The vitality of trade finance in todayâs contemporary world is massive. It plays a crucial role in effective and efficient functioning of trade, simply because it makes import and export transactions possible for organisations, be it a small business excited to debut with its first private-label product from overseas, or an MNC which has been extensively importing or exporting large amounts of inventory from around the world through the year.

What is Trade Finance?

Accounting for 3 per cent or almost $3 trillion annual global trade, the umbrella term of trade finance, which is a commercial activity, can be best expressed as the process of financing activities which are related to commerce and international trade. It is the financing of trade in a business life cycle- export and import of goods, commodities and services. This means that trade finance concerns both the international and national trade transactions and caters to both parties of trade- the buyer and the seller, making it both possible as well as easy for them to transact the business. The transactions are facilitated by intermediaries in the form of banks and financial institutions. Trade financing is often interchangeably expressed as supply chain and export finance.

The Evolution

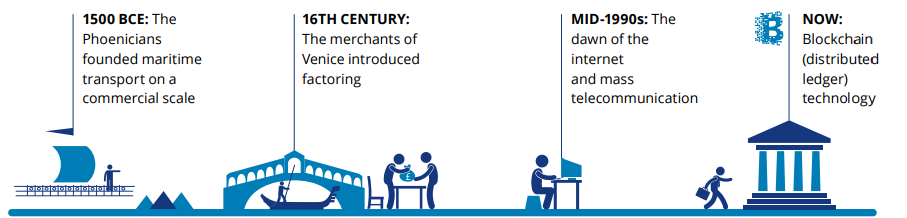

The financial sector has been a hot spot of innovation over the years. Be it the SWIFT (Society for Worldwide Interbank Financial Telecommunication) messaging network of the 1970s, or the dematerialization of stocks and bonds in 1980s, followed by the central counter party clearinghouses of 1990âs. Trade has come a long way, and is still evolving in this tech-savvy world. Today, we are pioneers of technology as a globe, with concepts of artificial intelligence, blockchain, robotics and machine learning breaking barriers and setting record by each passing day. Automation of banks and availability of DLTs (Distributed ledger technologies) has been promising and is moving very fast.

Evolution of Trade Finance (Source: Deloitte)

The Process

Trade finance is the financing mechanism that is important to bridge the time lag between a productâs shipment from one market and its arrival and inspection in another. Ideally, exporters wish to be paid when goods are shipped whereas importers do not wish to pay before they receive the merchandise. The process might be considered as a complex transaction, given the parties and days involved, but once the gap is addressed, every risk is minimised.

The process of trade finance involves parties including the seller and buyer, the trade financer, responsible export credit agencies, and the insurer parties. Middlemen in the form of banks and financial institutions facilitate and oversee the transactions, which could occur nationally or internationally via activities like issuing letters of credit, lending, forfaiting, export credit and financing, and factoring.

Benefits

Considering the fact that trade finance is the lifeblood of most cross-border business transactions, it comes with a hoard of benefits. Some of them are discussed below:

- Increases the working capital and facilitates cash flow management, allowing companies to have effective control over the running costs of business.

- The finance facilities aid in strengthening the relationship between the seller and buyer and provides the opportunity to better profit margins and EBITDA.

- It is a big catalyst in promoting trade relations across the globe and business diversification, encouraging healthy competition and creating efficient supply chains.

- Eases the pressure of bankruptcy and related risks.

- Drives economic development and helps in adhering to the flow of credit in supply chains.

- Beneficial for the developing countries, governments and SMEs together.

- Reduces the risk of bad debts, credit and payment risks on suppliers.

5 Facts You Cannot Miss

Mentioned below are 5 interesting facts about trade finance that cannot miss any financial enthusiastâs eye:

- Global trade volumes have grown steadily since 2016 and the global trade at present is worth approximately $16 trillion.

- According to the World Trade Statistical Review 2019, the trade finance market is vastly sizable of the $23 trillion worth of goods which require a payment guarantee, a loan or a credit insurance to cross borders.

- Trade finance markets have been relatively concentrated with approximately 30 to 40 global banks operating global networks of distribution, facilitating the smooth supply of trade finance anywhere across the globe.

- Post the Global Financial Crisis of 2008-2009, about 200,000 of correspondent banking relationships, which linked banks to developing countriesâ banks, have disappeared out of a pre-crisis, total of approximately 1 million.

- In July 2019, there was a vast trade finance gap of $1.5 trillion existing, challenging the regulatory compliance and the efforts made by international organizations, as per WTO and IFC.

The Crisis Of The Hour- US and China Trade War

In the context of trade finance in the current times, the ongoing China and the US complexity cannot be unseen. The fears of this trade war between both the worldâs biggest economies, America and China, prompted a global sell-off at the end of last year and continues to worry global economies with the gory consequences it might bear on the world economy.

President Trump had infused trade disputes with Americaâs trade partners, but the spectacle revolves majorly against China, where the waves of tariffs were almost half of the Chinese exports to the US (approximately $250 billion). In a counter-attack response, China hit back on almost $113 billion worth of US-based products. The trade wrangle over spread like wildfire in the global financial market and evoked a huge potential risk in the global economy.

Recently, in the G20 Osaka summit in June 2019, Mr Trump announced that he had agreed for a truce in the on-going dispute after trade talks with Chinese President Mr Jinpings. However, given the impact of the trade war, the market still predicts some uncertainties and believes that the upcoming American Presidential Election could be a probable decider of the issue.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.