What is Shorting or Short Selling?

Shorting means to sell the asset class/investment at the prevailing prices, and gain from the anticipated fall in the price of that particular asset class/investment. Besides, it may be used as a hedge for other risks as well.

Shorting requires an investor to borrow shares or securities and return them afterwards. The tenure of borrowing could vary from contract to contract. Besides, the borrowing of shares and securities is facilitated by market participatants, including brokers.

Shorting may lead to unlimited loss, as there is no cap on the upside movement of any stocks of shares. Profit is realised when the price of the security falls against the price at the security was borrowed from the broker.

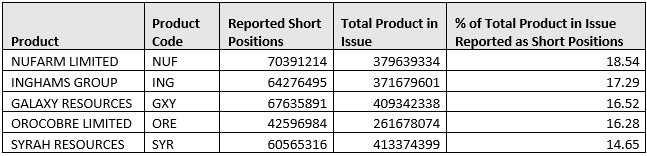

Australian Securities Investment Commission (ASIC) publishes report on short sales and related data. Below table reflects the latest data available on the ASICâs website, and these five companies are most shorted, as per the latest available data as of 30 August 2019.

Top Five Shorted Stocks as of 30 August 2019 (Source: ASIC)

Nufarm Limited (ASX: NUF)

Nufarm Limited develops solutions for seed & crop protection for the agricultural industry. It has presence in Australia, New Zealand, Asia, Americas, and Europe.

At 18.54% in short position out of the total product in issue, NUF is the most shorted stock, according to ASIC short selling report as of 30 August 2019.

In early August this year, the company raised $97.5 million through an issue of preference securities to an existing shareholder, and strategic business partner â Sumitomo Chemical Company Limited.

Some of the key terms of the transactions include:

- An option to exchange the securities with Nufarm shares at Sumitomoâs election any after two years at an exchange price of A$5.85 per Nufarm share.

- Nufarm has an option to purchase the preference securities from Sumitomo at any quarter after the issue for a consideration of full principal amount outstanding at that time along with any unpaid distributions.

- Preference securities are bearing a fixed interest of 6% for the first year, and 10% subsequently. In case, when distributions are not paid on the preference capital, Nufarm may not declare a dividend payment to ordinary shares or step-up securities until all distributions are paid on the preference capital.

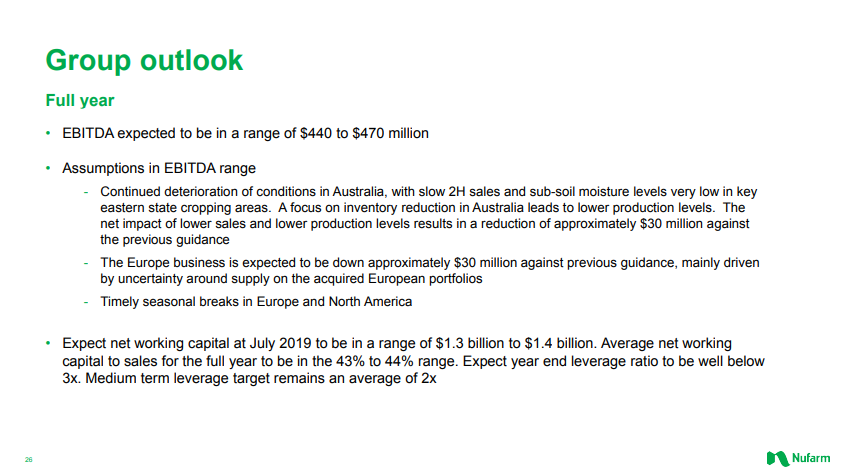

Reportedly, the company expects to report underlying EBITDA of around $420 million for FY2019, this was revised from previous range of $440 million to $470 million. The guidance downgrade is attributed to adverse impacts by weather conditions and supply issues.

Previous Outlook (Source: NUFâs Interim Results Presentation)

More specifically, the flooding conditions in North America and prolonged dry conditions in Australia has reduced the demand for crop protection products. Besides, the supply issues are being faced from China in a range of products attributing to higher costs, and lower than expected sales from the European business.

On 6 September 2019, NUFâs stock last traded at A$4.99, up by 2.464% relative to the previous close.

Inghams Group Limited (ASX: ING)

Poultry Retailer, Inghams Group deals in production and sales of chicken & turkey products across its vertically integrated business.

At 17.29% in short position out of the total product in issue, ING is the second most shorted stock, according to ASIC short selling report as of 30 August 2019.

Recently, the group reported that Bio Security New Zealand had become aware of possible detection of a poultry virus â Infectious Bursal Disease Virus type 1 in a layer egg farm in Otago, South Island of New Zealand.

Meanwhile, there was no suggestion that the virus has infected any chicken meat farm in the country, and all of the Inghamsâ farms are located in the North Island, which is geographically separated from South Island layer egg farms.

Reportedly, the company does not have any layer egg farms, and its farms are not affected. Besides, the company has biosecurity control in place at its farm to tackle any kind of problems. Inghams business in New Zealand has small export composition to countries other than Australia, which is not material toward its New Zealand business.

New Zealand Business (Source: ING Full Year Results Investor Presentation)

Meanwhile, Biosecurity Security New Zealand is not issuing certificates to export chicken meat to the countries that require guarantee that New Zealand is IBDV type 1-free, which includes Australia as well. The company would keep the market updated, if the development would have any impact on its New Zealand business.

On 05 September 2019, INGâs stock was last traded at A$3.26, up by 4.823% from the previous close.

Galaxy Resources Limited (ASX: GXY)

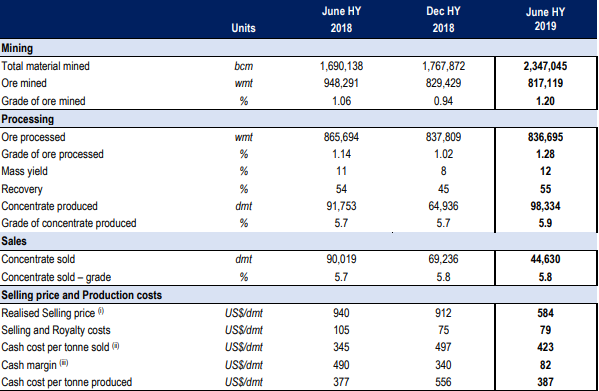

Recently, the company had released half-year results for the period ended 30 June 2019. Reportedly, the company produced a total of 98,334 dmt in H1 FY2019, up by 7% on previous corresponding period.

At 16.42% in short position out of the total product in issue, GXY is the third most shorted stock, according to ASIC short selling report as of 30 August 2019.

Meanwhile, the revenue was US$28 million, down from US$88.4 million in the previous corresponding period. Revenue was majorly impacted due to lower realised selling price and lower sales volume compared to H1 2018. The realised price was down 38% compared to previous corresponding period, and 36% compared to H2 2018.

Mt Cattlin Results (Source: GXY Half - Year Report)

Besides, the company had a non-cash write down and impairment of US$176.8 million during the year. At Mt Cattlin, the company had written down US$13.6 in inventory, and impairment in property plant & equipment was at US$123.5 million. US$39.7 million worth deferred tax assets were derecognised.

Subsequently, the company recorded net loss after tax of US$171.9 million compared to profit of US$11.5 million. In H1 2019, the company sold a tenement package for US$271.6 million to POSCO and invested A$22.5 million in Alita Resources (ASX: A40), as a part of strategic investment. Further, the company subscribed for the entitlement in the Lepidico (ASX: LPD) rights issue of A$1.2 million.

On 6 September 2019, GXYâs stock last traded at A$1.105, up by 4.739% from the previous close.

Orocobre Limited (ASX: ORE)

Recently, Orocobre had appointed Mr Hersen Porta as the Chief Operating Officer, responsible for managing both the Olaroz Lithium Facility & Borax Argentina S.A. Mr Porta is a graduate from Universidad Tecnológica Nacional in Rosario City and Babson College in Massachusetts, USA.

At 16.28% in short position out of the total product in issue, ORE is the fourth most shorted stock, according to ASIC short selling report as of 30 August 2019.

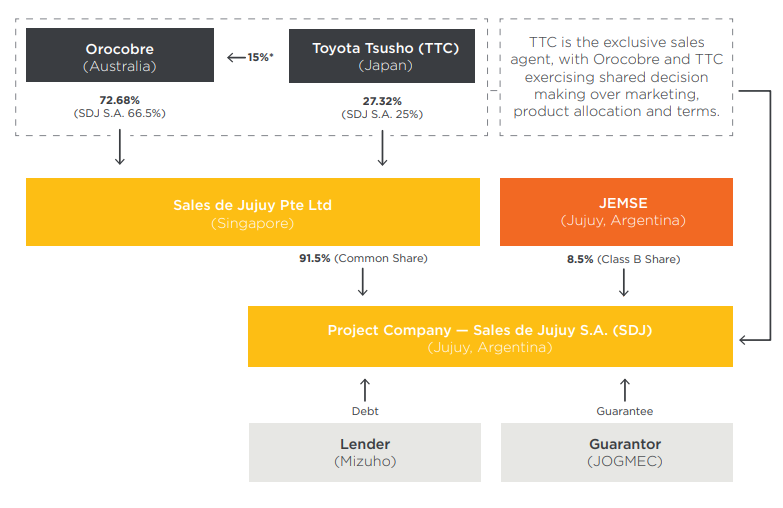

Recently, the company released full-year results for the period ended 30 June 2019. Accordingly, the group recorded net profit after tax of US$54.6 million compared to US$1.9 million in FY2018. The net profit included a one-off non-cash gain on business combination of US$30.7 million, and amortisation of US$3.7 million net of tax on fair value uplift for finished goods.

Orocobre Structure (Source: OREâs 2019 Annual Report)

Meanwhile, the revenue of the group was US$81.14 million for the period compared to revenue of US$17.37 million in FY2018. Besides, the average price of lithium carbonate for the year was US$10,322/tonne compared to US$12,578/tonne.

On 6 September 2019, OREâs stock last traded at A$2.52, up by 4.132% from the previous close.

Syrah Resources Limited (ASX: SYR)

On 5 September 2019, Syrah Resources reported that Chief Legal Officer and Company Secretary, Jennifer Currie has taken maternity leave for a minimum period of six months. The company has appointed Melanie Leydin as Company Secretary for the period. A few days earlier, the company had appointed Stephen Wells as Chief Financial Officer.

At 14.65% in short position out of the total product in issue, SYR is the fifth most shorted stock, according to ASIC short selling report as of 30 August 2019.

Balama Graphite Operation

Syrahâs Balama Graphite plant is a tier 1 producing asset located in Cabo Delgado Province, Mozambique. In early August this 2019, the company presented at Diggers & Dealers. Accordingly, the company has been working on delivery of production improvement plan with a target of 82% flake graphite recovery by the end of 2019. Syrah has an operational focus on increased recovery and higher value products.

Meanwhile, Syrahâs weighted average price was influenced by product mix of flake sizes, carbon grade, delivery location and increased total market supply due to Balama ramp-up. Pricing is bespoke and bilaterally agreed with no centrally accepted clearing price.

Besides, Syrah is now the largest integrated graphite producer globally, and provides a strategic ex-China source of supply, as demand growth increases. Natural graphite demand growth supports Balama reaching full capacity; driven by battery anode material demand and the China market balance.

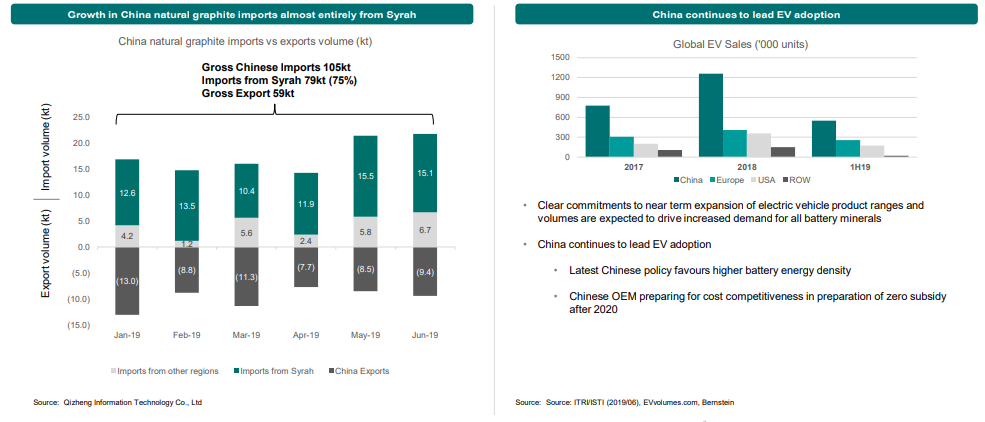

Graphite Import/Export (Source: SYRâs MD Presentation at Diggers & Dealers)

Further, China has emerged as a net importer of natural graphite for the first time in 2019 and exports are stable, demonstrating strong market growth. China has structurally changed the trade flow of commodities before; market balance and quality differentials would drive imports.

SYRâs stock was last quoted at A$0.705 on 5 September 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.