The coronavirus (COVID-19) pandemic, which has by nowemerged as asignificant human misery and brought major economic disturbance, has shaken investors across the world. China, playing a crucial role as an intermediary, for the supply of goods worldwide, felt the effects of production cutbacks in the country.

With the outbreak of this deadly disease, causing global troubles in economic, educational, medical, and civic welfare, 5G access has become very crucial not only to keep the public informed but also enables people to work from home, help students to attend online classes and individuals to keep in touch with their friends and family despite social isolation.

The contagion has impacted both social and personal life of an individual. The commercial and economic effect is being sensed in sectors extending from shipping, transportation to retail& telecommunication.

The introduction of 5G telecom networks has been postponed by government measures to take necessary precautions to stop the spread of the coronavirus. Even China that had its main objective to transform 5G into a nationwide urgency is feeling the blow with 5G focus slowly fading out.

Wuhan, which is at the center of outbreak, has two of the leading providers of fiberoptic cable. In February this year, President Xi Jinping informed the market that 5G investment could probablyminimise the decline in consumer spending on the heels of COVID-19 crisis.

Covid-19 Cases Escalating WorldWide

Coronavirushas already infected above12,73,000 people all over the world and with more than 69,000 people dying globally till date. Though new cases of coronavirus substantially dropped in China — the epicenter of the outbreak — the infection is circulatingquickly to other countries, especially in Europe.

COVID-19 is caused by a Coronavirus family member, SARS-CoV-2 that has never been confronted in the past. What makes the situation worse is that there is still no cure for this disease. Till the time the drug makers find an antidote or a vaccine, the health officials have no other option but to issue restraint orders by curbing overseas travel, especially to countries like Japan, Iran and South Korea.

5G to Skyrocket beyond 2020

Amongst all the chaos and confusion, the world is facing right now, 5G is set to flourishbeyond 2020. The 5thgeneration mobile network is touted to change the way in which we connect with technology, which in turn aidcontinuous transfer of data and faster download speeds.

As per media sources, the average speed of 5G is expected to be 13 timesquicker than the average mobile connection, by 2023.

Worldwide, mobile operators are lookingatgrowing their foothold in 5G network footprint. By 2026, the worldwide 5G technology market is expected to attain $667.90 billion, as per marketresearch report.

5G implementation is on a rise, backed by higherconsumer demand for bandwidth in the midst of massive increase in video consumption and the ongoing digital transformation amid coronavirus crises.

5G boom is further expected to boost fast adoption of IoT and connected smart-based devices, as well asdeveloping applications like augmented reality, virtual reality and artificial intelligence.

Our Pick

We have highlighted three stocks that are in position to gain from the growing implementation of 5G technology amid coronavirus outbreak.

5G Networks Limited (ASX:5GN)

5G Networks Limited is involved in providing a broad range of digital business solutions. The Company aims for establishing a profitable digital world and deliver an end-to-end digital service for enterprises. The Company has its registered office in Melbourne and was listed on the ASX in 2017.

Release of Shares from Voluntary Escrow: On 3 April 2020, 5GN provided notice in line with Australian Securities Exchange Listing Rule 3.10A that 1,123,235 ordinary securities, subject to voluntary escrow arrangements, would be released from escrow on 21 April this year.

COVID-19 Update: On 2 April 2020, 5GN highlighted its business strategies to deal with the impact of COVID-19 crises.In doing so, 5GN Networks is focusing on health and safety of its employees and clients, along with confirming business continuity across its operations. The company has a strong pipeline with continuousfocus on developing innovative products and services that accelerate customers shift to cloud-based solutions. Moreover, the Company continues to generate positive operating cashflows, and remains funded with $4.2 million cash and $1.3M undrawn debt as at 31st March 2020.

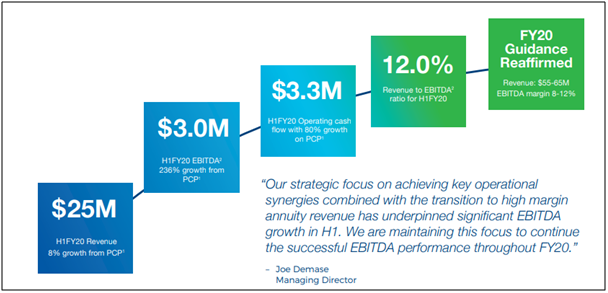

1HFY20 Financial Highlights for the period ending 31 December 2019: 5GN has recently released its interim results for the period ending 31 December 2019, wherein it reported a growth of 8% in revenue, which came in at $25 million. EBITDA for the period increased 236% and came in at $3.0 million. The Company’s strong financial performance was mainly due to the successful transition to higher margin annuity revenue. 5GN Network also reported operating cash flow of $3.3 million, indicating a rise of 80% on pcp.5GN cash and cash equivalents stood at $2.8 million at the end of 31 December 2019.

Key Financial Highlights (Source: Company’s Report)

Outlook: The Company has re-affirmed FY20 guidance and expects revenue to be in the band of $55 million to $65 million. 5GN remains on track to focus on successful EBITDA performance during FY20 and is also anticipating a growth of 8-12% in EBITDA margin. 5GN is planning stronger customer base with cross & upsell strategy and is aiming towards growth of infrastructure.

Stock Performance

On 6 April 2020, 5G Networks stock was trading at $0.855, (at AEST 12:38 PM)) up by ~7.547%. With almost 71.64 million shares outstanding, the Company’s market capitalisation stood at nearly $56.96 million.

Superloop Limited (ASX: SLC)

Superloop Limited is involved in offering telecommunications infrastructure and managed services. The company was listed on the ASX in 2015 and has its registered office in Brisbane.

Letter to Stakeholders: On 3 April 2020, SLC updated the market with a letter from its Chairman Mr Bevan Slattery addressed to the stakeholders. He mentioned that with the upcoming coronavirus impacts worldwide and the resulting market uncertainty, it was imperative for him to offer an interim update on the business operations amid the current times.

He added that SLC has been comparatively lucky with regards to conditions experienced till date, with effects observed in 2 major segments-

- A decline in Guest WiFi services as predicted in the Company’s updated guidance note dated 18February this year.

- A rise in wholesale IP transit and longer duration global capacity leases.

Also, during March 2020, SLC commenced various programs to speed up capital expenditure cuts and attain cost efficiencies as part of its lately executed program ‘Project Vulcan’.

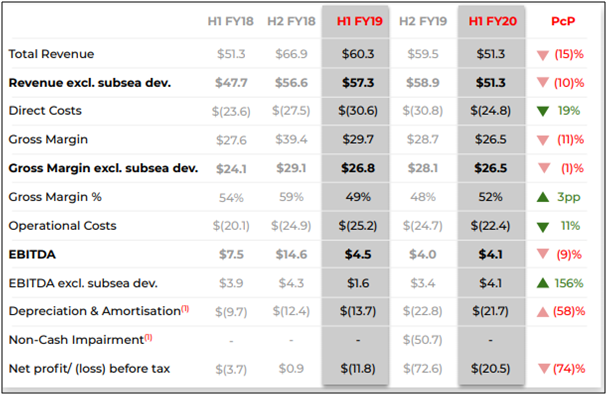

1HFY20 Financial Highlights for the period ending 31 December 2019: SLC has recently released its interim results for the period ending 31 December 2019, where in total revenue came at $51.3 million, a decrease of 15% year over year. Gross margin in dollar terms stood at $26.5 million, down 11% year over year. EBITDA for the period came in at $4.1 million, down from $4.5 million reported in the year-ago period. The decline was primarily due to lower subsea development margin, fixed wireless margin and high operating expenses.

The Company reported operating cash flows of $6 million for 1HFY20, up from $2 million in 1HFY19. The company exited the period with cash and cash equivalents $15.8 million, with total net debt amounting to $28.5 million.

Key Financial Highlights (Source: Company’s Report)

What to Expect: The Company expects underlying EBITDA to be in the band of $12-$15 million for FY20, indicating timing of delivery of contracts implementation and uncertainty relating to impact of coronavirus outbreak. Going forward, the Company expectsfocusing more on executing master service agreements, contracts and orders to provide higher connectivity and broadband services to consumers,in order to operational efficiency.

Stock Performance

Superloop Limited has a market cap of $235.98 million with ~ 365.87 million outstanding shares. Superloop Limited stock was trading at $0.65as on 6 April 2020, up by ~0.775% (at AEST 12:36 PM).

Telstra Corporation Limited (ASX: TLS)

Telstra Corporation Limited is involved in providingtelecommunications and information services, such as mobiles, internet, and pay television. TLS has recently reacted on COVID-19 impact and asserted that it is holding any further job reductions and is suspending late payment fees and disconnections, offeringsupport to small businesses.

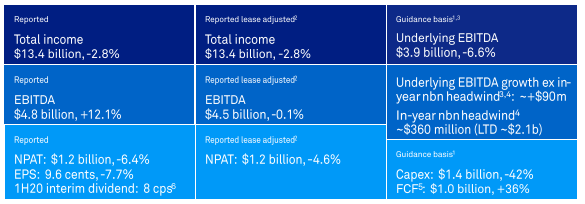

Growth in Customer Numbers a Key Catalyst: TLS has recently announced its interim results for the period ending 31 December 2019, wherein it reported a total income of $13.4 billion and NPAT of $1.2 billion. During 1H20, TLS continued to make solid progress in providing its T22 strategy and provided growth in customer numbers.

1H20 Financial Highlights (Source: Company’s Report)

What to Expect: COVID-19 has had a profound impact on business across the country and like many other companies it is likely to affect the business of TLS. The Company’s outlook remains within the range of its FY20 guidance and expects total income in the range of $25.3 to $27.3 billion. It also expects EBITDA to be at the bottom end of the range of $7.4 to $7.9 billion, and capital expenditure around the higher end of the range of $2.9 to $3.3 billion.

Stock Performance

Telstra Corporation has a market cap of $36.99 billion with ~ 11.89 billion outstanding shares. Telstra Corporation stock was trading at $3.125as on 6 April 2020, up by ~0.482% (at AEST 12:35 PM).