Financial businesses belong to the sector that offers a range of services such as retail and corporate banking, consumer, specialised and mortgage financing, insurance & financial advisory, and investment banking & brokerage.

In Australia, the financial services industry, a vital component of the economy, is characterised by a sophisticated, competitive and profitable structure. Major factors that are giving a boost to the Australian financial sector are:

- Consistent GDP performance for the past 25 years

- Overseen by a strong and proactive regulatory system

- Accelerating adoption of technology, as validated by the Australian Fintech sector

Historical low interest rate of 1% aimed towards lowering unemployment rate and boosting the economy to achieve the inflation target augers well for the financial sector, as it is directly going to get benefitted by the ensuing economic expansion. The current governmentâs pro-investor stance over taxation of franking credits is also benefitting the financial sector stocks, finding favour amongst dividend yield hunting investors.

The financial services industry in Australia is dominated by four major banks, Commonwealth Bank of Australia (ASX:CBA), Westpac Banking Corporation (ASX:WBC), National Australia Bank Limited (ASX: NAB), and Australia and New Zealand Banking Group Limited (ASX:ANZ). These Australian banks are ranked amongst the top 25 safest banks across the globe.

For income-minded investors, stocks offering dividend are the safe haven. Each of these banks are offering consistent dividend to their shareholders for the last many years. Additionally, these banks currently have an annual dividend yield of more than 5%.

Let us have a look at the dividend yield, dividend history and recent updates of these four major Australian banks listed on the ASX.

Commonwealth Bank of Australia

Scheduled to hold its annual general meeting on 16 October 2019 in Sydney, Commonwealth Bank of Australia is diligently working towards becoming a simpler, better bank in order to meet the customer needs in its core markets. The business areas in which the bank operates are retail banking services, business and private banking, institutional banking and markets, wealth management, ASB New Zealand and international financial services.

With an annual dividend yield of 5.25%, the CBA stock closed the dayâs trading at a price of AUD 81.690 on 16 September 2019, down 0.548% from its previous close. Commonwealth Bank of Australia has a market cap of AUD 145.41 billion and approx. 1.77 billion outstanding shares. In addition, the stock has delivered 2.14% and 12.44% in the last three months and six months, respectively, while the YTD return stands at 15.74%.

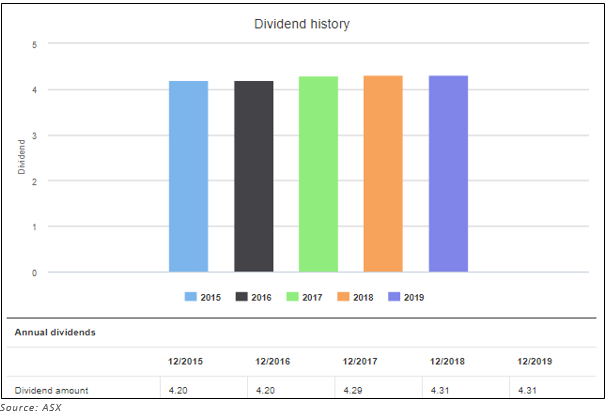

The dividend payout for the past five years (2015-2019), is as depicted below.

Subordinated notes Issue

CBA issued subordinated notes worth USD 2.5 billion on 12 September 2019. Of the total, USD 1.25 billion 3.610% subordinated notes are due in 2034, while the remaining USD 1.25 billion 3.743% subordinated notes are due in 2039.

CBA Performance in FY19

- On a statutory basis, the FY19 net profit after tax stood at AUD 8,571 million.

- On a cash basis, the FY19 net profit after tax was AUD 8,492 million.

- Common Equity Tier 1 (CET1) capital ratio was 10.7% at the end of June 2019.

- In July 2018, CBA sold Sovereign, the New Zealand life insurance business, for AUD1.3 billion.

- Full year dividend (fully franked) reached AUD 4.31 per share, including a final dividend of AUD 2.31 per share, which is scheduled for payment on 26 September 2019.

In August 2019, the bank completed the sale of its global asset management business, Colonial First State Global Asset Management (CFSGAM), for AUD 4.2 billion. CBA is expecting to close the sale of Count Financial in October 2019.

Westpac Banking Corporation

Catering to diverse banking needs at personal, business or corporate levels, Westpac Banking Corporation is focused on providing innovative financial packages. The bank is scheduled to hold its annual general meeting on 12 December 2019 at the International Convention Centre Sydney. The bank has an annual dividend yield of 6.33% as on 16 September 2019.

The WBC stock settled at a price AUD 29.540 on 16 September 2019, down 0.505% from its previous closing price. With a market cap of AUD 103.62 billion and approx. 3.49 billion outstanding shares, the stock has delivered 5.55% and 11.41% in the last three months and six months, respectively, while the YTD return of the stock stands at 21.28%.

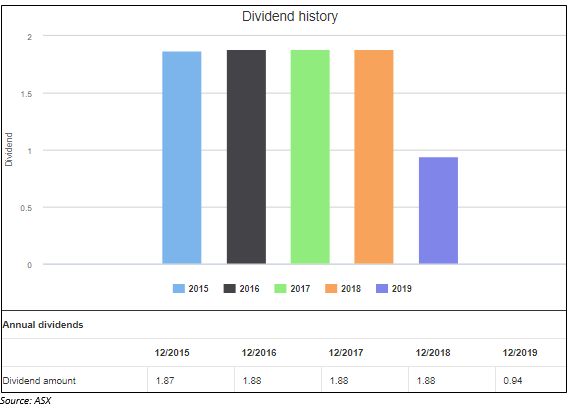

The dividend payout for the past few years (2015-2019), is as depicted below.

WBC CFO to Retire

In an ASX announcement on 12 September 2019, the bank unveiled that Mr Peter King would retire from his position of Westpac Group Chief Financial Officer in 2020. Having served Westpac for 25 years, Mr King has been the CFO since 2014, before serving as Deputy CFO. Mr King has given a notice of one year and would continue in his role until a successor is appointed after a global search.

H1 FY19 Highlights

During the six-month period ended 31 March 2019, the bank reported disappointing results, reflecting weaker business conditions. During the period, the bank dealt with outstanding issues such as remediation and reestablishment of its wealth strategy. For the reported period, the bank registered

- Revenue from ordinary activities of AUD 9.98 billion, down 10% year-on-year.

- Net profit of AUD 3.17 billion, down 24% year-on-year.

- Interim dividend (fully franked) stood at AUD 0.94 per ordinary share.

National Australia Bank Limited

Operating across Australia, New Zealand and around the world, National Australia Bank Limited is the largest business bank of Australia. The bank employs a staff of over 30,000 people catering to the needs of around 9 million customers at 900 + locations.

With an annual dividend yield of 6.24%, the stock of NAB closed the dayâs trading at AUD 29.130 on 16 September 2019, down 0.103% from its previous closing price. The bank has a market cap of AUD 84.07 billion and approx. 2.88 billion outstanding shares. The stock has delivered 8% and 15.99% in the last three months and six months, respectively, while the YTD return of the stock stands at 23.40%.

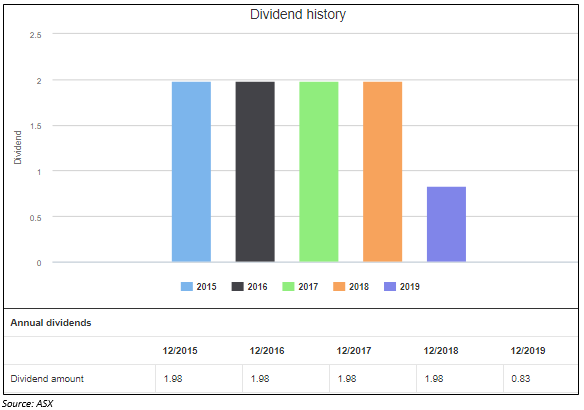

The dividend payout for the past few years (2015-2019), is as depicted below.

3Q FY19 Performance

National Australia Bank Limited registered solid performance during the third quarter of the financial year ended 30 June 2019 when compared with the 1H19 quarterly average, despite a challenging operating environment, including subdued home lending growth. For the concerned quarter, the bank reported

- Unaudited statutory net profit of AUD 1.70 billion

- Unaudited Cash earnings of AUD 1.65 billion

- Group Common Equity Tier 1 (CET1) ratio of 10.4%

- Leverage ratio (APRA basis) of 5.4%

New CEO and Group Chief People Officer

NAB announced in July 2019 the appointment of Ross McEwan as NABâs new Group Chief Executive Officer and Managing Director. Holding deep experience in international markets. Mr McEwan is expected to join the bankâs board no later than April 2020. His appointment is subject to regulatory approvals.

Additionally, the bank in late-July 2019 announced the appointment of Susan Ferrier as Group Chief People Officer, effective from 1 October 2019, subject to regulatory approvals. Ms Ferrier has served at various senior executive human resources roles, holding experience in Australia and overseas for multi-jurisdictional businesses.

Australia and New Zealand Banking Group Limited

Listed on ASX in 1969, Australia and New Zealand Banking Group Limited is a provider of banking and financial products and services, operating in and across more than 30 markets. The bank serves around 8 million individual and business customers.

With an annual dividend yield of 5.75%, the stock of ANZ closed the dayâs trading at AUD 27.600 on 16 September 2019, down 0.898% from its previous closing price. The bank has a market cap of AUD 78.94 billion and approx. 2.83 billion outstanding shares. The stock has delivered 3.92% in the last six months, while the YTD return of the stock stands at 16.72%.

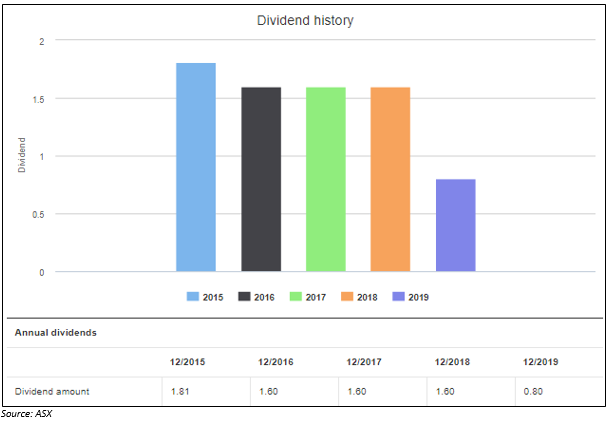

A snapshot of dividend paid over the last few years is as depicted below:

Changes to Company Secretary

On 13 September 2019, the bank announced the appointment of Ken Adams as a Company Secretary of ANZ, after Bob Santamaria and John Priestley ceased to be the bankâs company secretaries. Mr Adams was appointed as the new Group General Counsel on 21 May 2019, with his tenure effective from 19 August 2019.

Dividend Announcement

On 6 September 2019, ANZ announced an ordinary dividend of AUD 1.53050 (fully franked) per security related to a six-month period ending 1 March 2020, with a record date of 21 February 2020 and payment date of 2 March 2020.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.