The RBA had lowered its cash rate by 25 basis points to 0.75 percent during October 2019. The decision to lower its cash rate was mainly due to technology disputes and US-China trade war which is affecting the international trade flows. The Australian economy increased by 1.4 percent over the year 2019 in the June quarter, which was lower than expected.

Generally, when the bank lowers the cash rate, the interest rates fall. It gives rise to an increase in spending. As the spending increases, businesses also increase their production, which leads to an increase in employment and economic activity. When the employment increases, the demand increases which lead towards an increase in inflation.

Let us now have a look at the two banking stocks:

Bank of Queensland Limited (ASX: BOQ)

Bank of Queensland Limited (ASX: BOQ) is one of the leading regional banks in Australia, operating several brands engaged in offering a diverse range of products and services, catered towards individual and business customers.

The bank is operating in a low growth part of the cycle with increased regulatory and compliance costs, growing investment requirements, accelerating industry disruption and competition, declining margins and increased community expectations.

Its performance during the financial year 2019 ended 31 August 2019 was not as per the expectations and reflected a difficult operating environment.

BOQ Successfully Raises $90 million from Shareholders

Bank of Queensland’s Share Purchase Plan (SPP) was well supported with the bank receiving application for about $90 million from shareholders and the issue price per new fully paid ordinary share under the SPP will be $7.27 per share.

· Due to the strong support for the SPP received, the bank has decided to accept all valid applications from Eligible shareholders;

· The new stock will be issued on January 2 and start trading on January 3.

Disappointing Results in FY19

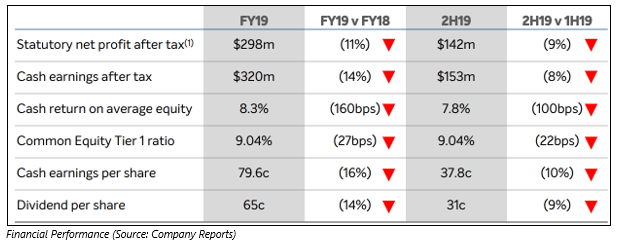

The FY19 statutory net profit after tax of the bank decreased by 11% from FY18 to $298 million, and cash earnings after tax declined by 14% to $320 million. During the reported period, cash return on equity also registered a decline to 8.3%, while common equity tier one lowered at 9.04% and cash earnings per share stood at 79.6 cents, which represented a drop of 16% from the year-ago period. The bank attributed these reductions to factors including a large jump in loan impairment expense, lower income, and higher operating expenses.

The disappointing financial performance of Bank of Queensland shows the deterioration across all these metrics in the second half relative to the first half. This, combined with the decision to reduce the dividend, highlights the challenging environment mainly in the past six months.

The dividends declared were in line with the reduction in cash earnings per share. The bank declared second half dividend of 31 cents, resulting in a full year dividend per share at 65 cents, which represented a reduction of 14% when compared with the same period a year ago.

Loan impairment expense increased by $33 million to $74 million, or 16 basis points of gross loans, which includes several one-off impacts. Although, the underlying asset quality remains sound with arrears at low levels.

On the positive side, total lending went up by $937 million, or 2%, with the first half slightly stronger, primarily driven by the Business Bank, with mortgages underperforming. The net interest margins of the bank went down by five basis points when compared with the prior corresponding period, with most of the reduction evident in the first six months of FY19. The total income posted a decline of 2% and operating expenses grew by 4%, with cost to income ratio increasing to 50.5% for the year and higher in the last six months.

Outlook for FY20

FY20 might prove to be a challenging year for BOQ.

· The bank is expecting a lower year-on-year cash earnings in the financial year, with revenue and impairment outcomes in line with FY19; however, subject to market conditions;

· MOQ also expects higher post-Hayne regulatory and compliance costs and increased operating expenses related to its investment in technology.

Many challenges remain for the bank such as regulatory changes, customer and technology behaviour and the broader economic challenges that the sector is facing. However, according to Bank of Queensland, based on a clear and focused strategy, there are good opportunities for the bank that would enable in capitalising on and again returning to profit.

Bank’s Performance

The stock of BOQ closed the day’s trading at $7.250 per share on 31st December 2019, down by 1.762% from its previous closing price. The bank has a market capitalisation of $3.26 billion as on 31st December 2019 with an annual dividend yield of 8.81%. The total outstanding shares of the company stood at 442 million, and its 52-week low and high is $7.110 and $10.770, respectively. The stock has given a total return of -25.60% and -22.40% in the time period of 3 months and 6 months, respectively.

Australia and New Zealand Banking Group Limited (ASX: ANZ)

Australia and New Zealand Banking Group Limited (ASX: ANZ) provides banking and financial products and services to individual and business customers.

Business Performance for Full Year

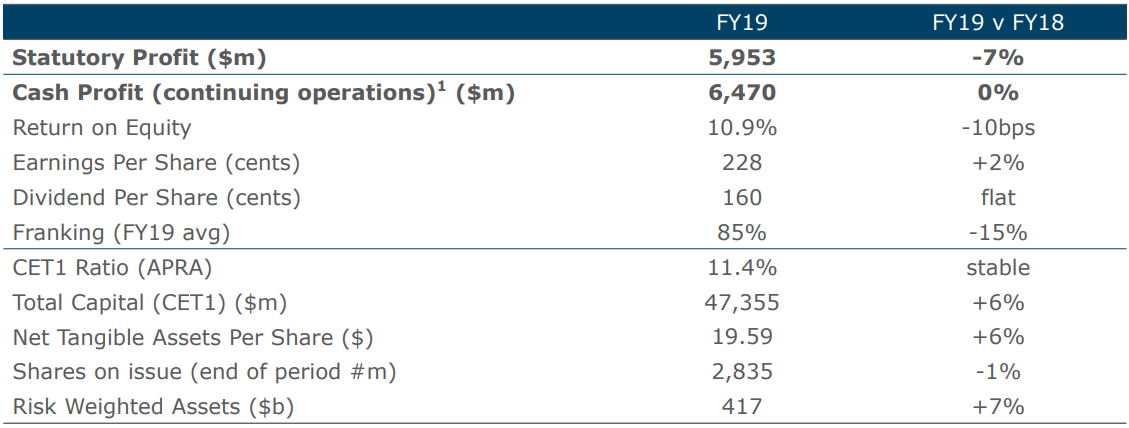

The bank reported statutory profit for the full year of $6 billion, down by 7% due to lower interest rates, intense competition and slower credit growth. The cash profit for the year stood at $6.5 billion, no change as compared to previous year. On the positive note, cash earnings per share grew by 2% to 228 cents mainly due to the capital management actions taken in past years. The bank paid final dividend of 80 cents per share franked at 70%, taking the whole year dividend to 160 cents mainly because of strong capital ratios.

Financial Results (Source: Company’s Report)

Appointment of New CEO

The bank has announced that it has appointed Antonia Watson as the company’s Chief Executive Officer, and she will also be a Director of ANZ NZ.

· She has received a non-objection from the Reserve Bank of New Zealand, has been ANZ NZ’s Acting CEO since May;

· As ANZ NZ CEO she will sit on ANZ Banking Group‘s Executive Committee and will also have responsibilities for the Pacific;

· Ms Watson joined ANZ NZ in 2009 as financial controller before becoming Chief Financial Officer in 2012;

· In 2017 she was appointed Managing Director Retail and Business Banking.

Outlook for FY20

The bank expects challenging trading conditions to continue in the near future, although the Australian housing market is slowly recovering. The Reserve Bank of New Zealand and APRA have both announced the proposal to increase the amount of capital required to support New Zealand subsidiary. The bank will maintain its focus capital efficiencies.

Bank’s Performance

The stock of ANZ closed the day’s trading session at $24.630 per share on 31st December 2019, down by 0.685% from its previous closing price. The bank has a market capitalisation of $70.34 billion as on 31st December 2019 with an annual dividend yield of 6.45%. The total outstanding shares of the company stood at 2.84 billion, and its 52-week low and high is $23.810 and $29.300, respectively. The stock has given a total return of -13.04% and -12.31% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.