Technology stocks are the stocks of those companies that are engaged in the research & development of new technologies, or involved in the development, distribution and sale of goods and services related to technology.

In this article, we would be discussing five ASX-listed tech stocks, covering their recent developments, along with performance on the Australian stock exchange.

OneMarket Limited

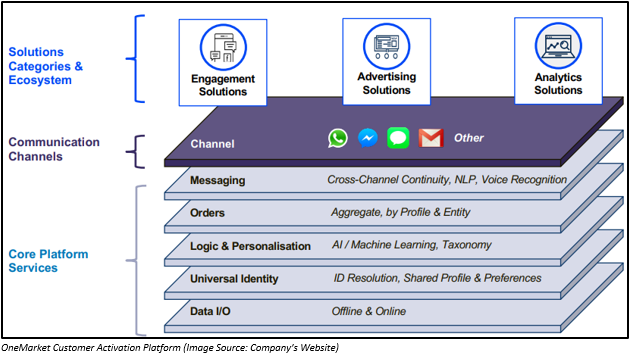

OneMarket Limited (ASX: OMN) is a leading player in customer data management and activation, enabling mid-sized as well as evolving retailers to acquire new clients and significantly improve the lifetime value of existing customers.

Completion of Strategic Optionsâ Review

On 30 September 2019, OneMarket Limited announced the completion of the review of its strategic options, as unveiled by the company at the AGM held on 28 August 2019.

Mr Steven Lowy, the Chairman of OneMarket Limited in the AGM, highlighted that the board has been working proactively on reviewing options during most of the current financial year to boost the value of shareholders. When the review was started, the companyâs shares were trading at a materially low price than the price as on 30 September 2019. The background to the strategic review was that OMN was an early stage technology start-up with a higher risk profile linked to such ventures.

Since the company demerged from the Westfield Corporation and got separately listed on the ASX in June 2018, OMN made various adjustments to its operations in order to reduce expenditure as well as realign short-term priorities.

As part of the strategic review, the company has now considered a complete range of options for improving shareholdersâ value. These options include the sale of the assets of OMN, introduction of a significant new business partner/equity investor along with other opportunities to either improve or realise the value of OMN. The company received interest from various parties; however, none of them resulted in a firm proposal that the board believes could be secured through an orderly winding-up of the OneMarket group and return of the remaining surplus to shareholders.

As a result, the company has decided to proceed with an orderly winding-up of OMN, depending on the shareholder approvals. It would also be seeking to get delisted from ASX. Also, net assets of the company would be distributed to shareholders as soon as practicable, as part of the proposal.

Meanwhile, the company would be looking for options through which it could realise the value for its assets, subject to shareholder approvals. The company expects that there would be two distributions. The first distribution would be within the three months of the EGM, depending on shareholder approvals, and the other distribution would be after the completion of the winding-up process.

Stock Information:

The stock of OMN was trading at a price of $0.925 on 3 October 2019 (AEST 12:05 PM), down by 1.07% from its previous closing price. OMN has a market capitalisation of $97.17 million and approximately 103.93 million outstanding shares. On a year-to-basis, the stock has delivered a return of 64.04%.

Dreamscape Networks Limited

Listed on ASX in 2016, Dreamscape Networks Limited (ASX: DN8) is engaged in multifaceted business activities, including provision of domain name, hosting and online services and solutions. The company, through its online solutions, aids businesses in building, growing as well as managing their online presence successfully.

FY2019 Annual Report

On 30 September 2019, Dreamscape Networks Limited released its annual report for the year ended 30 June 2019.

The company during the year delivered strong profit results, with positive contributions from the region of South East Asia as well as from the underlying business in Australia.

FY2019 Highlights:

- There was an increase of 19% in bookings to $77.7 million.

- Revenue for FY2019 soared by 21% to $74.3 million.

- Adjusted EBITDA stood at $14.9 million.

- The company also completed the transition of global headquarters to Singapore.

- DN8 reported a net profit of $5.647 million.

- Net assets of the company improved from $12.621 million in FY2018 to $18.406 million in FY2019.

- Net cash and cash equivalents at the end of FY2019 stood at $7.102 million.

- Progressing well with the integration of its recent acquisitions and operations, the company expects full-year benefits to be realised in FY2020.

Stock Information:

The stock of DN8 last traded at a price of $0.265 on 30 September 2019. DN8 has a market capitalisation of $103.26 million and approximately 389.65 million outstanding shares. On a year-to-basis, the stock has delivered a return of 227.16%.

Envirosuite Limited

Environmental management technology company, Envirosuite Limited (ASX:EVS) was listed on the ASX in 2008. The company offers access to a leading solution-as-a-service that is capable of translating data into action in real-time.

Deal for Launch in China

On 6 September 2019, Envirosuite Limited signed a transformational binding contract to introduce the company in China, which is the largest market for its solutions, globally. The company collaborated with Mr Zhigang Zhang, who is among the most renowned leaders in China in the environmental protection sector.

Stock Information:

The stock of EVS was trading at a price of $0.320 on 3 October 2019 (AEST 12:08 PM), down by 4.478% from its previous closing price. EVS has a market capitalisation of $132.56 million and approximately 395.7 million outstanding shares. On a year-to-basis, the stock has delivered a return of 431.75%.

CSG Limited

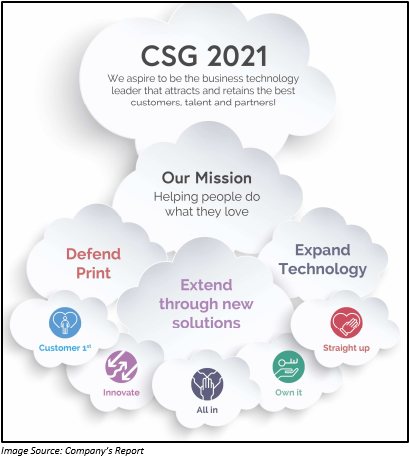

CSG Limited (ASX: CSV) is a publicly listed player that has more than 30 years of experience in offering IT managed services as well as office IT solutions to the Australian and New Zealand markets. Focusing on the small-to-medium enterprise (SMEs) customers, the company offers solutions such as print, display, cloud-unified communications and contact centre solutions. All the solutions are offered âas a subscriptionâ.

FY19 Performance Highlights:

- The company in FY2019 delivered an EBITDA growth of 71% to $17.1 million as compared to FY2018. The reported EBITDA growth was in line with the company guidance.

- The company made eight key appointments.

- Revenue declined by 3% to $217.6 million during the year, highlighting the companyâs focus towards generating sustainable and profitable revenue.

- Underlying NPAT for FY2019 was $5.7 million, up 148% year-on-year.

- Subscription revenue up 17%.

- Cash and cash equivalents at the end of the reported year stood at $26.56 million.

- The company also rolled out the CSG 2021 Program with a new vision, mission, strategy and values.

Stock Information:

The stock in the last three months has given a positive return of 84.29%, while on a year-to-basis, the stock has delivered a return of 46.87%. Moreover, on 1 October 2019, the company reached its 52 weeks high. The stock was trading at a price of $0.225 on 3 October 2019 (AEST 12:09 PM). CSV has a market capitalisation of $105.58 million and approximately 449.26 million outstanding shares.

Structural Monitoring Systems Plc

Based in Claremont, Western Australia, Structural Monitoring Systems Plc (ASX: SMN) is engaged in the design and production of electronic products as well as the provision of manufacturing services to the aviation industry.

FY2019 Annual Report:

On 1 October 2019, Structural Monitoring Systems Plc released its annual report for FY2019 ended 30 June 2019. The companyâs revenue from ordinary activities increased by 120% to $16.380 million. The company made a loss of $4.027 million, compared with $3.89 million in the prior corresponding period.

Balance sheet of the company witnessed a fall in net assets from $13.477 million in FY2018 to $12.378 million in FY2019. Net cash outflow from operating activities increased from $1.200 million in FY2018 to $1.957 million in FY2019. Net cash outflow from investing activities declined from $11.215 million in FY2018 to $229,991 in FY2019 and net cash inflow from financing activities declined from $12.768 million in FY2018 to $192,348 in FY2019. By the end of FY2019, net cash and cash equivalents stood at $1.561 million.

Stock Information:

The stock of SMN was trading at a price of $0.880 on 3 October 2019 (AEST 12:21 PM), down 5.376% from its previous close. SMN has a market capitalisation of $107.6 million and approximately 115.7 million outstanding shares. On a year-to-date basis, the stock has delivered a negative return of 8.82%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.