.034, with no change from the previous close.

Cann Group Limited (ASX: CAN)

Recently, on 27 August 2019, the company had released full-year results for the period ended 30 June 2019. Year-on-year revenue growth for the period stood at 182.72%, and total revenue was clocked at $4.25 million from $1.5 million a year ago.

On its Outlook front, the company asserted that the development of the new Mildura facility remains a focus for the management team to operate the business in scale. Reportedly, Cann Group is progressing ahead to undertake debt funding for the completion of the facility.

Besides, the company anticipated commencing exports under the offtake agreement with Canada-based Aurora Cannabis. Presently, the company is assessing export pathways for a medicinal cannabis product.

GMP Capability (Source: CGB Full Year Presentation)

Additionally, the company would continue its progress to develop GMP product manufacturing capability with third-party operator â IDT Australia (ASX: IDT). The facility would allow the company to export GMP grade product, as well as supply for the domestic market.

Looking at the balance sheet, the company held ~$46.38 million in cash and cash equivalents at the close of the year.

On 13 September 2019, CANâs stock last traded at A$1.725, down by 0.862% relative to the previous close.

AusCann Group Holding Limited (ASX: AC8)

As announced by AusCann Group on 12 September 2019, it would be hosting an audio Investor Webinar on Wednesday 25 September, as reported by the company. Besides, the company had released an Investor Presentation a day before on 13 September 2019.

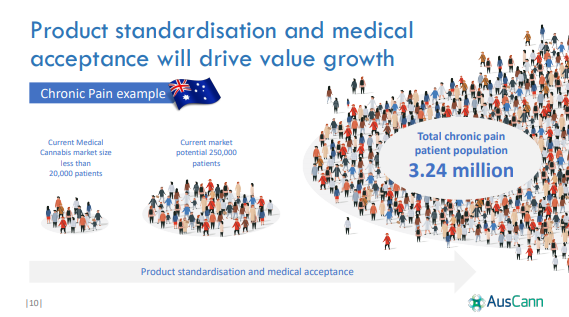

According to the presentation, AC8 is purely focused on capitalising the persisting medicinal cannabis opportunities, backed by a strong domestic market. In Australia, the market is underpinned by a swift regulatory framework to allow cultivation and manufacturing of cannabis products in the country.

Besides, the company is focusing on chronic pain, which is the largest prescribed space for medicinal cannabis products. It further shed some lights on the facts which said, chronic pain treatment market is expected to exceed US$100 billion by 2024; also, sick days due to body pain around the world cost an estimated US$245 billion annually.

Chronic Pain Opportunity (Source: AC8 Investor Presentation)

Meanwhile, the company is on track to deliver CY 19 strategic priorities, including the first capsule to the market, raw material supply, product development, and disciplined capital management. In FY20, it intends to develop new products with the completion of new product development facility in Western Australia. Creating a scale of operation, and the development of clinical evidence will be prioritised as well.

On 13 September 2019, AC8 last traded at A$0.365, slipping by 1.351 percent from the previous close.

MGC Pharmaceuticals Ltd (ASX: MXC)

Recently, on 11 September 2019, the company reported that its Priority Offer & Shortfall Offer was oversubscribed with approx. $1.36 million received in applications. As a result, the company would be undertaking scale back to refund application monies, as the Priority Offer was to raise $1 million.

Reportedly, the company had issued approx. 5.85 million shares to Panax s.r.o as a consideration to acquire an additional 6.6% stake in Panax. The company had also issued 3.63 million shares as a part performance rights held by key employees of the company, excluding directors and related party.

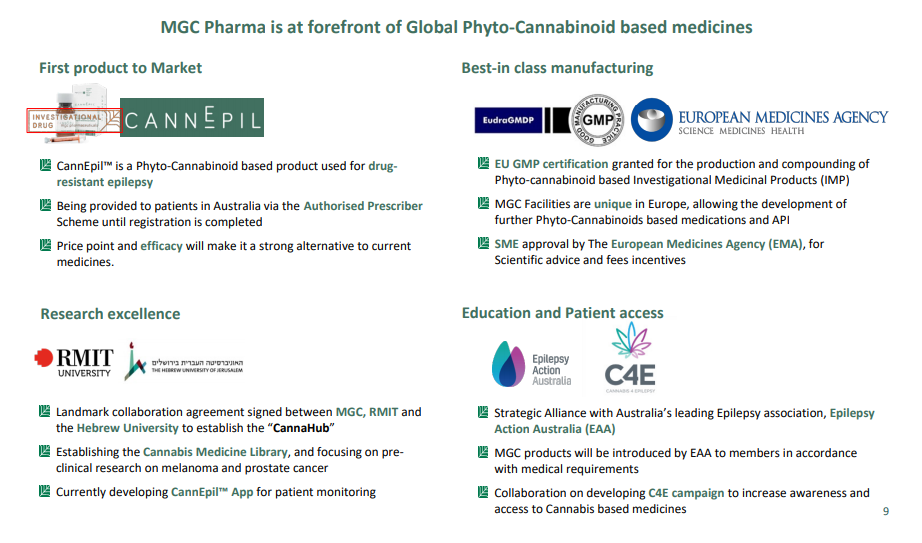

CannEpilTM (Source: MXCâs Presentation, April 2019)

Earlier this month, the company had notified on the approval received to conduct a clinical study on the severe intractable epilepsy. It will collaborate with Cannabis Access Clinics and Epilepsy Action Australia in conducting the study, and approval was granted by Human Research Ethics Committee (HREC).

Additionally, the study would compare the effectiveness of the companyâs CannEpilTM and MXP100 for the treatment of epilepsy.

On 13 September 2019, MXC was last quoted at A$0.04, without any change from the prior close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.