Usually to distribute profits, company pays dividends to its shareholders. The company has an option of whether to retain the surplus it has made in the year in the form of retained earnings or pay out a part of the profits to its shareholders in the form of dividends. Generally, how much dividend a company is going is to pay is decided by the board of directors of the company.

Generally, companies with large market cap are the best dividend payers as they have more predictable profits. These companies seek to maximize shareholders wealth apart from catering to normal business growth. High growth companies and start-ups do not usually pay dividends, because of their future growth opportunities and low level of disposable profits.

These large market cap companies are also known as âBlue-Chipâ companies, a term created from a renowned poker game, where the blue chip retains the highest value. These stocks are considered to be the best high-valued and long-term investment vehicles.

Blue-chip stocks are considered to be safe havens due to their stable performance even during an economic downturn. As these stocks are less volatile, they offer regular dividends to their shareholders. Blue-chip stocks may provide uninterrupted and increased dividends over time.

Letâs look at ten blue-chip dividend paying stocks.

BHP Group Limited (ASX: BHP)

BHP Group Limited is one of the top Australian minerals production, processing and exploration company with a market cap of $110.2 billion on 6th December 2019. As per ASX, the stock has given total returns of 2.89% in the time period of three months and is trading slightly above the average of its 52-week high and low prices. The stockâs P/E multiple was 16.340x on TTM basis with an annual dividend yield of 5.13%.

Guidance: The Pilbara shipment guidance for 2019 remains unchanged at 320 to 330 million tonnes, and cash unit cost remains at $14 to $15 per tonne for 2019. The sustaining capital expenditure is projected to be between $1 billion to $1.5 billion/year from 2020, as compared to the previous guidance of around $1 billion.

Rio Tinto Limited (ASX: RIO)

Rio Tinto Limited is engaged in the production of iron ore, gold, copper and other minerals with a market cap of $35.56 billion on 6th December 2019. As per ASX, the stock has given total returns of 6% in the time period of three months and is trading above the average of its 52-week high and low prices. The stockâs P/E multiple was 8.380x on TTM basis with an annual dividend yield of 4.91%.

The company has decided to cease operations at Richards Bay Minerals (RBM) located in South Africa. This is in order to protect the security and safety of its employees as a result of an increase in violence in communities near the operations.

Macquarie Group Limited (ASX: MQG)

Macquarie Group Limited acts as a NOHC (Non-Operating Holding Company) for the consolidated entity that offers financial advisory services, banking, funds management and investment services. The company had a market cap of $47.33 billion on 6th December 2019. As per ASX, the stock has given total returns of 6.31% in the time period of three months and is trading above the average of its 52-week high and low prices. The stockâs P/E multiple was 14.600x on TTM basis with an annual dividend yield of 4.52%.

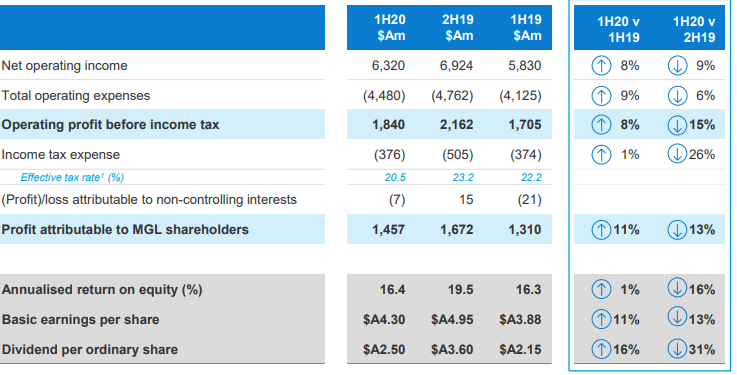

For 1H20, Macquarie reported NPAT of $1,457 million up by 11% on 1H19. MQG also announced a 40% franked interim ordinary dividend of $2.50 per share.

1H20 Results (Source: Companyâs Report)

CSL Limited (ASX: CSL)

CSL Limited is engaged in the manufacturing, development and marketing of diagnostic and pharmaceutical products, human plasma fractions and cell culture media with a market capitalisation of $126.04 billion on 6th December 2019. As per ASX, the stock has given total returns of 16.12% in the time period of three months and is trading above the average of its 52-week high and low prices. The stockâs P/E multiple was 46.520x on TTM basis with an annual dividend yield of 0.95%.

CSL Provides Update on its R&D Pipeline

CSL Limited is slowly expanding its Research & Development capabilities and pipeline to deliver a highly diversified product portfolio and focus on a broader range of patientsâ unmet needs.

- The company is building its leadership in plasma therapies by identifying emerging new medicines;

- To support this approach, CSL has forged targeted innovation partnerships near its R&D locations;

- CSL also released details on progress for a novel treatment of asthma, which has advanced to Phase 1 trials.

Commonwealth Bank of Australia (ASX: CBA)

CBA is one of Australiaâs leading providers of financial services with more than 17.4 million customers with a focus on retail and commercial banking. CBA had a market cap of $139.18 billion as on 6th December 2019 and as per ASX, the stock has given a total return of -0.69% in the time period of three months and is trading above the average of its 52-week low and high prices. The stockâs P/E multiple was 16.270x on TTM basis with an annual dividend yield of 5.46%.

Outlook

The bank believes its operating context to remain challenging as it adapts to heightened regulatory changes, increasing competition, evolving customer preferences and the need to invest in risk and compliance and in technology and innovation. However, the Bank is well-positioned to navigate through this challenging environment, on the back of a strong balance sheet, resilient customer base and leading distribution and digital assets.

Woolworths Group Limited (ASX: WOW)

Woolworths Group Limited mainly operates in New Zealand and Australia with about 3,292 stores and provides retail operations across Australian food, endeavour drinks, New Zealand food, Big W and hotels. Woolworths has a market cap of $47.95 billion as on 6th December 2019 and as per ASX, the stock is trading above the average of its 52-weeks low and high prices. The stock has given total returns of 19.69% in the time period of six months. The companyâs P/E multiple stood at 18.600x on TTM basis with an annual dividend yield of 2.66%.

Brad Banducci, the CEO of the company, has decided to skip his FY20 short term bonus of $2.6 million and the group chairman has also decided to take a 20% reduction in fees for FY20.

Wesfarmers Limited (ASX: WES)

Wesfarmers Limited is engaged in diversified industrial with interests including retail operations covering home improvement and office supplies with a market capitalisation of $46.37 billion as on 6th December 2019. As per ASX, the companyâs stock is trading higher than the average of its 52-week low and high prices and has gained 3.46% in the time period of three months. The companyâs P/E multiple stood at 8.40x on TTM basis with an annual dividend yield of 4.35%.

Telstra Corporation Limited (ASX: TLS)

Telstra Corporation Limited offers facility of telecommunications and information services, including pay television, internet and mobiles with a market cap of $43.89 billion as on 6th December 2019. As per ASX, the stock is trading above the average of its 52-week low and high prices and has gained 2.79% in the time period of three months. The stockâs P/E multiple stood at 20.440x on TTM basis with an annual dividend yield of 2.7%.

Woodside Petroleum Ltd. (ASX: WPL)

Woodside Petroleum Ltd. is engaged in operations and management of hydrocarbon development, transportation, exploration, production, and marketing and also completion and operation of the North West Shelf Gas Project. The company has a market cap of $31.63 billion as on 6th December 2019. As per ASX, the companyâs stock is trading near the average of its 52-weeks low and high prices and has given total returns of 5.87% in the time span of three months. The companyâs P/E multiple stood at 17.470x on TTM basis and with an annual dividend yield of 5.35%.

On its investor briefings day, the company provided a narrowed production guidance of 89 to 91 MMBoe for 2019 and the company is expecting production growth of 6% CAGR in the time period from 2019 to 2028.

National Australia Bank Limited (ASX: NAB)

National Australia Bank Limited offers leasing, banking services, credit and access card facilities, housing and general finance services with a market cap of $73.26 billion as on 6th December 2019. As per ASX, the stock is trading near the average of its 52-week high and low prices and has corrected 8.43% in the time period of three months. The bankâs P/E multiple stood at 14.810x on TTM basis and its annual dividend yield is 6.53%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)